Top Swing Trading Stocks In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best swing trading stocks:

Apple Inc. (AAPL) – highly liquid with strong price swings driven by product launches and earnings.

Tesla Inc. (TSLA) – extremely volatile, offering rapid price movements and high trading volume.

Amazon.com Inc. (AMZN) – strong growth with price fluctuations linked to earnings and market trends.

Microsoft Corporation (MSFT) – stable trends with good swing opportunities around earnings reports.

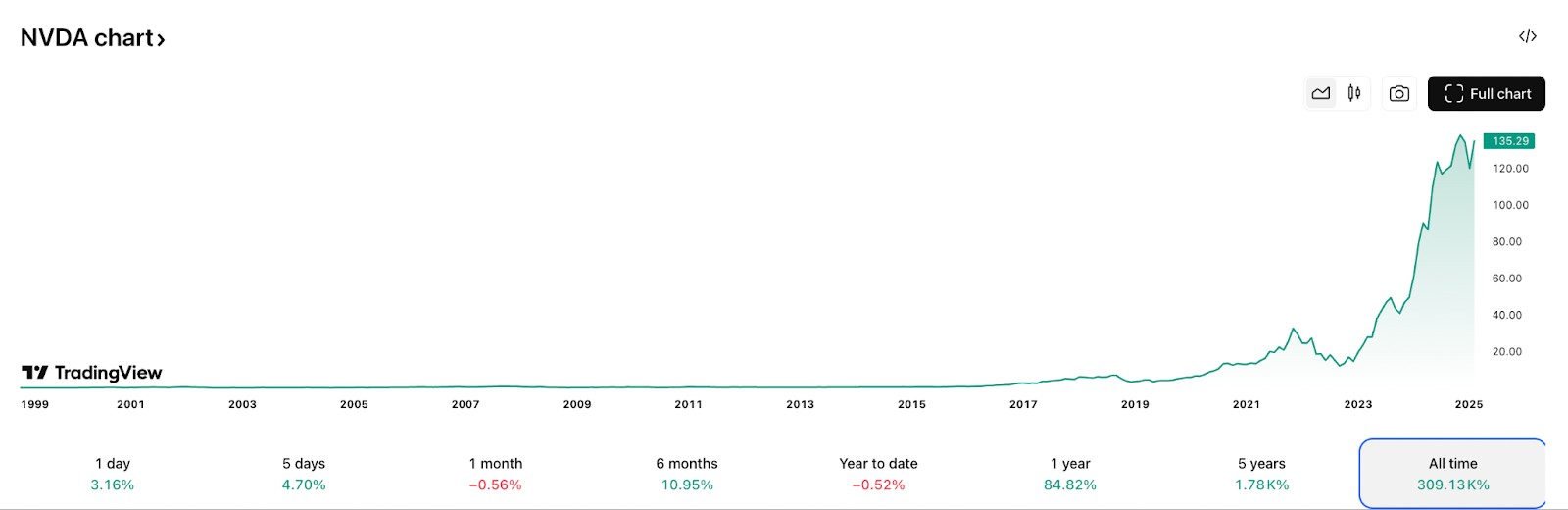

NVIDIA Corporation (NVDA) – sharp price moves based on AI and semiconductor industry demand.

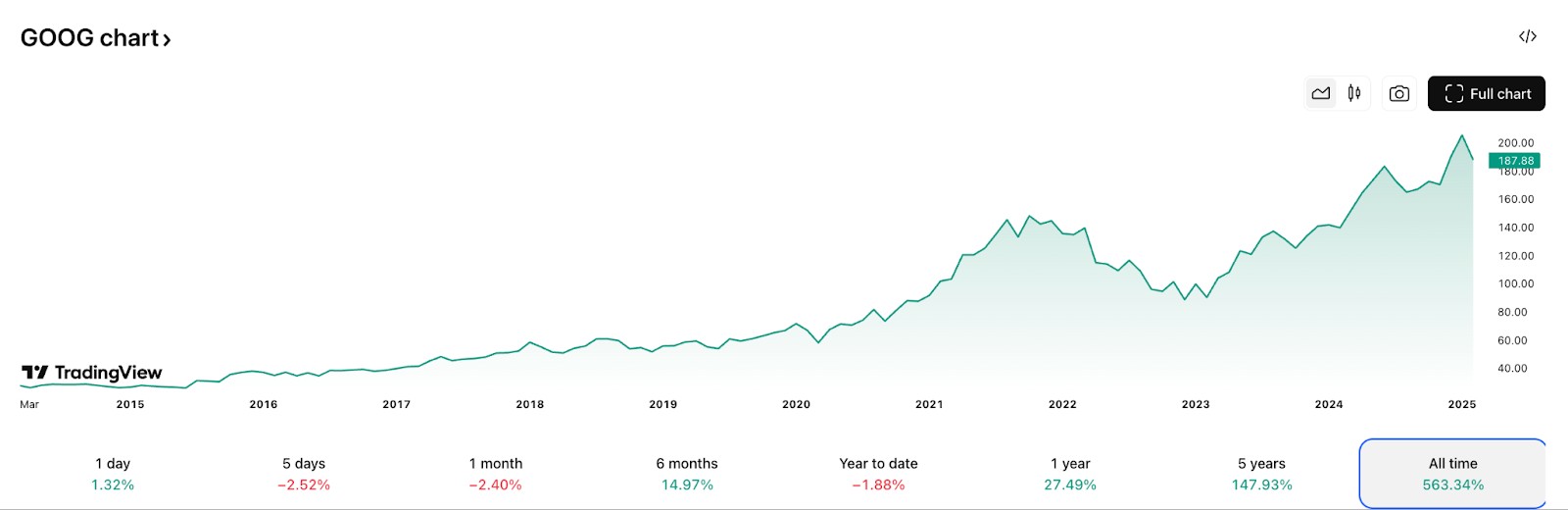

Alphabet Inc. (GOOGL) – regular swings tied to digital ads, AI news, and regulatory updates.

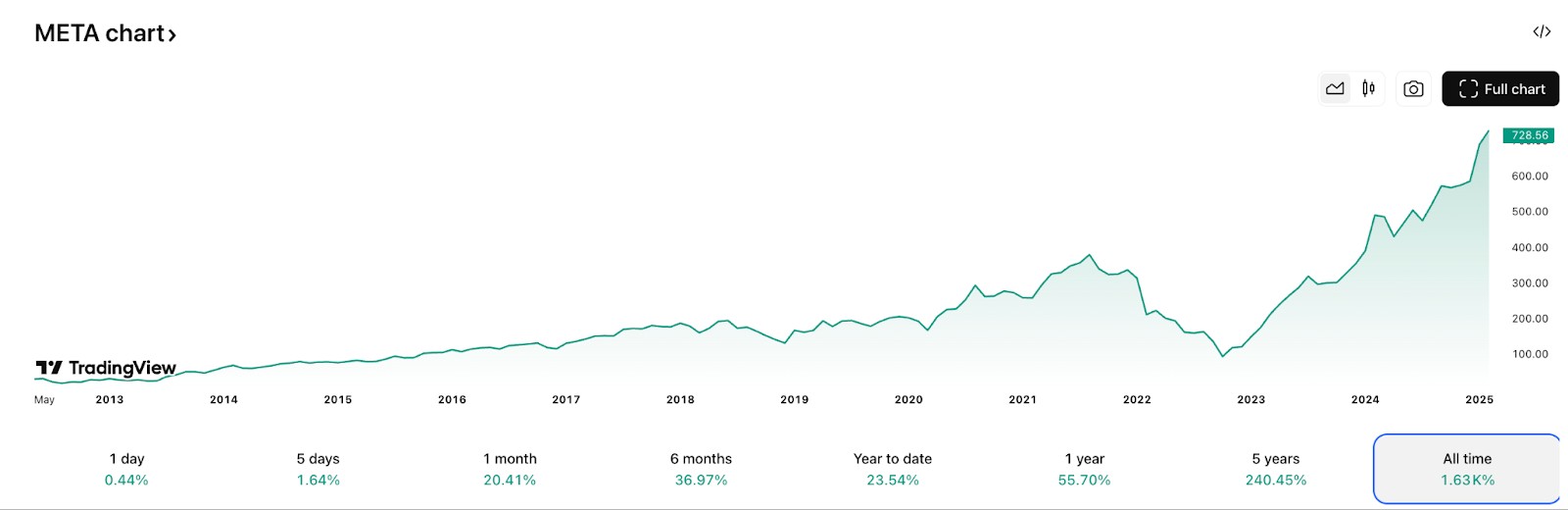

Meta Platforms Inc. (META) – reactive to social media and metaverse developments, creating volatility.

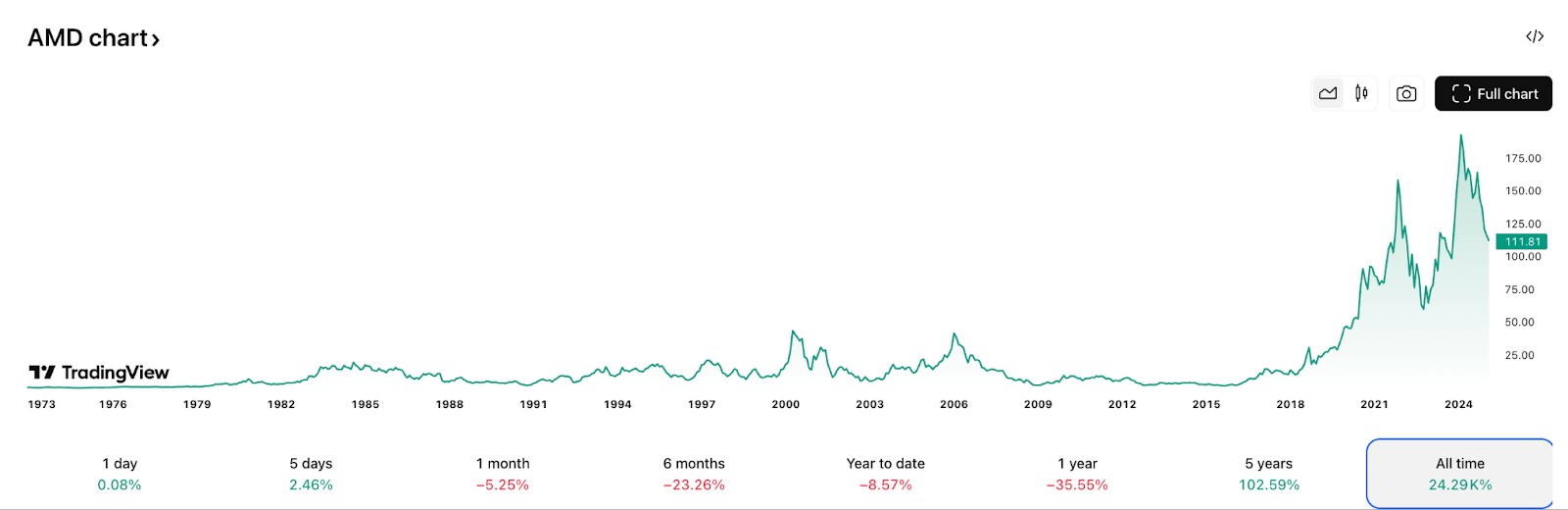

Advanced Micro Devices Inc. (AMD) – cyclical stock with swings based on semiconductor market trends.

Swing trading is a popular trading strategy for those looking to capitalize on short- to medium-term price movements in the stock market. It requires a keen understanding of market trends, technical analysis, and stock selection.

In this guide, we’ll explore how to choose the best stocks for swing trading, the benefits and risks involved, and how you can make money with this strategy.

List of top swing trading stocks

Swing trading involves holding positions in stocks for a short to medium term, typically from a few days to several weeks, aiming to profit from price "swings." The following stocks are popular among swing traders due to their liquidity, volatility, and strong market presence:

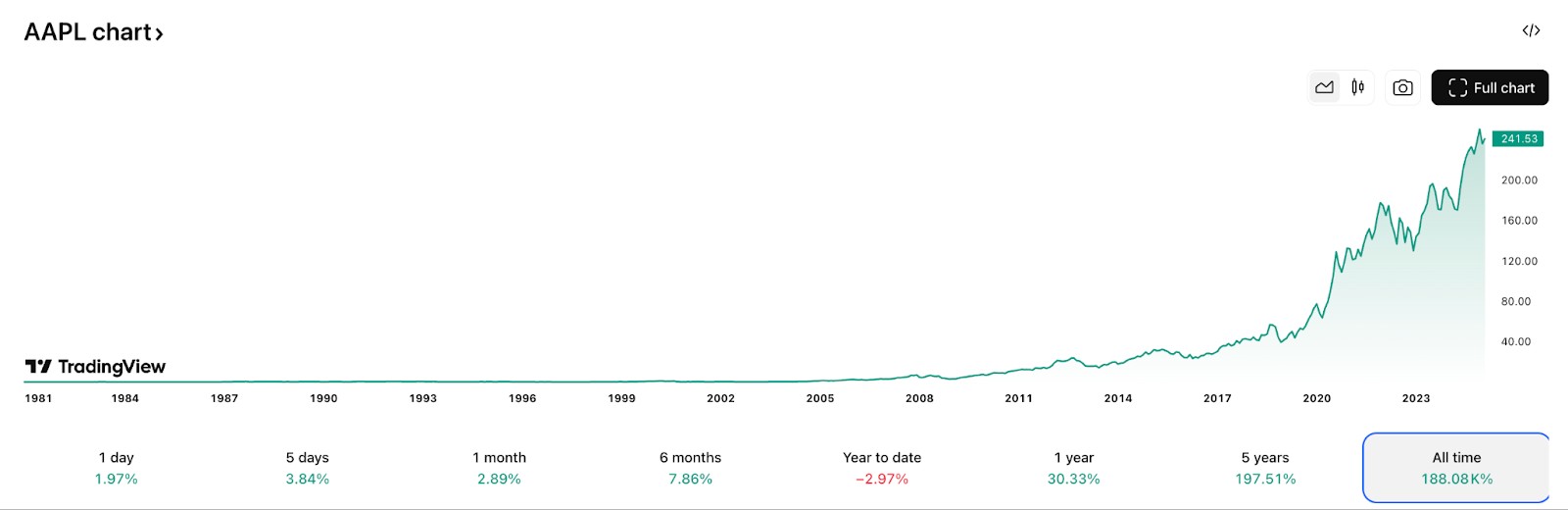

Apple Inc. (AAPL)

Apple is renowned for its innovative technology products and has a significant influence on the tech industry. Its stock exhibits substantial trading volume and price movements, making it a favorite among swing traders.

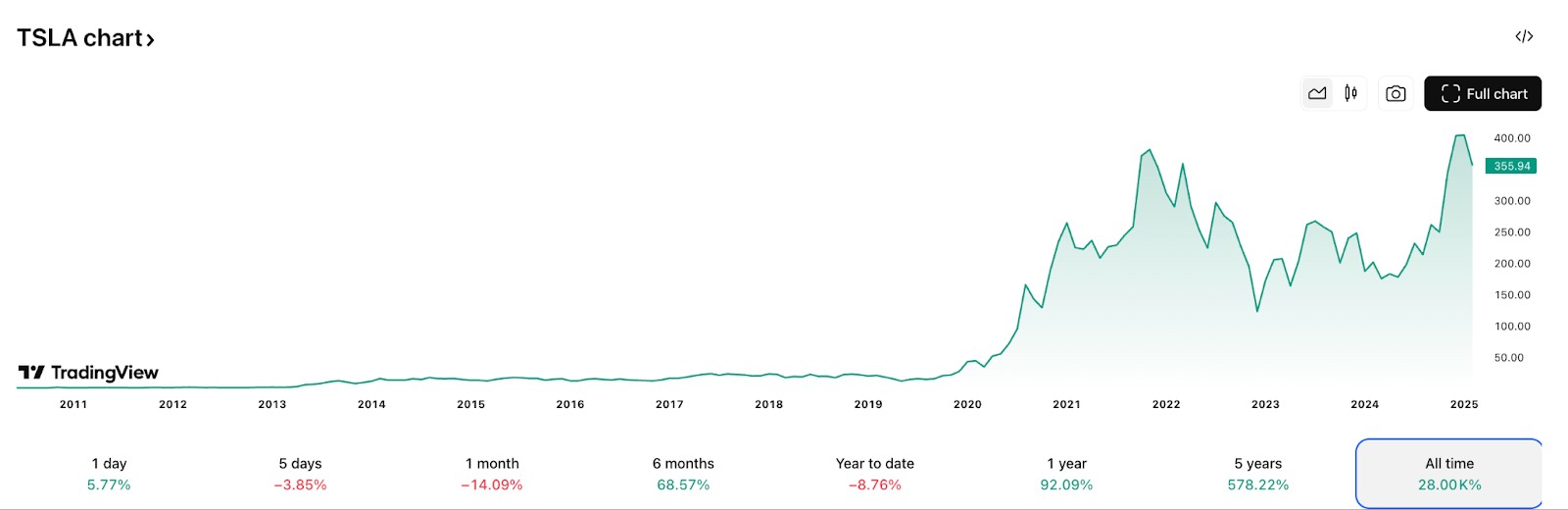

Tesla Inc. (TSLA)

Tesla, a leader in electric vehicles and renewable energy solutions, is known for its dynamic stock performance. The company's stock is characterized by high volatility, presenting numerous opportunities for swing trading.

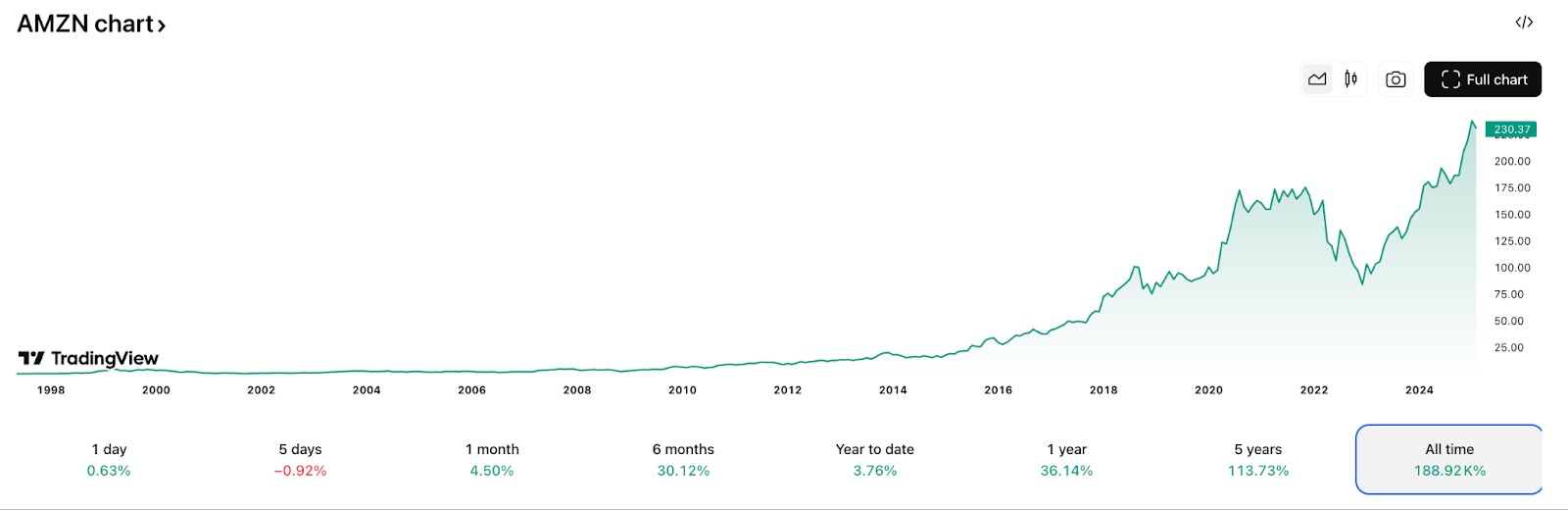

Amazon.com Inc. (AMZN)

As a global e-commerce and cloud computing giant, Amazon's stock is highly liquid and experiences notable price fluctuations, providing potential swing trading setups.

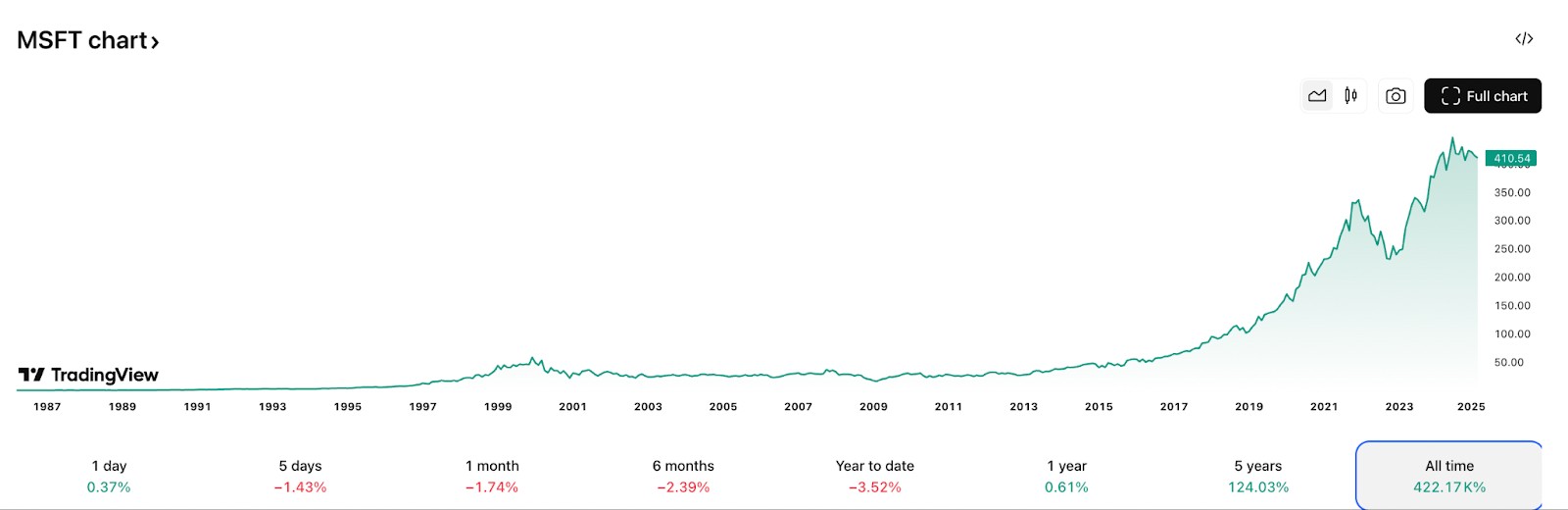

Microsoft Corporation (MSFT)

Microsoft's diverse product portfolio and strong market position contribute to its stock's consistent trading activity and price movements, making it suitable for swing trading strategies.

NVIDIA Corporation (NVDA)

NVIDIA, known for its advanced graphics processing units (GPUs) and AI technologies, often exhibits significant stock volatility, offering opportunities for swing traders.

Alphabet Inc. (GOOGL)

As the parent company of Google, Alphabet's stock benefits from the company's dominance in search and advertising, leading to substantial trading volumes and price swings.

Meta Platforms Inc. (META)

Formerly known as Facebook, Meta's focus on social media and virtual reality contributes to its stock's active trading and volatility, appealing to swing traders.

Advanced Micro Devices Inc. (AMD)

AMD's advancements in semiconductor technology and competition in the CPU and GPU markets result in its stock experiencing notable price movements, suitable for swing trading.

When engaging in swing trading, it's crucial to conduct thorough technical analysis, monitor market trends, and implement sound risk management practices to make informed trading decisions.

Here's a comparative table of key financial metrics for selected major technology companies, based on the latest available data:

| Company | Market Cap (USD) | Dividend Yield | Net Income (TTM, USD) |

|---|---|---|---|

| Apple Inc. (AAPL) | $3.63 Trillion | 0.41%% | $93.74 B |

| Microsoft Corporation (MSFT) | $3.05 Trillion | 0.81% | $88.14 B |

| Amazon.com Inc. (AMZN) | $2.44 Trillion | N/A | $59.25 B |

| Tesla Inc. (TSLA) | $1.14 Trillion | N/A | $7.13 B |

| NVIDIA Corporation (NVDA) | $3.31 Trillion | 0.03% | $29.76 B |

| Alphabet Inc. (GOOGL) | $2.28 Trillion | 0.43% | $100.12 B |

| Meta Platforms Inc. (META) | $1.85 Trillion | 0.27% | $62.36 B |

| Advanced Micro Devices (AMD) | $181.19 Billion | N/A | $1.64 B |

How to choose the best swing trading stocks?

Swing traders focus on stocks with high liquidity, moderate volatility, and strong price trends. To choose the best stocks for swing trading, identify stocks with clear patterns, active trading volumes, and suitable price ranges. Tools like swing trading scanners can help streamline the process by pinpointing potential candidates. Here are some key points to keep in mind:

Focus on liquidity and volatility. Pick stocks that are easy to buy and sell and have regular price movements without weird spikes.

Avoid stocks with heavy institutional ownership. Stocks controlled by institutions often move slowly, making them less ideal for quick trades.

Track earnings-related patterns. Some stocks show consistent movements after earnings reports — learn their habits to catch trends.

Check for sector momentum. See which sectors are booming, then pick the top stocks in them for swing trading.

Use pre-market movements. Watch early market activity to spot stocks that will be active and offer opportunities during the trading day.

Avoid overnight surprises. Skip stocks that are prone to risky announcements or sudden news when markets are closed.

Advantages of investing in swing trading stocks

Balances flexibility and profit potential. Unlike day trading, swing trading doesn’t require constant monitoring but still offers ways to profit from short-term market moves.

Reduces emotional stress. Swing traders avoid the constant pressure of making quick trades, leading to calmer decision-making and fewer impulsive moves.

Opportunities during market corrections. Instead of waiting out market dips, swing traders can catch price bounces during corrections and make gains.

Allows time for planning. With trades lasting a few days or weeks, you can plan your trades without rushing, making smarter entry and exit decisions.

More room to recover from mistakes. Since you hold positions for several days, you can adjust your strategy if trends shift, unlike the split-second decisions in day trading.

Works for busy schedules. Swing trading is ideal for people who have jobs or studies since you can plan trades in the morning or evening without needing to watch the market all day.

Risks of investing in swing trading stocks

Impact of market volatility. While swing trading benefits from price fluctuations, sudden volatility due to news events, earnings reports, or geopolitical issues can lead to unexpected losses. Traders must stay updated and have risk management strategies in place.

Requires timely decision-making. Success in swing trading depends on entering and exiting trades at the right moments. Delays or miscalculations can reduce profits or amplify losses, making it crucial to follow market trends and technical indicators carefully.

Emotional pressure from market swings. Swing traders must manage emotions like fear of missing out (FOMO) or panic selling. Holding trades for days or weeks can lead to overthinking, making it important to stick to a well-planned strategy.

Here’s how to earn money with swing trading:

Step 1: Learn the basics

Begin by understanding swing trading fundamentals, including key concepts like support and resistance, technical indicators, and chart patterns. Use resources like books, online courses, and practice accounts to build your knowledge.

Step 2: Develop a trading plan

A clear trading plan lists your goals, how much risk you’re comfortable with, and when you’ll enter or exit a trade. Decide how much you’re willing to risk per trade and set reasonable profit goals. Having a plan helps you stay steady and avoid snap decisions.

Step 3: Use swing trading scanners

Swing trading scanners streamline the process of finding potential stocks. These tools analyze market data to identify stocks with the desired characteristics, such as high liquidity and clear trends. Incorporating a scanner into your strategy can save time and improve accuracy.

Step 4: Monitor and refine your strategy

Regularly review your trades to identify strengths and weaknesses. Keep track of your performance and adjust your strategy based on what works. Swing trading is a learning process, and continuous improvement is vital.

If you don’t already have a trading account with a stock broker, here are some of the best brokers to use for swing trading:

| Stocks | Regulation level | Demo account | Account min. | Interest rate | Basic stock/ETF fee | Foundation year | |

|---|---|---|---|---|---|---|---|

| Yes | Tier-1 | Yes | No | No | $3 per trade | 2007 | |

| Yes | Tier-1 | No | No | 1 | Zero Fees | 2014 | |

| Yes | Tier-1 | No | No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | 2015 | |

| Yes | Tier-1 | Yes | No | 4,83 | 0-0,0035% | 1978 | |

| Yes | Tier-1 | No | No | 0,01 | Zero Fees | 2011 |

Spotting resilient stocks for swing trading success

When picking stocks for swing trading, avoid buying popular stocks without studying how they move. Instead, focus on stocks with steady price patterns that move predictably between highs and lows. Check how they’ve performed in different situations, like after earnings reports or major announcements. Stocks that bounce within clear ranges are easier to trade because they give you obvious times to buy and sell.

Another important strategy is to look at how the stock holds up during market dips. Some stocks stay strong even when the broader market falls — these "steady stocks" help reduce losses in uncertain times. Avoid stocks with too much buzz, as they often have unpredictable price swings. Choosing stocks with steady patterns and resilience in tough markets can make swing trading more profitable and less stressful.

Conclusion

Choosing swing trading stocks isn’t just about noticing price changes — it’s about finding stocks that fit your approach and the current market vibe. Focus on stocks that move in ways you can predict, have strong trading interest, and are influenced by events like earnings releases or market news. Build a watchlist that matches how you trade — whether you’re aiming for quick wins or buying the dips. The key is knowing when to make a move and when to hold back. Swing trading isn’t about trying to catch everything — it’s about finding trades that fit your goals and making the most of them.

FAQs

What is the best time frame for swing trading?

Swing traders often use daily and hourly charts to identify trends and entry/exit points. The timeframe depends on your strategy and the stock’s volatility.

Can beginners succeed in swing trading?

Yes, with proper education and practice, beginners can succeed in swing trading. Start with small trades and focus on learning technical analysis to build confidence.

How much capital is needed for swing trading?

The capital required depends on your risk tolerance and the stocks you trade. Many brokers allow you to start with as little as $500, but having at least $2,000–3,000 can provide more flexibility.

What tools are essential for swing trading?

Essential tools include charting platforms, swing trading scanners, and reliable news sources. These tools help you analyze trends, identify opportunities, and stay informed.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

FOMO in trading refers to the fear that traders or investors experience when they worry about missing out on a potentially profitable trading opportunity in the financial markets.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.