Deepfake Financial Frauds: Is It Time to Be Cautious?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Deepfake financial frauds are on the rise, with criminals using AI-generated synthetic media to impersonate high-profile individuals and scam businesses out of millions.

Deepfake financial frauds represent a new and increasingly sophisticated scheme where criminals use AI-generated synthetic media. Once the deepfake is created, it's used to simulate legitimate requests for urgent fund transfers or sensitive financial actions.

What is a deepfake financial fraud and how does it work?

Deepfake financial fraud is a sophisticated scam that uses manipulated videos or audio recordings to trick people into making unauthorized financial transactions. So, what exactly is a deepfake? It's like a high-tech magic trick where someone's face or voice is digitally swapped with another's using artificial intelligence (AI). Imagine seeing your boss on a video call, giving urgent instructions to transfer money, but it's not really them—it's a deepfake!

Here's how it works: first, the scammers target employees who have access to financial systems, making them the perfect prey. Then, they create a deepfake video or audio recording of a high-ranking executive, like the CEO or CFO, giving instructions to transfer funds. The deepfake looks and sounds so real that the unsuspecting employee thinks it's genuine. They follow the instructions and transfer the money to the scammer's account.

But how do they pull off these convincing deepfakes? Well, scammers use advanced AI algorithms to mimic someone's voice or create fake videos that seem legit. They can even fabricate financial documents, like profit statements, to make the scam seem more convincing.

These fraudsters also exploit deepfakes to open fake bank accounts using stolen identities, allowing them to launder money or accumulate debt under false pretenses. Plus, they use deepfakes to bypass security measures and fool identity verification systems, putting financial institutions and their customers at risk.

In essence, deepfake financial fraud is a high-stakes game of deception, where scammers use cutting-edge technology to manipulate people and systems for financial gain. To protect against this emerging threat, it's crucial to stay vigilant, employ robust authentication methods, and always double-check the authenticity of instructions, especially when it involves transferring money.

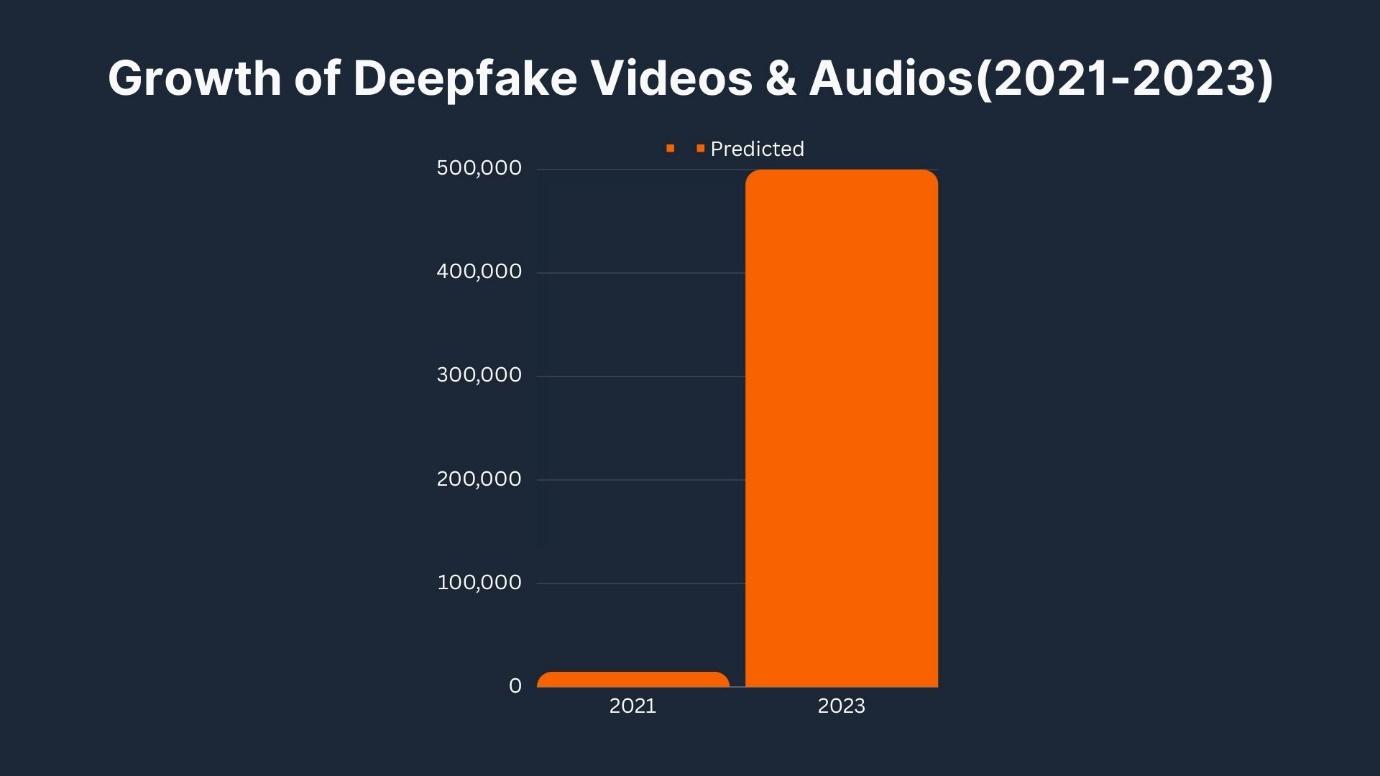

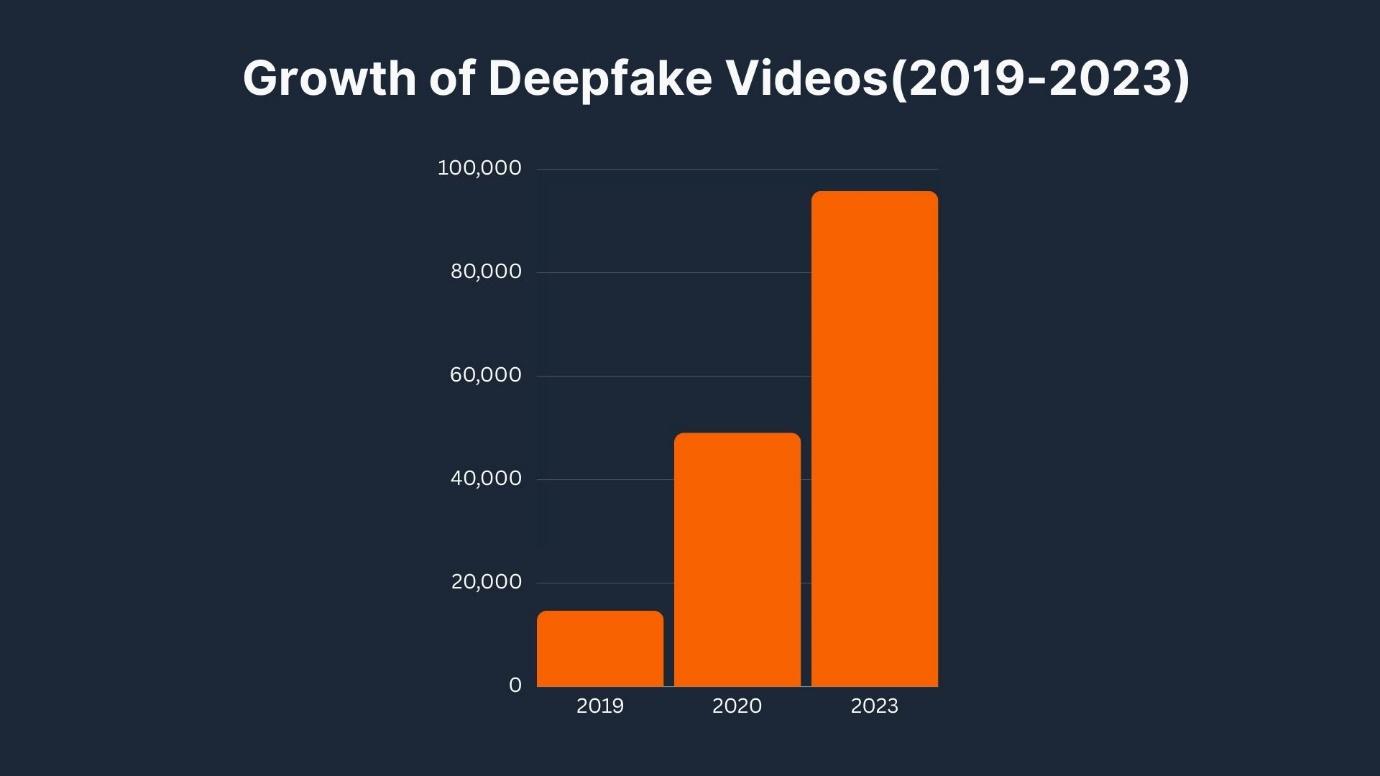

Growth of Deepfake Videos and Audios

Growth of Deepfake Videos and Audios Growth of Deepfake videos

Growth of Deepfake videosWhat are the recent cases of deepfake financial frauds?

Hong Kong Office Scam

Scammers used deepfake technology to impersonate the CFO and other employees of a multinational company.

They tricked an employee into transferring HK$200 million (US$25.6 million) through a video conference call.

The scam was uncovered after an employee received a phishing message supposedly from the company's UK-based CFO, leading to 15 unauthorized transfers totaling HK$200 million.

Bunq Bank Deepfake Attack

Bunq bank fell victim to a deepfake attack, highlighting the risks posed by deepfake technology in the financial sector.

Deepfake AI imiteert CEO Bunq Bank

Deepfake AI imiteert CEO Bunq BankUK Energy Company Scam

Fraudsters used deepfake audio to impersonate a company director on the phone.

They convinced a bank manager to authorize a transfer, resulting in the loss of $243,000 for the UK energy company.

South African Deepfake News Scam

Deepfake videos featuring TV news anchors announcing Elon Musk's supposed "new secret investment" project circulated on social media in South Africa.

The videos claimed that Musk's project had scared the government and big banks and had made hundreds of people very rich.

However, the videos were debunked as fake, but not before many fell victim to the scam.

Hong Kong Quantum AI Scam

Authorities uncovered an unlicensed, fraudulent cryptocurrency exchange called Quantum AI in Hong Kong.

The scammers falsely claimed an affiliation with Elon Musk and promised AI-based crypto trading services, leveraging Musk's reputation and deepfake technology.

The Hong Kong Securities and Futures Commission (HKSFC) issued a warning against Quantum AI, urging investors to be cautious.

Top 3 trustable Forex brokers

Why are deepfake financial frauds so alarming?

Deepfake financial frauds are deeply concerning for several reasons that anyone can understand:

Replication of Voice and Video

Imagine someone being able to make it seem like you said or did something, even though you didn't. That's what deepfake technology does. It's like a really advanced editing tool that scammers use to make fake videos or recordings of important people, like bosses or company leaders. They can sound and look just like the real thing, making it hard to tell if it's genuine or not. This makes it much easier for scammers to trick people into doing things they shouldn't, like sending money to the wrong place.

Deepfake with an Elon Musk clone

Deepfake with an Elon Musk cloneTargeting Executives or Influential Individuals

Have you ever received an important email from your boss asking you to do something? Now, imagine if that email wasn't really from your boss, but from a scammer pretending to be them. That's what happens in deepfake financial fraud. Scammers target bosses or other important people in a company because they have the power to make big financial decisions. By pretending to be them, scammers can trick employees into doing things like sending money to fake accounts or sharing sensitive information.

Enhanced Credibility and Trust

If you got a call from someone who sounded exactly like your boss or CEO, wouldn't you trust what they said? That's the problem with deepfake technology. It makes fake messages seem incredibly believable. Scammers can use this to their advantage, making employees more likely to believe fake instructions or requests. This trust makes it easier for scammers to carry out their schemes without raising suspicion.

Difficulty in Detection

Spotting a deepfake is like finding a needle in a haystack. These fake videos and recordings look and sound so real that it's hard to tell them apart from genuine ones. Even sophisticated security systems can struggle to detect deepfakes, leaving organizations vulnerable to attacks. This means that scams can go undetected for a long time, giving scammers more time to steal money or information.

Potential for Reputational Damage

Imagine if your company got tricked into sending money to scammers. It wouldn't just be about the money lost. Your company's reputation could take a big hit too. Customers, investors, and others might lose trust in the company, thinking it's not safe to do business with them. Even the bosses or executives impersonated in deepfake videos could suffer reputational damage, making it hard for them to do their jobs effectively.

How do governments and companies fight deepfake financial fraud?

Governments and companies are joining forces to fight deepfake financial fraud using several key strategies:

Legislation and Regulation - Governments create laws specifically targeting deepfake fraud. These laws cover actions like impersonation, misrepresentation, and unauthorized use of someone's identity. Companies also follow regulations and work with authorities to enforce these laws.

Education and Awareness - Public awareness campaigns educate people about the dangers of deepfakes. Companies train their employees to recognize signs of deepfake scams, especially in financial matters. When people know what to look for, they're less likely to fall for fraudulent schemes.

Advanced Authentication and Verification - To beef up security, companies use multi-factor authentication and biometric verification. They also implement strong identity verification processes to stop unauthorized access. Some even use blockchain technology for extra transparency and security in transactions.

AI Detection Tools - Machine learning algorithms are employed to spot deepfakes. Companies develop detection models that analyze audio, video, and images for inconsistencies that reveal fake content.

Collaboration with Tech Companies - Governments and financial institutions team up with tech giants like Google, Facebook, and Microsoft. These companies invest in research to develop tools that can detect and stop deepfake scams faster.

Forensic Analysis - Digital forensics experts dig into suspected deepfake cases. They examine metadata and digital footprints to trace where fraudulent content came from. This helps catch the bad guys and recover stolen funds.

Real-Time Monitoring - Companies set up systems to watch for any strange activity in transactions, communication, or user behavior. If something seems off, it triggers an alert for further investigation.

Collaboration with Social Media Platforms - Social media is a common place for deepfake spread. Companies work with these platforms to quickly flag and remove fake content. Users can also report suspicious material to help keep everyone safe.

Whistleblower Protection - Encouraging whistleblowers to speak up is important. Laws protect those who expose deepfake fraud, and their information can be invaluable for stopping scams.

International Cooperation - Deepfake fraud doesn't stop at borders. Governments work together to share information, track down criminals, and dismantle their networks. This global cooperation strengthens the fight against financial fraud everywhere.

How to avoid falling victim to deepfake financial frauds yourself?

With the increasing sophistication of deepfake technology, it's crucial to have a robust strategy to protect yourself and your business. In my research and investigation into deepfake financial frauds, I've identified some practical recommendations to help individuals and companies avoid falling victim to these scams.

| Strategy | Description |

|---|---|

| Verify Identity and Requests | Always verify the identity of anyone requesting sensitive information or financial transactions. Double-check instructions received via phone calls, emails, or video conferences. For example, independently verify the identity of a bank representative by contacting the bank directly. |

| Beware of Urgency and Pressure | Be cautious of urgent requests for immediate action, such as transferring funds urgently. Take a step back and verify the situation independently if someone insists on immediate action. For instance, a deepfake voice impersonating a CEO might pressure you into authorizing a wire transfer. |

| Educate Yourself and Stay Informed | Learn about deepfake technology and common scams used by fraudsters. Stay informed about emerging threats, such as deepfake attacks on banks and financial institutions. |

| Implement Multi-Factor Authentication | Enable multi-factor authentication for your financial accounts to add an extra layer of security. Even if someone gains access to your password, MFA makes it harder for them to access your accounts. |

| Be Skeptical of Unsolicited Messages | Exercise caution when receiving unexpected emails, messages, or calls, especially if they request financial information. Verify the legitimacy of such communications independently before responding or providing any sensitive information. |

| Secure Your Devices and Accounts | Keep your software updated, use strong passwords, and enable security features on your devices and accounts. Regularly updating your systems helps protect against vulnerabilities that could be exploited by deepfake scammers. |

| Check for Inconsistencies | Scrutinize videos, audio clips, or images for inconsistencies that may indicate a deepfake. Look for unnatural movements, glitches, or lighting inconsistencies. If something seems off, trust your instincts and investigate further before taking action. |

| Limit Personal Information Online | Minimize the personal information you share on social media and other platforms to reduce the risk of deepfake creation using publicly available data. Be mindful of the information you share online to protect yourself from identity theft and fraud. |

| Report Suspicious Activity | If you suspect a deepfake scam or encounter suspicious activity, report it to your bank, authorities, or relevant institutions immediately. Early reporting helps prevent further financial loss and allows authorities to take appropriate action against fraudsters. |

| Trust Your Instincts | Trust your instincts and be cautious of offers or requests that seem too good to be true. Deepfake frauds often exploit emotions and trust to deceive victims. If something feels off or suspicious, take the necessary steps to verify the authenticity of the communication or request. |

Expert opinion

I nearly fell victim to a deepfake scam myself. I received a phone call one day from someone who sounded exactly like a senior executive at my company, urgently requesting that I authorize a $50,000 fund transfer to a new supplier. The "executive" provided all the necessary details and emphasized the urgency of the transaction.

At first, I was convinced it was legitimate, but a couple of things raised my suspicion: the caller’s tone seemed slightly off, and the request deviated from our standard procedures. Instead of complying immediately, I decided to verify the request by calling the executive directly through his known personal number. It turned out that the executive hadn't made the call, confirming that I was targeted by a deepfake scam.

Through this experience, I learned valuable lessons and formulated some recommendations for others to avoid falling victim to deepfake financial frauds. I recommend a multi-layered defense strategy against deepfake financial frauds. First, implementing authentication technologies like biometric verification, including voice and facial recognition, can add a secure layer of protection. Additionally, it's crucial to invest in deepfake detection tools.

An effective fight against fraud also requires collaboration between the IT, finance, and legal departments to develop a holistic approach. Alongside this, it's imperative to advocate for stricter regulations governing the creation and distribution of deepfake content.

Final thoughts

The evolution of deepfake technology has opened new doors for cybercriminals, turning deepfake financial frauds into a real and growing threat. However, by understanding these scams, implementing robust security measures, and promoting awareness, businesses and individuals can effectively protect themselves. Stay alert, verify communications, and remember: in the world of deepfakes, trust is paramount, but verification is crucial.

FAQs

What are the dangers of deepfakes?

Deepfakes can manipulate reality convincingly, leading to reputational damage, financial losses, and breaches of privacy. People may lose trust in legitimate communications, affecting decision-making. Companies can lose significant sums due to fraudulent instructions.

Are deepfakes a cybercrime?

Yes, deepfakes can be classified as cybercrime when used for fraudulent purposes, including financial scams, misinformation, and identity theft.

Are deepfakes an invasion of privacy?

Deepfakes often involve the unauthorized use of personal images and voices, violating privacy rights and creating false representations.

What is being done to prevent deepfakes?

Governments and companies are introducing regulations and AI tools to detect deepfakes, such as deepfake detection software, educational campaigns, and tighter security protocols.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.