Best Forex Cards For The UK

Best Forex card in the UK:

-

Revolut Travel Card - Overall best Forex card in the UK

-

Wise Travel Card - best for competitive exchange rates and low fees

-

The Post Office Travel Money card - best for holidays with competitive exchange rates

-

Caxton Currency Card - best for offering flexible card options

-

ASDA Travel Money Card - best for international travel and vacations

If Foden lives in the US but wants to travel to the UK, he needs one of the best Forex cards to make flexible payments in pounds, even if his account has been loaded with US dollars while in the US. Hence, a Forex card in the UK is primarily used to make transactions in the local currency, notwithstanding that your account was funded with a foreign currency before you flew into the United Kingdom.

The best Forex card in the UK allows travelers to transact conveniently in the UK without having to carry cash or convert currencies at each transaction. In this article, you will learn about the 5 best Forex cards in the UK, how they compare, their features, how to get them, and how to choose the best from these cards.

-

Will forex cards work in the UK?

Yes, Forex cards work in the UK and Revolut and Wise are popular financial platforms offering Forex cards for the UK.

-

Can we withdraw cash from a forex card in the UK?

Yes. You can withdraw cash from a Forex card in the UK or approved ATMs.

-

Can you put US dollars on a Forex card?

Yes. You can conveniently top up your card in USD, which will convert to GBP with ease for safe and convenient purchases and withdrawals.

-

Can a foreigner get a forex card in the UK?

Yes, but you must have the required documents needed to verify your identity in the UK.

What are the best Forex cards for the UK?

While the Revolut travel card leads the list of the best Forex cards in the UK, other cards like the Wise travel card, Caxton currency card, ASDA travel money card, and Postoffice travel money card are other top travel credit cards in the UK. It is best practice to compare the different travel credit cards for the UK and learn what makes each of them special before you choose. So, if you are ready to compare and find out what makes these cards special, below is a comprehensive review of the best Forex cards in the UK.

Revolut Travel Card

Revolut Travel Card

The Revolut card leads when considering the best Forex cards in the UK. This card allows travelers to spend and withdraw in the UK and beyond with low fees and powerful international features. You can choose to have one, two, or three cards and decide the form you want them in (disposable, virtual, or physical). In terms of security, Revolut is governed by e-money licenses under the Financial Conduct Authority. Also, the latest scam detection feature launched by Revolut helps protect customers against card scams.

|

Issuance fee |

|

|

Card replacement fees |

$5.00 |

|

Card delivery fee |

|

|

Currency exchange fees |

|

|

Supports currencies |

GBP, USD, ZAR, EUR, CHF, JPY, AUD, SGD, BGN, AED, CAD, INR, CLP, TRY, COP, NZD, DKK, EGP, HKD, CZK, HUF, RSD, MXN, ILS, ISK, PLN, KRW, KZT, MAD, NOK, QAR, PHP, PL, RON, SAR, SEK, THB |

|

Top-up fees |

No fee If your transfer is made in a currency that Revolut does not support, your bank might convert it at their rate, which could result in a fee |

|

Inactivity fees |

No fee |

|

UK and foreign ATM withdrawal fees |

In-network ATM withdrawal = $0 Out-of-Network ATMs = A fee of up to 2% of the withdrawal amount will apply to Standard Plans |

|

Monthly fees |

No fee |

How to get the Revolut Forex card

-

Download the Revolut app and create an account

-

Upload your proof of identity to verify your account

-

Order your card

-

Pay the delivery fee, which depends on the kind of account you have

-

Verify your mailing address, and your card will be sent to you

Wise Travel Card

Wise Travel Card

Another top Forex card you can use while in the UK is the Wise Travel Card. This card, which provides a simple method of making international purchases and cash withdrawals using the interbank exchange rate, ranks second among the best Forex cards. It also features two fee-free cash withdrawals of up to £200 per month, with low fees of 0.43%, and uses the mid-market exchange rate at the time of conversion. You can quickly freeze and unfreeze both your virtual and physical cards.

|

Issuance fee |

7 to 9 GBP |

|

Card replacement fees |

2.50 GBP

|

|

Card delivery fee |

|

|

Currency exchange fees |

From 0.43% applies |

|

Supports currencies |

EUR, GBP, USD, AUD, BGN, CZK, DKK, BRL, IDR, SGD, JPY, CAD, CNY, CHF, NOK, NZD, RON, SEK, HUF, MYR, TRY, PHP, PLN |

|

Top-up fees |

2% |

|

Inactivity fees |

No fee |

|

UK and foreign ATM withdrawal fees |

|

|

Monthly fees |

No fee |

How to get card

-

Launch the desktop website or Wise app

-

If you wish to create a personal account, sign up using your Google, Apple, Facebook, or email address

-

Upload your proof of identity to finish the verification process

-

Select the Cards tab

-

After you confirm your mailing address and pay the one-time fee, your card will be shipped and should arrive in 14 to 21 days

The Post Office Travel Money card

The Post Office Travel Money card

The Post Office travel money card is the third in this series of the best Forex cards in the UK that make managing money while traveling easier. This card offers flexibility and convenience of use in the UK by allowing travelers to load multiple currencies onto a single card. The Post Office Travel card can be used anywhere Mastercard is accepted, has a contactless feature for quick and easy low-value transactions, and is compatible with Apple Pay and Google Pay. When loading currency onto a card, travelers can lock in rates, potentially saving them money by avoiding exchange rate fluctuations compared to traditional methods.

|

Issuance fee |

No fee |

|

Card replacement fees |

£5 |

|

Card delivery fee |

It varies by location |

|

Cross border fees |

3% |

|

Currency exchange fees |

Varies depending on currency |

|

Supports currencies |

GBP, EUR, ZAR, USD, AUD, JPY,CAD, AED, NZD, CHF, CNY, SGD, DKK, CZK, TRY, HKD, PLN, HRK, HUF, SEK, NOK, SAR, THB |

|

Top-up fees |

1.5% |

|

Inactivity fees |

£2 |

|

ATM withdrawal fees |

1.5 GBP

|

|

Monthly fees |

Twelve months after the expiration of your card, a £2 monthly maintenance fee will be deducted from your balance |

How to get card

-

Go to the Post Office branch that is closest to you or visit their website

-

Look for the section that deals with currency exchange or travel money services

-

Select the Travel Money card

-

Either in person or online, complete the application

-

Give all the requested information and the appropriate identification

-

You will receive your Travel Money card upon processing and approval of your application. Cards purchased through the app and online should arrive in two to three working days. Follow the directions in your welcome letter to activate it

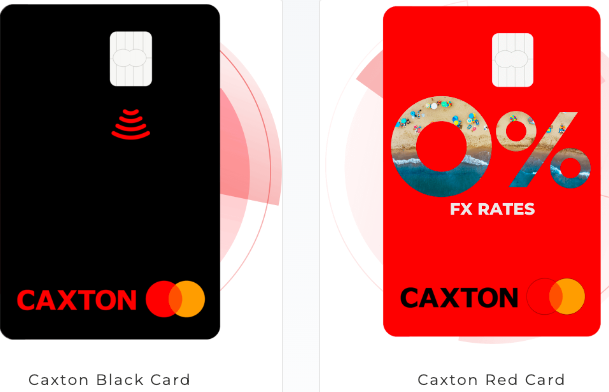

Caxton Currency Card

Caxton Currency Card

The Caxton currency card stands out as a premier choice for Forex needs in the UK. Available in two variations, the "Black" and "Red" cards, both offer the convenience and security of a prepaid card for spending abroad. However, the Red Card boasts the advantage of the most favorable exchange rates. In addition to having excellent exchange rates, the Caxton Forex Card excels at offering contactless services without charging extra for foreign ATM withdrawals or transactions. You can use the Caxton app to track your transaction history, manage your travel expenses, and load money onto your card before or during your trip. This app allows you to quickly block your card in the event that it is lost or stolen.

|

Issuance fee |

|

|

Card replacement fees |

£5 |

|

Redemption processing fee |

£1.50 |

|

Card delivery fee |

Varies |

|

Cross border fees |

- |

|

Currency exchange fees |

Varies |

|

Supports currencies |

EUR, GBP, USD, AUD, CAD, NZD, CHF, ZAR HKD, DKK, JPY, SEK, HUF, PLN, NOK |

|

Top-up fees |

Free

|

|

Inactivity fees |

After 12 months of inactivity, £2 per month |

|

ATM withdrawal fees |

Free

|

|

Monthly fees |

|

How to get card

-

Login into your account

-

Apply for a card. Select the type of ASDA Travel Money Card (black or red) you prefer

-

Select the Travel Money card

-

Once your application is approved, you'll need to load funds onto the card; load your Caxton Red Currency Card with at least £10. This can usually be done online through various payment methods, including bank transfer, debit card, or credit card

-

After loading funds onto the card, you may need to activate it before you can start using it for transactions. Follow the instructions provided by ASDA Money to activate your card

ASDA Travel Money Card

ASDA Travel Money Card

The ASDA Travel Money Card is fifth on our list of the best Forex cards in the UK. Unlike carrying cash or bank cards when traveling, this card—which you can order online—offers security and convenience, and you can top it off instantly online or through an app. Managing foreign exchange while traveling abroad is made simple and secure by allowing travelers to load multiple currencies onto the card that is meant for their use. The card also has contactless payment capabilities, no foreign transaction fees, and no bank account connections.

|

Issuance fee |

Free |

|

Additional card fees |

£5 |

|

Card replacement fees |

Free |

|

Card delivery fee |

Varies |

|

Cross border fees |

Varies |

|

Currency exchange fees |

5.75% |

|

Supports currencies |

EUR, GBP, USD, AUD, CAD, NZD, CHF, ZAR, HKD, DKK, JPY, SEK, HUF, PLN |

|

Top-up fees |

|

|

Inactivity fees |

After 12 months of inactivity, £2 per month. No charge if your balance is zero |

|

ATM withdrawal fees |

Free |

|

Monthly fees |

Free |

How to get card

-

Purchase a card at a store or online. A card can be delivered to your house, picked up from a bureau

-

If you pick it up in person, your card will be activated. Activate your card by calling the number printed on it if it is delivered to your home

-

To make account management easier, register your card via your app or online

How to choose? Comparison of the best Forex cards in the UK in 2025

| Name | Card Issuance Ease | Fees and Charges | Withdrawal Limit | Welcome benefits | Best for |

|---|---|---|---|---|---|

|

Very Easy |

No monthly or inactivity fees |

Up to 3000 GBP per 24 hours |

Yes |

Overall best |

|

|

Very Easy |

No monthly or inactivity fees |

£4,000 a month |

Yes |

Competitive exchange rate and low fees |

|

|

The Post Office Travel Money card |

Very Easy |

No monthly fees but there is an inactivity fee of £2 |

£300 per day |

- |

Holidays with competitive exchange rates |

|

Caxton Currency Card |

Very Easy |

Monthly fee of £8 for the Red card; £2 inactivity fee |

£300 per day |

- |

Offering flexible card options |

|

ASDA Travel Money Card |

Very Easy |

No monthly fees but there is an inactivity fee of £2 |

£500 per day |

Yes |

International travel and vacations |

Best Forex brokers

Your location is United States

If you would like to learn about the best brokers in your region, please use the “Find my broker” service.

How to choose a Forex Card for the UK?

Spending in British pounds and sterling can be more convenient and less expensive if you have an international travel card before visiting the UK. Here are some key points to consider if you are wondering how to get the best Forex card for the UK.

-

Examine and contrast the exchange rates provided by various providers of Forex cards. Seek out favorable exchange rates with minimal markup costs to obtain the most for your money

-

Find out the range of currencies your Forex card can accommodate. The best Forex card in the UK should cover the currencies of your intended travel destinations, like the Currensea card

-

Know your Forex card's fees (inactivity fees, balance inquiries, ATM withdrawals, issuance, and reloading schedule) inside and out. Choose a credit card with few or no fees if you want to cut costs

-

Consider the card's accessibility and the availability of customer service. Choose cards with robust security features like chip and PIN technology, zero liability protection, and EMV compliance

-

Examine reviews and visit online forums to find out how satisfied customers are with different Forex card providers. This can help you base your decision on real-world experience and make an informed decision

Expert Opinion

When selecting a Forex card for your travels, prioritize transparency in fees and exchange rates. Examine the fine print carefully before choosing a Forex card, as many of them offer low fees and good exchange rates. You should also be aware of other costs like inactivity fees, ATM withdrawal fees, and currency conversion fees. Additionally, find out how the exchange rates are calculated. Certain credit cards might present their rates as appealing, but when you use them, there could be an additional fee. Seek out credit cards that provide competitive, clear, and ideally benchmarked exchange rates against market rates.

Summary

Using a forex card to access foreign currencies and handle your finances while traveling overseas is quick, easy, and safe. Consider features like multiple currency loading, simple fund reloading, online account management, and any extra benefits like travel insurance or rewards programs before choosing the best Forex card in the UK.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).