How To Buy US Stocks In Kenya: A Comprehensive Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Here’s how you can buy US stocks in Kenya:

Investing in US stocks has become a popular choice for many Kenyan investors looking to expand their portfolios and access the US market. Thanks to easy-to-use online platforms, what was once a complex process is now much simpler for anyone with an internet connection and a passion for global investments. In this guide, we’ll break down the steps to buying US stocks in Kenya, share useful tips for both beginners and experienced traders, discuss the risks, and offer advice to help make your investment journey smoother.

How to buy US stocks in Kenya (Step-by-step guide)

Step 1. Choose a broker that supports US stocks trading

Selecting the right broker is crucial. Look for a platform that supports US stock trading, offers low fees, and provides user-friendly tools. We have listed some of the top options below to make the choice easier for you:

| Available in Kenya | Demo | Account min. | Min. stock/ETF fee | Withdrawal fee | Foundation year | Regulated | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | 2,000 | US Stocks $2, EU Stocks €4 | Varies | 2001 | FCA, BaFin | Open an account Your capital is at risk.

|

|

| Yes | No | No | Zero Fees | No charge | 2014 | Investment Industry Regulatory Organization of Canada (IIROC) U.S. Securities and Exchange Commission (SEC) Canadian Investor Protection Fund (CIPF) | Open an account Via Wealthsimple's secure website. |

|

| Yes | No | 10 | 0,02% | USDT (TRON) - 4 USDT USDT (Ethereum) - 10 USDT | 2020 | No | Open an account Your capital is at risk.

|

|

| Yes | No | No | £1.00 in the UK, €1.00 in the Eurozone | No charge up to a limit | 2015 | FCA | Study review | |

| Yes | Yes | No | $1,00 | No | 1978 | SEC, FINRA, CFTC, NFA, IIROC, Central Bank of Ireland (CBI), Central Bank of Hungary (MNB), Securities and Exchange Board of India (SEBI), Japan Securities Dealers Association (JSDA), Monetary Authority of Singapore (MAS) | Open an account Your capital is at risk. |

Step 2. Create and verify your account

To start trading, register with your chosen broker and complete the Know Your Customer (KYC) process. Typically, you’ll need:

A valid government-issued ID (passport or national ID).

Proof of residence (utility bill or bank statement).

A bank account or mobile wallet for transactions.

Step 3. Deposit funds

Most brokers allow deposits via bank transfers, debit cards, or mobile payment systems like M-Pesa. Be mindful of:

Currency conversion fees. Deposits are often converted from KES to USD.

Minimum deposit requirements. Some platforms have higher thresholds for first-time investors.

Step 4. Search for US stocks

Use the broker’s platform to find stocks that align with your investment goals. Many platforms offer tools like stock screeners and real-time market data to help you make informed decisions.

Step 5. Place your order

Decide how much you want to invest and select the type of order:

Market order. Executes immediately at the current price.

Limit order. Set a specific price at which you want to buy.

Step 6. Monitor and manage your investments

Keep track of your portfolio’s performance. Utilize apps and tools to:

Set alerts for price changes.

Rebalance your portfolio as needed.

Stay informed about market news.

Top US stocks for Kenyan traders

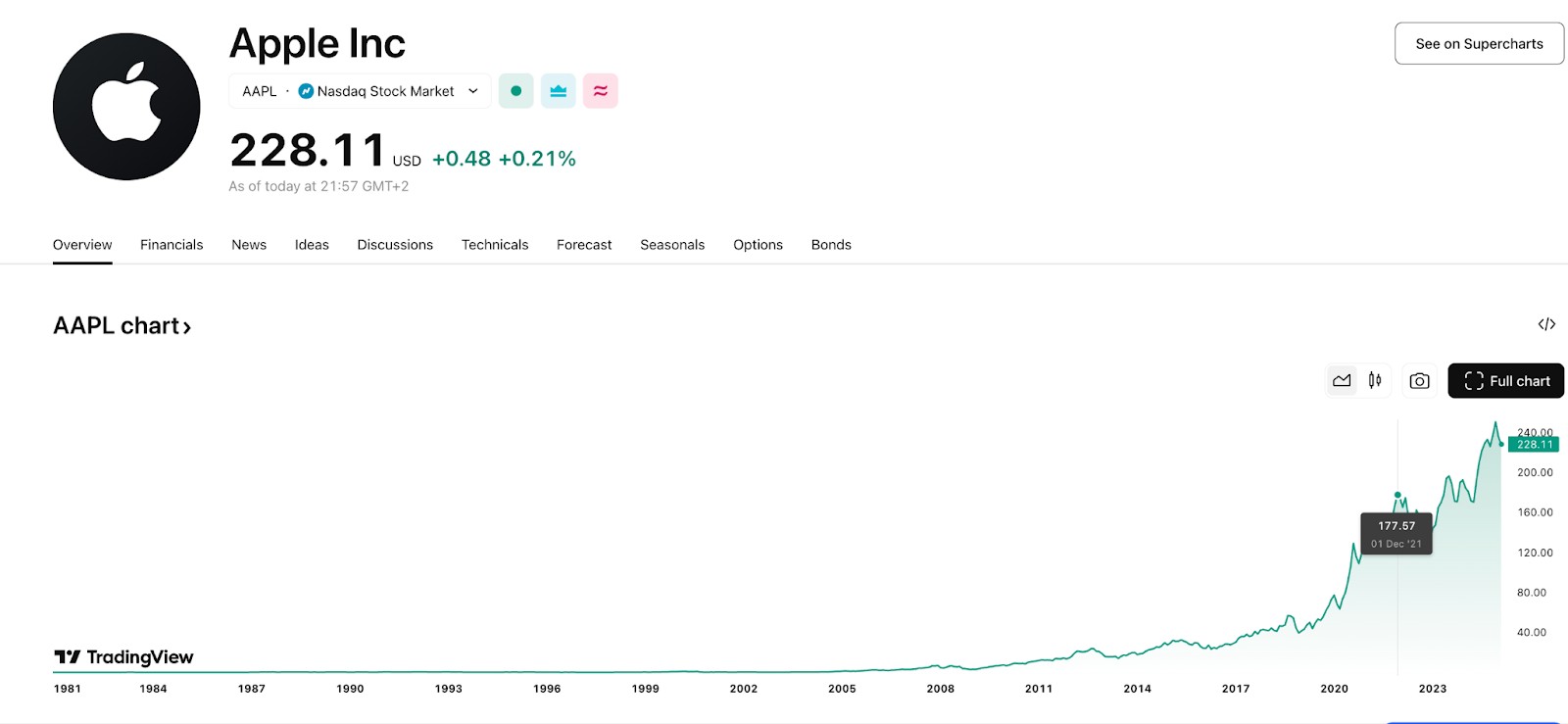

1. Apple Inc. (AAPL)

Apple is a global technology leader, known for its innovation in consumer electronics. With products like the iPhone, MacBook, and Apple Watch, it has created a loyal customer base worldwide. Apple’s services segment, including iCloud and the App Store, contributes significantly to its revenue. The company’s ability to generate consistent cash flow and its commitment to returning value to shareholders through dividends and stock buybacks make it an attractive investment. The company has demonstrated consistent growth, with a 5-year total return of 197.71%.

Pros. Strong brand loyalty, consistent revenue growth, and regular dividend payouts.

Cons. High dependence on hardware sales, competitive tech industry.

Current Price. $229.98 per share (approx.)

Market Cap. $3.474 trillion.

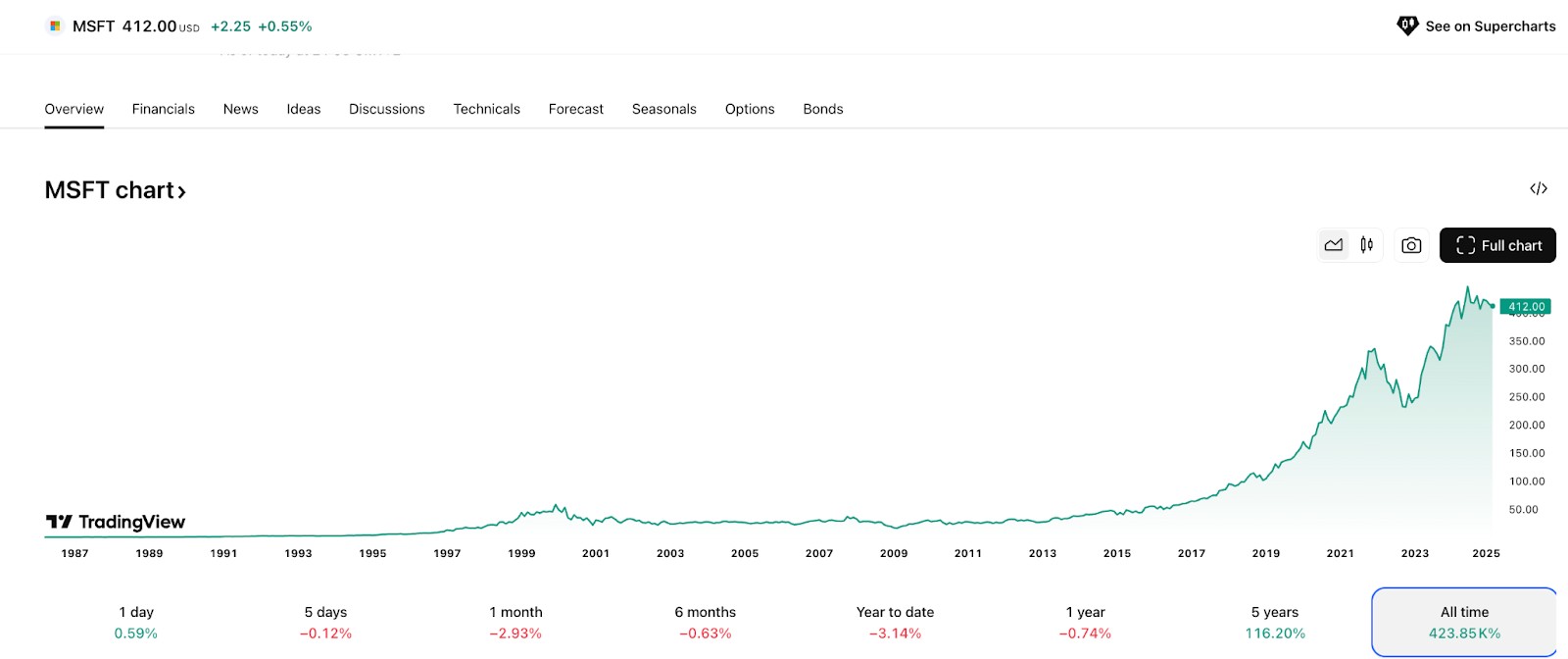

2. Microsoft Corporation (MSFT)

Microsoft is a leading software provider, offering products like Windows OS, Office Suite, and Azure cloud services. It has successfully diversified its business, with significant growth in cloud computing and gaming through Xbox. Microsoft’s subscription-based revenue models provide stable cash flow, making it a reliable choice for long-term investors. The company has shown resilience, with a 5-year total return of 168.43%.

Pros: Diversified product portfolio, strong cloud computing growth.

Cons: High valuation, potential regulatory scrutiny.

Current Price: $429.03 per share (approx).

Market Cap: $3.231 trillion.

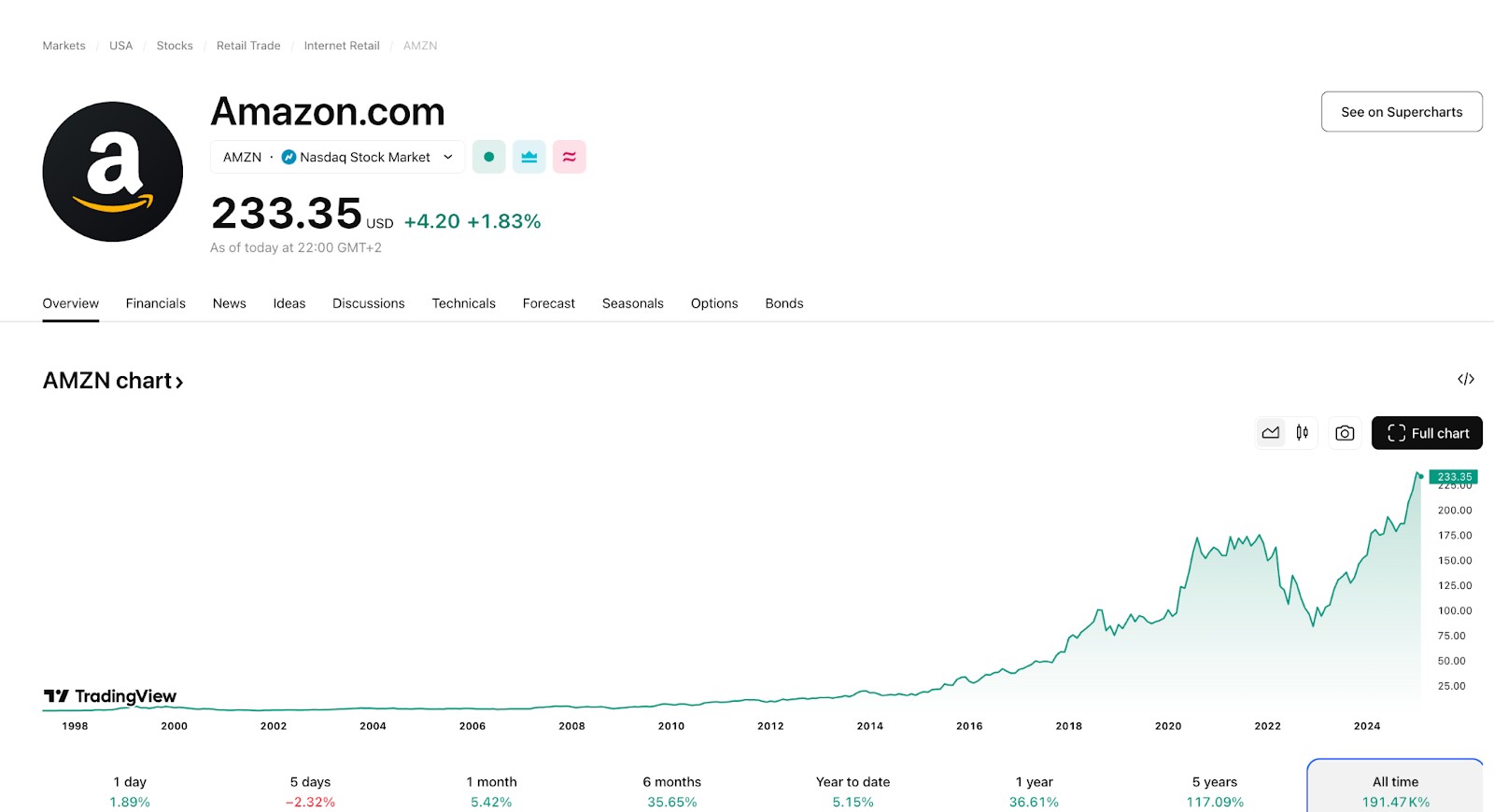

3. Amazon.com Inc. (AMZN)

Amazon is the world’s largest online retailer, with a robust presence in e-commerce and cloud computing. Amazon Web Services (AWS) is a major revenue driver, powering businesses globally. The company’s innovation in logistics and its ability to expand into new markets, such as healthcare and grocery delivery, make it a dynamic investment option. The company has experienced significant growth, with a 5-year total return of 142.33%.

Pros: Rapid revenue growth, strong e-commerce market presence.

Cons: Thin profit margins, heavy competition in cloud services.

Current Price: $225.94 per share (approx).

Market Cap: $2.433 trillion.

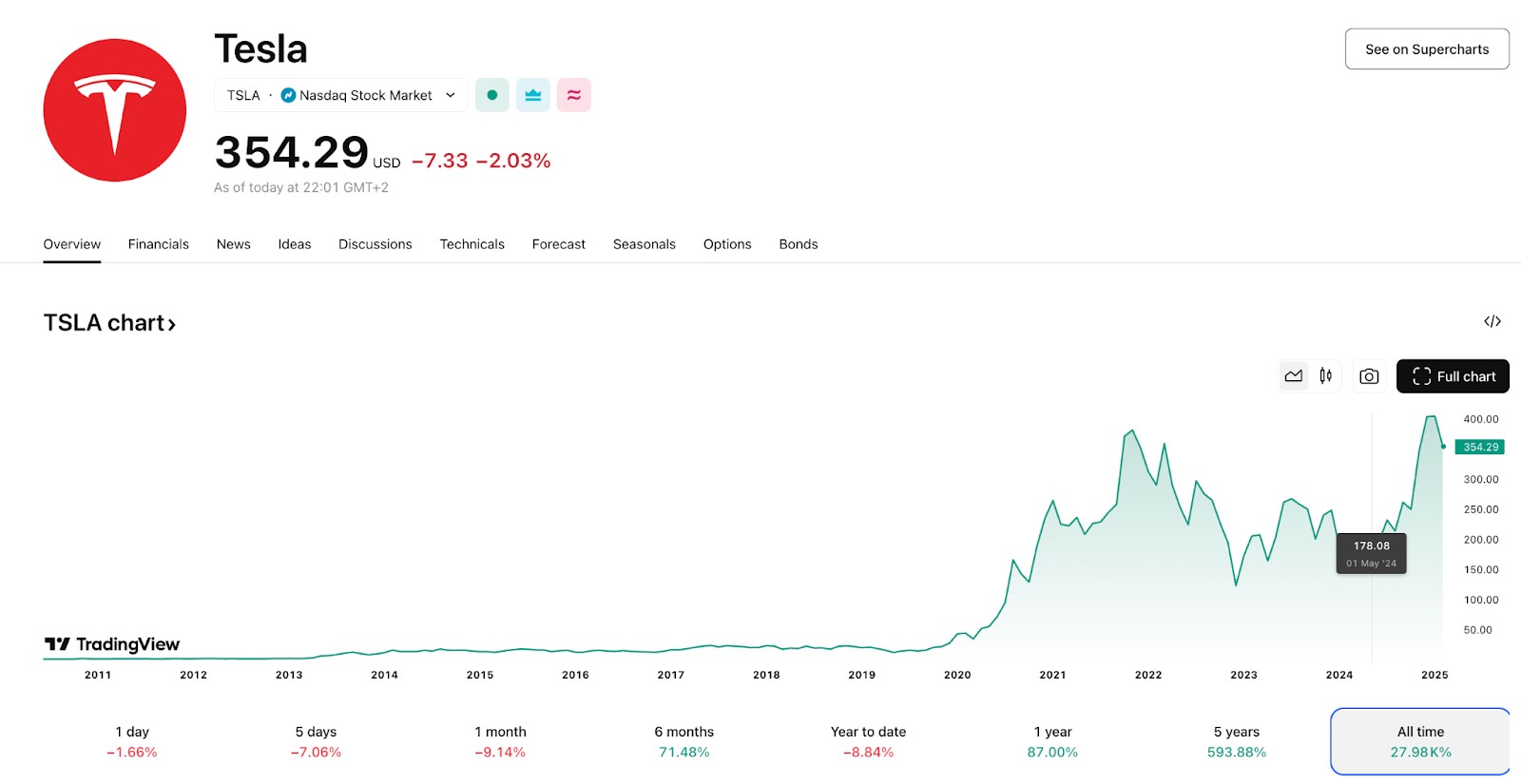

4. Tesla Inc. (TSLA)

Tesla is a pioneer in electric vehicles (EVs) and renewable energy solutions. Its focus on innovation, from autonomous driving technology to battery advancements, sets it apart in the automotive industry. Tesla’s growth potential is fueled by its ability to scale production and expand its global footprint. The company has demonstrated remarkable growth, with a 5-year total return of 1,153.18%.

Pros: Dominant EV market share, strong brand.

Cons: High valuation, cyclical demand for EVs.

Current Price: $426.50 per share (approx).

Market Cap: $1.449 trillion.

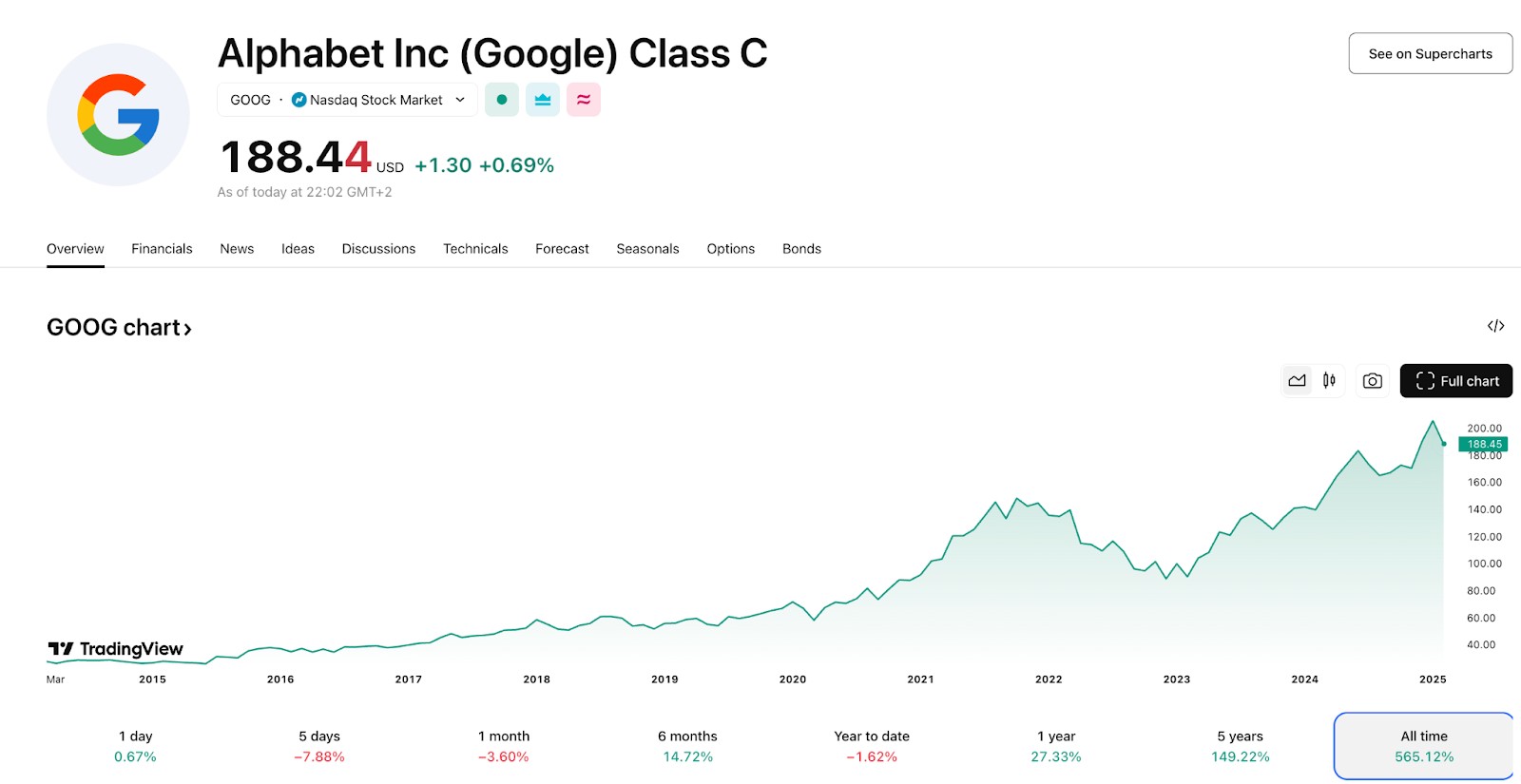

5. Alphabet Inc. (GOOGL)

As the parent company of Google, Alphabet dominates the online search and advertising market. The company’s investments in artificial intelligence, self-driving cars (Waymo), and cloud computing highlight its commitment to innovation. Its diverse revenue streams and market leadership position it as a resilient investment. The company has shown consistent growth, with a 5-year total return of 165.91%.

Pros: Strong ad revenue, investments in AI and cloud computing.

Cons: Reliance on advertising revenue, potential regulatory challenges.

Current Price: $196.00 per share (approx).

Market Cap: $2.443 trillion.

Why invest in US stocks from Kenya?

Investing in US stocks offers numerous benefits for Kenyan investors:

Gain access to top global companies. By investing in US stocks, you’re putting your money into well-established companies that have a huge impact on the global economy.

Broaden your investment mix. US stocks help balance your portfolio, spreading the risk across different industries and countries, which can shield you from local market swings.

Join in on innovation. The US leads the world in sectors like tech, healthcare, and green energy. Investing here gives you a chance to be part of that progress.

Shield yourself from local instability. When things aren’t going well in Kenya’s market, US stocks can provide a safer, more stable place for your money.

Take advantage of the dollar’s strength. The US dollar is a major global currency, and investing in US stocks helps you indirectly protect your wealth from changes in the Kenyan Shilling.

Earn through dividends. Many US companies pay solid dividends. If you pick wisely, you can earn regular passive income, something hard to come by in Kenya’s stock market.

Legal and tax implications

Kenya Revenue Authority (KRA)

Kenyan residents must report any income they earn from abroad, including profits from US stocks. This keeps you in line with tax laws and helps you avoid any issues down the road. Make sure to keep detailed records of all earnings, like dividends and capital gains, to make the reporting much easier.

US withholding taxes

For non-US residents, the US government withholds a tax of 15-30% on dividends paid by US companies. While this tax is deducted automatically, you can consult a tax expert to determine if your country has a double-taxation treaty with the US that might reduce the amount of tax.

Tools and resources

Market data platforms

To make informed investment decisions, leverage reliable market data platforms like Bloomberg and Yahoo Finance. These platforms provide real-time updates, company financials, and detailed analysis to keep you ahead in the market.

Currency conversion apps

Changes in currency values can really affect how much you make. Using tools to monitor exchange rates as they happen helps you time your moves so you get the most out of your conversions.

Local Fintech platforms

Certain platforms are built specifically for Kenyan users, making investing more accessible. These services allow seamless transactions with mobile money options, making it easier to deposit and withdraw funds. Additionally, they offer educational resources that guide you through the process of investing in US stocks, helping you understand the market's nuances. This combination of convenience and learning support is great for both beginners and experienced investors.

Pros and cons of buying US stocks in Kenya

- Pros

- Cons

Get access to top global companies. Buying US stocks opens the door to investing in big names like Apple, Amazon, and Microsoft, which are often leading the way in innovation and market growth.

More ways to spread risk. Adding US stocks to your portfolio helps you balance out any local market risks by exposing you to other economic environments and industries.

Invest in cutting-edge sectors. The US market is where a lot of the world’s most exciting companies grow, especially in tech and biotech, so you can get involved in future industries before they take off.

Currency fluctuations can hurt. The value of the Kenyan Shilling compared to the US Dollar can affect your profits, so the exchange rate becomes a factor you need to watch carefully.

Extra costs involved. Investing in US stocks means dealing with higher fees, such as transaction charges and currency conversion costs, which can eat into your gains.

You miss out on local tax breaks. Unlike US investors, Kenyan traders don’t get certain tax advantages, so you’ll need to plan around the fact that your returns could be affected by higher taxes.

Risks and warnings

Currency risks. When the Kenyan Shilling weakens against the US Dollar, your investment’s value might shrink when you convert it back. Keep an eye on exchange rates, as they can eat into your returns.

Tax complexities. The US tax system differs from Kenya’s, and overlooking taxes like capital gains or dividend taxes can land you in trouble. Make sure you understand the tax rules for foreign investors and stay compliant.

Access to real-time data. Without proper access to US market data, you could miss key opportunities or get stuck with outdated info. Ensure your platform provides reliable and timely updates.

Volatility risks. US stocks, especially in tech and biotech, can swing wildly. As a beginner, focus on managing your emotions to prevent impulsive decisions during sharp market shifts.

Brokerage costs. Low-cost platforms might hide extra charges for things like currency conversion or international transactions. Always dig into the details of what you’re paying for.

Time zone challenges. The US market operates when you’re likely asleep in Kenya. Be prepared to trade or react to market shifts outside of regular business hours to avoid missing opportunities.

Exchange rates and tax strategies can affect your profits

When buying US stocks in Kenya, it’s crucial to consider how the exchange rate between the Kenyan Shilling and the US Dollar can affect your profits. Many beginners overlook this, but the truth is that the value of the shilling compared to the dollar can make a noticeable difference in what you end up with. To avoid this, keep an eye on exchange rates and use platforms that let you lock in a good rate, so you aren’t caught off guard when converting.

Also, don’t forget about taxes. While the IRS takes a 30% cut of your US stock dividends, you may be eligible for a refund through a double taxation agreement between the US and Kenya. This means you can reclaim some of what was taken. Be sure to know how to handle the paperwork to get that refund. And remember, your earnings from US stocks will still be taxable in Kenya, so make sure to report them correctly when you file your taxes here.

Conclusion

Buying US stocks in Kenya is a viable way to diversify your investments and gain exposure to global markets. By following the steps outlined above, understanding the risks, and leveraging expert advice, you can start your journey toward financial growth and independence. Whether you’re a beginner or an advanced trader, the opportunities in the US market are abundant and worth exploring.

FAQs

Are there minimum investment amounts for US stocks?

Yes, most brokers have a minimum deposit requirement, typically ranging from $1 to $100. Some platforms also allow fractional share investing, making it easier to start small.

How long does it take to open an account with a broker?

Account opening and verification can take anywhere from a few hours to a couple of days, depending on the broker and how quickly you submit the required documents.

What happens if the broker I use shuts down?

Reputable brokers often segregate client funds from operational funds, ensuring your money is protected. Always choose a regulated broker to minimize risks.

Can I withdraw my earnings in Kenyan Shillings?

Yes, most brokers allow withdrawals to Kenyan bank accounts or mobile wallets like M-Pesa, but the funds are typically converted from USD to KES at prevailing rates.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).