Insider Trading And Stock Market Clues. How To Spot Unusual Moves Before Big News

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Insider trading occurs when individuals buy or sell stocks based on confidential company information before it becomes public. While legal insider transactions follow strict disclosure rules, illegal trades based on non-public earnings, mergers, or regulatory decisions can lead to market manipulation and regulatory action. Unusual trading patterns, such as executives selling shares before bad news or options activity spiking ahead of announcements, often signal hidden market shifts. Smart investors monitor insider trading trends to identify potential risks and opportunities before major stock movements occur.

Stocks don’t suddenly jump or crash without a reason. When company insiders start buying or selling in big volumes right before big announcements, it raises the question — did they know something before the rest of the market? Yes, trading on private information is illegal, but that doesn’t mean it never happens. In many cases, unusual insider activity hints at what’s coming before official news breaks.

If top executives start dumping shares right before a bad earnings report or a failed merger, chances are the market is already reacting before the public even knows what’s going on. The trick for investors is figuring out when insider trades actually signal something important — and when they’re just normal business as usual.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding insider trading

Insider trading happens when someone buys or sells a stock based on confidential company information that has not yet been made public. While some insider transactions are completely legal, others break securities laws by giving unfair advantages to those with inside knowledge. Illegal insider trading hurts market fairness and investor trust, which is why regulators closely monitor such activities.

Definition and legal framework

Insider trading involves trading stocks using non-public information that could affect share prices. When done improperly, it creates an uneven playing field by allowing certain individuals to profit while the general public remains unaware of key company developments.

Examples of insider trading

Buying shares before a major merger or acquisition is announced.

Selling stock before a company reports weaker-than-expected earnings.

Passing confidential financial information to friends or relatives who trade on it.

Key insider trading laws around the world

U.S. Securities Exchange Act (1934)

- Prohibits trading on material non-public information and gives enforcement power to the SEC.

Europe’s Market Abuse Regulation (2016)

- Prevents financial misconduct and promotes transparency in European stock markets.

India’s SEBI Regulations (2015)

- Defines strict rules for corporate insiders and compliance officers to prevent illegal stock trades.

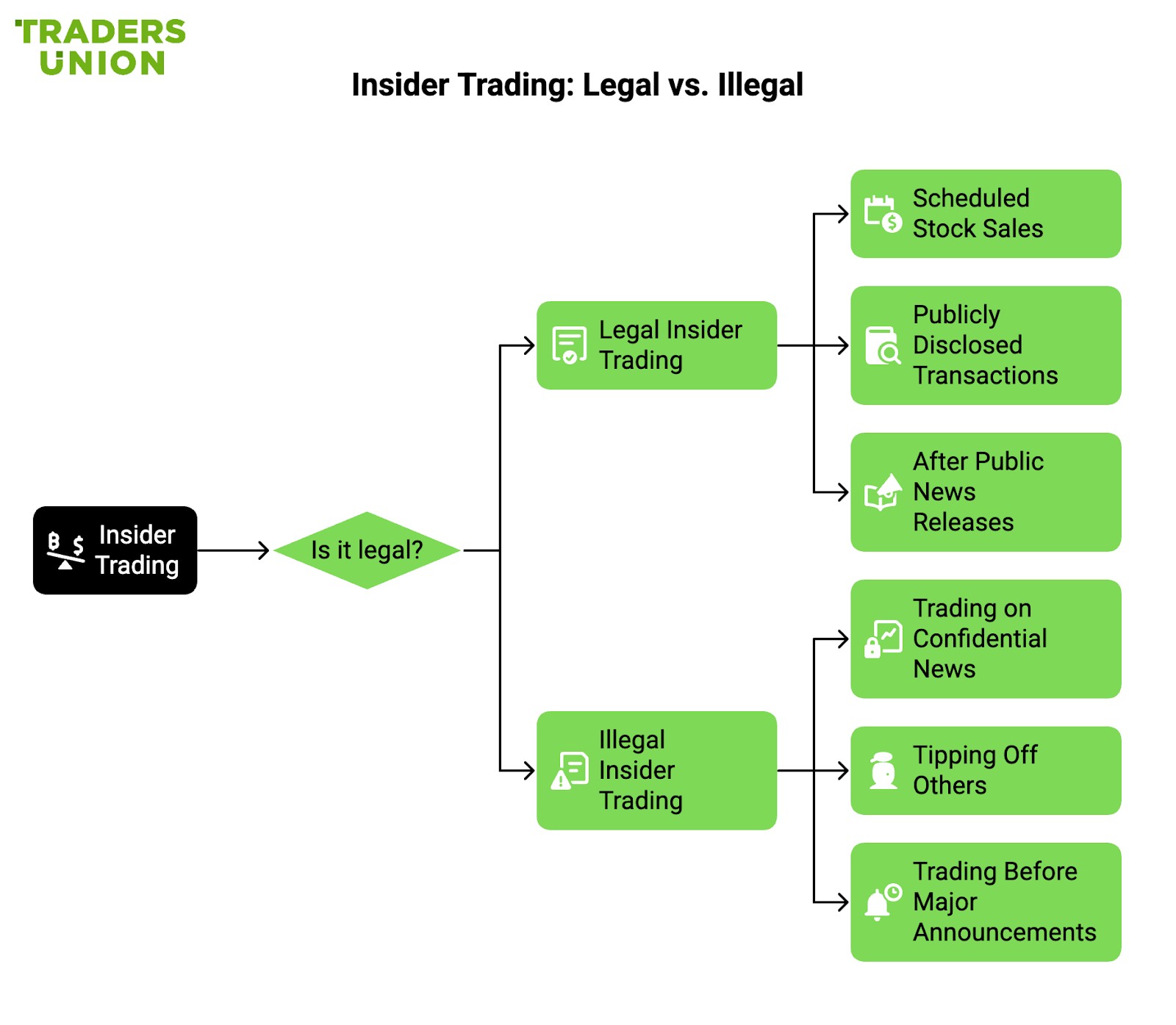

Legal vs. illegal insider trading

Not all insider trading is illegal. Corporate executives, employees, and board members can legally trade company stocks — but they must follow clear disclosure rules.

Legal insider trading

Scheduled stock sales

- Executives can set up pre-planned stock sales (10b5-1 plans in the U.S.) to avoid unfair trading concerns.

Publicly disclosed transactions

- When an insider buys or sells stock and reports it to regulators, the trade is legal.

Buying shares after public news releases

- If a company has already announced financial results or new business developments, insiders are free to trade.

If you wish to invest in stocks and don’t already have an account, you may choose from the list of brokers we have presented below. They are market leaders in terms of features and accessibility.

| Stocks | Foundation year | Account min. | Demo | Research and data | Basic stock/ETF fee | Deposit Fee | Withdrawal fee | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2007 | No | Yes | Yes | $3 per trade | No | $25 for wire transfers out | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| Yes | 2014 | No | No | Yes | Zero Fees | No | No charge | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| Yes | 1919 | No | No | Yes | Zero Fees | No | $25 | FDIC, FINRA, SIPC, SEC, CFTC, NFA | 6.61 | Study review | |

| Yes | 2015 | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | No | No charge up to a limit | FCA, SEC, FINRA | 7.69 | Study review | |

| Yes | 1978 | No | Yes | Yes | 0-0,0035% | No | No | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

Illegal insider trading

Trading on confidential company news

- If someone buys or sells stock based on non-public earnings, mergers, or business deals, it is illegal.

Tipping off others with insider information

- Sharing company secrets with friends, family, or business associates who then trade stocks is also against the law.

Trading ahead of major announcements

- Executives, employees, or investors placing trades before a company releases earnings or regulatory filings violate insider trading laws.

Indicators of insider trading before major news

Before a company makes an important announcement, trading activity can reveal clues that some investors may have access to inside information. Regulators and analysts watch for sudden jumps in trading volume or unexplained price movements as signs that someone might be acting on confidential news before it becomes public.

Unusual trading volumes

One of the biggest red flags for insider trading is a sharp increase in trading volume before a major company event. If more shares are being bought or sold than usual — and there is no public news to explain it — there is a chance that some investors know something others do not.

Warning signs in trading volume

The sudden increase in buy or sell orders before major announcements

- If a stock typically trades 100,000 shares daily but suddenly jumps to 500,000 shares before earnings or merger news, it raises suspicions.

Spike in options trading

- Instead of trading the stock directly, some insiders buy call options before good news or put options before bad news to make higher profits.

Large institutional trades before public disclosures

- Big hedge funds or investors placing massive trades before earnings or regulatory news can be a red flag.

Multiple company insiders making similar trades

- If several executives or board members buy or sell shares at the same time, it may indicate inside knowledge.

Real-life cases of unusual trading volume

Equifax (2017). Before the company announced a major data breach, top executives sold millions of dollars’ worth of stock, sparking insider trading investigations.

ImClone Systems (2001). Several executives and close associates sold stock before the FDA rejected a drug application, leading to insider trading convictions.

When regulators notice unusual trading activity, they often investigate whether insiders had access to non-public information.

Price movements without public information

If a stock rises or falls sharply without any clear reason, it could mean that some investors are acting on inside information.

What unusual price movements look like

Unusual options activity before major events. If there’s a sudden spike in call or put options trading before earnings, a merger, or a regulatory decision, it could signal that informed traders are making moves.

Stock volume spikes without news. When a stock’s trading volume surges above its daily average without any public announcement, some investors may have inside information.

Large institutional trades before announcements. Big block trades by hedge funds or institutions, especially in off-exchange dark pools, can suggest major news is coming.

Related stocks moving before big events. If suppliers or competitors start moving sharply with no clear news, they may be reacting to inside knowledge about an upcoming event.

Insiders trading before key news. Executives or board members making unusual stock sales or purchases right before earnings, acquisitions, or regulatory fines can be a red flag.

Analyst upgrades or downgrades with vague reasoning. Sudden analyst rating changes or price target adjustments just before major news may indicate inside knowledge.

Spike in social media and forum activity. If Reddit, Twitter, or trading forums start buzzing about a stock with no news, it could be an early sign of leaks or coordinated trading.

Short interest changes before price swings. A sharp decline in short positions before good news or a spike in short selling before bad news may suggest traders are acting on inside information.

Real-world example of suspicious price movements

HP (2011). The stock fell before the CEO’s resignation was announced, raising insider trading concerns.

Case studies of insider trading ahead of news

Pfizer’s Paxlovid trial results

In 2022, a former Pfizer executive was caught trading on non-public information about the company’s COVID-19 antiviral drug, Paxlovid.

What happened?

While working at Pfizer, the employee had early access to clinical trial results for Paxlovid.

Before the company officially announced the drug’s high effectiveness, he bought stock options, expecting Pfizer’s stock price to rise.

When Pfizer publicly released the trial results, the stock jumped, allowing him to profit illegally.

How authorities responded

The SEC investigated and charged the former employee with insider trading.

He was forced to return the illegal profits and faced legal penalties.

Why this case was significant

It exposed the risk of insider trading in pharmaceutical companies, where clinical trial results can cause big stock movements.

It led to stricter security measures for handling sensitive trial data.

This case was a reminder that pharmaceutical trial data is highly valuable, and companies need strong compliance measures to prevent insider trading.

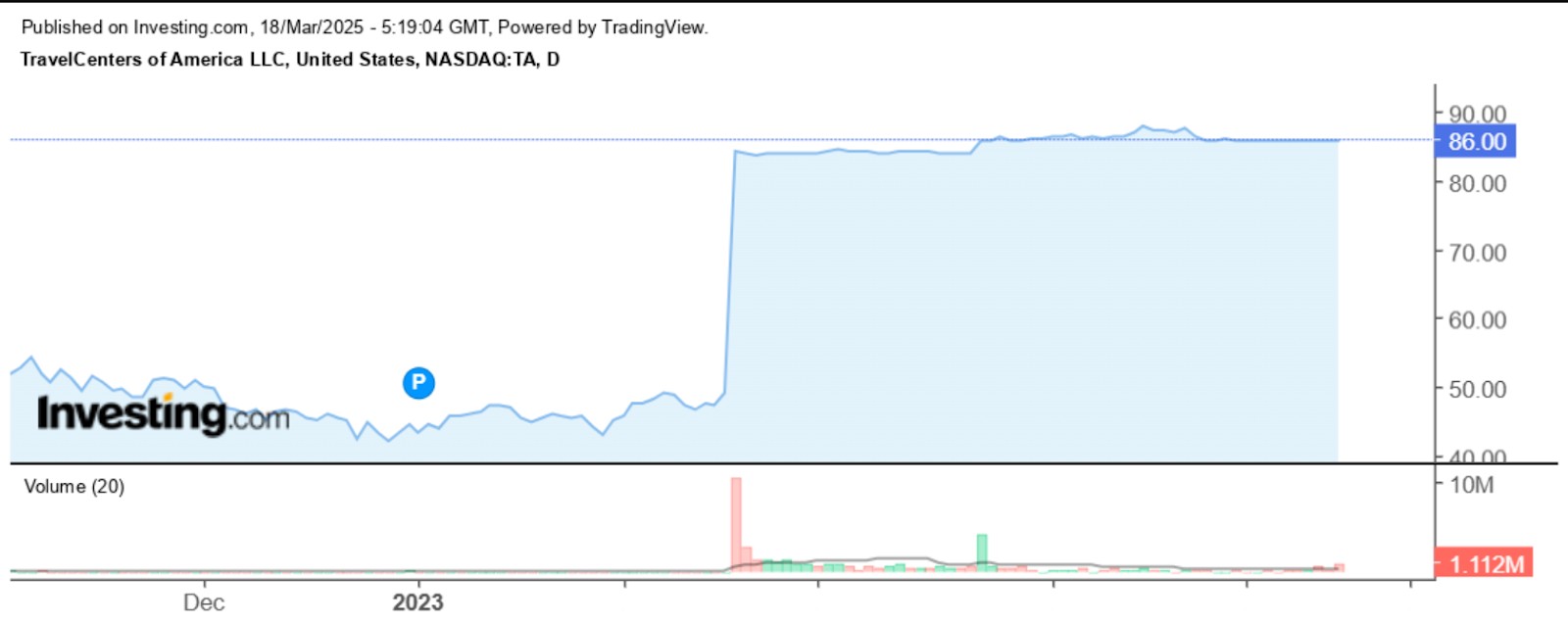

BP’s acquisition of TravelCenters of America

In 2023, an employee at BP was caught using confidential deal information to trade stock in TravelCenters of America (TA) before an acquisition was announced.

What happened?

BP planned to buy TravelCenters of America for $1.3 billion, a deal that would significantly impact the company’s stock price.

A BP employee, who had access to merger discussions, bought shares of TA before the announcement.

Once the deal was made public, TA’s stock price surged by over 70 percent, allowing the employee to sell shares for a large profit.

How authorities responded

The SEC opened an investigation into unusual stock trading before the acquisition announcement.

The BP employee was charged with insider trading and faced legal consequences.

Why this case was important

It showed how insider trading often occurs around mergers and acquisitions, where deal information is highly sensitive.

It reinforced the need for companies to monitor employees who have access to confidential corporate deals.

Consequences of insider trading

Insider trading is not just illegal — it can also lead to heavy financial penalties, jail time, and lasting reputational damage. Regulatory agencies such as the SEC, FCA, and SEBI enforce strict laws to punish those who trade on non-public information. Those caught engaging in insider trading often face lifelong consequences, including career setbacks and public disgrace.

Legal penalties

Governments have strong legal frameworks in place to prevent insider trading, with penalties designed to deter individuals and companies from using confidential information to manipulate stock markets.

Common legal consequences

Expensive fines

- Those convicted of insider trading often have to pay fines that exceed their profits.

- Example. Raj Rajaratnam (Galleon Group) was fined nearly $93 million, in addition to his prison sentence.

Prison time for serious offenses

- Many high-profile cases have led to multi-year prison sentences.

- Example. Martha Stewart served five months in prison for her role in an insider trading case.

Bans from working in finance

- Regulators can permanently bar convicted individuals from trading or holding executive positions.

- Example. Some Wall Street traders lost their securities licenses and were never allowed to work in finance again.

Corporate lawsuits and settlements

- Companies involved in insider trading often pay large fines and legal settlements to resolve claims.

- Example. Goldman Sachs paid $550 million in a settlement related to misleading investors.

Ongoing regulatory scrutiny

- Companies and individuals caught once often remain under strict watch by financial regulators.

Legal consequences are severe to prevent unfair trading practices and maintain trust in financial markets.

Reputational damage

While legal penalties are harsh, the long-term damage to reputation can be even worse. Insider trading scandals can destroy careers, shake investor confidence, and hurt corporate brands for years.

How insider trading affects reputations

Executives and traders lose credibility

- Many lose their jobs and struggle to find new opportunities after being linked to insider trading.

- Example. Raj Rajaratnam, once a top hedge fund manager, was permanently banned from financial markets.

Negative media coverage

- Once a case becomes public, the media reports heavily on the scandal, making it difficult for individuals or companies to recover.

- Example. Martha Stewart’s conviction (2004) harmed her reputation, although she later rebuilt her brand.

Stock prices fall due to investor distrust

- Companies involved in scandals often see their stock values drop as investors lose faith in management.

Companies struggle to rebuild trust

- Even after paying fines, some businesses never fully recover from an insider trading scandal.

- Example. ImClone Systems never regained investor confidence after its insider trading case in 2001.

Difficulties in hiring and partnerships

- Convicted individuals face career challenges, and companies may struggle to gain regulatory approvals for future deals.

Track insider moves over weeks or months

A lot of investors think insider trading is either illegal or too rare to matter, but that’s not the case. Corporate executives buy and sell stock all the time, and their moves can be great clues — if you know what to look for. The trick isn’t just watching who is trading but when and why. If a CEO sells shares, it could just be for personal reasons. But if a company’s CFO — the person in charge of the books — suddenly dumps stock right before a bad earnings report, that’s a warning sign.

Similarly, when multiple insiders from different departments start buying at once, they may not be breaking any rules, but they could be acting on confidence about something the public doesn’t yet know.

What really matters isn’t just one trade, but patterns over time. A single executive selling shares might mean nothing, but when several top insiders start cashing out at the same time, it’s often because they see trouble coming.

On the other hand, if insiders keep buying even as the stock price drops, they may believe the market is undervaluing the company. The smartest investors don’t just react to one-off trades — they track insider moves over weeks or months to spot trends before they turn into major headlines.

Conclusion

When insiders trade ahead of big news, it’s not always illegal — but it’s almost always worth watching. Not every trade means something major is about to happen, but some moves can give away what’s coming before the rest of the market figures it out. The trick isn’t to follow every insider trade, but to focus on who’s making them, when they’re happening, and what they might mean. If company leaders are selling stock before bad news or quietly buying ahead of a big shift, paying attention to these signals can help investors make smarter moves before the headlines break.

FAQs

Can insiders buy before news?

Insiders cannot legally buy shares based on non-public, material information, as it constitutes insider trading. Regulatory bodies impose strict rules to prevent unfair advantages in the market.

What is a real-world example of insider trading that has been in the news?

The Martha Stewart case is a well-known example where she sold shares based on non-public information. She faced legal action, including fines and imprisonment, for insider trading violations.

What is the 11 am rule in trading?

The 11 am rule suggests that market trends established by 11 am often continue for the rest of the day. Traders use this rule to gauge momentum and make informed decisions.

What are the three types of insider trading?

The three types of insider trading include legal trading with proper disclosures, illegal trading based on non-public information, and tipping, where insiders share confidential information with others for trading purposes.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Insider trading is the illegal practice of buying or selling a company's securities (such as stocks or bonds) based on non-public, material, and confidential information about the company. This information is typically known only to insiders, such as company executives, employees, or individuals with close connections to the company, and it gives them an unfair advantage in the financial markets.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.