What Currency Does Mexico Use? A Trader’s Guide For 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Mexico uses the Mexican peso (MXN) as its official currency. As of 2025, the peso remains one of the most actively traded currencies worldwide and is managed by Banco de México. The currency code is MXN, and the symbol is $. Banknotes come in denominations from 20 to 1,000 pesos, while coins range from 50 centavos to 20 pesos. The peso is accepted across the country and plays a key role in regional trade and international currency markets.

Whether you're heading to Cancun or exploring emerging market currencies, it's important to know how Mexico’s money works. In this guide, you’ll find clear answers about the Mexican peso: what it is, how it functions, and why it matters. From how the currency is structured to what influences its value, this breakdown offers useful insights for everyone, whether you're just starting or already trading. You’ll walk away with a solid understanding of how to approach trading the MXN.

What currency does Mexico use?

The Mexican peso (MXN) is the official currency of Mexico, represented by the symbol $ or Mex$. One peso is divided into 100 centavos.

Coins and banknotes. Coins commonly in use include 50¢, 1, 2, 5, 10, and 20 pesos. Banknotes are issued in denominations of 20, 50, 100, 200, 500, and 1,000 pesos.

Origin of the term “peso.” The word “peso” comes from the Spanish word for “weight,” reflecting the currency’s origins in colonial-era silver trade.

Global ranking of the peso. As of early 2025, the Mexican peso ranks as the 18th most used currency in international payments, according to recent data.

Regional importance. The peso is one of the most actively traded currencies in Latin America and plays a central role in regional trade and remittances.

Why currency knowledge matters. Knowing that Mexico uses the peso helps in understanding its economic environment and in evaluating foreign exchange opportunities tied to the region.

How the Mexican peso performs in global markets

The Mexican peso (MXN) is a free-floating currency managed by the Bank of Mexico (Banxico). Its value is influenced by factors such as U.S. economic policies, global commodity trends (particularly oil prices), domestic inflation, and interest rate differentials.

Banxico policy rate. 9.00%

Inflation rate. 3.80% YoY

FX reserves. Approximately $234.8 billion USD.

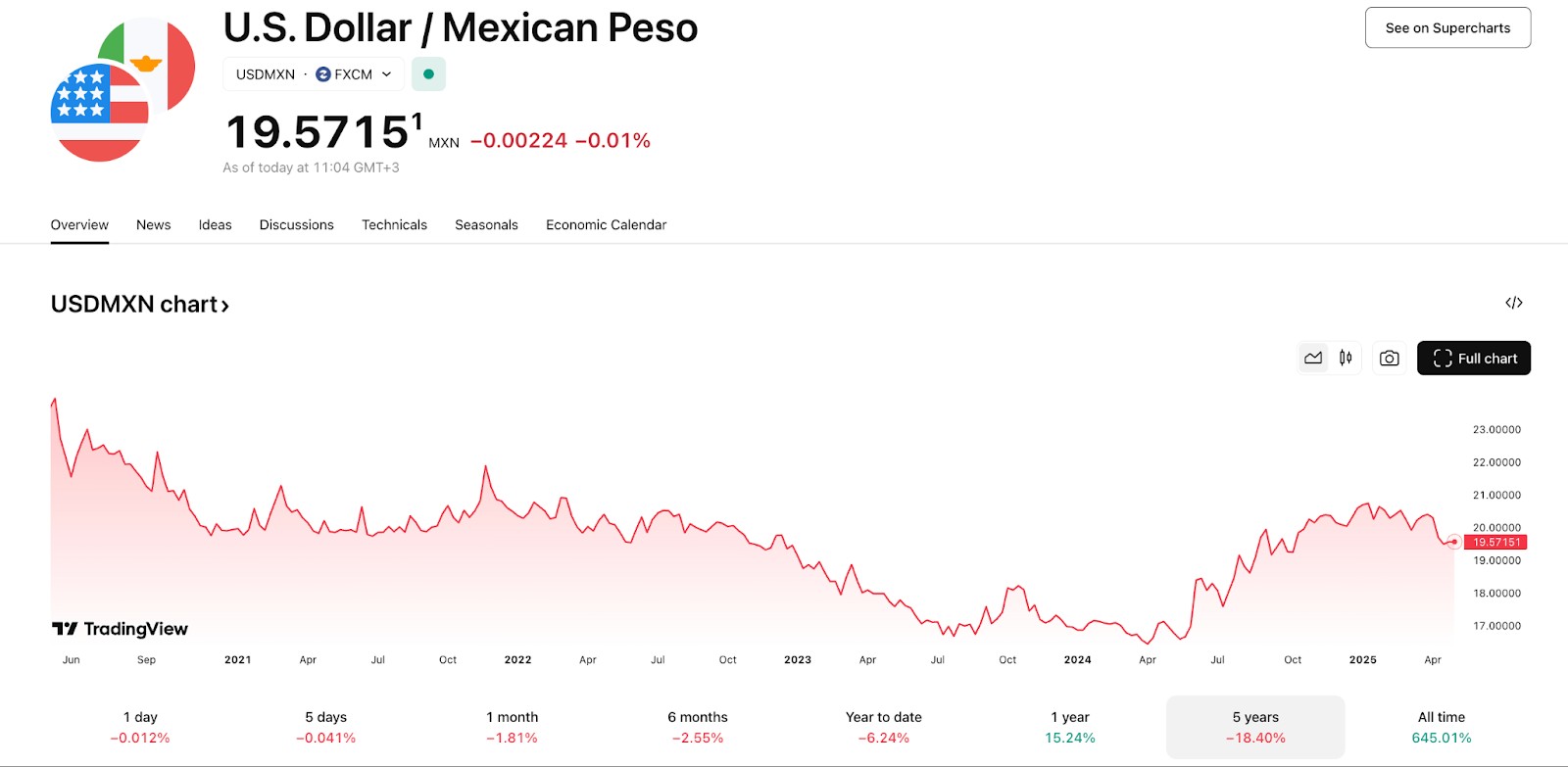

USD/MXN range. 19.5 to 19.7 (Q2 average: 19.6)

The Mexican peso is often seen as a bellwether for investor confidence in Latin America's economic outlook.

How to trade the Mexican Peso (MXN)

The Mexican peso (MXN) is known for its liquidity and volatility, attracting a diverse group of traders, from those focusing on short-term movements to those analyzing broader economic trends.

As per the BIS Triennial Survey, the MXN had an average daily turnover of approximately $114 billion, making it the 16th most traded currency globally.

The USD/MXN currency pair is the most actively traded involving the peso, reflecting the strong economic ties between Mexico and the United States.

The top MXN currency pairs are:

USD/MXN. This pair is highly liquid and exhibits significant volatility, making it a focal point for many traders.

EUR/MXN. Traders often use this pair to explore macroeconomic divergences between the Eurozone and Mexico.

MXN/JPY. This pair is popular in carry trade strategies due to interest rate differentials.

GBP/MXN. Traders interested in strategies involving both European and Latin American markets often engage with this pair.

If you’re planning to trade the Mexican Peso (MXN) on the Forex market, the first step is to open an account with a broker that offers MXN currency pairs. Below, we’ve listed some of the top Forex brokers that support trading in the Mexican Peso. Review their trading platforms, spreads, and account types to find the best fit for your trading style and goals.

| MXN | Currency pairs | Min. deposit, $ | Max. leverage | Deposit fee, % | Withdrawal fee, % | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 40 | 100 | 1:500 | No | No | ASIC, SCB, CySEC, FCA | 9.1 | Open an account Your capital is at risk. |

|

| Yes | 57 | 5 | 1:1000 | No | No | CySEC, FSC (Belize), DFSA, FSCA, FSA (Seychelles), FSC (Mauritius) | 9 | Open an account Your capital is at risk. |

|

| Yes | 40 | 10 | 1:2000 | No | 0-4 | FSC | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 100 | 10 | 1:2000 | No | No | FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, CBCS, CMA | 8.7 | Open an account Your capital is at risk.

|

|

| Yes | 55 | 100 | 1:500 | No | 1-3 | ASIC, FSCA, FSC Mauritius | 8.69 | Open an account Your capital is at risk. |

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions. Learn more about our methodology and editorial policies.Why trust us

Key considerations for beginners

Before jumping into MXN trades, beginners should understand that the Peso behaves differently from major currencies due to its regional exposure, carry trade appeal, and unique sensitivity to U.S. policy.

Monitor Banxico’s surprise factor. The Mexican central bank (Banxico) has a history of unexpected rate decisions; these can create short-term trade spikes that smart traders prepare for by reviewing meeting tone shifts, not just forecasts.

Use U.S. dollar correlation with caution. While MXN often mirrors USD movements due to trade ties, divergence happens during U.S. political instability or Mexican election cycles; don’t assume they're always in sync.

Time your trades around the U.S. and Mexican market overlaps. The Peso shows higher liquidity and tighter spreads when both markets are open, typically between 8 AM to 1 PM EST. Trading outside this window? Expect slippage.

Respect the Peso’s carry trade appeal. In high-interest periods, MXN attracts short-term capital inflows. Pairing it with low-yield currencies (like JPY or CHF) can offer edge, but watch for sudden unwinding risk on global fear events.

Price in NAFTA/USMCA-linked policy shifts. Many traders forget that even a minor tariff announcement or labor clause tweak can shift sentiment fast. News scanning should cover both sides of the border.

Don’t ignore remittance-driven seasonality. MXN demand spikes around certain months (like May and December) due to remittance inflows. This isn’t just noise, but an edge for planning directional trades.Key considerations for advanced traders

Pros and cons of trading MXN

- Pros

- Cons

Access to emerging market arbitrage. MXN’s correlation with commodities like oil creates price inefficiencies across pairs like USD/MXN and EUR/MXN that savvy traders can exploit.

High interest rate differential. Mexico’s relatively high interest rates compared to major economies make it a favorite in carry trade setups, generating yield beyond price moves.

Intraday volatility spikes. MXN experiences powerful but time-boxed volatility around U.S. data releases, offering prime setups for short-term scalpers using tight risk controls.

Underrated seasonal flows. Remittance seasonality, particularly around U.S. tax refund and holiday periods, can create predictable inflows into MXN, often overlooked by new traders.

Susceptible to U.S. policy shocks. Any unexpected hawkish pivot from the Fed can crush MXN sentiment due to the Peso’s sensitivity to U.S. rate expectations.

Wide spreads during off-hours. Liquidity dries up rapidly outside North American market hours, leading to unexpected slippage even on limit orders.

Noisy technical levels. MXN pairs often fake out near conventional support/resistance zones — partly due to algorithmic positioning and regional bank flows.

Headline risk from local politics. Political volatility in Mexico, especially near elections, can drive wild moves unrelated to global macro trends, confusing technical setups.

Using rate tone mismatch and fuel spreads to forecast Peso moves

If you're just getting into trading the Mexican Peso (MXN), one power move most new traders miss is knowing when the market goes off-script. Look closely at the gap between Banxico and Federal Reserve announcements. The peso often reacts more to a mismatch in tone than to the rate decision itself. If the Fed sounds aggressive while Banxico holds back, expect the peso to dip as traders reprice carry potential. Instead of reacting to the headlines, lean into the narrative traders will build in the next 2–3 days. That’s where the action really kicks in.

Here’s another edge that slips under the radar: peso strength often hinges on oil spreads, not just the price of oil. Mexico exports crude but relies on importing refined fuel — so what really matters is the WTI vs. Gulf Coast gasoline spread. When that spread tightens, it hints at a healthier trade balance and can push the peso higher. Few everyday traders even notice this shift, but it’s already factored in by big institutional players. Follow the EIA’s weekly data to catch those early signals, and you'll be ahead of the herd.

Conclusion

The currency of Mexico, the Mexican peso (MXN), remains a top choice for traders seeking exposure to Latin America. With a robust macroeconomic structure, high-interest environment, and responsive price action, MXN offers rich opportunities. Whether you're just beginning or deploying institutional strategies, knowing what currency does Mexico use is the key to navigating this exciting market.

FAQs

Can the peso act as a proxy for emerging market sentiment?

Yes, the peso often moves ahead of other emerging market currencies like BRL or ZAR. Traders use MXN as a “canary” for global EM flows, especially during shifts in U.S. policy or global risk appetite.

How do fuel imports impact MXN trading?

Mexico exports crude oil but imports most of its refined fuel. This makes the peso sensitive to refining margin shifts, especially between WTI and U.S. Gulf gasoline prices. It’s a smart edge for macro traders.

What trading hours offer best spreads for USD/MXN?

The best liquidity and tightest spreads for USD/MXN are during the U.S.–Mexico overlap: 8 AM to 1 PM EST. Outside this window, spreads widen and slippage increases, especially during the Asia session.

Does remittance seasonality impact peso flows?

Absolutely. MXN demand surges in May and December due to remittances from abroad. These flows boost liquidity and can temporarily support the peso. Few traders factor this in, but it’s a repeatable pattern.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).