NAGA is a social trading platform that is actively influencing the direction of investments and offering several proprietary products for generating passive income.

Currently, the copy trading platform is NAGA’s premier project. Trading on NAGA is carried out on a proprietary service, and so the broker doesn’t cooperate with third-party platforms. Look for TU’s comprehensive review of NAGA Auto Copy platform. Let's consider the main features and functions and find out how to copy traders on NAGA.

What is copy trading?

The first trade copy service was developed and launched in 2010. During the next 10 years, many brokers developed similar platforms.

The copying traders principle is quite simple. Join the platform and select the trader you want to copy. Next subscribe to the strategy provider. This can be done in the following ways:

-

click on the Copy (or similar) button;

-

add a special file to the trading terminal.

Each broker and each platform has its own principle, depending on the set of functions. Brokers can develop their platforms or cooperate with social trading platform providers (for example, MQL5 or MyFxBook). Copying trades on NAGA is carried out on its proprietary service.

NAGA Copy Trading network in 2024

Today, NAGA Copy Trading network is known for carefully selecting strategy providers. They’re pros who have passed several stages of strict selection. In addition, the platform Auto Copy has a high level of reliability.

The platform used for copying trading |

Auto Copy |

Regulators |

Cyprus – CySec No.204/13; Great Britain – FCA No.609499. |

Minimum investment for copying |

USD 250 |

Commissions for traders |

0% |

Replenishments and withdrawals |

Bank transfer, bank cards, Sofort, Neteller, Skrill, cryptocurrencies |

Markets to copy |

Forex, stocks, CFDs on stocks, indices, commodities, cryptocurrencies, ETFs. |

Number of instruments |

1000+ |

Average spread in EUR/USD |

2.5 |

Network Scale |

Over 9000 strategy providers |

NAGA Auto Copy review

The NAGA Auto copy platform offers users a wide range of copy trading methods.

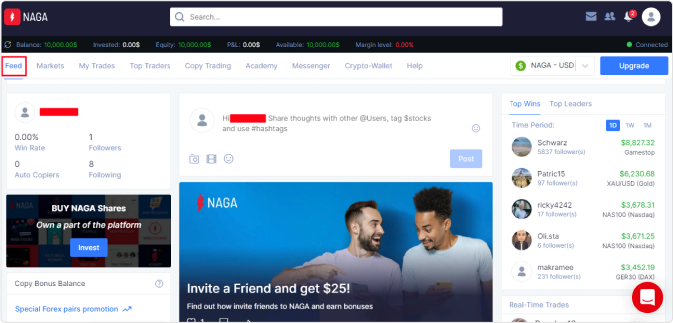

After registering and logging into your account, you will be directed to the Feed section, where all the information specified in your profile is provided. If you are planning not only to copy trades but also intend to become a strategy provider, we recommend that you fill out the profile completely so that future subscribers can get more information about you.

NAGA Auto Copy review

Information on markets

Important!

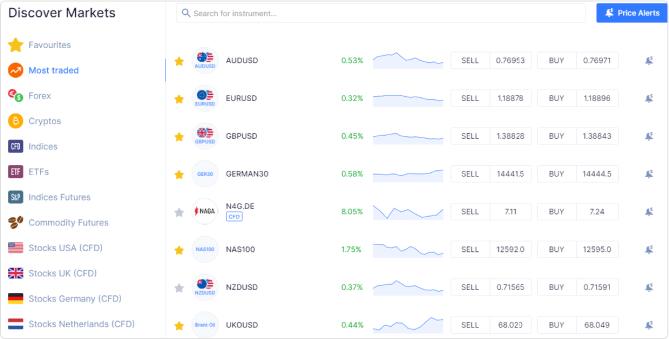

Pay attention to the Markets tab in the top menu of your NAGA Copy Trading account. Here, find information on the markets available for copying. Also, find here a brief overview of the market situation concerning certain trading instruments. This is important as by choosing the strategies for copying trade providers, you will be able to choose the ones that trade in the “hottest” markets.

Click on the Most Traded item to find out which instruments are the most active (hottest). To add instruments to your favorites click on the star, which is located next to each item. You can view them in your Favorites tab later.

NAGA Auto Copy review - Information on markets

Statistics of trades and traders

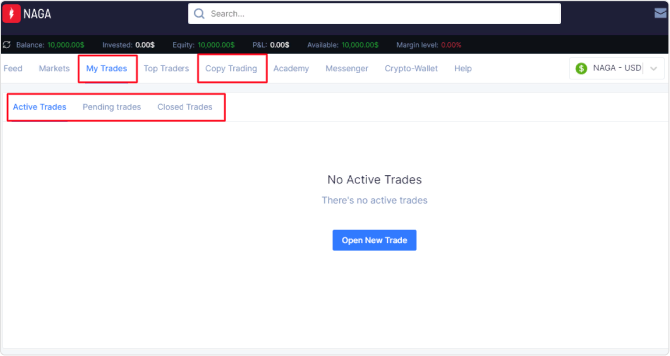

There are two tabs in the top menu to study the statistics of trades and traders you are subscribed to. Find the information on trades in My Trades. There are three extra tabs here:

-

Active Trades;

-

Pending Trades;

-

Pending Trades;

View all the parameters for trades, including profitability, the direction of opening (buy or sell), the number of pips, the take-profit and stop-loss orders, etc., in this section of the NAGA Auto copy platform.

The Copy Trading section provides information about the traders you are subscribed to. Here you will find detailed statistics about the strategy providers you are subscribed to.

NAGA Auto Copy review - Statistics of trades and traders

The social network of NAGA traders

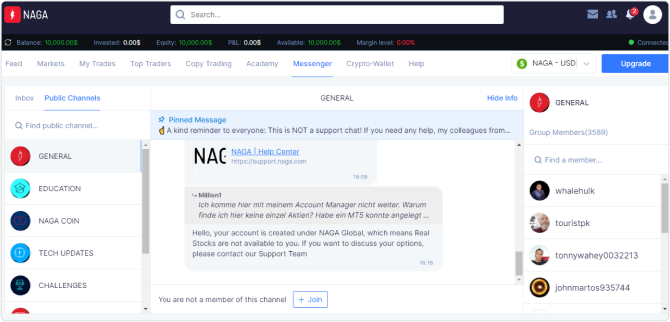

NAGA positions itself not only as a Copy Trading service but also as a social network for traders. To follow the news, select the Messenger tab in the top menu. There you can find a list of the broker's public channels that publish information to its subscribers. They are sorted by popularity by default. Use the search if you are interested in a specific channel.

The channels work in chat mode. Click on the Join button under the messenger to join the chat. You can view the list of subscribers to the public channels in the right corner of the screen.

NAGA Auto Copy review - The social network of NAGA traders

Follow the Inbox tab to view subscriptions. All the channels you are subscribed to will be displayed here. Also, you can find the information that is published by traders to whom you are subscribed or you are copying.

NAGA Auto Copy review - The Inbox tab

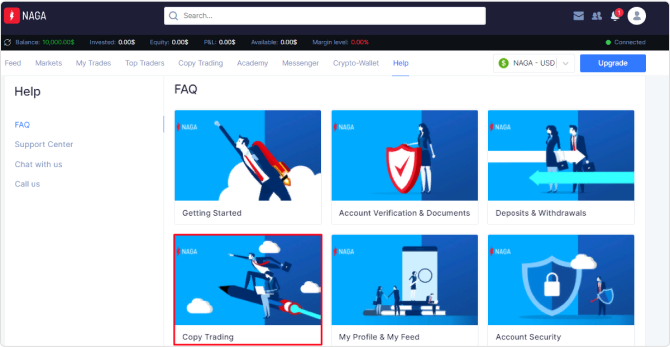

Training and help

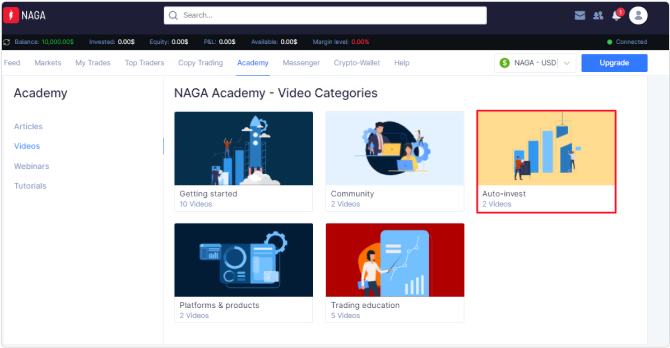

Complete the training before you start to copy traders on NAGA. The company has prepared a video course on working with the service, and it contains a section on automated trading. Follow the Academy tab and select the Auto-Invest section to view it.

NAGA Auto Copy review - Training and help

There are two videos in the Auto Invest section. Here you can watch a video about a portfolio of traders, as well as find instructions on how to subscribe to a strategy provider.

NAGA Auto Copy review - FAQ

Traders’ profiles

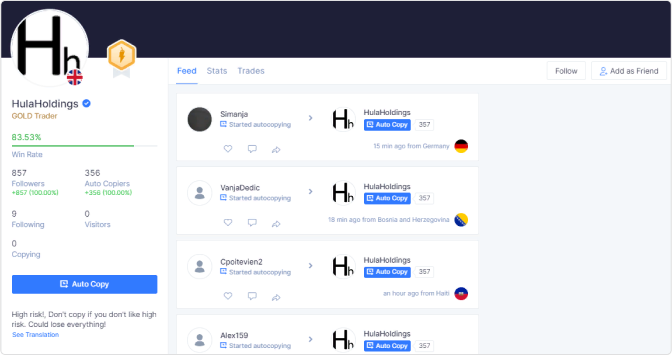

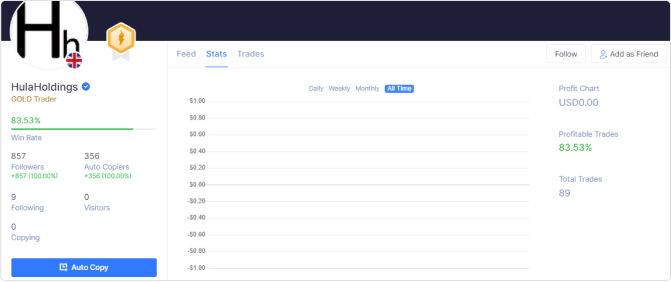

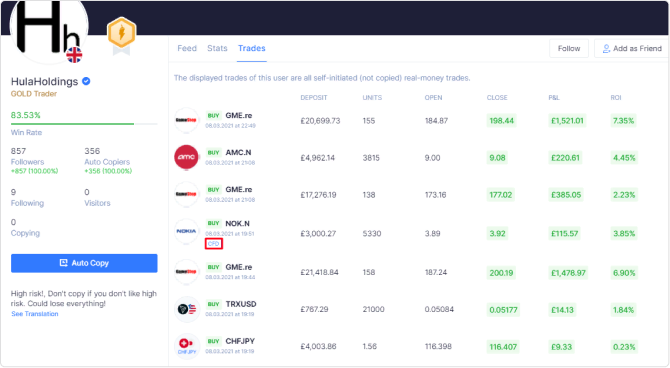

As soon as you open the trader's profile, you will see brief statistics of the strategy provider. The following data is indicated here:

-

Win rate;

-

Followers;

-

Auto Copiers;

-

Following;

-

Visitors;

-

Copying.

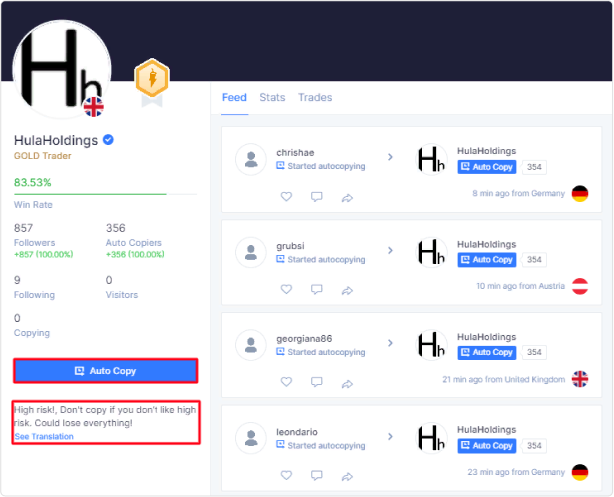

You will see who is following which trader after opening his profile. There is also a Follow button, which allows you to subscribe to traders' news (in this case, the strategy provider's news will go to your Inbox in Messenger) and click the Add as Friend button, and in this case, you can write directly to the trader.

NAGA Auto Copy review - Traders’ profiles

Traders’ statistics

Click on the Stats button in the strategy provider's profile to view statistics. After that, the platform will prompt you to view the trader's trading data per day, week, month, or the entire time of trading.

First of all, the platform will offer to view the Profit Chart. There, you can view data on profit for different periods of time. Moreover, here you can see the Profit Chart in monetary terms, the percentage of profitable trades, as well as the total number of trades.

NAGA Auto Copy review - Traders’ statistics

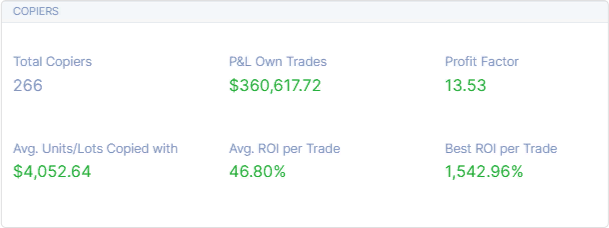

Next, you can view the subscriber statistics. In the table below you will find the following information:

-

Total copiers;

-

P&L own trades;

-

Profit factor;

-

Avg units/Lots copied with it;

-

Avg ROI;

-

Best ROI.

NAGA Auto Copy review - The subscriber statistics

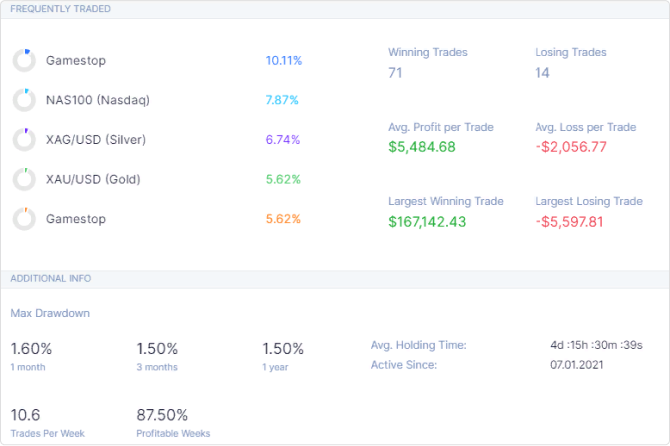

Please find below the information on the assets with which a trader most often works, as well as brief trade statistics. You will find 5 assets that a trader trades most often in the section of trading instruments.

You will also find the share of these instruments in the total number of trades as a percentage. Moreover, you will be able to find the following data:

-

the number of profitable and unprofitable trades;

-

average profit and loss per trade;

-

the biggest trades for profit and loss.

There are also extra statistics. In particular, it provides information on the maximum drawdown, Average Holding Time, and the date of the start of trading on the platform.

NAGA Auto Copy review - Extra statistics

In general, the statistics of traders on the platform can only be considered basic. There is not a lot of data. Also, there is a very modest visualization here. There is only one chart on the service, the rest of the information is presented only in the form of numbers.

Copying the traders’ trades

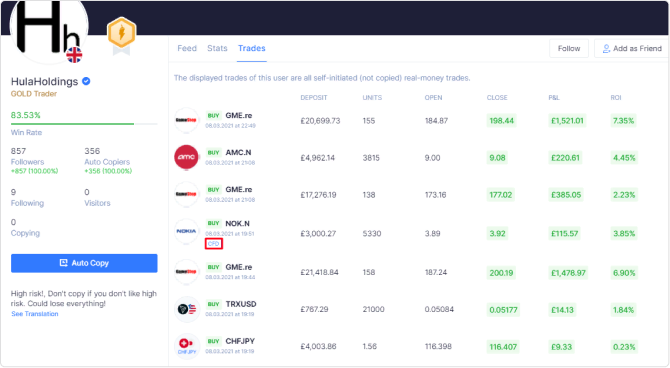

The platform also provides information on trades opened by the strategy provider. The table includes nine parameters, including:

-

The name of the asset or trading instrument;

-

date and time of the opening of the trade;

-

opening direction (buy or sell);

-

deposit;

-

opening price;

-

closing price;

-

profit/loss

-

ROI.

You can copy trades with real shares and CFDs on NAGA. If a trader works with both instruments, in the case of opening positions with CFDs on shares, a special note will appear in the table.

NAGA Auto Copy review - Copying the traders’ trades

Pros and cons of copying trades on NAGA

👍 Pros

👎 Cons

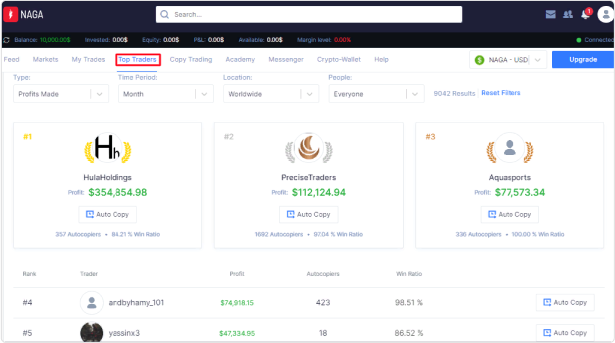

Finding the right trader to copy on NAGA

The range of traders on NAGA is quite large. There are 9003 strategy providers represented on the platform. All of them are listed in a single table.

Filters will help you to choose a trader to copy trades on the platform. There are four filters on the platform:

-

Type;

-

Period (from 1 day to all-time indicators);

-

Location (the whole world or near the subscriber’s country);

-

People (everyone, the people that you are following, people you added as friends or “friends and leaders”).

Also, it is worth noting the type of filters. There are 14 indicators presented there. In this section, you can sort traders by overall profitability, profit for subscribers, and Successful Copiers. You can also choose according to the bonus indicators for traders, each fund amount under management, profitability when trading cryptocurrencies (cryptocurrency is one of the key areas of NAGA's work).

Moreover, traders can be sorted by the best investment return, the number of subscribers, the number of trades made, the size of the referral bonus, and the total bonus amount. There is also a filter for ROI per trade, when trading on Forex and when trading with CFDs.

Finding the right trader to copy on NAGA

However, we consider the filter system at NAGA to be incomplete. In particular, you cannot set filters here in a certain indicator range. All sorting is made from highest to lowest. However, for example, you cannot choose a trader with 80% of the filter Win Ratio.

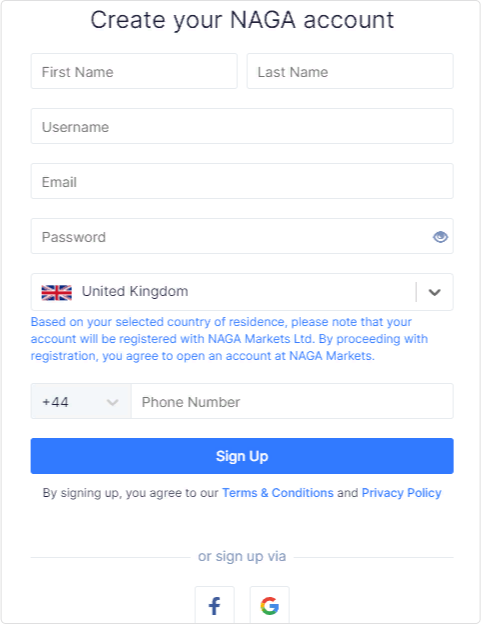

How to start copying traders on NAGA

To start copying trades on NAGA, you must go through the registration procedure. Click the Sign Up button on the broker’s main screen and complete the form:

-

name;

-

surname;

-

User name;

-

email address;

-

password;

-

phone number;

-

1

Confirm your phone number. You will receive a 4-digit code on your phone. Also, you can go through a quicker registration process using Facebook or Google.

-

Open a demo account to test the copy trading platform and after that go through the verification procedure to open a live account. Your documents are reviewed within 48 hours. Upload your passport and proof of residence address for verification.

2

How to start copying traders on NAGA

-

3

After that, log into your account and open the Top Traders tab. The table below includes all the strategy providers that offer trades for copy trading.

The Top Traders tab

-

If you have selected a trader, you can click on the Auto Copy button in the table. However, we recommend that you open a strategy provider's trading account and first study his statistics. The account provides a brief description of the strategy provider. Study the description carefully because it may contain information about the risk of the strategy, the minimum recommended budget for trading, etc.

Only after you are satisfied with the strategy provider, should you click on the Auto Copy button.

4

The Auto Copy button

-

5

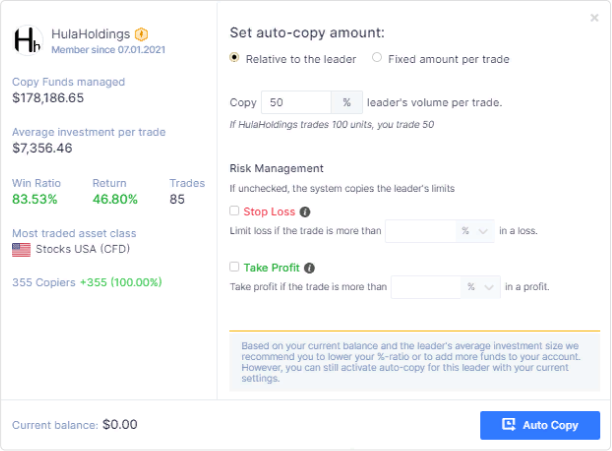

After you click on Auto Copy, you will see a window with copy trading settings. Here you can specify the following parameters:

-

Volume;

-

Take profit value;

-

Stop loss value.

Parameters can be specified as percentages or fixed values. By default, the Relative To The Leader window shall be opened in front of the trader, where all parameters may be set in percentages. If you are interested in fixed numbers, switch to the Fixed Amount Per Trade tab. In this case, you can specify the maximum investment amount for each trade (in the base currency of the account), as well as the fixed amount of Take Profit and Stop Loss in pips.

The Auto Copy button

-

Can I make money by copying traders on NAGA?

NAGA's copy trading service can be profitable. There are many traders here demonstrating excellent returns. The profit depends on the strategy risk level, your copy trading budget, instruments the strategy provider works with, etc.

Important!

However, copy trading does not exclude risks. The more risky a signal provider's strategy is, the more likely it is to lose money. Therefore, risk management and the correct choice of a trader, whose trades you copy, are all important when copying trades.

Costs of NAGA Copy Trading

NAGA provides special commissions for copying trades, but they are valid only for certain types of trading instruments. The commissions for copy trading are as follows:

-

CFD on shares – 0.2% per lot;

-

CFD on ETFs – 0.1% per lot.

For other types of instruments, the standard commissions of the selected trading account are applied. For example, the average spread for EUR/USD is 2.5 on a standard trading account. This is a high rate.

Subscribers do not pay commissions to traders for copy trading. They are paid by NAGA as a bonus for each trade copied. The amount of the bonus may differ depending on the trading account of the strategy provider - from $0.1 to $0.3 for each copied trade.

Is NAGA Auto Copy safe?

Copying trades on NAGA can be considered safe. The broker is licensed by reputable regulators. In particular, NAGA has the following financial licenses:

-

Cyprus – CySec No.204/13;

-

Great Britain – FCA No.609499.

Moreover, NAGA securities are traded on the Frankfurt Stock Exchange.

Summary

NAGA is an innovation-focused trading platform offering a wide range of investment instruments. The copy trading service is key among them. The broker provides a proprietarily developed platform. It is quite simple and has a nice interface. It is worth noting the large number of traders who provide trades for copy trading and a convenient account with lots of information.

However, the terms for trading on NAGA are not the most attractive. In particular, there are large spreads here and there are commissions aimed directly at copy trading. The search for traders is also difficult due to the unfocused filter system.

Expert’s review

The NAGA broker offers traders a copying service that is proprietarily developed. It is worth noting that the project team did a good job on it. The NAGA social trading platform looks modern, the interface is pleasant and is not overloaded with unnecessary elements. You can select options for copying trades, and thus reduce the risk of losing funds.

However, the search for strategy providers on the platform is difficult due to poorly designed filters. There are few criteria, and it is impossible to specify exact parameters for the search. Moreover, the high spreads are worth noting. A spread of 2.5 pips for EUR/USD is quite high.

Antony Robertson

Traders Union financial analyst

NAGA Copy Trading reviews

Very good and very convenient service for copy trading. I‘ve been working with NAGA for 6 months now, and I am completely satisfied. The platform is very easy to understand, you can subscribe to traders with a single click. Also, you can follow the news published by strategy providers. This helps when self-trading.

Charlotte Werner

novice investor

Great Britain

Good enough service for copy trading. Everything is at hand, and this is convenient enough. Their terminal is also very good. It is convenient to control trades that are opened when copying. However, it takes a lot of time to find traders here. I’d like to see a better filter system here.

Haris Parris

investor

Greece

It is difficult to work with this service due to the high fees. Spreads here are unprofitable, regardless of a commission-free policy for strategy providers. The statistics are inconvenient. I didn't like this copy trading platform.

Floor Cooke

retired

Netherlands

FAQ

What platform is used for copy trading on NAGA?

NAGA offers a proprietary trading terminal. It is used for both trading and copying trades.

Is copy trading with NAGA safe?

NAGA is regulated in Cyprus and the UK, so it can be considered reliable. The main risk of working with copying trades is the copying itself.

What is the minimum deposit for copy trading on NAGA?

Replenish your account with $250 to start copying trades.

What base account currencies are available on NAGA?

NAGA offers clients four base account currencies such as USD, EUR, GBP, and PLN