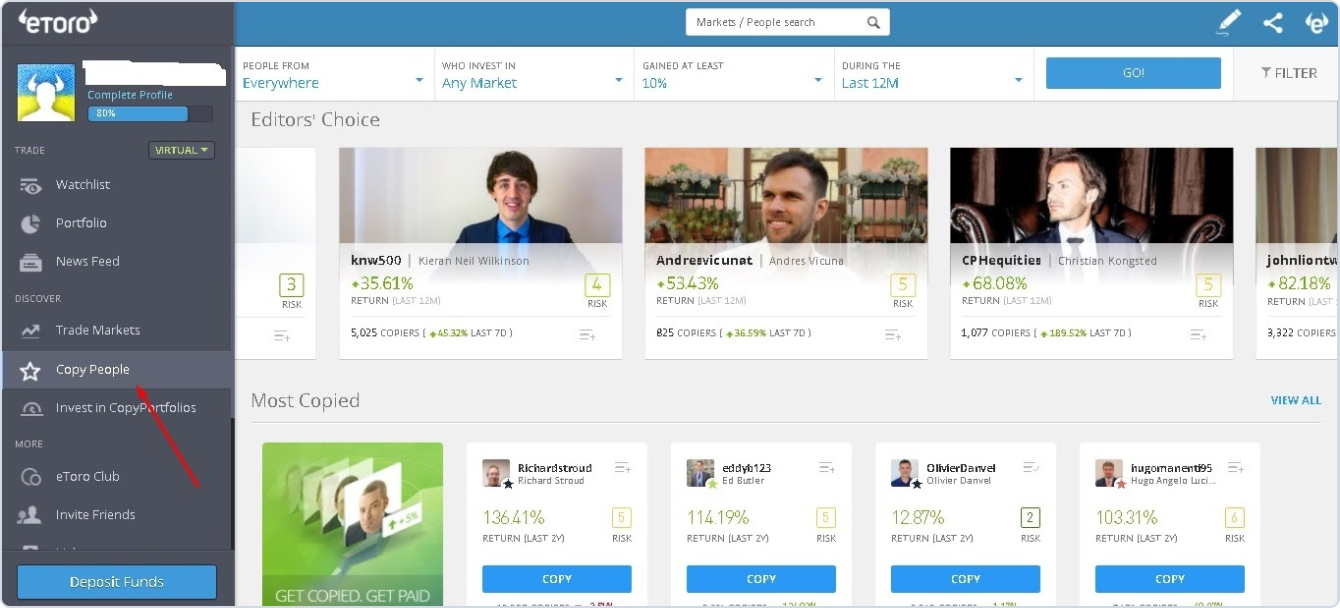

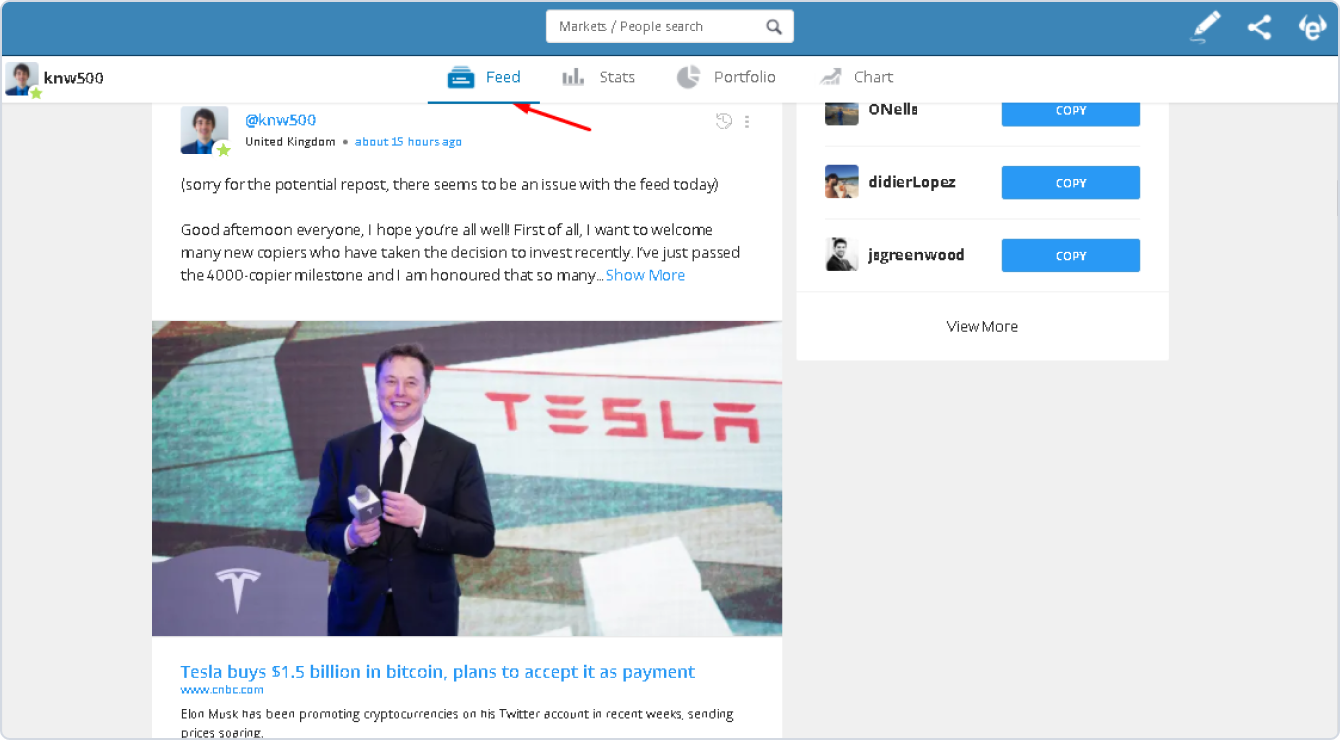

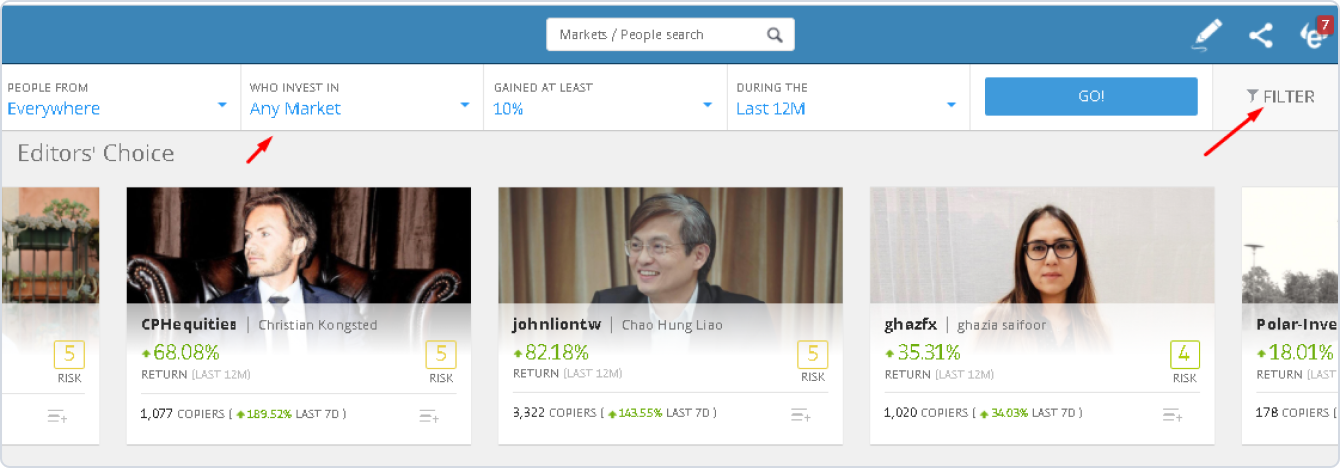

Same as on any social media, every user has a profile, in which he/she shares personal information, keeps a blog. Users can comment, like and share the posts.

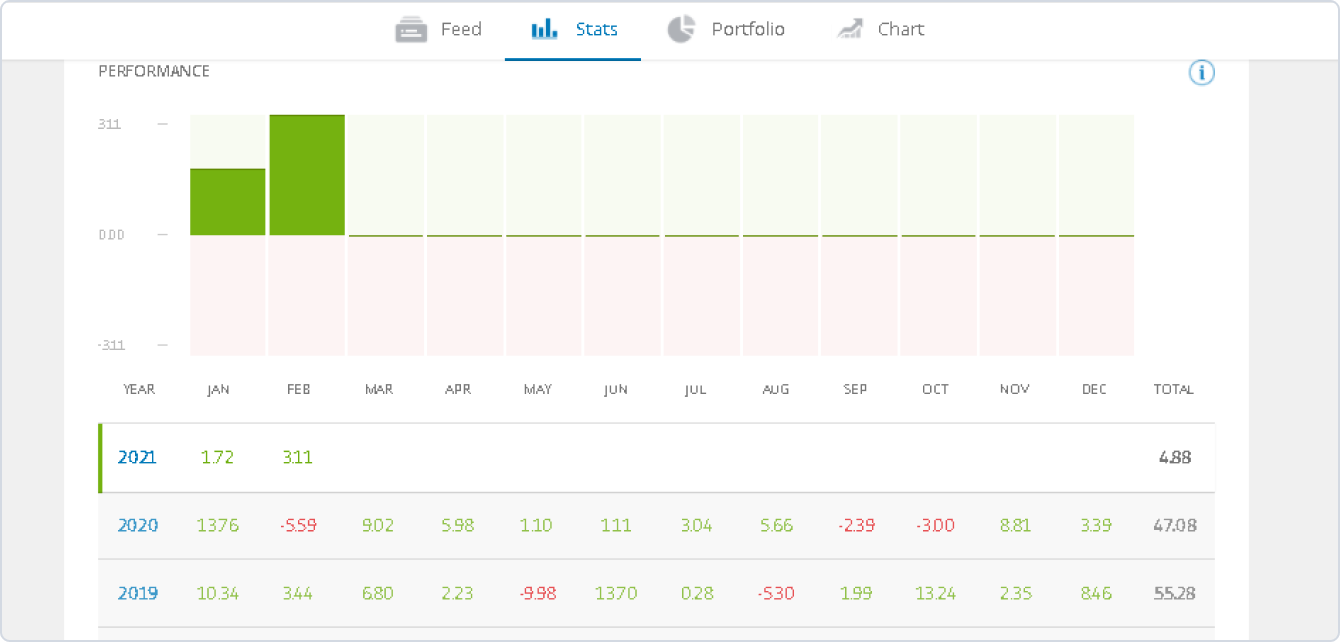

I grew as a trader thanks to the social trading platforms. I first registered on eToro five years ago. At first, I only studied how professionals worked, copied their trades. When I gained some experience, I opened the profile for copying. Generally speaking, I’d advise all novice traders to try this. You don’t have to copy traders, you can simply watch and learn what works on the market now, how the professionals trade.