According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $25000

- Zulu Trader

- MetaTrader4

- MetaTrader Web

- Trading Station Web

- ASIC

- FCA

- FSCA

- 1999

Our Evaluation of FXCM

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXCM is a moderate-risk broker with the TU Overall Score of 6.22 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXCM clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

FXCM is a general purpose-type broker for active traders who trade independently and implement classic strategies in their trading.

Brief Look at FXCM

FXCM Markets company incorporated in Bermuda and provides a wide range of financial services for traders almost all over the world. The company was founded in 1999 and registered in Great Britain. It is regulated by the independent nongovernmental organization of Great Britain — Financial Conduct Authority (FCA). Broker’s registered license number — 217689. The FXCM Group has several significant awards such as: prizes in the "Best Trading Tools” category and the "Best Customer Support 2018" by FXEmpire.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- wide range of the popular trade tools;

- reliable and reputable regulator;

- the minimum deposit is $50.

- there is no possibility of trust management and, as a result, no PAMM accounts;

- no incentives/ bonuses offered to clients.

TU Expert Advice

Financial expert and analyst at Traders Union

FXCM broker has magnificent experience in the Forex market. During this time, it has developed a reputation as a reliable partner that provides clients with optimal trading conditions. The company offers two types of accounts, as well as the ability to open a demo account for novice traders.

FXCM offers a wide range of trading instruments as well as several trading platforms (MetaTrader 4, MetaTrader Web, ZuluTrade, Trading Station Web). The lack of "classic" bonus programs is a real disadvantage.

The broker's website is functional and convenient enough.

- You're a beginner or intermediate trader as they provide user-friendly platforms such as Trading Station and MetaTrader 4, along with educational resources specifically designed for newcomers. This makes it easier for less experienced traders to navigate the trading process and learn essential skills.

- You're interested in trading a variety of assets, including forex, stocks, indices, commodities, and cryptocurrencies. This broker also offers CFDs on a wide range of options.

- You prioritize the strictest regulation as they are regulated by the Vanuatu Financial Services Commission (VFSC), which is perceived as a less stringent regulator compared to others like the US Securities and Exchange Commission (SEC) or the European Securities and Markets Authority (ESMA).

- You require advanced trading features as their platform may lack some advanced charting tools and order types that are available with certain competitors. If you rely heavily on advanced trading features for your trading strategies, you may find this broker's platform to be less suitable for your needs.

FXCM Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader Web, ZuluTrade, Ninja Trader, Trading Station Station (Web, Mobile, Desktop) |

|---|---|

| 📊 Accounts: | Demo, Mini, Standard, Active Trader |

| 💰 Account currency: | USD and more |

| 💵 Deposit / Withdrawal: | Visa, Mastercard, Skrill, Neteller, Wire Transfer |

| 🚀 Minimum deposit: | From $50 |

| ⚖️ Leverage: | Up to 1:30 *Leverage is a double-edged sword and can dramatically amplify your profits. It can also just as dramatically amplify your losses. Trading foreign exchange/CFDs with any level of leverage may not be suitable for all investors. |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lot |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currencies, stocks, indices, commodity, cryptocurrency. *Cryptocurrency is not available to UK retail clients. |

| 💹 Margin Call / Stop Out: | 50% |

| 🏛 Liquidity provider: | Barclays Bank, Citibank N.A., Deutsche Bank, FASTMATCH MKP, ХТХ Markets ltd., UBS, Morgan Stanley |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | You can use advisers |

| 🎁 Contests and bonuses: | Yes |

FXCM broker provides acceptable trading conditions to its clients. The minimum deposit for a Mini account is $50. The spread size depends on the specific trading tool (the minimum is 0.2 pips for EUR/USD as per FXCM’s Spread Report (Q1 2021). The minimum trade volume is 0.01 of lot for all account types. Leverage for deposits up to $20,000 is up to 1:400 for currency pairs and up to 1:200 for CFDs. Leverage for deposits over $20,000 is up to 1:100 for currency pairs and up to 1:200 for CFDs.

FXCM Key Parameters Evaluation

Video Review of FXCM

Trading Account Opening

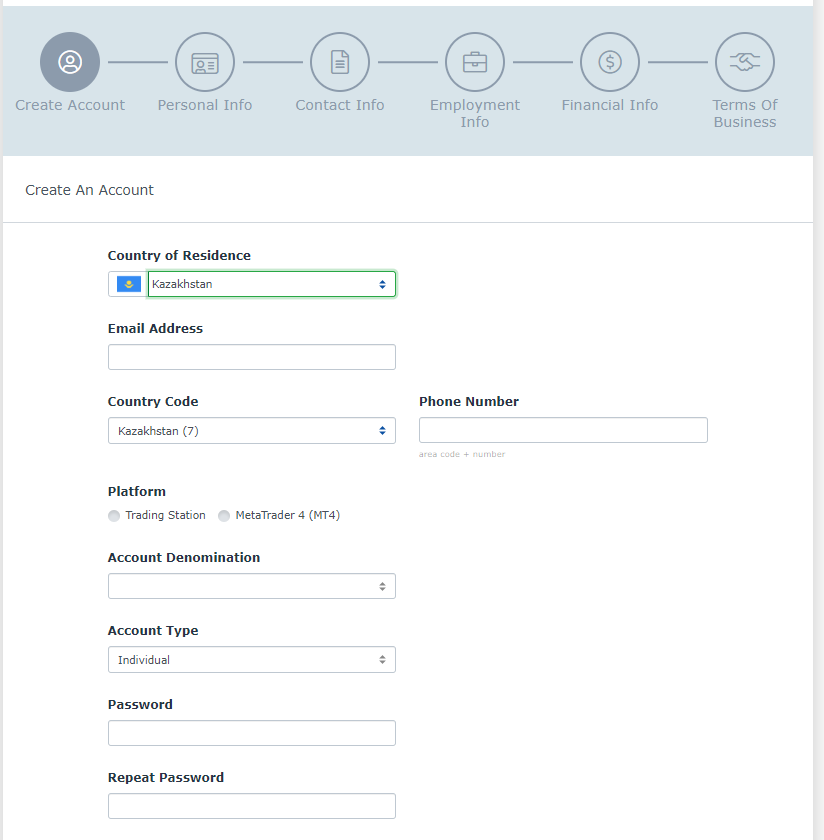

To start trading with FXCM and get compensation using the Traders Union rebate service:

Register on the Traders Union site and follow the Affiliate link to the broker's website. Then click the “Open Account” button.

Specify your country of residence, name and surname, email address, current phone number, account type, and also create a password.

The following functions will be available in your personal account:

-

Trade deposit balance.

-

Statistics (statement) of trade.

Also, other useful functions will be available in the personal account:

-

broker regulations and rules;

-

technical support and assistance of a personal manager;

-

account settings;

-

account management;

-

access to trading terminals;

-

personal data change.

Regulation and safety

FXCM has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 26 years

- Strict requirements and extensive documentation to open an account

FXCM Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

CIRO CIRO |

Investment Industry Regulatory Organization of Canada | Canada | CAD 1,000,000 | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FXCM Security Factors

| Foundation date | 1999 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker FXCM have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of FXCM with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, FXCM’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

FXCM Standard spreads

| FXCM | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,3 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

FXCM RAW/ECN spreads

| FXCM | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with FXCM. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

FXCM Non-Trading Fees

| FXCM | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0-40 | 0 | 0-15 |

| Inactivity fee ($, per month) | 50 | 0 | 0 |

Account types

FXCM Markets has several types of accounts: Standard and Active Trader accounts are for all types of clients. The main differences are the spread costs as well as the possibility of using additional services.

The broker also provides an opportunity to open a demo account to test trading conditions and get acquainted with the trading platform. FXCM is a broker focusing on all types of traders.

Deposit and withdrawal

FXCM received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

FXCM provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank card deposits and withdrawals

- Low minimum withdrawal requirement

- Bank wire transfers available

- No withdrawal fee

- BTC payments not accepted

- Only major base currencies available

- Wise not supported

What are FXCM deposit and withdrawal options?

FXCM provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller.

FXCM Deposit and Withdrawal Methods vs Competitors

| FXCM | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are FXCM base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. FXCM supports the following base account currencies:

What are FXCM's minimum deposit and withdrawal amounts?

The minimum deposit on FXCM is $50, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact FXCM’s support team.

Markets and tradable assets

FXCM offers a limited selection of trading assets compared to the market average. The platform supports 83 assets in total, including 46 Forex pairs.

- Copy trading platform

- Indices trading

- Commodity futures are available

- Bonds not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by FXCM with its competitors, making it easier for you to find the perfect fit.

| FXCM | Plus500 | Pepperstone | |

| Currency pairs | 46 | 60 | 90 |

| Total tradable assets | 83 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products FXCM offers for beginner traders and investors who prefer not to engage in active trading.

| FXCM | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Additional Trading Tools

-

API Trading.

An API is a set of definitions, protocols, and tools for creating application software. It defines methods of interaction between different software components. FXCM offers three free APIs that connect directly to the FXCM trading server.

-

Market Data Signals.

This trading tool provides information to help you find potential trading opportunities. Data includes the latest prices, volume trends, trader sentiment, and historical instrument data. The propriety Speculative Sentiment Index (SSI) provides a market snapshot.

-

Market Scanner.

FXCM's Market Scanner offers a quick way to check Forex and CFDs using suitable technical parameters. Traders can select their preferred indicators and time frames to scan. After scanning, the scanner provides the five strongest signals.

-

Economic Calendar.

The FXCM economic calendar helps you track critical economic events and analyze previous market fluctuations and the impact of the last economic events on them. Using the calendar, traders can check the volatility of the market and trading instruments in certain circumstances and, based on the data obtained, form or change their trading strategies.

-

Live Forex Charts.

The tool is designed to build charts and market analysis indicators. The charts obtained using Live Forex Charts allow you to analyze the selected currency pair or other asset. For traders' convenience, the tool can change the period and study historical data.

Customer support

Information

The support service provides technical and operational support twenty-four/five.

Advantages

- There is a FAQs section

- Form for sending emails

- Telephone support

Disadvantages

- Does not work on weekends

- It takes 3-4 days on average to get an answer

- No online chat

There are several ways to contact customer support specialists:

-

by phone as indicated on the site;

-

via email;

Support is available both on the FXCM website and in the Personal Account in the Support section.

Contacts

| Foundation date | 1999 |

|---|---|

| Registration address | 20 Gresham Street, 4th Floor, London EC2V 7JE, United Kingdom. |

| Regulation | ASIC, FCA, FSCA |

| Official site | fxcm.com |

Education

Information

There is a separate section with many analytical tools, as well as online training and video courses to help you. These materials can be useful for both novice and professional traders.

There is a demo account for testing trading systems and self-study.

Comparison of FXCM with other Brokers

| FXCM | Eightcap | XM Group | RoboForex | LiteFinance | 4XC | |

| Trading platform |

MultiTerminal, Ninja Trader, MetaTrader4, Mobile, Web, Trading Station | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, MultiTerminal, Sirix Webtrader | MT5, MT4, WebTrader |

| Min deposit | $50 | $100 | $5 | $10 | $10 | $50 |

| Leverage |

From 1:1 to 1:400 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | Yes | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | 7.00% | No |

| Spread | From 0.2 points | From 0 points | From 0.8 points | From 0 points | From 0.5 points | From 0 points |

| Level of margin call / stop out |

No / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 50% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed Review of FXCM Markets

FXCM is a British broker that has been operating in the financial services market for over 20 years. It has offices in multiple countries, its activities comprise traders worldwide. The broker is expanding the number of trading instruments and trading platforms. Moreover, FXCM does not offer programs for passive investment.

A few figures that could be interesting for traders choosing a broker:

-

over 20 years on the exchange market;

-

minimum investment amount is $50;

-

over 200,000 registered users.

FXCM is a respectable broker focusing on all types of traders.

FXCM Markets provides standardized financial services in the Forex market. The broker provides a variety of trading assets, such as currency pairs (both basic and exotic), CFD contracts, ofindices, commodities and cryptocurrency contracts. Also, the broker has a fairly well-developed network of representative offices and offices around the world; the central office is situated in London. Liquidity providers are such reputable banks as: Barclays Bank, Deutsche Bank, and Morgan Stanley.

The company's clients have the opportunity to choose from among four trading platforms: MetaTrader 4, MetaTrader Web, ZuluTrade, Trading Station Web. The broker also provides an opportunity for all traders to use the mobile application and open deals from any spot on Earth.

The FXCM broker useful services:

-

economic calendar with the most important information on the different economies;

-

online trading courses and video tutorials;

-

"Market scanner" using technical indicators.

Advantages:

a few comfortable platforms;

a large number of training materials, video and online courses;

wide range of trading instruments;

availability of demo accounts.

There are no limits on strategies. Hedging and locking orders are allowed. There is no information on the minimum duration of the transaction retention on the site. *Cryptocurrency is only available to UK retail clients.

Latest FXCM News

Articles that may help you

Check out our reviews of other companies as well