What Are US30 Market Hours

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The US30 refers to the Dow Jones Industrial Average Index made up of 30 of the USA’s biggest blue-chip companies. Traders can trade the US30 index from 9:30AM to 4:00PM EST, during pre-market hours from 8:00AM to 9:30 AM, and in after-market hours from 4:00PM to 8:00PM EST. Traders can also trade futures and CFDs almost 24 hours from Sunday evening to Friday, though the stock market is only active during US market hours.

The US30 index is one of the most well-known trading indexes on the stock market. In this article, Traders Union delves into the popular stock trading index, the US30, and its trading hours. We’ll explain what exactly the US30 is, look at what hours you can trade the US30, provide additional tips for trading US30 and examine the best hours for volatility when trading US30.

The US30, sometimes referred to as Dow Jones Industrial Average or the Dow 30, is a stock market index that measures the performance of the stocks of 30 of the largest blue-chip companies in the USA. The stocks that the US30 index is composed of are all listed on the NASDAQ and NYSE, and includes American tech companies, gas and oil companies, and even transportation and public sectors.

US30 market hours

The stocks that make up the US30 index are only available for trading during US market hours. So, if you wanted to directly trade in the underlying assets, that is the 30 stocks that the Dow Jones 30 index comprises, you could only do so when the New York Stock Exchange is open, from 9:30AM to 4:00PM Eastern Standard Time. You can also trade the index during these hours. Index share trading can also be conducted during pre-market hours, from 8:00AM to 9:30AM EST, and in after-market hours from 4:00PM to 8:00PM EST.

However, when trading in the index using derivatives such as futures, traders can open positions almost 24 hours a day, from 6:05PM Sunday to 5PM Friday. The US30 market also closes from 4:15PM to 4:30PM each day, and then 5PM to 6PM. It’s worth noting that while the US30 can be traded on almost 24 hours a day, the actual market price will only move during market hours so positions will not be affected during these hours.

Time zones

Traders trading US30 outside of the New York Eastern Standard Time zone should be aware of the time differences between their own location and that of the NYSE. For example, if using Greenwich Meridian Time (GMT) or Universal Time Coordinated (UTC) should be noted that EST is five hours behind, so the market hours would be 2:30PM to 9PM GMT/UTC.

Advice on timing US30 index trading

Depending on the type of financial instrument you are trading, as well as your trading strategy, there are different factors to consider when timing your US30 trades. Let’s take a look at them.

Futures: Trading US30 futures involves speculating on the future price movements of the index via contracts, where traders buy or sell at a predetermined time and price based on the performance of the Dow Jones 30. US30 futures can be traded almost 24 hours on the CME Global Index, Sunday to Friday, with halts from 4:15PM to 4:30PM EST and 5:15PM to 6:00PM EST. Index futures can move outside of stock exchange market hours, though they will be more volatile during open times.

US30 CFDs:US30 CFDs (Contract for Difference) are financial derivatives that allow traders to speculate on the price movements of the Dow Jones 30 without owning the underlying assets. CFDs mirror the performance of the index, and traders can profit from both rising and falling markets. US30 CFDs can be traded during US market hours (9:30AM to 4PM EST), during pre-market hours, and after-market hours. Some CFD platforms offer overnight trading and even weekend trading of US30 CFDs, though there may be gaps in price movement and increased volatility.

US30 Options: Options on the Dow Jones Industrial Average (DJX), grant the holder the right, but not the obligation, to buy or sell the Dow Jones 30 at a predetermined price within a specified timeframe. The options market is typically only open from 9:30AM to 4:00PM EST, with no option for after-hours trading as the price of the index will not move. When opening US30 options, consider the opening times of the market and the times with highest volatility (see below)

What is the best time to trade the US30 index?

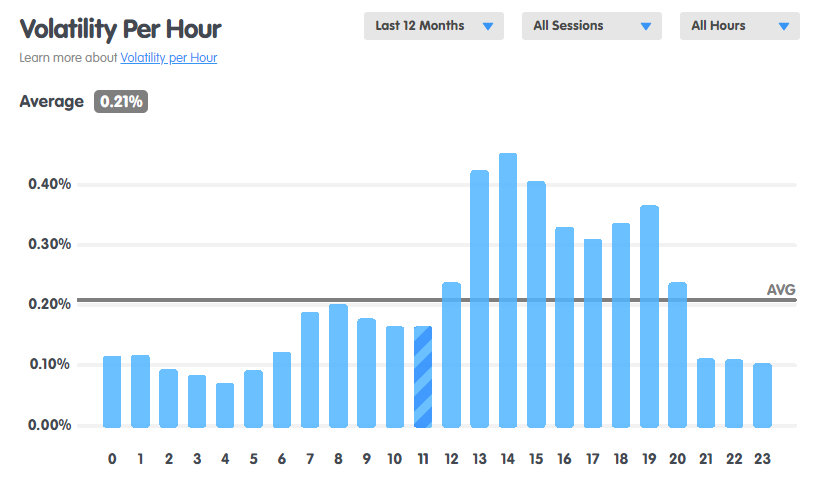

Depending on your strategy and chosen instrument, the time that suits you best will vary. However, times of increased volatility often present the best opportunities for profit. The average volatility for trading the US30 index is 0.21%. Due to the US market hours of the NASDAQ and NYSE, volatility sharply increases and stays above average from 12PM to 9PM GMT, or 7AM to 4PM EST. This can be seen in the chart below.

Volatility of US30 by hour (Source: Babypips.com)

Volatility of US30 by hour (Source: Babypips.com)What is the most volatile day for the US30?

Volatility differs throughout the trading week, so depending on your trading strategy, days should also be considered. Higher volatility leads to increased opportunities, potential for higher profits due to rapidly changing prices, and higher liquidity for increased ease of trading. The most volatile day to trade the US30 index is Thursday, though volatility is also above the daily average of 1.22% on Tuesdays.

Volatility of US30 by day (Source: Babypips.com)

Volatility of US30 by day (Source: Babypips.com)Best stock brokers

Tips for trading US30

Many believe that the Dow Jones 30 can be looked at as an indicator for the overall health of the US economy, so there is plenty of interest in trading it. Let’s look at some tips for trading financial instruments related to the US30.

Active Hours: The US30 market is most active during the morning and afternoon sessions of the American market. In Eastern Standard Time (New York), this is from 9:30AM to 4:00PM EST, and 2:30PM to 9PM in GMT/UTC. It does not close for lunch.

Morning Volatility: The morning session of the US30 market is typically more volatile. During this time, traders react to news that may have occurred the previous evening, over the weekend, or right before the market open. Many companies choose to release economic data such as earnings calls during pre-market hours. Others release economic data during after-market hours, so the wider market reacts the following morning.

Afternoon Stability: The afternoon hours of the US30 market are typically more subdued compared to the morning. During this time, traders tend to digest market news from the morning and position themselves for the next day.

24/5 Trading: Outside of directly trading the US30 index, traders can also trade CFDs, and ETFs derived from the US30, or trade futures and options to speculate on its performance. This can be done almost 24 hours a day, Sunday to Friday.

Understand Time Zones: Traders who are interested in trading the US30 index should familiarize themselves with its market hours and the trading patterns that typically occur during those hours. Be sure to take location and time zones into consideration when calculating this.

Expert opinion

One of the most important lessons I've learned when trading the US30 index is to pay close attention to both the timing of trades as well as staying on top of relevant news and events. Considering the index composition, macroeconomic reports and company-specific announcements tend to be large market movers.

When there are significant earnings releases, economic indicators, or geopolitical developments scheduled during the regular trading day, I try to avoid taking new positions in the 30 minutes leading up to the news. The surge in volatility makes it too risky to catch the initial move. Instead, I wait and analyze the price action once the numbers are out. If the index spikes in one direction but starts to hesitate or reverse within the following hour, that's typically my cue to enter, riding the midday trend.

For Fed meetings, I similarly wait until after the monetary policy decision and comments from the Chair have concluded before initiating any trades. This allows me to see how interest rate-sensitive asset classes like bonds and currencies are reacting first.

Major unforeseen world events are harder to time-box but can induce prolonged trends over multiple days. In such cases, I may place US30 positions at the end of the first day's reactionary move.

Overall, this approach of combining timely trade execution with careful news monitoring has served me well over the years. It helps take advantage of disruption and trending moves while avoiding choppy, reactionary phases.

Knowing market hours is crucial when trading the US30 (or any other asset) because it determines when the market is open and when it's closed. The Dow 30 is traded on major stock exchanges during specific hours, so understanding these hours helps traders plan their activities, execute orders, and react to market events.

FAQs

Is Dow 30 the same as US30?

Yes, they are both names for the same stock market index. It can also be referred to as the Dow Jones Industrial Average (DJIA), the Dow Jones, Dow, Dow 30, or USA 30.

What's the best time to trade US30?

The best time will depend on your strategy, but is typically when volatility is highest, from 9:30AM to 4:00PM Eastern Time. Volatility is also highest on Tuesdays and Thursdays.

Is US30 good for day trading?

It depends on who you ask. Some professionals recommend not investing in products that track the Dow 30, due to its volatility. However, others will tout the benefits of trading US30 instruments as its performance can experience significant short-term gains. It’s worth noting that compared to other indices, the US30 has one of the lowest levels of volatility.

Is Dow Jones traded 24 hours?

The Dow Jones is traded during standard US market hours from 9:30AM to 4:00PM EST, and during pre-market and after-market hours.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.