The Trading Analyst Alerts - Should You Try?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The Trading Analyst offers comprehensive education for traders, including real-time alerts, market analysis, and strategy training. Its focus on actionable insights and learning resources makes it ideal for both beginners and experienced traders, though its premium services may not suit those on a budget.

When it comes to options trading, making profitable decisions in fast-moving markets can be challenging. This is where options trading alert services provide value, helping traders stay up-to-date on emerging opportunities and trends.

In this review, we examine the Trading Analyst Alerts service to see if it can deliver on its promises. We will take an in-depth look at the service's key features and performance stats, evaluating whether a subscription could help boost returns.

What is The Trading Analyst?

The Trading Analyst is an options alert service offering real-time SMS alerts for traders. It’s designed for beginners seeking informed trading decisions without high fees. The service provides reasonable pricing, a history of profitability, frequent alerts, and educational resources.

Subscribers receive instant buy and sell alerts with clear signals and precise pricing. Alerts are sent when entering or exiting a trade, ensuring traders don’t miss opportunities.

The Trading Analyst targets steady profits of 10%–25% per trade while prioritizing risk management to minimize losses. With an annual subscription fee of $787, it delivers valuable market insights at a competitive price.

Is The Trading Analyst worth it? Is it effective?

The Trading Analyst focuses on long-term profitability through risk management. Since July 2018, they’ve recorded 331 wins and 289 losses, with an average win of $4,383.25 and an average loss of -$2,619.59, yielding a profit factor of 1.67.

Their unique Target Profit Calculation formula helps traders maximize gains and minimize losses by determining when to take profits or cut losses, promoting consistent profitability. Below are the pros and cons of the Trading Analyst.

- Pros

- Cons

Easy-to-follow alerts. Real-time SMS alerts are clear, actionable, and easy to execute, helping traders respond quickly.

Proven trading strategy. Focuses on swing trading for larger wins, backed by a strong track record of profitable trades.

Significant savings with an annual plan. Save up to $1,467 by choosing the annual subscription over monthly or quarterly plans.

Flexible subscriptions. Cancel anytime, offering risk-free flexibility for new users.

Profit-maximizing formula. Uses a Target Profit Calculation formula to optimize gains and minimize losses.

Weekly trading reports. Subscribers get detailed market updates, portfolio insights, and trade summaries for better decision-making.

Higher subscription cost. Fees are higher compared to some competitors, which may deter budget-conscious traders.

Limited research reports. No in-depth research reports are provided, which might be a drawback for traders needing detailed market analysis.

The Trading Analyst features review

Out of all the services The Trading Analyst has to offer, the experts have reviewed some of the most unique and useful ones:

Real-time trading alerts via SMS

The trading analyst's real-time trading alerts via SMS messaging allow traders to receive timely notifications of potential trading opportunities. The real-time nature of these alerts is especially useful in fast-moving markets where timing can be critical.

Gain access to a real-time Portfolio Tracker

The real-time portfolio tracker offered by The Trading Analyst provides a detailed view of a trader's portfolio performance in real-time. This feature is especially useful for traders who want to track their progress over time and make adjustments to their trading strategy as needed.

Educational database

The educational database offered by The Trading Analyst is an extensive resource with trading strategies, market analysis, and risk management tips, ideal for beginners aiming to enhance trading skills.

2-5 real-time trade alerts per week

On average, the trading analyst generates 2-5 real-time trade alerts based on a range of market data and expert analysis per week. This feature helps to avoid overwhelming traders with too many alerts, allowing them to focus on the most promising trades.

Profitable trading record

The Trading Analyst boasts a solid track record with 331 wins and 289 losses, resulting in a 53.3% win rate and a profit factor of 1.67. This means the service has earned 1.8 times more profit than it lost, offering strong profit potential for traders.

Weekly trading report

The Trading Analyst's weekly trading report gives members exclusive insights into the options market. Released every week, it covers key market events and upcoming opportunities, keeping traders informed and ready.

The Trading Analyst costs

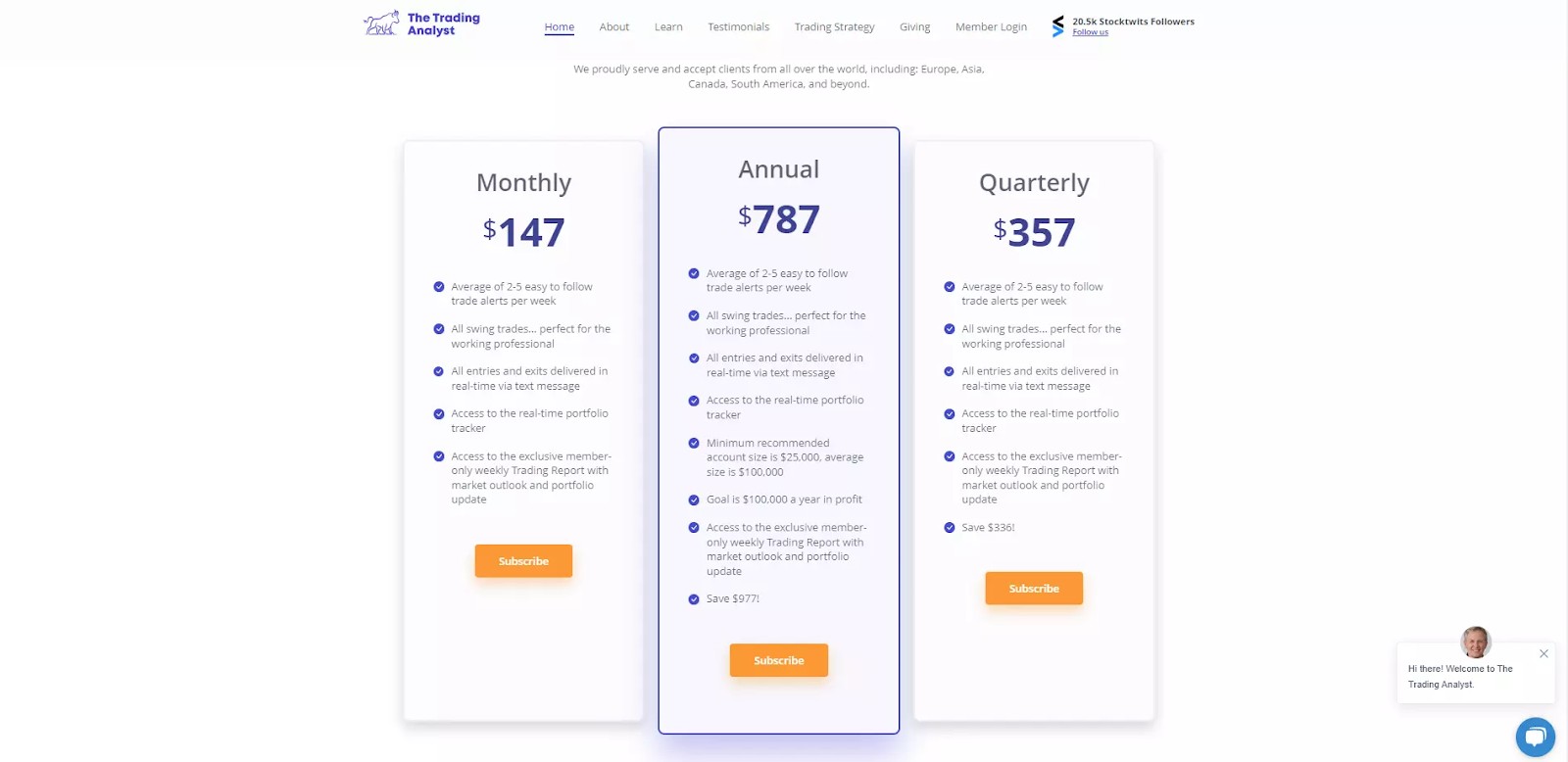

The Trading Analyst offers three subscription options to fit different trading styles and budgets. Here's a closer look at each subscription option:

Subscription plans:

Monthly - $147. Includes 2-5 trade alerts per week, real-time SMS updates, live portfolio tracking, and weekly trading reports.

Quarterly - $357. Offers the same features as the monthly plan, saving $336 compared to monthly billing.

Annual - $787. Provides full access while saving $977 compared to monthly payments. Recommended for accounts of $25,000+, aiming for $100,000 in annual profits.

Is the Trading Analyst safe?

The Trading Analyst is an options alert service that provides real-time trade alerts via SMS, focusing on swing trading strategies aiming for gains between 10% and 25% per trade. The service emphasizes risk management and offers educational resources to assist traders in making informed decisions.

They set two profit targets: selling half the position at the first target and the rest at the second. A stop-loss strategy limits potential losses, while precise position sizing ensures consistent results. Since July 2018, The Trading Analyst has maintained a 53% win rate, with average wins of $4,383.25 and average losses of - $2,619.59, resulting in a profit factor of 1.67.

User testimonials indicate positive experiences, with some reporting significant account growth within a month of using the service. However, it's important to note that trading involves inherent risks, and past performance does not guarantee future results.

How to start working with The Trading Analyst

Here's a step-by-step process to start working with The Trading Analyst:

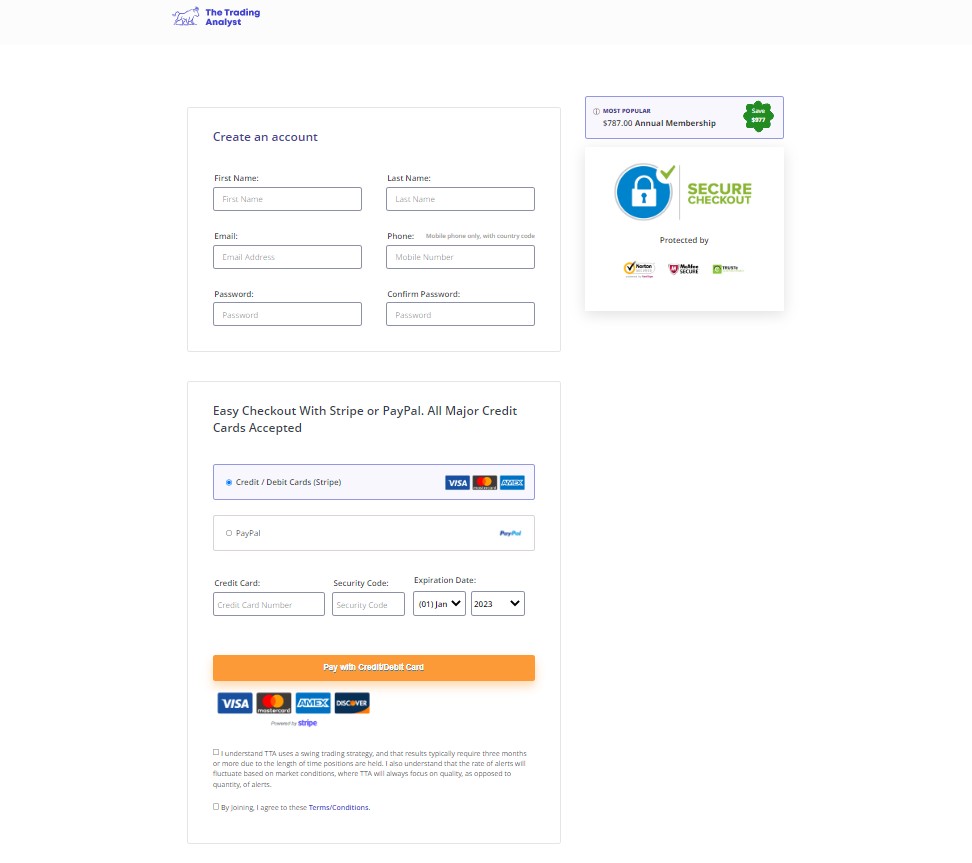

Go to The Trading Analyst website and choose your preferred subscription plan. The Trading Analyst offers a monthly plan for $147, a quarterly plan for $357, and an annual plan for $787.

Provide your contact information and billing details to sign up for the service. You can cancel your subscription anytime.

Once subscribed, start receiving trade alerts instantly. Keep your trading platform and alert service open simultaneously, especially if you’re day trading.

Boost your trading skills with The Trading Analyst's educational content, including video tutorials, webinars, and expert blog posts.

Use the real-time portfolio tracker to monitor current and past trades, review performance metrics, and adjust your strategy as needed.

Get the exclusive weekly trading report featuring market analysis and portfolio updates to stay prepared for upcoming trades.

Follow recommended risk management strategies to minimize losses and maximize gains while tracking your trading performance regularly.

Is The Trading Analyst the best options signal provider for you?

As an aspiring trader or investor, choosing the right option signal provider can be a daunting task. With so many options out there, how do you know which provider is the best for you? It's important to evaluate a signal provider based on several key factors, including performance record, signaling methods, trading strategy, and educational resources. Here's why The Trading Analyst might just be the best option signal provider for you.

Maintaining a good (and transparent) performance record

The Trading Analyst boasts a strong, transparent track record, outperforming the market by 20% consistently. With 331 winning trades and 289 losses since July 2018, they show experience and steady returns backed by a risk-focused strategy.

Consistent alerts and signals

Receive 2-5 real-time SMS alerts weekly with clear BUY and SELL signals. Their instant notifications help traders stay ahead, making it easier to act on profitable trades without delays common with email alerts.

Proven trading strategy

The Trading Analyst follows a well-defined, adaptable trading strategy focused on risk management. They avoid risky small-cap stocks and use advanced screening techniques for precise entry and exit points. Their transparent approach builds trust and confidence.

Educational material

More than just alerts, they provide educational videos, articles, and guides. These resources help traders build knowledge and make informed decisions.

How to use option alerts?

Whether you’re a beginner looking for guidance or an experienced trader seeking efficiency, learning how to use option alerts effectively can enhance your trading strategy. Below is how to get started with options trading alerts and maximize their potential.

Choose a service. Research reliable options and alert services based on accuracy, customer support, and subscription cost.

Sign up. Register and complete any required verification. Look for free trials or flexible payment plans.

Set your alert method. Decide how to receive alerts — via SMS, email, push notifications, or direct integration with your broker.

Start with micro-allocations. Begin with small trade sizes to test the accuracy of alerts and understand market reactions without risking significant capital.

Pair alerts with your market bias. Use option alerts as confirmation tools, not decision-makers. Align them with your personal market analysis for better results.

Customize alert filters smartly. Set up filters based on your trading style (e.g., high volatility stocks or sector-specific options) to avoid irrelevant signals.

Track alert reliability. Maintain a log of past alerts, noting the win rate and accuracy over time. This helps you trust the system or reconsider its effectiveness.

Use alerts during power hours. Focus on alerts during market power hours (first and last trading hour) when liquidity and price movements peak, boosting your chances of profit.

Think about how it fits into your trading style rather than chasing profits

If you’re considering The Trading Analyst alerts, think about how it fits into your trading style rather than chasing profits. Instead of just following alerts, align them with your personal market view. Beginners should dive into the educational materials — not just to know what trades to take but to understand why certain trades are suggested, helping build long-term trading instincts.

Use the free trial differently: treat it like a real trading period by keeping a paper trade journal. This helps track performance without emotional pressure. Record key points like entry/exit timing and reasons behind trades. If the service complements your trading style, it could be a valuable tool.

Summary

The Trading Analyst stands out for its steady performance and strong focus on risk management. Its strategy balances limiting losses while aiming for consistent profits, making it suitable for long-term trading success.

Subscribers benefit from simple text alerts and educational resources, making the service beginner-friendly. Committing to an annual plan offers better value. While no service is risk-free, The Trading Analyst’s proven track record suggests reliable, data-driven guidance for smarter trading decisions.

FAQs

Are the alerts beginner-friendly?

Yes, they are designed to be easy to understand, even for those new to trading, with clear entry and exit points.

What’s unique about The Trading Analyst alerts?

They emphasize risk management, detailed trade reasoning, and a strong track record of profitability.

How often are alerts sent?

Alerts are sent as opportunities arise, which can vary depending on market conditions.

Can I rely solely on the alerts for trading?

While helpful, it's recommended to use the alerts alongside personal research and analysis for better decision-making.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.