Options alerts | Explained

Options alerts are trading-related information in the form of notifications that keep you apprised of the status of your transactions, their respective positions, and price changes throughout the course of the day, week, or month. Additionally, options alerts can advise you on new tactics and give notifications for changes in money in and out as well as trade expirations. Finally, the TU answers a few frequently asked questions to clear up any confusion.

Start trading Options now with Interactive Brokers!What are options alerts?

As has already been said, options trading alerts are push notifications. Just like regular push notifications from any program, these are straightforward alerts. On the options market, traders set up alerts to keep track of their trades, price changes, and when their options are about to expire. Options trading alert services also come with several tools that traders with and without a lot of experience can use.

Also, options trading alerts not only let traders know when prices change or contracts end, but they also help them lower the risk of losing money. Besides, options alerts provide guides to trades and a chat room where traders can chat with other traders globally and solve their queries. However, options trading alert services are not always free of charge. Some good service providers may charge up to $199 per month or more.

Options trading alerts allow traders to set prices at which they want to sell or buy their trades. Also, traders who use trading alerts don't have to check their trades all the time because the alerts will let them know about key changes and important information. Options alert services offer tools that can compare the percentages of prices from the past and present.

How to read options alerts | Options contracts

Options alerts are well known for the beneficial resources and services that they offer to traders and guides, so many traders shouldn't find it strange or unfamiliar. It's not difficult to use choice notifications, but you must become familiar with their terminology. Learn what an options contract is before continuing.

An options contract is a contract that gives traders the right to buy or sell stocks at a set price and on a specific future date. There are two different kinds of option contracts: call and put. A call contract is when a trader buys the stock at a set price, and a put contract is when a trader sells the stock.

There are a few terminologies used in alerts, and you wouldn’t want to miss out on their actual meanings. Below are some terms you should learn to be able to properly read and interpret options alerts.

Call contracts - are intended to buy shares;

Calls at the ask - a bullish sign;

Calls at the bid - a bearish indication;

Earnings - an indication of the asset’s upcoming earnings date;

Expiration - the time when a contract expires. It would be best if you acted before the expiration of a contract.;

Open interest - contract activity history;

Premium - the price of the contract;

Puts at the ask - a bearish indication;

Puts at the bid - a bullish sign;

Put contracts - are intended to sell shares;

Strike price - the price agreed to sell or buy shares.

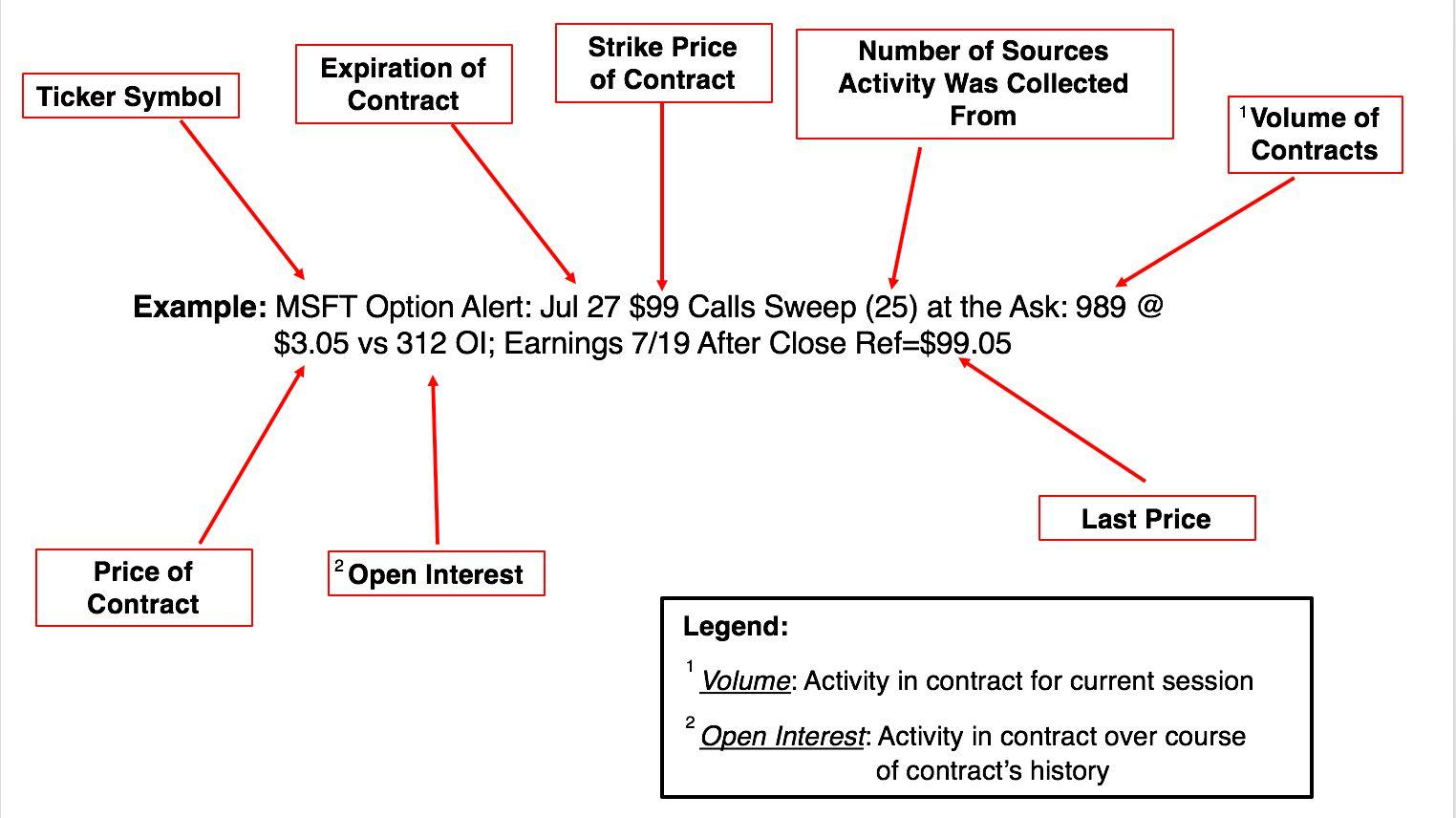

An options alert will have a company name, expiration date, a $ (strike price), call or put, sweep (number of sources orders are coming from) at $ (the price of the contract) vs open interest; ref (last price stocks were traded at).

Below is a diagram of an option alert for Microsoft:

An option alert for Microsoft

How do options alerts work?

Signals that produce options trading alerts are generated by algorithms. Traders use the results of these algorithms to predict changes in the market. Experienced traders use them to discover fundamental changes in various assets and market trends. Moreover, they support other traders too.

Traders who make predictions and look at signals every day can help automate options trading alerts. Options alerts then send automated notifications to traders when key changes appear. Options alerts are based on signals that are sometimes just a gamble by expert traders and other times a fairly accurate prediction of how the market will move.

How to use an options alerts service for trading

Options trading alert services provide tools, guides, and push notifications to traders. Below TU discusses the steps to effectively use trading alert services.

Research shows that options trading alert services are helpful to traders because they provide handy tools, detailed analytics, guides, and suggestions. They also help traders reduce their risk of loss. Options alerts are user-friendly and easy to use for beginners too. Market Alerts services assist newcomers in learning about markets, market trends, and other new things that will aid them in profitable trades. When you use services for options trading alerts, you can get better advice about the market and learn how to make money the right way.

However, options trading alert services are not always accessible. Something that comes for free is not always worth it. In the same way, free alert services are important, but they don't come with any helpful tools, learning materials, or instructions. Paid options trading alert services are worth it because of their features and tools.

The process of using options trading alert services is simple. The following steps will help you leverage the benefits efficiently.

Step 1: You can start your search for quality alert services with the alert alternatives.

Step 2: Investors must sign up for alert services and pay any required subscription fees.

Step 3:

You may customize your notification preferences.

Some service providers use phone and email to provide notifications.

Some companies promise to quickly apply your notifications to trades made through your broker.

Step 4:

Your selection alerts will soon begin to arrive!

Just be careful not to depend completely on these notifications.

To get the most out of them, keep them engaged.

Best Options Brokers

FAQ

How can I become an options trader?

To become an options trader, you need to read about the market, its trends, and the asset you want to trade and practice with your virtual account. You will need to learn the terminology, how options trading works, how to buy and sell the option shares, and how to make a profitable trade.

What are some options trading terms I should know?

Some terms you should know as an options trader are stated below:

Call contracts: The right of a trader to buy shares;

Expiration: The expiry date of a contract;

Put contract: The right of a trader to sell shares;

Premium: The overall purchase price of the contract.

Are options trading alerts worth it?

Yes, options trading alerts are worth it, not because they help you trade better, but because they provide advanced-level educational material and suggestions and help reduce the risk of loss.

Are options trading alerts free?

Yes, you can get options trading alert services for free, but they are not worth it. Paid options trading alerts are worth the money because of the available tools and services.

Glossary for novice traders

-

1

Algorithmic trading

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

-

2

Robo-Advisor

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

-

3

SIPC

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.