Best Forex brokers to trade on the weekends

Even on weekends when other markets close, Forex traders still have the ability to make trades. For active traders or those who use algorithmic trading, having a broker that allows weekend access can be extremely beneficial. However, not all Forex brokers offer trading services over the weekend. The availability of weekend trading depends on the broker and the markets they provide access to.

In this article, we review some of the top Forex brokers that enable weekend trading, including services for other assets like cryptocurrencies.

-

Are there any specific trading strategies better suited for weekends?

Range trading works well as markets become less volatile.

-

When is the market most volatile during the weekends?

The daily open on Sundays when some markets gap up/down. Also after major news events.

-

Will I pay any extra commissions when trading over the weekends?

Brokers may charge small premiums for weekend market access through wider spreads.

-

What kind of crypto analysis should traders prioritize on weekends?

Fundamental news - regulations, tech developments, institutional adoption indicators that could spark volatility.

Do Forex brokers work on weekends?

It's common practice for the Forex markets to close on weekends. Trading normally begins from 5 pm on Sunday to 5 pm on Friday, New York time and closes the rest of the time, making the regular trading period 24/5. Although with the different world time zones, sometimes market trading can happen on weekends. For example, when it's Friday at 5 p.m. in New York, it's Saturday at 4 a.m. in Japan.

Despite most markets being closed over the weekend, there are many brokers who, aside from stock and Forex trading, also offer cryptocurrency trading. Unlike regular market trading, the crypto fd (fixed deposit) trading market never closes.

What are Forex market trading hours?

The US Stock market operates within certain hours and days, allowing for a time overlap with different cities and remaining closed during some calendar holidays.

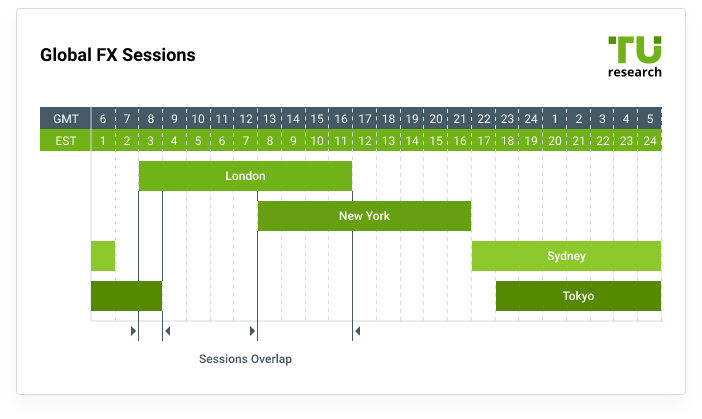

Below is a chart showing Forex market trading hours and the time overlap.

Forex trading hours

What Are Crypto Trading Hours?

Because crypto trading remains open 24/7, the cryptocurrency market offers the opportunity to trade on weekends and throughout the week. Something also worth noting is that in contrast to Forex markets, Crypto CFD trading is more stable over the weekend, allowing traders to maximize their profits. Cryptocurrency market trading is one of the top 3 markets to trade on weekends.

Best Forex brokers for trading on the weekends

We have prepared a table highlighting the best weekend Forex brokers alongside their weekend trading stocks and trading requirements as a guide to assist you in making your choice.

| Minimum deposit | Regulation | What can I trade on the weekend | ||

|---|---|---|---|---|

$10 |

CySec, FSC |

30 cryptocurrencies |

||

$10 |

FINRA, FCA, CySec, ASIC |

50+ cryptocurrencies |

||

$1 |

CySec, FCA |

28 Cryptocurrencies |

||

$5 |

FCA, CySec, ASIC |

30 cryptocurrencies |

||

$50 |

MAS, ASIC, BAFIN |

10+ trading pairs |

What is the best US broker to trade on the weekend?

With its relatively low trading fees, the best trading platform is eToro because you can use the same platform for 24/7 crypto trading and trade several other assets throughout the week. You can use one single platform for all your trading.

eToro is also a FINRA and SEC-regulated broker.

Top 5 US Forex BrokersTop 3 markets to trade on the weekends

We have mentioned a lot about specific markets that remain open over the weekend, but which markets are they? Here are some markets to consider for weekend trading:

Cryptocurrency Market

The first market you should consider is the cryptocurrency market. It remains open 24/7 so you can consistently trade on this market without having to switch over the weekend. It is also the most rational option as this market is easy to access.

In addition, sometimes on weekends, there is normal liquidity. Unlike the forex and stock markets, the cryptocurrency market can be more stable over weekends. Continuous availability means that traders can maximize their profits as well.

Tel-Aviv Stock Exchange

The Tel-Aviv Stock Exchange is open every day of the year except for select holidays. This market also has numerous assets and securities available for traders.

Traders have the option of choosing from:

Convertible securities

Corporate and government bonds

Short-term certificates

There are several companies to consider in this market, but the most promising are:

Bank Leumi

Solar Edge Technologies

Tadawul Index – Saudi Arabia

Tawadul market is open on all days of the week except for select holidays that change from year to year. You can confirm and keep track of them here. You can trade on all major assets, and with all major instruments on this market.

The best companies to consider in this market are:

Saudi Aramco

Saudi Basic Industries

Saudi Telecom Companies

Is it a good idea to trade on the weekends?

Most traders avoid trading on weekends because the majority of markets are closed. Weekends also have the lowest liquidity, among other reasons.

However, there are advantages to trading on the weekend too.

Pros

Traders have more time to analyze markets.

Most traders are hard at work during the week and need more time to monitor charts and keep up with market news. Not all retail traders can hire someone to handle their trades. As a result, weekends allow traders to spend more time on trend analysis and, as such, trade more.

Opportunity to practice trading strategies.

During the weekend, the open markets are slower, and there are fewer activities, making it the perfect time to put your methods to the test. You won't need to test strategies on live accounts, but it makes it easier to spot trends and draw conclusions.

Get a head start on trading during the weekend.

Most traders use the points mentioned earlier to prepare for weekday trading, analyze markets and fine-tune strategies, which is vital in getting a headstart on the coming week.

Cons

Less market liquidity

Market trading on weekends is less liquid because weekend markets have fewer active managers and participants. Another contributing factor is the scarcity of economic and geopolitical news, forcing market prices to move slowly. As such, the market is less volatile and offers fewer profit opportunities.

Fewer Markets and trading assets

On weekends, most major markets are closed. Traders must therefore make do with fewer, less popular markets they would not typically trade, making trading inconvenient.

Weekends also provide fewer trading instruments and assets, regardless of market conditions. Trading thus becomes less flexible than it is during the week.

Odd trading hours

If a trader wants to stick to the major markets, they must trade at odd hours. In the example given at the start of this post, traders who wish to work into the weekend would only have the first four hours of the day.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

5

Crypto trading

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).