Unicorn IPOs | Which Startups Succeed After Going Public?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Unicorn IPOs generate excitement, but long-term success depends on financial health, market conditions, and investor confidence. Some companies soar after listing, while others struggle once the initial hype fades. Factors such as revenue growth, profitability, and insider trading patterns help determine whether a unicorn stock will thrive or decline. Investors should focus on strong business fundamentals rather than short-term market trends when evaluating IPOs.

Going public is a defining moment for unicorn startups, but the real test begins after the IPO excitement fades. Some of these billion-dollar companies soar on opening day, only to lose steam when investors start questioning their business model. Others stumble out of the gate but steadily prove their worth over time.

The real challenge for investors isn’t spotting the hottest IPO — it’s figuring out whether the company can keep growing once the hype dies down. Are these startups truly built to last, or were they overvalued before they ever hit the public market? Looking at how they perform a year or more after listing can reveal which companies are the real deal and which were better off staying private.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding unicorns and IPOs

In the business world, unicorns are private companies that reach a $1 billion valuation before going public. These high-growth startups often capture investor attention due to their disruptive business models and rapid expansion. At some point, many unicorns take the next big step — going public through an initial public offering (IPO). This move allows them to raise capital, expand further, and give early investors a way to cash out.

Definition of unicorns

The term unicorn refers to a private company worth at least $1 billion before it is listed on the stock market. The name was first used by venture capitalist Aileen Lee in 2013 to describe how rare these startups were at the time. Today, unicorns are much more common, especially in tech-driven industries.

What sets unicorns apart?

High valuation before going public. These companies attract large private investments and do not need to be publicly traded to reach billion-dollar status.

Venture capital funding. Most unicorns are backed by venture capitalists and institutional investors before they go public.

Technology-driven models. Many unicorns disrupt traditional industries by leveraging tech solutions. For example Uber changed the ride-hailing market, while Stripe revolutionized online payments.

Delayed IPOs. Unlike traditional companies, unicorns stay private longer, raising multiple funding rounds before going public.

Famous unicorns

Stripe (Online payments) – valued at over $50 billion.

SpaceX (Aerospace) – still private, with a valuation above $100 billion.

Bytedance (TikTok’s parent company) – one of the highest-valued private companies, exceeding $200 billion.

Unicorns often generate excitement ahead of their IPOs, but their high valuations do not always translate into stock market success.

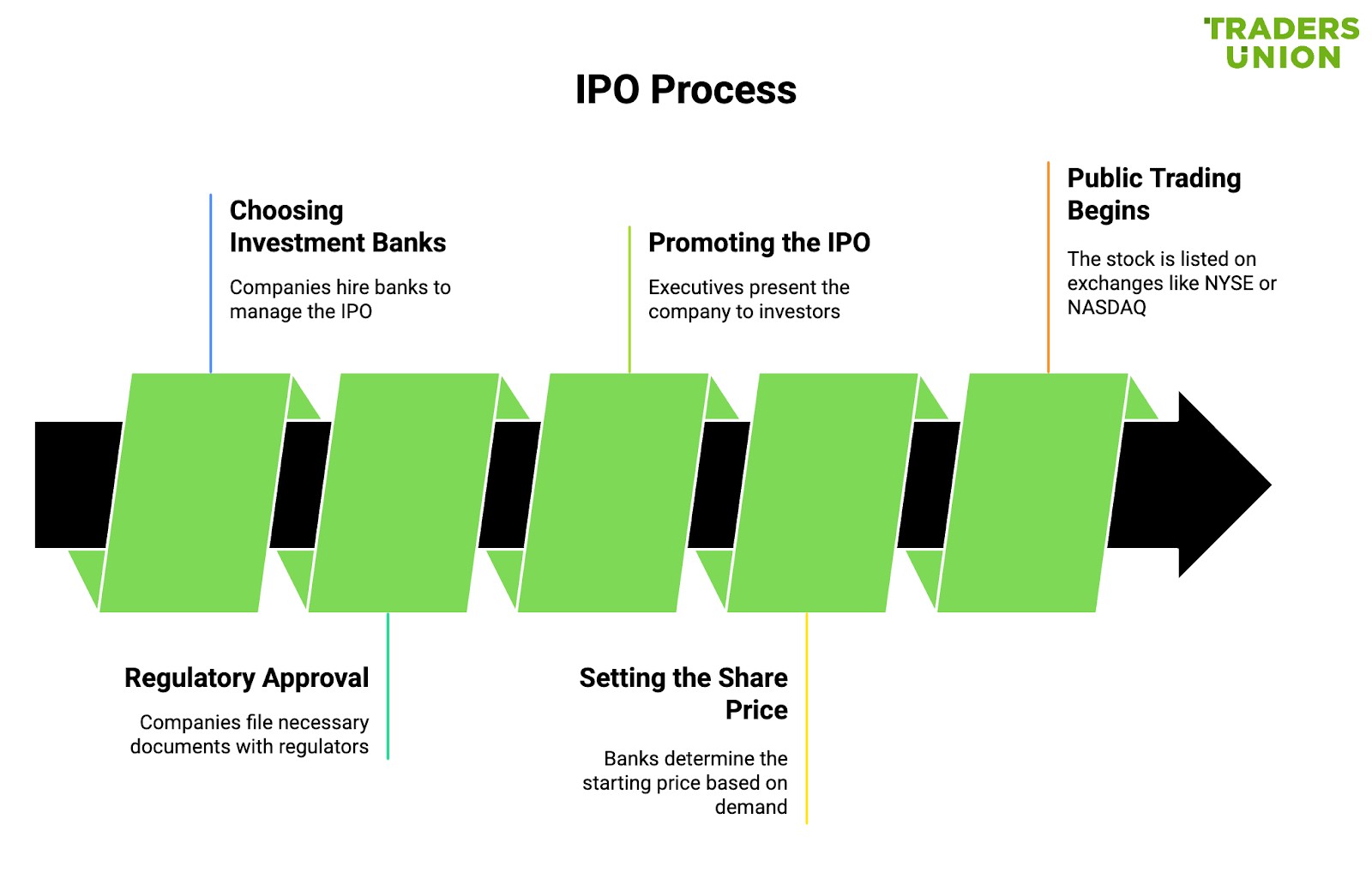

The IPO process

An initial public offering (IPO) is when a private company sells shares to the public for the first time, officially becoming a publicly traded business. This move helps companies raise money, expand operations, and provide returns to early investors.

Key steps in an IPO

Choosing investment banks. Companies hire banks like Goldman Sachs or Morgan Stanley to manage the IPO.

Regulatory approval. U.S. companies file an S-1 statement with the SEC, while other markets have similar requirements.

Promoting the IPO. Executives present the company to investors to build demand before the stock starts trading.

Setting the share price. Banks determine a starting price based on demand and market conditions.

Public trading begins. The stock is officially listed on an exchange like the NYSE or NASDAQ.

Why IPOs matter

Raises capital – companies use IPO funds to expand operations and invest in growth.

Gives early investors a way to sell shares.

Boosts brand reputation – being a publicly traded company increases visibility and credibility.

Factors influencing post-IPO performance

Some IPOs take off and deliver strong gains for investors, while others lose steam quickly. What happens after a company goes public depends on market conditions, company fundamentals, and investor expectations. While a hot IPO can attract attention, long-term success depends on whether the company has a solid business model and strong financials.

Market conditions at the time of IPO

The overall stock market can boost or hurt IPO performance. When the market is strong and investors are optimistic, IPOs tend to perform well. But if the economy is struggling, investors become cautious, making it harder for new stocks to gain traction.

Key factors affecting IPOs:

Bull markets attract more IPO interest, while bear markets make investors risk-averse.

Low interest rates encourage investors to buy stocks, but high interest rates can reduce demand.

Some IPOs benefit from strong sector trends — like how tech IPOs thrived in 2020.

Timing matters. A great company that goes public during a market downturn may struggle, while a mediocre company can ride the wave of a strong bull market.

Company fundamentals

A company’s financial health determines whether it thrives or struggles after going public. Investors look at factors like profitability, revenue growth, and industry position before deciding to hold onto IPO shares.

Companies with high growth and profitability do well (e.g., Snowflake’s IPO).

Unprofitable companies struggle unless they prove long-term potential (e.g., Uber).

Debt-heavy companies face risks, especially in tough economic conditions.

Investor sentiment and expectations

Some IPOs get caught up in excitement, leading to overvaluation and sharp sell-offs when reality sets in.

Strong media coverage can boost IPO demand but also set unrealistic expectations.

If an IPO is overhyped, early investors may sell quickly, causing a price drop.

Lock-up periods can lead to sell-offs when insiders finally cash out.

Performance of Unicorn IPOs post-listing

Unicorns often generate a lot of excitement when they go public, but not every IPO turns out to be a long-term success. Some stocks soar in the first few days but struggle later, while others start slow and gain strength over time. Looking at both short-term and long-term trends helps investors understand which unicorns deliver lasting value and which ones fade away.

Short-term performance

The first few weeks of trading can be unpredictable, with some stocks soaring due to investor excitement while others fall flat if expectations are too high.

Why do some IPOs pop while others drop?

Investor hype. If a company has strong demand before IPO, the stock often jumps on day one.

Market conditions. A strong stock market helps IPOs perform well, while market uncertainty hurts debut prices.

Lock-up periods. If investors think insiders will sell shares after their lock-up expires, prices may drop early.

Real-world examples

Airbnb (2020 IPO). Stock doubled on the first day due to high demand and strong brand recognition.

Uber (2019 IPO). Shares fell immediately as investors worried about its lack of profitability.

Long-term performance

Over time, IPOs face real-world challenges like competition, profitability, and investor expectations. Some companies prove their worth, while others struggle to meet expectations.

What determines long-term IPO success?

Revenue and profit growth. Amazon struggled early but became a stock market giant because of its long-term strategy.

Market competition. Rivian’s stock fell after the IPO because of increasing competition in the electric vehicle sector.

Share dilution. Some companies issue more stock after IPO, reducing the value of existing shares.

Real-world examples

Tesla (2010 IPO). Started slow but became a powerhouse as demand for electric vehicles soared.

Peloton (2019 IPO). Jumped early but collapsed when demand for home fitness slowed.

Case studies of notable Unicorn IPOs

Reddit and Birkenstock’s IPOs show how investor excitement, market conditions, and business strategy all play a role in what happens after a company goes public.

Reddit's IPO

Reddit, the community-driven social media platform, had one of the most talked-about IPOs of 2024. The stock took off immediately, but analysts aren’t convinced it will be smooth sailing from here.

What happened?

The stock was priced at $34 but jumped 48% on the first day, closing at $50.44.

In the months that followed, it kept climbing above its IPO price.

Growth was fueled by higher ad revenue and increased user engagement.

What could go wrong?

Too dependent on Google. If Google changes its search rankings, Reddit could lose traffic overnight.

User growth is slowing. One earnings report missed expectations, causing the stock to fall 15%.

Market volatility. By March 2025, Reddit’s stock had fallen 12.3%, partly due to analyst downgrades and overall market weakness.

Reddit’s IPO got off to a great start, but its future depends on keeping users engaged and finding new ways to grow.

Birkenstock's IPO

Birkenstock, the German sandal maker with a loyal following, had an underwhelming IPO, but the company is playing the long game.

What happened?

The stock was priced at $46 per share, giving it a $8.64 billion valuation.

On day one, it fell 10.9%, opening at $41 per share — one of the worst IPO performances in recent years.

Investors weren’t sure the brand could keep growing fast enough.

Why Birkenstock isn’t worried

Expanding direct-to-consumer sales to rely less on third-party retailers.

Teaming up with fashion brands to keep the brand fresh and trendy.

Boosting production to meet demand in the U.S. and Asia.

Recent results

The company posted a €52.5 million profit on €455.8 million in revenue, beating expectations.

Profits are expected to increase further as new factories ramp up production.

Birkenstock’s IPO wasn’t a big hit at first, but the company’s strong brand and expansion plans could pay off over time.

If you missed these, or any of the other unicorn IPOs in the recent past but still believe in the growth story of the stocks, you can still make an entry through any stock broker. We have researched the market and narrowed down to a list of best options available. You can compare them through the table below and make a choice for yourself:

| Stocks | Foundation year | Account min. | Demo | Research and data | Basic stock/ETF fee | Deposit Fee | Withdrawal fee | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2007 | No | Yes | Yes | $3 per trade | No | $25 for wire transfers out | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| Yes | 2014 | No | No | Yes | Zero Fees | No | No charge | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| Yes | 1919 | No | No | Yes | Zero Fees | No | $25 | FDIC, FINRA, SIPC, SEC, CFTC, NFA | 6.61 | Study review | |

| Yes | 2015 | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | No | No charge up to a limit | FCA, SEC, FINRA | 7.69 | Study review | |

| Yes | 1978 | No | Yes | Yes | 0-0,0035% | No | No | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

Future outlook for Unicorn IPOs

After a quiet period in the IPO market, things are finally starting to heat up again. More unicorns are gearing up to go public, hoping to take advantage of improving market conditions and renewed investor interest. But while this creates exciting opportunities, not every IPO is worth jumping into. Smart investors will take their time, research the companies carefully, and focus on the ones with real growth potential.

Market trends

The IPO market slowed down in recent years, but things are starting to shift. Several factors are setting the stage for more unicorns to go public:

Better economic conditions. If interest rates drop, it’ll be cheaper for companies to borrow money, making IPOs more appealing.

Tech and fintech IPOs leading the way. Companies in AI, digital finance, and e-commerce are getting ready to enter the public market.

Unicorns delaying IPOs can’t wait much longer. Many private companies have been holding off on IPOs for years, but now they need new capital for expansion.

Governments are making it easier to go public. More streamlined regulations could speed up the IPO process.

This means investors will soon see an influx of IPOs hitting the stock market.

Investor considerations

With so many new companies going public, not every IPO will be a good investment. Investors need to look beyond the hype and focus on the fundamentals. Here’s what matters most:

Does the company make money? Look at profits, revenue growth, and how much debt it has. A business burning through cash with no clear plan for profitability is risky.

Is the leadership strong? The best IPOs have experienced leaders who know how to scale a business.

Does it have an edge over competitors? A unicorn with a loyal customer base and an innovative business model has a better chance of long-term success.

Is the stock fairly priced? Some companies go public at sky-high valuations that don’t match their actual performance.

How much demand is there? Stocks that attract big investors like hedge funds and mutual funds tend to perform better after an IPO.

Watching what insiders do after the IPO can reveal more

A lot of new investors assume that if an IPO does well on its first day, the company is set for long-term success — but that’s not how it usually works. Many unicorn startups start strong but then struggle as their early investors cash out and reality catches up.

A major warning sign? If company executives and early backers start selling large amounts of stock as soon as they’re allowed to, it’s a bad look. It suggests that even the people who built the company don’t believe in its future. But if insiders continue holding their shares — or even buying more — it’s a sign that they see real long-term potential. Watching what insiders do after the IPO can reveal more than the stock’s first-day performance.

Another key thing to watch is the company’s revenue quality. Just because a startup reports strong revenue growth doesn’t mean it’s on solid ground. If those numbers come from big discounts, one-time partnerships, or aggressive spending, it might not last.

A simple way to check? Compare revenue growth to cash burn. If revenue is increasing but the company is still losing money just as fast — or even faster — that’s a problem. The best IPOs aren’t just about who grows the fastest; they’re about who can build a profitable business without constantly relying on outside funding.

Conclusion

Just because a company goes public with a lot of excitement doesn’t mean it’s built for the long haul. Some unicorns find their footing in the stock market, while others crash after the early hype fades. The best way to tell the difference? Pay attention to what insiders do with their shares, look at whether revenue growth is turning into real profits, and be wary of companies that were overhyped before they even went public. The smartest investors don’t just chase IPOs for a quick gain — they look for businesses that can actually stand the test of time.

FAQs

What is a unicorn in an IPO?

A unicorn in an IPO refers to a privately held startup valued at over $1 billion before going public. These companies attract significant investor attention due to their high growth potential.

What startups are nearing IPO?

Several startups, especially in technology, fintech, and healthcare, are preparing for IPOs. The exact list changes frequently, depending on market conditions and regulatory approvals.

What is the IPO of Unicorn E Solutions?

There is limited public information on Unicorn E Solutions' IPO. Checking financial news sources or the company's official announcements will provide the latest updates.

What is the next big IPO coming?

Upcoming major IPOs depend on market conditions, but companies in AI, fintech, and e-commerce sectors are expected to go public soon. Following financial news can help track the most anticipated listings.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Insider trading is the illegal practice of buying or selling a company's securities (such as stocks or bonds) based on non-public, material, and confidential information about the company. This information is typically known only to insiders, such as company executives, employees, or individuals with close connections to the company, and it gives them an unfair advantage in the financial markets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.