Trading platform:

- Stripe Wallet

- PSD2

- SCA

Stripe review in 2024

- 48

- 2.9% + 30 cents per account

Currencies:

- 135

cryptocurrencies:

- No

Summary of Stripe

Stripe provides a set of e-payment and offline payment automation solutions that scale to fit most technology stacks. This is not just a payment system that allows businesses to connect payment by card, through a browser, or mobile banking. Stripe has many of the brand's original designs, including solutions powered by machine learning and intelligent optimization that automate payments, protect against fraud, and accurately convert currencies. However, the main functionality is all about payments. Stripe payments are convenient for both the business owner and their customers. This is one of the most functionally simple, reliable, and fast systems.

| 💼 Main types of accounts: | Stripe has only one account type, it is customizable to a template or individually |

|---|---|

| 💱 Multi-currency account: | Yes (135 currencies) |

| ☂ Deposit insurance: | Depending on the type of transaction, 2.9% + 30 cents for accepting an electronic payment |

| 👛️ Savings options: | Detailed statistics, cost optimization, business process automation, conversion increase |

| ➕ Additional features: | Personal domain, individual system scaling, tax and accounting automation, instant payments, fraud protection |

👍 Advantages of trading with Stripe:

- Easy integration into the company's technology stack.

- Full adaptability and scalability of solutions.

- The possibility to accept electronic payments in 135 currencies from anywhere in the world.

- There are no fees for installation, configuration, or connection of standard services; everything is transparent.

- Favorable price, the cost of using the system is 2.9% + 30 cents for each write-off.

- You can set up an individual tariff plan for a specific country, bank, or organization.

- End-to-end real-time reporting with the possibility of finite customization.

- Management of all business processes and individual operations from a mobile application.

👎 Disadvantages of Stripe:

- The system is focused on business, so it does not provide services to individuals.

- Stripe does not support PayPal and some other electronic payment systems.

Analysis of the main features of Stripe

Table of Contents

Geographic Distribution of Stripe

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Stripe

Stripe is an Irish-American company that provides financial services and e-commerce software. It is one of the leading players in the payment systems market, however, unlike most competitors, the Stripe payment service offers solutions only for businesses. That is, individuals cannot use this system.

The convenience of working with the company is the company does not offer a single service. It is not a monolith, but a conglomerate of microservices designed to interact among and between themselves and technological stacks of various configurations. It doesn't matter what technical base the business uses, Stripe can be connected to it in minimum time. The system can even be integrated with CRM to aggregate communication channels and receive end-to-end reporting. In this sense, Stripe has no analogs.

On the one hand, the company offers ready-made solutions for businesses of various sizes and profiles. At the same time, the client has the opportunity to customize any solution, completely going through the list of connected microservices. Let's say you don't need risk-based dynamic KYC/AML verification, so you can turn it off. And in return, connect, for example, the flow of compliance with the requirements of ASC 606 and IFRS 15.

All this makes Stripe.com a convenient partner for organizing easily scalable online and offline sales outlets. Amazon, Google, and Booking cooperate with this company, which speaks of its popularity better than any statistics.

Latest Stripe News

Dynamics of Stripe’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs, available markets, and products of Stripe

The official Stripe website provides detailed information about all the company's services, but among them, none allow a business to increase its capital through investment, savings, or lending. Technically, the very fact of using the service allows you to optimize costs and increase conversion in online sales. Considering that in the USA 90% of the adult population makes purchases in stores that use Stripe, it is clear that the number of customers will increase when this system is connected, regardless of the segment.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Stripe Money Transfer Terms & Conditions

Assume that the price shown is the standard rate for connecting the company's technical stack to the system for accepting electronic payments. This already includes the comprehensive Stripe dashboard, KYC/AML verification, acceptance of one-time and recurring payments, conversion settings, and many other features such as instant payouts, additional payment methods, bank debits, and invoicing that is billed separately.

As a rule, payment for functions is linked to a transaction. For example, invoicing costs 0.5% of the invoice amount, and there are options. But such a service as a personal domain will cost $10 per month. That is, for some functions, a regular subscription fee is charged. The convenience of Stripe is that the user of the system can customize it, disabling even standard solutions.

The full functionality of a personal set of services is linked to a mobile device. The business owner receives reports on current transactions and processes and can group these processes, and filter and deselect them. From a mobile phone, users can issue and pay invoices, generate and send reports (for example, tax reports), give their staff access to certain functions, and pay salaries.

| 💼 Main types of accounts: | Stripe has only one account type, it is customizable to a template or individually |

|---|---|

| 💱 Multi-currency account: | Yes (135 currencies) |

| Deposit terms and conditions: | Over 20 |

| Loan terms and conditions: | Per transaction + subscription fee for individual services |

| ☂ Deposit insurance: | Depending on the type of transaction, 2.9% + 30 cents for accepting an electronic payment |

| 👛️ Savings options: | Detailed statistics, cost optimization, business process automation, conversion increase |

| Types of payment: | Electronic payments and transfers (except PayPal and some other systems), NFC, Visa-standard cards |

| ➕ Additional features: | Personal domain, individual system scaling, tax and accounting automation, instant payments, fraud protection |

Comparison of Stripe with other e-payment systems

| Stripe | Advcash | Payeer | Skrill | Remitly | PayPal | |

| Supported Countries | 48 | 150 countries | 127 countries | 200 countries | Most developed countries | All developed countries |

| Supported Currencies | 135 | 9 currencies (USD, EUR, GBP, RUB, BRL, TRY, UAH, KZT, VND) | 3 fiat currencies (USD, EUR, and RUB) and most cryptocurrencies | 40 currencies | Most currencies | USD, EUR, GBP and 22 other currencies |

| Support for cryptocurrencies | No | Yes | Yes | Yes (deposit) | Yes | Yes |

| Subscription fee | 2.9% + 30 cents per account | No, only transaction fees | No, transaction fees only | No, only transaction fees | No | No |

| Payment acceptance equipment | No, just the software | No, only software | No, online only | No, only online | $2.99 + 0.5% of the amount for the Economy or 1.5% of the amount for the Express option | Upon receipt of payment/transfer, depend on the region |

Stripe Commissions & Fees

Traders Union pointed out above that 2.9% + 30 cents for a paid invoice is the standard rate of the service. The user receives it immediately after registering and connecting his store to the system. Later, he can disable some features from the standard stack, but the payment will not decrease because the rate is standard. The stack, among other things, includes 3D Secure authentication, updating a card account, accepting and verifying standard payments, and many other useful features that competitive services often provide for additional fees.

Of the third-party functions most often connected by online stores, one can note the acceptance of ACH bank debit transfers (0.8% of the amount). For 80 cents/transfer, you can connect additional payment methods like SEPA, Klarna, and EPS. The machine learning function of the system to speed up all types of authorizations and, as a result, increase the speed of transactions, will cost the user 0.08% for each successful withdrawal from the card. Onboarding flow control costs 0.25% of the account volume.

It is not possible to list all commissions and fees within this review. In general, the standard fees for accepting payments from this service are average or below average compared to its competitors. Ultimately, the total commission that the business owner will pay depends entirely on which features he has connected to the payment service.

Traders Union also compared Stripe’s fees with similar types of fees on other e-payment systems.

| FastSpring | 2Checkout | Stripe | |

| Payment commission | 5.9% + $0.95 | 3.5% + 0.35$, 4.5% + 0.45$ or 6% + 0.60$ per transaction | 2.9% + 30 cents |

| Deposit commission | 2% (max $20) | Depending on the payment method | 0.8% |

| Withdrawal commission | $5 | Depending on the payment method | 0.08% |

| Commission for international transfers | 8.9% | Depending on the payment method | Depending on the payment method |

The Stripe payment system is used by tens of thousands of online stores around the world. It is integrated into a business of almost any level, regardless of its design and electronic architecture. It is a series of microservices that provide payment acceptance at online and offline sales outlets. The system accepts payments in 20+ ways in 135 currencies. One of its key features is fast integration with existing technological solutions.

There is a subscription fee for some additional features, standard fees are paid by the business owner for transactions (for example, when accepting payments). The functions in the standard package are enough to meet the needs of small businesses. It is beneficial for larger companies to connect additional features such as a custom domain, tax automation, biometric verification, and identity search (available for 33 countries).

Detailed review of Stripe

Stripe is one of the first payment services built not on a monolithic design, but on a microservice platform. Now many systems are heading over to microservices, but for Stripe this is not just a method of organization, but a business philosophy. This is expressed primarily in the fact that even at the standard payment of 2.9% + 30 cents, the user receives a set of functions, each of which is represented by a separate microservice.

The convenience of such a design is obvious in that each service independently scales, and can have its own database and support. Connecting, disconnecting, or adjusting one service does not affect the operation of the system as a whole. This makes the mechanism for accepting payments as stable as possible and resistant to any destructive factors that would disrupt or stop the operation of a monolithic solution.

It is worth noting that Stripe.com releases about 100 updates per year. Also, every year new solutions for businessmen appear in the application store on the website. Without exaggeration, the company offers a rich potential for adapting and scaling almost any business.

Stripe’s success by the numbers:

-

3.1 million websites use Stripe;

-

48 patents belong to the company;

-

13 thousand requests are processed per second;

-

135 currencies are supported;

-

35 countries have localized options;

-

10 minutes is the average service connection time.

Stripe users often praise the application. Despite the abundance of services, functions, and options, they are all managed through a single application that can be installed on a mobile gadget.

Useful services of Stripe:

-

Stripe Checkout. A turnkey solution that adapts to the customer's device and location to accept payments. It comprises a payment page with integrated features to boost conversions. The page can be customized.

-

Stripe Elements. A solution for creating your own payment form on the site. Consists of a fully customizable UI builder for a branded interface with support for CSS styles and built-in payment logic.

-

Stripe Radar. A proprietary solution based on machine learning. The service analyzes the activity of the business environment, preventing acts of fraud. It reacts by following the protection matrix of the platform.

-

Stripe Adaptive Acceptance. This is another service with machine learning that allows you to automate the processing of typical and recurring payments. The service itself detects behavior patterns and saves them, accelerating payment processing many times over.

-

Card account updater. Many payment systems continue to work with cards that the issuing bank has replaced or blocked. To prevent this from creating problems, the card registry updating in Stripe occurs continually and automatically.

-

Payment links. This service creates links with specified conditions for accepting payments. The link opens a working payment page that does not require input from your own online store. The type of payment pages is customizable.

-

Buy now, pay later. A business owner can connect Klarna or an equivalent service to his online store so that the client can receive the goods right now and pay for them later within a certain time or by splitting a large payment into several small ones.

There are dozens of such services on Stripe.com. Each of them can be connected to the existing business model, getting an additional function to increase conversion.

Advantages of the Stripe payment system:

-

Stripe payments are processed instantly, except for situations where delays are due to interbank interactions or local laws.

-

The system allows you to accept more than 20 types of payments, including electronic transfers, from debit and credit cards.

-

Works at online and offline sales outlets.

-

Stripe is not a monolith, but a group of microservices. The user can disable an unnecessary service at any time and connect a new one.

-

Integration takes a minimum of time.

-

Services are managed through a mobile application with a simple and intuitive interface. It is possible to delegate to staff access and partial authority to conduct specified activities.

-

A profitable indicator is the 2.9% + 30 cents for a paid account and almost no other service offers a lower commission. In general, the system has loyal fees.

-

The service allows the online store to process payments in 135 currencies, while it is available in 48 countries (with 35 having localized functions; while for others special conditions may apply).

-

Stripe.com provides detailed information on compliance with US and EU financial management standards. It is PCI DSS Level 1 Certified with PSD2, and is Strong Customer Authentication (SCA) compliant.

Types of accounts in the Stripe payment system

Stripe offers one account type, no premium or advanced accounts. All services are connected to the account discretely and only at the request of the user. You can enable/disable any function through the application with just a couple of presses on the screen. The convenience of the approach can hardly be overestimated, because it makes it possible to almost completely reshape the financial policy of the organization, being, say, on the road.

The grouping of services on the stripe.com website is selected in such a way that the user can quickly find a specific set of solutions for their business, or develop one for their own tasks without using the recommended templates.

For example, you can use Stripe Checkout to create ready-made checkout pages. These pages are easy to brand, but sometimes the site design does not allow such solutions. In this case, you either finalize the site or use Payment Links to create an additional payment link with an independent page that is not linked to your site. This may be a temporary measure or a promotional offer. These links and pages are often used as part of A/B testing.

Banking features

Stripe is a payments infrastructure for the internet service. It's not a mobile bank, however, Stripe does have some neo-banking features. First, it facilitates payments and transfers. Users of the system can accept payment in various ways, including electronic payment services, and debit and credit cards. They also can issue and pay invoices.

The peculiarity of this payment service is that it allows you to automate accounting and taxation following regional requirements and standards. Some neobanks also provide such services. The difference is that Stripe is aimed at helping businesses, it does not have solutions for individuals. This makes for a slightly different scale of services and service stack.

Social programs of Stripe

The company offers the Stripe Climate social program. If the user agrees to the terms of the program, 1% of his income goes to leveling carbon dioxide emissions into the planet's atmosphere. One hundred percent of the funds received from users go to the program, the service does not charge any commissions or fees from these payments.

Stripe has its own staff of environmentalists and engineers who research carbon emission, design, and implement environmental restoration solutions in collaboration with leading US research institutes. This is a unique initiative aimed, among other things, at reducing carbon dioxide emissions. It is critical because reforestation and soil carbon sequestration are not enough to offset the damage already made to nature. Fundamentally, new solutions are needed, and Stripe is looking for them.

Each user of the system who joins the program receives an individual certificate and a unique badge that he can place on his resource. In that way, your customers will know that your company is preserving and restoring the environment. As a result, brand confidence increases.

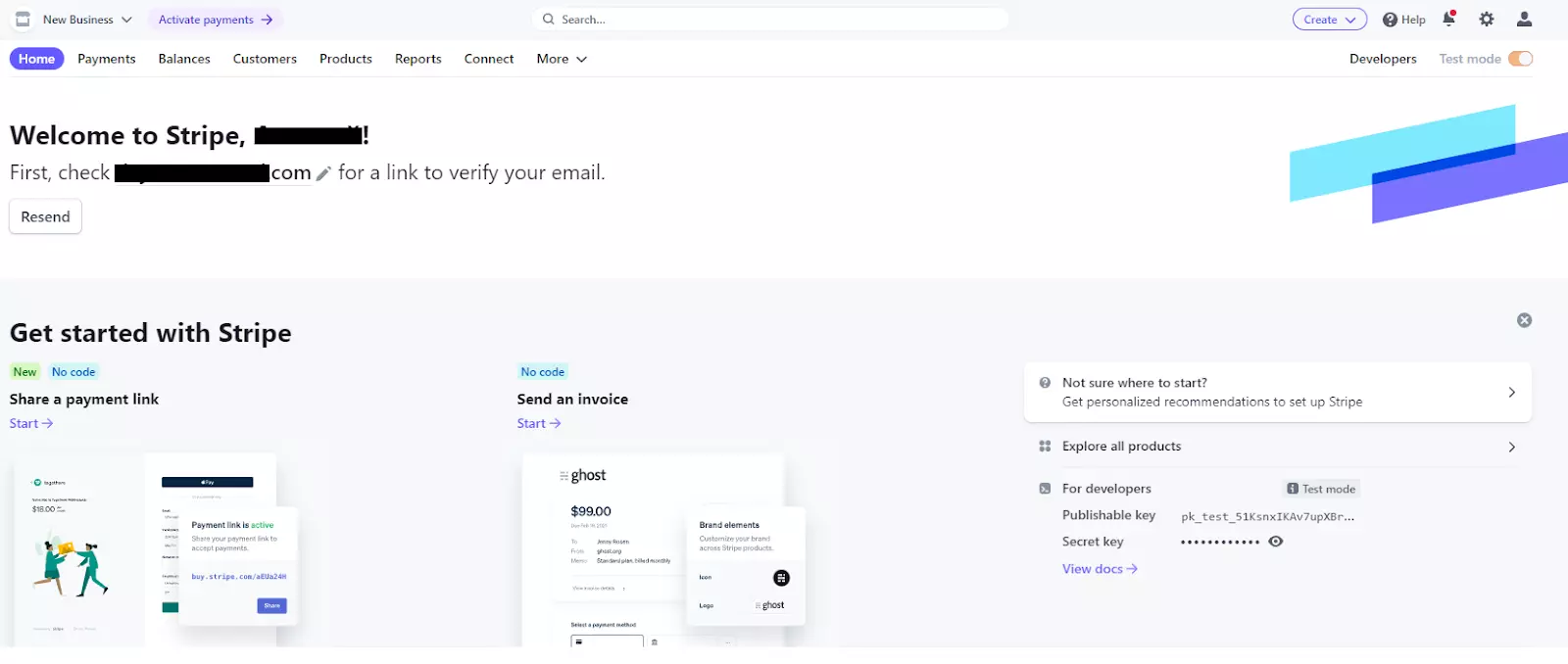

How to open an account at Stripe

Go to dashboard.stripe.com and click on the "Register" button. The headnotes on the benefits of registering with Stripe will be presented on the left of the screen, and the registration form is located on the right side. Enter your email address, and first and last name, select the country where you implement your business, and create a password. After that, check the box indicating that you agree to the terms of service, and click the "Register" button.

You will receive an email, click on the link in it to confirm your registration. After logging into your account, in the main menu of your user account, click on the "Start" button and fill out the application for opening an account. Here you also need to indicate the country where you have a business, as well as enter the address and postal code. Finally, specify the type of business. In addition to the data already entered, you will need to provide the address of the actual residence, phone number, and the last 4 digits of your social security number.

Fill in the details about your business and how you sell your products. In the following form, enter the contacts of your technical support service. Finally, link your bank account number and click on the "Continue" button. Verification of data may take some time, after its completion you will receive a notification by mail. You can now go to the developer dashboard in the top right corner of your user account home page to add API keys.

To generate keys, go to Settings, then Payments, then Debit & Credit Cards, and select Stripe from the services menu. Now you have the opportunity to enable payment acceptance on your site. Further, in the user account, you can connect client authentication, additional currencies, etc. Adjusting the settings is available at any time, do not forget to click on the "Save changes" button at the bottom of the page.

You can download the Stripe Dashboard application for accessing your user account from a mobile gadget in the Play Market or the App Store by going to the appropriate digital store and entering "Stripe" in the search box. To log in, you need to use the email and password data that you entered during registration.

Technical support

In the footer of the site, there is a "Contacts" section. In it, the user can ask technical support a question by filling out a simple form. It is also possible to send a question by email, it is indicated in the same section. Stripe has its own Discord server, where technical support specialists are on duty around the clock. Another way to communicate is live chat, which is available on the website and in the app. Finally, the user can phone the call center, which works without breaks and on weekends.

FAQs

Does the Stripe payment system work officially?

Yes. The payment system is officially registered and licensed for financial activities.

Is it possible to withdraw money to a bank card from a Stripe account?

Stripe customers can withdraw money to debit and credit cards of any bank.

Can I buy cryptocurrency through Stripe?

By means of the Stripe wallet, you can replenish your account on a cryptocurrency exchange and buy cryptocurrency.

Does Stripe have a mobile app?

Yes. The Stripe payment system offers a convenient mobile application for money transfers.

Traders Union Recommends: Choose the Best!

Via Advcash's secure website.

Via Payeer's secure website.

Via Skrill's secure website.