How To Sell Bitcoin P2P | Step-By-step Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To sell Bitcoin P2P, follow these steps:

Selling Bitcoin through peer-to-peer (P2P) platforms is a practical and secure way to trade your digital assets without going through a centralized exchange. But trading this way means you need to be mindful about safety, verify who you’re dealing with, and choose platforms that you can actually trust.

This guide takes you through everything you need to know about selling Bitcoin through P2P, from picking the right platform and creating your sell offer to making sure the payment process goes smoothly. It also includes smart tips to help you stay safe from scams.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

How to sell Bitcoin P2P

Selling Bitcoin through peer-to-peer (P2P) platforms gives you the freedom and security to convert your crypto into Fiat or other digital coins. This guide lays out the full process, including key steps, safety tips, risks to be aware of, and useful insights to help you make the most of your trades.

Step 1: Choose a reputable P2P platform

Start by picking a reliable platform. Options like Binance P2P, Paxful, and LocalBitcoins are well-known. Make sure the platform offers solid security, uses an escrow system to protect funds, and supports different payment methods that work for you.

Step 2: Register and complete verification

Once you've picked a platform, create your account and go through the identity verification process. This is a standard security step to prevent fraud. You’ll usually need to upload a government-issued ID and a proof of address, like a utility bill or bank statement.

Step 3: Set up your P2P sell order

After your account is verified, head to the P2P section and set up your sell order. Choose your price, payment method, and any specific conditions you want buyers to follow. Pricing your offer competitively can help you close deals faster. Some platforms let you link your price to real-time market rates.

Step 4: Select a buyer and initiate the trade

When your ad is live, buyers will start reaching out. Take a moment to check their profile, look for things like how many trades they’ve done, how other users have rated them, and whether they’re verified. Be clear in your communication to avoid confusion about payment.

Step 5: Receive payment and release Bitcoin

Once the buyer says they’ve made the payment, double-check that the money has actually landed in your account. P2P platforms hold your Bitcoin in escrow and won’t release it until you confirm payment. Never release your Bitcoin before you’re sure the payment is complete.

Best practices for secure P2P transactions

Trading Bitcoin peer-to-peer can be efficient and rewarding, but without the right precautions, it can also be risky. These strategies will help you trade smarter and stay protected.

Avoid trades right before major news. Big events like ETF approvals, legal verdicts, or regulatory announcements often trigger sudden price movements. Scammers know this and may take advantage of inexperienced traders by setting trap prices or rushing the trade. Wait at least 24 hours after any such news breaks to let the market stabilize before you enter a P2P trade.

Don’t just trust the platform to verify someone. Even on regulated platforms like Paxful, LocalBitcoins, or Binance P2P, identity verification can be faked or misused. For extra safety, ask your trade partner to send a live selfie holding their government ID and a handwritten note with your name, the date, and trade details. Most genuine users won’t mind. Scammers typically vanish when faced with extra verification steps.

Use smart wallets with time locks for big trades. If you're dealing with a large sum, say above $2,000, it's worth going beyond the basic escrow. Multi-signature wallets or wallets with time locks can release funds only when both parties confirm the trade, or after a set period. While not common in everyday P2P trades, they offer protection against sudden ghosting or disputes.

Never trade late at night. Scam attempts spike between 1 AM and 5 AM, especially in your local time zone when customer support teams are often unavailable or delayed. Avoid making trades during those hours. Schedule your transactions during regular working hours, when platform support can intervene faster if something goes wrong.

Take full screenshots of your screen. Always capture more than just chat messages. Take screenshots showing wallet addresses, transaction hashes, payment confirmations, and timestamps. Make sure your system time and browser window are clearly visible. These screenshots can serve as concrete evidence if a dispute arises later.

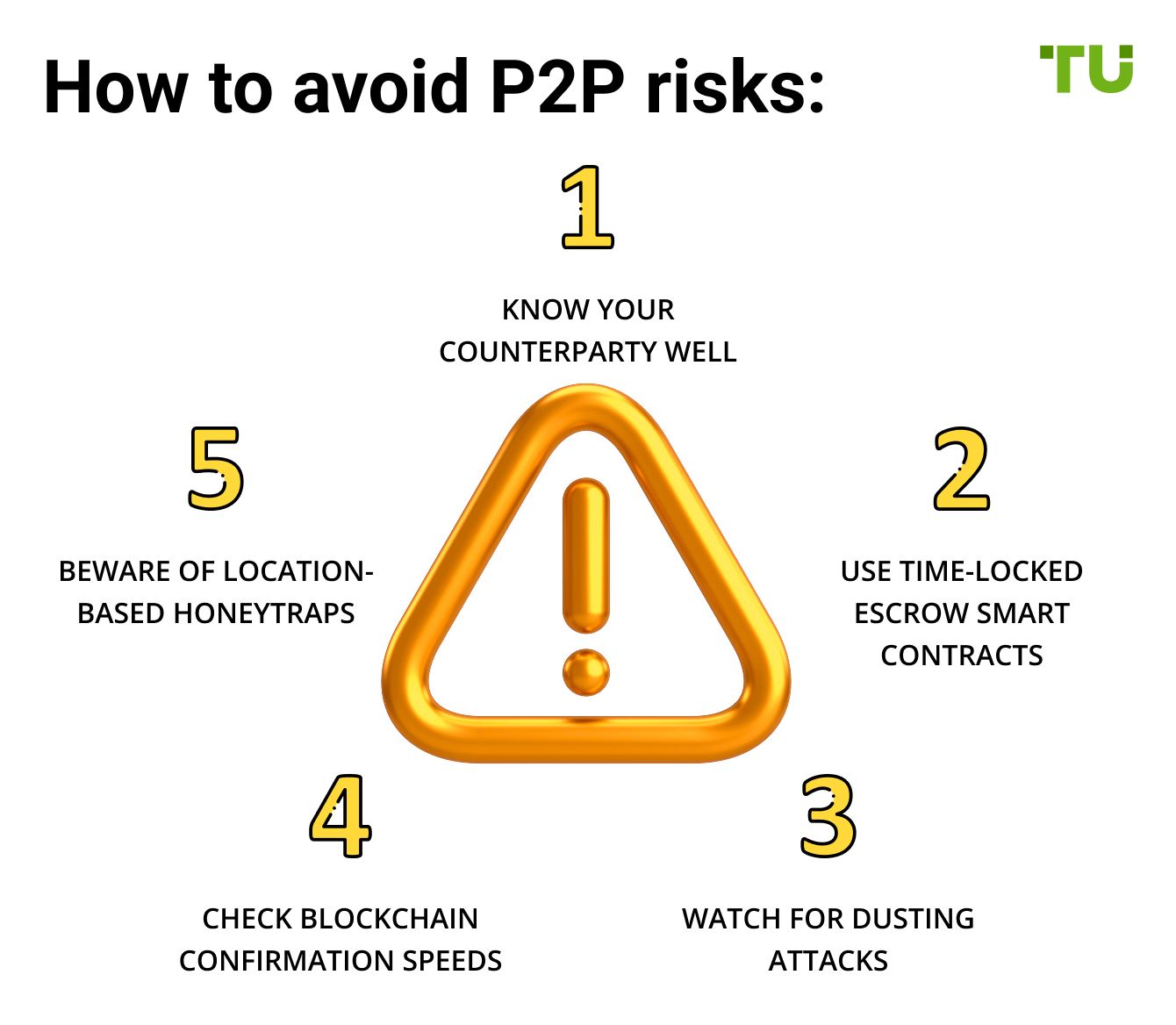

Potential risks and how to avoid them

Here's how to avoid major risks and stay secure while doing Bitcoin P2P transactions, especially as a trader understanding real-world deals.

Know your counterparty well. Use a P2P platform that verifies user identities and reputation over time. Start with small transactions and interact with sellers or buyers who have at least 6 months of consistent positive reviews and history.

Use time-locked escrow smart contracts. If you’re doing direct wallet-to-wallet deals outside platforms, use Bitcoin time-locks via CheckLockTimeVerify (CLTV). This locks the funds for a set time, ensuring the seller can’t disappear before delivering their part.

Watch for dusting attacks. These began spiking in 2019 and involve sending tiny Bitcoin amounts to trace wallets. Avoid interacting with random incoming micro-transactions and regularly use wallet address rotation and coin control tools.

Check blockchain confirmation speeds. After 2020, network congestion has occasionally led to long delays, especially during bull runs. Always agree on the number of confirmations beforehand (at least 2 to 3), and check mempool stats in real-time before sending.

Beware of location-based honeytraps. Since 2021, scammers in some countries have used face-to-face deals to steal hardware wallets or force transfers. Never meet in isolated areas and always carry a decoy wallet or mobile-only version of your wallet.

Sell bitcoin faster with localized P2P timing and layered identity checks

Most new sellers just post their offer and hope someone bites. But here’s what smarter traders do: they time their listings around local paydays or festivals, when people are more likely to have cash in hand and are ready to buy. In some places, that might be the start of the month or right before a holiday. If you list your bitcoin when local demand is heating up but other sellers haven’t caught on yet, you can nudge your price up a little and still close the deal fast.

One more thing that makes a huge difference? Do your own quiet background checks on buyers before confirming anything. Don’t just rely on whatever badge or checkmark the platform gives. Look at how they talk, how fast they reply, what kind of payment proof they send. If something feels off, trust that instinct. Many experienced sellers keep their own little list of sketchy users who’ve tried to pull stunts before. That small habit can save you big trouble later.

Conclusion

Selling Bitcoin through P2P platforms is a convenient way to exchange crypto while maintaining control over pricing and payment methods. By choosing a reputable platform, verifying buyers, using escrow services, and following best security practices, traders can conduct safe and profitable transactions. Always stay informed about platform policies and market trends to optimize your selling experience.

FAQs

What happens if the buyer never marks the payment as sent?

If the buyer doesn't mark the payment as sent, the trade stays inactive and your Bitcoin remains in escrow. Most platforms will auto-cancel the trade after a set time. You won’t lose your Bitcoin, but always monitor the timer to avoid unnecessary delays.

Can I sell to someone in another country using P2P?

Yes, but be cautious. Cross-border payments can involve delays, currency conversion fees, and higher scam risk. Stick to trusted platforms and payment methods that offer strong buyer protection and local support in both regions.

Is it safe to reuse the same wallet address for multiple trades?

Not really. Reusing addresses can expose your full transaction history, making it easier for someone to track your balances or link trades. Use a new wallet address for each trade to improve privacy.

How do I handle a buyer who keeps asking for discounts mid-trade?

Don’t negotiate after a trade has started. Stick to the terms you agreed on. Politely cancel if needed, buyers trying to haggle after the fact often signal potential trouble or manipulation.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.