Best Crypto Screeners (2025)

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best crypto screeners for 2025:

TradingView Crypto Screener. A powerful tool with advanced charting, technical indicators, and real-time market data.

CoinMarketCap. A widely used platform for tracking prices, market caps, trading volume, and new listings.

Yahoo Finance. A finance-focused screener that includes cryptocurrency price tracking and market news.

Cryptolume. A data-driven platform offering real-time alerts, trading signals, and blockchain insights.

CoinTelegraph Markets Pro. A premium screener providing sentiment analysis, news-driven insights, and predictive analytics.

Quantify Crypto Screener. A technical analysis-based tool featuring AI-driven signals and crypto performance ratings.

Messari. An institutional-grade platform for in-depth research, on-chain metrics, and fundamental analysis.

As the cryptocurrency landscape grows more dynamic, having access to a powerful crypto screener can make all the difference when analyzing assets that meet specific trading criteria. Regardless of whether you're a full-time analyst or someone casually exploring opportunities, tools that simplify complex market data help sharpen your decision-making. In our 2025 guide, we’ve explored platforms designed to reduce noise, surface real insights, and highlight strong trading opportunities based on live metrics and performance trends.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Best crypto screeners review 2025

The cryptocurrency space is evolving rapidly, attracting both retail traders and institutional investors who are increasingly looking beyond Bitcoin to altcoins with real-world utility and long-term growth potential. As digital assets mature, success often comes down to identifying projects backed by strong communities, real innovation, and healthy market capitalization. Informed decisions rely on platforms that deliver real time data on blockchain activity, developer updates, and token movement.

To stay ahead, many traders turn to a reliable crypto screener that filters coins using practical metrics like average volume, price movements, volatility, and technical tools such as the Relative Strength Index (RSI). The best tools pull data collected from trustworthy crypto exchanges and offer features like risk management filters, trend detection across trading pairs, and insights into market cap shifts.

While some platforms offer free services, the best crypto screener often includes a paid subscription tier, unlocking advanced alerts, portfolio sync, and the ability to compare trading volume across assets. These deeper insights make it easier to navigate the fast-moving crypto markets and seize valuable trading opportunities with clarity and confidence.

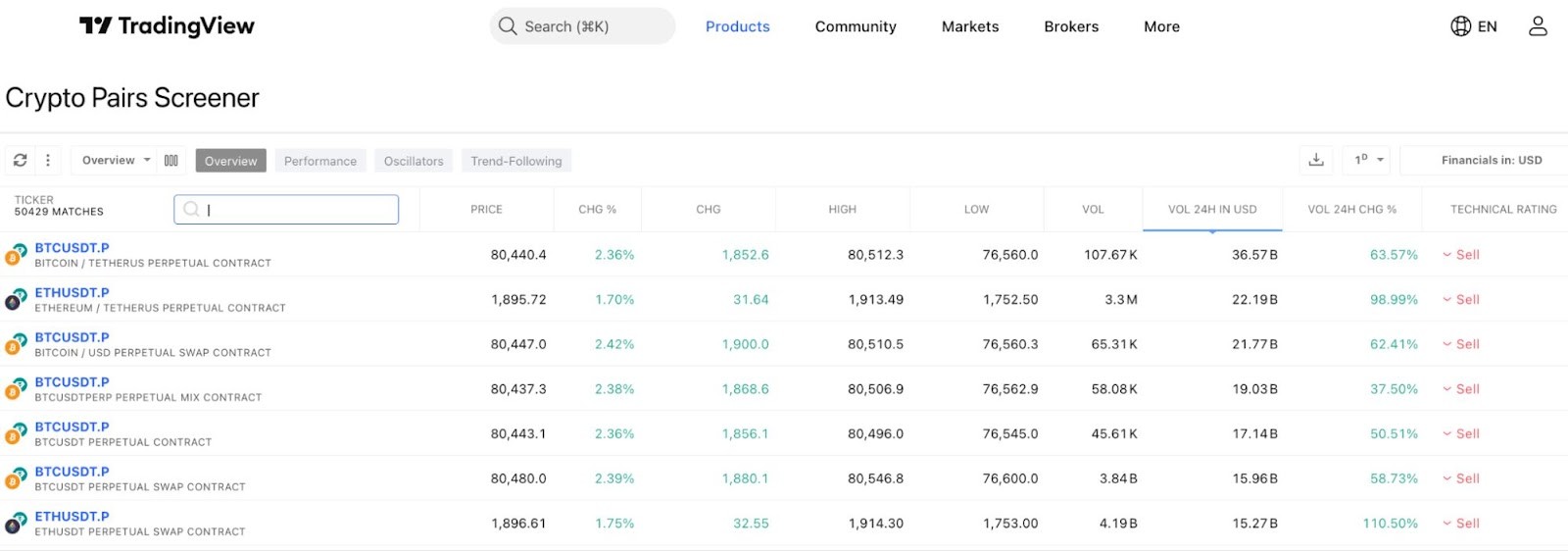

TradingView Crypto Screener

The TradingView crypto screener continues to stand out for its wide coverage of over 7,000 trading pairs, smart charting tools, and dependable access to real time data. Its web-based interface means there’s no need to install a desktop app, giving traders a smooth experience right from their browsers.

With flexible filtering options based on market capitalization, volume, and past performance, users can personalize their screen with custom criteria. It supports technical tools like RSI, MACD, Bollinger Bands, and oscillators, helping traders better evaluate trade efficiency and spot solid trading opportunities. The alert system also lets advanced users track price movements in popular coins like Shiba Inu, making TradingView one of the most feature-rich crypto screeners available today.

Some other useful features of this crypto screener are:

Ability to assess coin performance over multiple timeframes, from the current day to 3 months, 6 months, and yearly intervals.

A dedicated oscillators tab featuring indicators such as momentum, ATR, MACD, and RSI, along with buy/sell/neutral signals.

Tools that let users search by name, filter by market cap or volume, and even sort based on average price movement patterns.

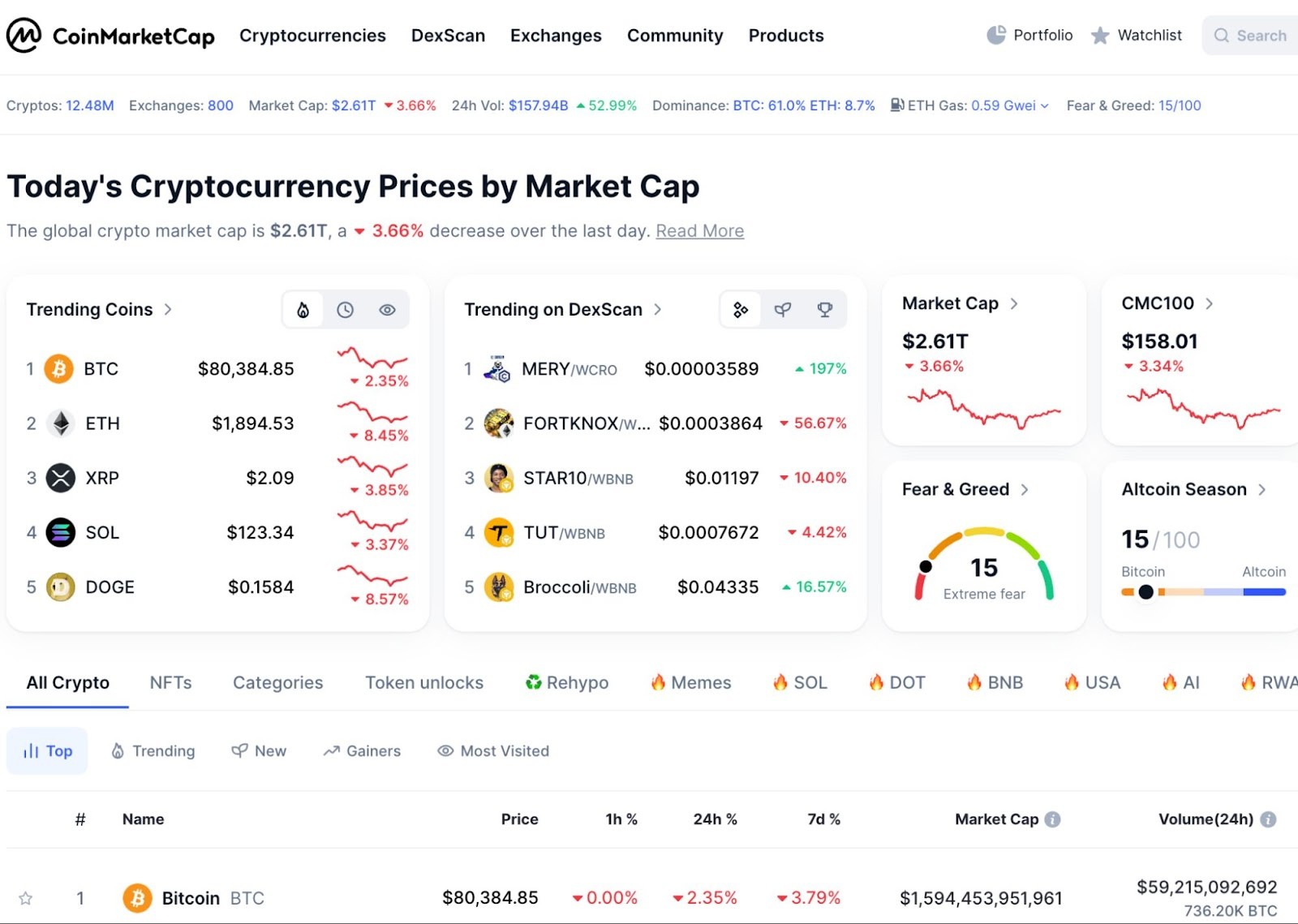

Coinmarketcap

CoinMarketCap goes far beyond just showing live prices, it’s a robust crypto screener packed with tools for browsing through over 16,000 coins. With features that include coin profiles, historical charts, and news updates, users gain access to rich analysis across a wide range of projects. You can also compare trading pairs, check price change metrics, and explore coins based on market sector or algorithm.

While it may not offer advanced technical indicators, its user-friendly layout and ability to flag coins or manage portfolios make it ideal for both beginners and experienced investors looking to organize and monitor their assets effectively.

The listed coins can also be categorised based on their sectors, price changes, market caps, volumes, and circulating supply.

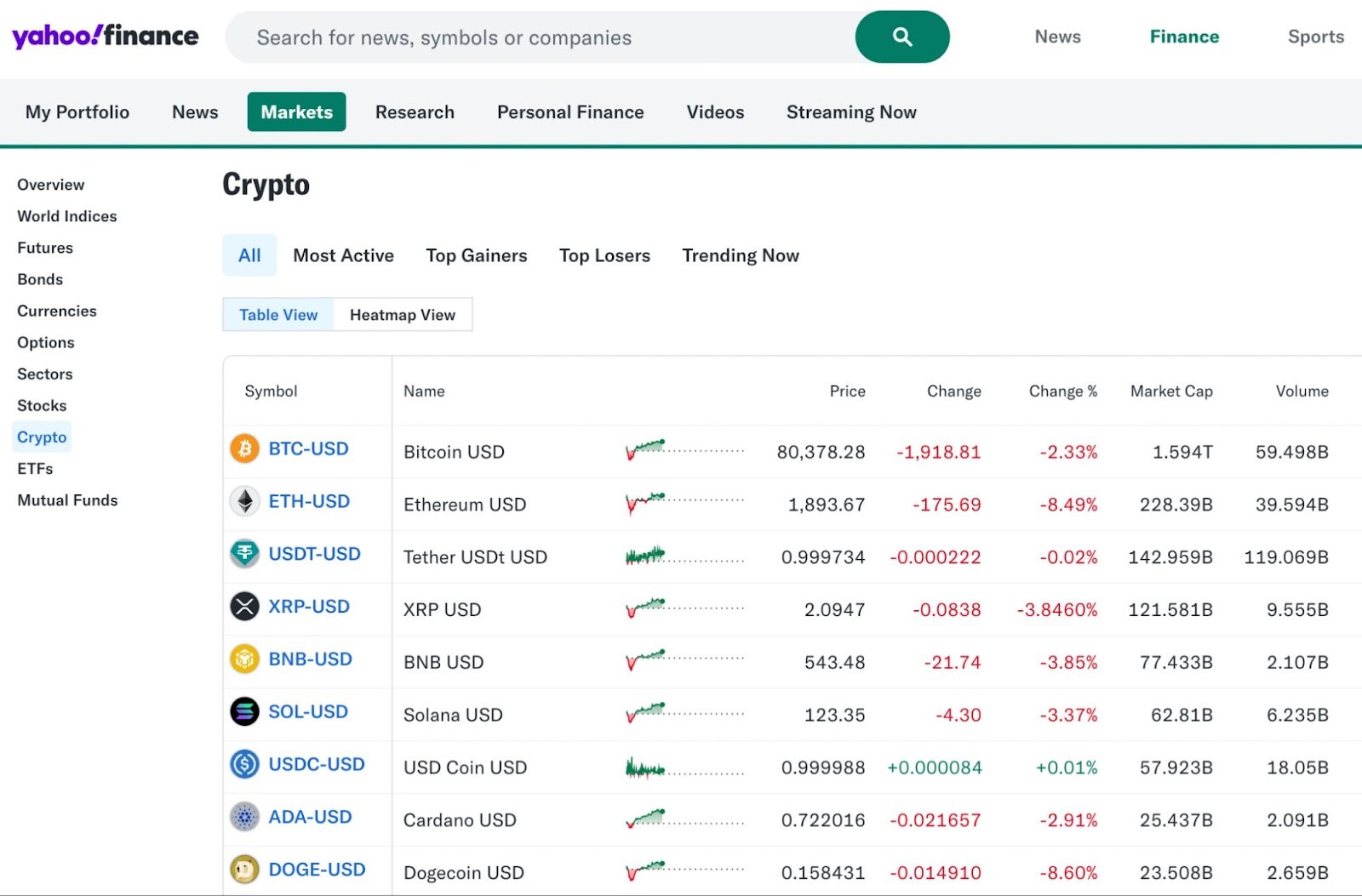

Yahoo Finance

Traditionally a hub for equities, Yahoo Finance has upgraded its crypto screener with unique visual tools, including colorful heatmaps that illustrate market sentiment and sector performance.

Users can sort crypto prices by price, market capitalization, and volume to quickly gauge movement and opportunities. Though it lacks deep technical features, its clean charts and intuitive layout are perfect for those who want to check their investments on the go, particularly through its mobile app. It allows users to stay informed without needing technical expertise.

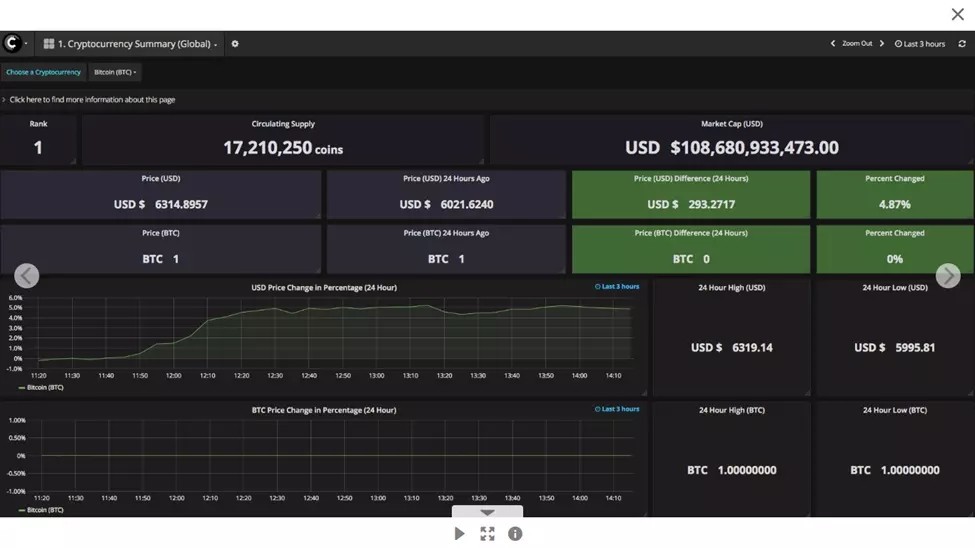

Cryptolume

Designed for the data-heavy trader, Cryptolume provides over 1,000 signals per day through precise, alert-based tools. It highlights sudden volume spikes, unusual price movements, and trend-driven setups, ideal for those trading futures or managing active portfolios.

The platform’s paid subscription model supports professional-grade insights, allowing traders to act on algorithm-triggered flags that spotlight volatile conditions. With a focus on responsiveness and detailed functionality, Cryptolume is tailored for decision-makers who operate in high-speed markets.

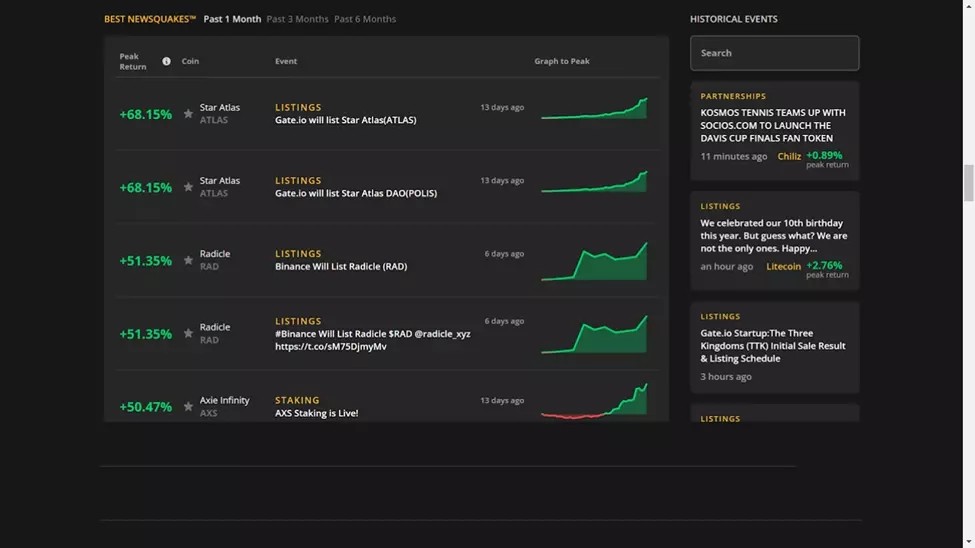

CoinTelegraph Markets Pro

CoinTelegraph Markets Pro blends news and data to give traders an edge. Its VORTECS Score leverages social trends and historical performance to detect early trading opportunities, helping traders anticipate price movements before the market reacts.

With a dedicated app, NewsQuakes alerts, and a supportive Discord community subscribers gain deep access to social listening tools. You’ll better understand market behavior through social sentiment, trending indicators, and updates designed to keep active traders one step ahead.

CoinTelegraph's investor-grade technology and data. Several features are included, including an easy-to-understand layout:

Market news and updates from NewsQuakes.

The Discord community lets you share ideas with other members.

Keeping track of what Twitter thinks about assets.

Scoring tool for VORTECS.

Money back guarantee of 14 days.

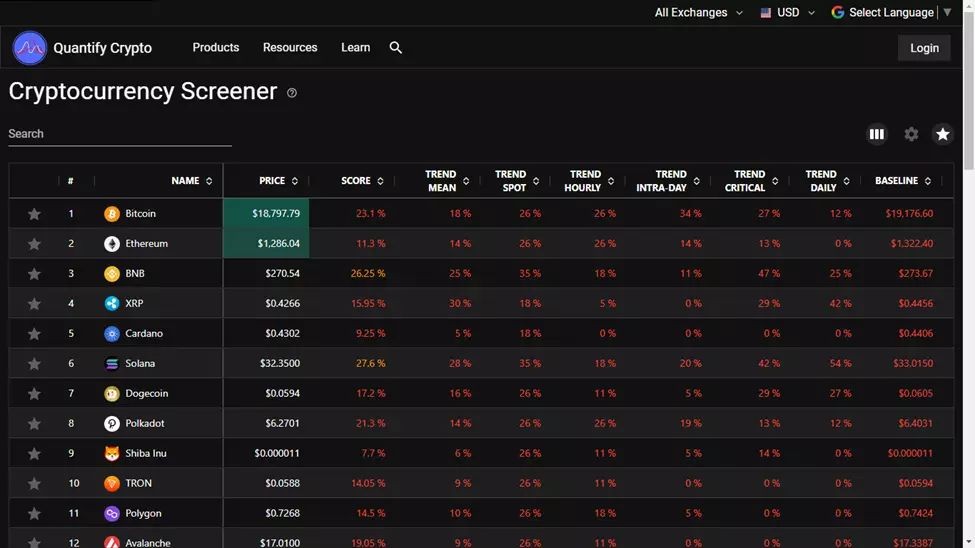

Quantify Crypto Screener

Quantify Crypto caters to traders who rely on technicals. With coverage of about 250 coins, it lets users focus on detailed indicators like RSI, moving averages, and bollinger bands, all while offering smart filtering options via a fully customizable edit tab.

It’s especially suited for spotting short-term performance trends, tracking fast changes in price, and reacting quickly. The interface is clean and straightforward, allowing users to find actionable insights fast and enhance trade timing, particularly useful in fast-moving DeFi sectors.

While QuantifyCrypto analyzes only 250 coins, it covers more than 90% of the market and covers more than 90% more than CoinMarketCap.

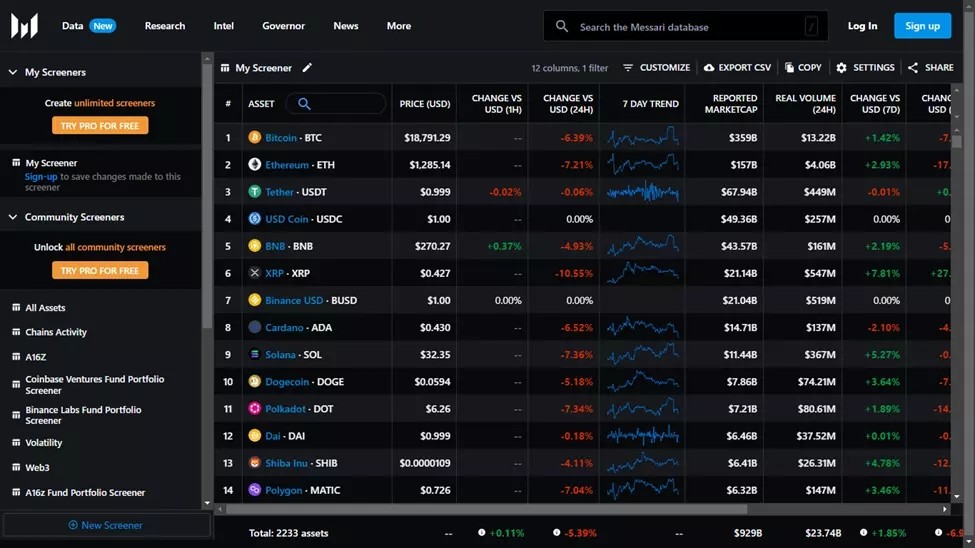

Messari

Built for institutional users and long-term thinkers, Messari provides deep data and structured analysis for around 842 coins. Though it covers fewer assets, the quality of insights is unmatched. It collects everything from volume, volatility, and exchange spreads to key metrics like average price and sector strength.

Messari’s charting tools help break down coins like Avalanche, letting you analyze trends in context and assess where a coin sits in broader cycles. It’s a go-to for those who want to track a project’s position in the market and understand its real-world fundamentals.

Using Messari's dedicated chart area, you can view coins with various metrics and data. You can get a complete technical analysis-based view by looking at a coin's price, volume, market size, volatility, and other factors that are displayed in its own charts and metrics. Investors and traders can use this information to better understand the coin's realistic situation and where it is likely to move in the future.

Best crypto exchanges with crypto screeners

One of the best crypto screens out there is the one provided by TradingView. Below we have prepared a list of crypto exchanges that support TradingView crypto screening capabilities:

| Min. Deposit, $ | Spot leverage | Spot Maker Fee, % | Spot Taker fee, % | TradingView | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 10 | 1:10 | 0,08 | 0,1 | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| 10 | 1:5 | 0,25 | 0,4 | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| 1 | 1:3 | 0,25 | 0,5 | Yes | Yes | 8.36 | Open an account Your capital is at risk. |

|

| 1 | 1:5 | 0,1 | 0,2 | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| 10 | 1:3 | 0,5 | 0,5 | Yes | Yes | 6.89 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

What is a crypto screener?

A crypto screener is a tool that helps users identify potential trading opportunities by applying specific criteria such as price change, market capitalization, or average volume. Much like stock screeners in traditional finance, these tools help investors scan through thousands of crypto assets with speed and efficiency.

By incorporating built-in technical indicators like relative strength index, MACD, and bollinger bands, a screener interprets real time data to highlight behavior patterns and shifts in crypto markets. Some platforms even allow users to create custom signals and adjust filters, making it easier to detect emerging trends or unexpected movement in volatile conditions.

Whether you’re focused on micro-cap assets or analyzing movements in large-cap coins like Shiba Inu or Avalanche, a solid screener reduces distractions by organizing your data and helping you zero in on meaningful metrics.

Should I use a crypto screener?

Absolutely. A good crypto screener is valuable to both novice and experienced traders, especially when you need to make sense of fast-changing market data. It allows you to scan for coins based on key indicators such as trading volume, recent price movements, or pattern strength.

Some platforms even integrate tools that track social buzz or large wallet transfers, so users can act before the wider market reacts. The ability to customize settings and apply focused criteria improves your analysis and risk management. Whether you’re making long-term investments or executing quick trades, screeners can support smarter, more responsive decision-making.

By boosting your access to quality tools and giving you a better understanding of key metrics, a crypto screener becomes an essential part of staying ahead in the evolving world of crypto.

- Pros

- Cons

Quickly screen and compare thousands of cryptocurrencies using personalized settings.

Monitor live prices and uncover early signals or developing market activity.

Use targeted filters to fine-tune your screening results.

Save time by automating repetitive analysis tasks.

Receive alerts tied to indicators, community sentiment, or technical triggers.

Some screeners display data collected that lags slightly during rapid price swings.

Full access may be gated behind a paid subscription.

Beginners might need time to learn how to apply complex indicators effectively.

How to use a crypto screener

To use a crypto screener effectively, start by choosing filters that suit current market conditions. These tools are designed to help you evaluate volume, price, and available trading pairs using detailed, up-to-the-minute data.

Here’s how to use a crypto screener:

Select criteria. Choose filters like price, market cap, volume, or circulating supply.

Set parameters. Specify values, e.g., market cap of $1 billion+ or coins listed within a specific timeframe.

View results. The screener displays cryptocurrencies matching your criteria.

Sort data. Organize results by price (ascending/descending), market cap, or volume.

Refine further. Use additional filters for more precise results (e.g., trending or newly added coins).

These steps give traders access to focused analysis, making it easier to understand movements in the market and make better trading decisions with fewer distractions. With the right use of indicators, a crypto screener can highlight assets with significant upside potential.

Types of crypto screeners

Different screeners are designed to detect unique patterns, market signals, and trading setups by processing varied data sources. Choosing the right type depends on your strategy and preferred functionality.

Here’s an overview of the main types of crypto screeners:

Price-based screeners track real-time price movements, market trends, and volatility.

Technical analysis screeners use advanced technical indicators and pattern recognition tools.

Fundamental analysis screeners assess long-term value by analyzing market cap, tokenomics, and project activity.

On-chain data screeners monitor wallet activity, trading volume, and blockchain data.

DeFi & DEX screeners help users explore DeFi protocols, assets, and yield farming opportunities.

Arbitrage screeners compare prices across exchanges to identify profitable differences.

AI & sentiment screeners analyze social trends and generate alerts based on market psychology.

These screeners enable users to screen coins effectively and adapt to various market scenarios through tailored filters.

Use on-chain metrics and advanced alerts for smarter crypto screening in 2025

If you're serious about crypto screening in 2025, you must move beyond basic filters. A top-performing strategy combines on-chain metrics, predictive alerts, and custom signals. Start by analyzing wallet activity: tracking whale trades is no longer optional, it’s essential.

Set your system to notify you when massive transactions hit the blockchain. These movements often foreshadow significant price trends. Don't stop there, layer in alerts tied to RSI divergence, MACD crossovers, or volume spikes for confirmation.

Want to outpace average traders? Integrate social sentiment tracking. When community buzz aligns with on-chain market data, it's often the start of a breakout.

Conclusion

Using the right crypto screener gives traders and investors the edge needed to navigate complex trends and identify key assets. Whether it’s spotting breakout price action or filtering coins by market cap, these tools turn overwhelming data into actionable insights.

A well-chosen screener aligns with your trading strategy, offering access to critical real time data, intuitive filters, and accurate technical indicators. These features ensure users don’t just screen the market, they anticipate it.

As crypto evolves, your ability to adapt using smart analysis tools will define your success. Choose wisely, filter efficiently, and keep learning.

FAQs

Are crypto screeners accurate?

Yes. A crypto screener provides reliable real time data and market metrics, but no tool can predict prices with full certainty. Use it alongside broader analysis and risk strategies.

How do I find profitable coins?

Set clear criteria in your screener, such as rising trading volume, breakouts, or indicators. The tool filters potential assets, which you can then verify through deeper analysis.

How can screeners spot early price moves?

Track wallet flows and signals like RSI or MACD. A good crypto screener will alert you to moves — often before they appear in price charts or mainstream coverage.

What features should a 2025 screener have?

Look for custom alerts, social sentiment tools, whale tracking, and advanced filters. These help you screen for trends early and make data-backed decisions.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.