Is Prop Firm Trading Halal? Full Islamic Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Proprietary trading may be considered halal when it is structured in a way that reduces excessive uncertainty (gharar), avoids interest-based dealings (riba), and upholds ethical practices by steering clear of manipulation or unfair price practices.

Prop trading, or proprietary trading, is a method financial firms use to engage skilled traders to manage and trade various financial instruments using capital provided by the firm. Profits earned through this account are shared between both parties. As this model becomes more common in the financial industry, it prompts a closer look at whether it complies with Islamic values.

The debate around whether prop trading is halal or haram in Islam stems from the fact that Islamic financial practices are governed by Shariah law, which prohibits specific types of transactions — particularly those involving interest (riba), ambiguity (gharar), and excessive speculation (maysir). Some prop firms may offer services that fall into these categories, which is why questions like “are prop firms halal or haram in Islam?” are increasingly relevant for Muslim traders.

This article explores proprietary trading through the lens of Islamic finance to determine whether it is compliant with Shariah principles. Our experts aim to provide clarity on whether proprietary trading aligns with Islamic values by analyzing key foundations of Islamic finance and the specific features of this trading approach.

Risk warning: Proprietary trading involves substantial financial risk. Using firm capital can lead to gains or losses, and failure to meet targets may result in account closure. Over 85% of prop traders do not achieve long-term profitability. Understand the risks and seek professional guidance.

Is it legal in Islam to do prop trading?

In Islamic finance, the legality of prop trading hinges not just on the trading instrument, but on how risk and reward are structured between the firm and the trader. Most prop firms operate on a profit split or funded model where traders use the firm’s capital in return for a share of profits.

This isn’t automatically haram, but many firms impose daily drawdown limits and mandatory stop-losses that shift risk disproportionately onto the trader. If the firm retains all control and the trader shoulders all financial risk without actual capital ownership, the model leans toward gharar (excessive uncertainty), which can render it non-compliant under Islamic law.

A deeper issue arises when prop firms trade in leveraged instruments like Forex or CFDs, where interest-bearing swaps (overnight fees) or margin borrowing come into play. Even if the trades are short-term, any agreement that allows or tolerates riba, even indirectly, invalidates the contract from a Shariah standpoint. However, if a firm uses Islamic accounts with no swap fees and avoids debt-based leverage, a structured and transparent profit-sharing model could pass Shariah review, especially if there's mutual consent, clear capital delineation, and accountability in risk sharing.

What are the best prop firms to consider for Muslims?

For Muslim traders, choosing prop firms that respect ethical values and Sharia principles is a key consideration. Although fully Islamic accounts are still rare in prop trading, it’s better to look for firms with honest fee structures that stay away from interest-based elements. Working with firms that have strong ethical policies can support your efforts to trade in line with your faith. Muslim traders may also go for firms offering assets such as stocks, cryptocurrencies, and futures contracts, which generally avoid interest or rollover charges.

We reviewed the trading setups of three well-known prop firms that provide a wide range of assets and clearly stated terms.

| Funding Up To, $ | Profit split up to, % | Stocks | Crypto | Futures | Open an account | |

|---|---|---|---|---|---|---|

| 4 000 000 | 95 | No | Yes | No | Open an account Your capital is at risk.

|

|

| 200 000 | 90 | No | Yes | No | Open an account Your capital is at risk.

|

|

| 2 500 000 | 90 | No | Yes | No | Open an account Your capital is at risk.

|

|

| 2 000 000 | 95 | No | Yes | No | Open an account Your capital is at risk.

|

|

| 400 000 | 80 | No | Yes | Yes | Open an account Your capital is at risk. |

When prop trading may not be halal

If you’re just stepping into proprietary trading as a Muslim trader, here are some reasons why it might not be halal, even if it looks fine on the surface.

Risk is shifted unfairly. If you bear all the losses while the firm keeps control of the capital, that’s an imbalance that violates Islamic risk-sharing principles.

Riba sneaks in through swaps. Some firms use accounts that quietly charge or credit interest on overnight positions, which makes the setup non-compliant without the trader even realizing it.

You don’t actually own what you trade. Many funded accounts don’t give you real asset ownership, which means your profits could be based on synthetic exposure rather than actual halal transactions.

No say in where the capital goes. If the firm trades in haram sectors like alcohol or conventional banking with your trades, your intention doesn’t override the impermissible nature of the activity.

Payout structures mimic interest. Some firms guarantee monthly payouts or offer fixed returns if targets are hit, which closely mirrors interest-based earnings and violates Shariah rules.

Ambiguity in contracts. If the contract lacks clarity on who owns what, how losses are handled, or what happens during a margin call, it introduces gharar, which is a major red flag in Islamic finance.

How to keep prop trading halal?

If you're a beginner trying to make prop trading work within Shariah boundaries, here are some sharp, often-overlooked tips to keep it clean and compliant.

Avoid firms with swap-based accounts. Even if the firm calls itself “Islamic-friendly,” if their broker charges overnight interest, that’s riba in disguise.

Make sure risk is genuinely shared. If the firm keeps full ownership of the capital and only you take the hit for losses, that turns the deal unfair and possibly haram.

Stay away from hidden leverage. Some firms sneak in margin exposure without telling you — it might look like a funded account, but the backend is still debt-based.

Choose firms with Shariah-reviewed models. A few prop firms now consult Islamic scholars for their funding structures — look for those with actual Shariah boards, not vague claims.

Don’t treat challenge fees like gambling. If you're paying for a shot at funding with no clarity on real value or odds, it can resemble maysir (speculation), which is prohibited.

Use platforms that allow Islamic account settings. If the broker allows swap-free accounts, confirm that they're not just rolling the cost into hidden spreads or other charges.

Focus on asset-backed instruments. Trade in markets like stocks or commodities instead of synthetic indices or contracts with no real-world backing.

Prop trading is acceptable under the following conditions

Prop firms avoid engaging in activities, such as insider trading and market manipulation, that jeopardize the market's integrity and fairness.

Trading is conducted to advance legitimate business goals and real economic activity.

There should be no interest involved in trades (riba). This implies that leveraged trades, or those involving instruments that bear interest, are prohibited.

Transactions should not be fraught with ambiguity (gharar). Therefore, conjecture or uncertainty should not be the basis for transactions.

Prop firms should not integrate haram (forbidden) assets, activities, or products, like those about gambling, alcohol, or pork.

The underlying stocks traded should be halal assets. For example, trading in the stocks of companies that do not carry out haram activities is typically acceptable.

What Islamic authorities say about prop trading

Many scholars highlight that the permissibility of prop trading comes down to how well it follows the core principles of Shariah. While using a firm’s capital to trade is not automatically considered haram, the terms set by the firm, how leverage is handled, and what kind of assets are traded play a key role in deciding if prop firm trading is halal or haram in Islam.

"Gold for gold, silver for silver... like for like, same for same, hand to hand. If the types are different, then sell however you like, so long as it is hand to hand." – Sahih Muslim 1584

This foundational hadith underlines that trades must be fair, immediate, and without deferred settlement terms involving uncertainty or interest.

In most proprietary trading arrangements, the use of leverage,especially when provided as a conditional, non-transferable loanraises major concerns. As noted in the Hadith:

“It is forbidden to lend on the condition of a sale, have two conditions in one transaction, or sell what you do not have.” – Sunan an-Nasa’i 4611

Contemporary Shariah opinion. Scholars such as Mufti Taqi Usmani emphasize that “any structure involving leveraged capital tied to exclusive platform use and future obligations can amount to gharar and riba, making the arrangement impermissible.”

In response, some modern firms now offer Islamic accounts that address such issues by avoiding overnight swaps, making sure all assets are halal, and offering risk-sharing contracts that are fair and easy to understand.

To stay aligned with Islamic principles, Muslim traders should:

Avoid platforms that involve interest-based leverage or speculative derivatives.

Seek firms that build funded stages using mudarabah or wakalah agreements.

Verify that traded instruments exclude haram industries and maintain openness in operations

How prop trading compares to other halal or haram trading styles

Each style, whether short-term or long-term, comes with its own rulings based on risk, speculation, and the use of leverage.

Some Muslim traders explore day trading for quick opportunities, but its permissibility hinges on avoiding excessive speculation and interest-based positions. Similarly, copy trading can raise concerns if it involves passive gains without effort or if the copied trader engages in haram instruments.

Swing trading tends to be viewed more positively, especially when based on asset-backed securities and transparent contracts. However, scalping, like day trading, must be evaluated for gharar (excessive uncertainty) and execution clarity.

Then there's short selling, perhaps the most debated of all. Since it involves selling assets one does not own and often includes borrowing with interest, most scholars classify it as haram. Prop trading can include any of these techniques, so understanding their rulings is key to staying compliant.

If you wish to invest in financial assets (stock, crypto, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.95 | Study review |

Alternative investment options for Muslims

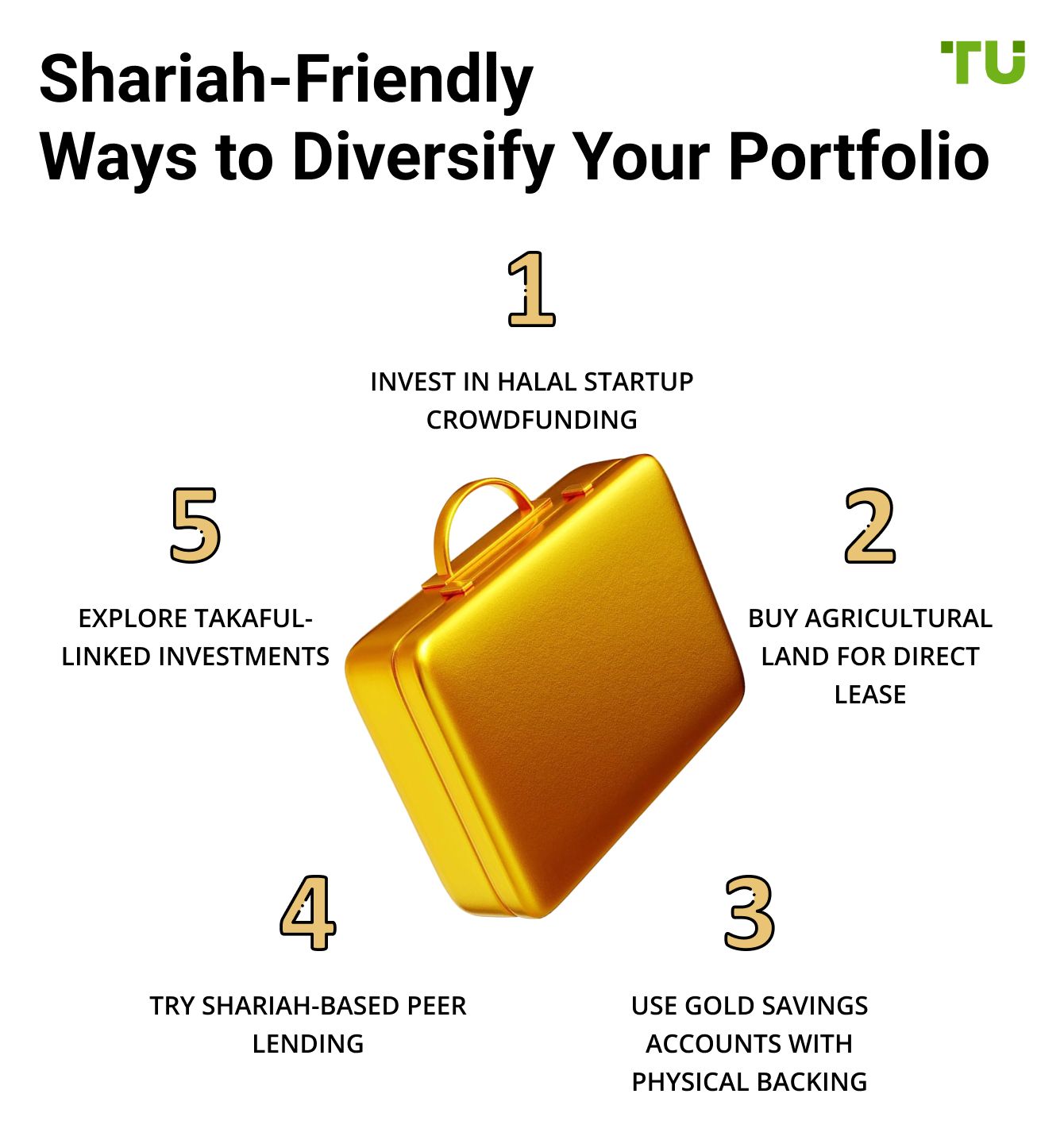

If you’re a Muslim looking for halal ways to grow money beyond stocks and mutual funds, here are some options that offer both returns and religious peace of mind.

Invest in halal startup crowdfunding. Platforms like Ethis or Saturna let you back real businesses with Shariah-compliant structures, but look for deals vetted by scholars, not just the platform itself.

Buy agricultural land for direct lease. Leasing land to farmers with fixed rental terms (not profit-sharing) can avoid uncertainty and give steady halal income tied to real assets.

Use gold savings accounts with physical backing. Some apps offer gold-backed accounts where you actually own physical grams, not just paper exposure, important because speculative contracts are often not Shariah-compliant.

Try Shariah-based peer lending. Platforms offering qard hasan or mudarabah-based lending avoid interest and let you fund small businesses or personal needs in a faith-compliant way.

Explore takaful-linked investments. Certain takaful models now combine protection with savings plans that are invested in Shariah-screened funds, offering ethical long-term growth.

Structuring halal prop firm trades through risk delegation and contract clarity

A lot of new traders write off prop firms as haram without digging into how the deal is structured. But if the firm uses a clear wakalah (agency) or mudarabah (partnership) setup, where they put up the capital and you bring your trading skills, it can actually follow Shariah principles.

The key question often asked is: is trading with prop firms halal or haram in Islam? The answer depends heavily on how the contract is built. What matters is that the agreement spells out that you're not personally liable for losses, and that risk-sharing is fair and transparent. This helps avoid the excessive uncertainty (gharar) and hidden traps that Islamic finance seeks to eliminate.

Another commonly overlooked factor is the source and nature of the trading capital. For example, if the firm confirms that their funds are not linked to interest-bearing instruments and you're trading only halal markets — such as spot Forex, commodities, or screened equities — and not options or leveraged CFDs, the structure may be far more Shariah-compliant than it appears at first glance.

This raises the broader discussion around is funded trading halal or haram in Islam — especially when traders receive capital in exchange for sharing profits. If the arrangement is clearly defined, ethically funded, and limited to halal instruments, many scholars see no contradiction with Islamic finance principles.

Summary

Proprietary trading can be considered halal (permissible) in Islamic finance if trading activities avoid elements of uncertainty (gharar) and interest (riba). In the context of proprietary trading, this means transactions should be transparent and based on tangible assets or commodities, with clear terms and conditions. Additionally, trading should not involve speculation or gambling, and traders should not manipulate prices or exploit market conditions unfairly.

FAQs

Can I pay a fee to join a prop firm and still be Shariah-compliant?

Yes — if the fee strictly covers administrative, evaluation, or platform access costs, and is not tied to any guaranteed profit or interest-based return. It must not resemble a wager or a speculative entry fee. This distinction is crucial when discussing whether funded accounts are halal or haram in Islam, as the permissibility hinges on the purpose and structure of the payment.

Is it halal to receive a profit split if I’m trading on a simulated account?

If the contract is structured as a genuine risk-sharing partnership (musharakah) and the firm pays you from real profits based on your actual trading performance, most scholars permit it — even if you trade using a demo or simulated account. This topic is increasingly relevant as traders ask: are funded trading accounts halal or haram in Islam? The answer depends on whether the account represents a fair profit-sharing setup or merely simulates risk with no real value transfer.

Does using a proprietary trading bot affect the halal status of my trading?

Only if the bot executes a strategy that complies with Shariah. Automated trading is allowed as long as the tool avoids haram instruments, interest-bearing trades, and excessive speculation. Like manual trading, the rules of halal apply to the method and the market — not just to the trader.

Does paying a fee to join a prop firm make it haram?

Not necessarily. If the fee is for platform access or evaluation, not a gambling-like entry fee or guarantee of profits, it's generally permitted.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Insider trading is the illegal practice of buying or selling a company's securities (such as stocks or bonds) based on non-public, material, and confidential information about the company. This information is typically known only to insiders, such as company executives, employees, or individuals with close connections to the company, and it gives them an unfair advantage in the financial markets.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.