Success Stories In Prop Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The famous success stories in prop trading are about:

Mike Bellafiore – Co-founder of SMB capital, a New York-based prop trading firm

Steven Cohen – Founder of SAC capital, a prominent figure in proprietary trading

Paul Rotter – The eurex flipper by leveraging a unique approach to market behavior

Mark Spitznagel – Founder of Universa Investments, known as "tail-risk" events

Dan Zanger – Record-breaking trader (29 000% return on his portfolio).

The growth of prop trading firms has been remarkable, with more traders looking to expand their trading beyond personal accounts. This trend is fueled by the support these firms provide, including educational resources, flexible funding, and clear evaluation processes. The most appealing aspect, however, lies in the real success stories of traders who have achieved substantial financial growth through prop trading. In this article, we’ll explore key insights and lessons from these success stories that can help traders of all levels enhance their trading journey.

Success stories in prop trading

This section provides real-life examples of traders who have succeeded in the competitive world of prop trading, offering both inspiration and actionable lessons.

Mike Bellafiore – Co-founder of SMB capital

Mike Bellafiore, co-founder of SMB capital, a New York-based prop trading firm, is known for his influence in professional trading and training. His journey began after college, driven by a love for financial markets. Alongside starting SMB, Bellafiore also launched SMBU, an educational branch aimed at teaching traders to build a solid trading routine and stay focused under pressure. His firm has been featured on platforms like CNBC and Bloomberg TV, showcasing the effectiveness of their trading programs.

Bellafiore’s books, One Good Trade and The Playbook, share practical insights from his experiences, offering readers a view into trading psychology and smart decision-making. He emphasizes the importance of consistent routines and growth through small, deliberate improvements. Through SMB capital , Bellafiore has mentored numerous aspiring traders, showing how discipline and a steady approach can lead to both personal and institutional success.

Steven Cohen – Founder of SAC capital

Steven A. Cohen , founder of SAC Capital Advisors and later Point72 Asset Management, is a prominent figure in hedge funds and proprietary trading. His career began at Gruntal & Co., where he quickly made a name as a trader known for his fast-paced, high-stakes approach, routinely generating substantial returns. In 1992, Cohen launched SAC capital, which became one of the most profitable firms of its time by focusing on short-term trades, with positions often held for hours or days. At its peak, SAC managed around 2% of daily U.S. stock trading volume and delivered annual returns averaging 25%. The firm profited heavily from events like the dot-com bubble, where Cohen capitalized on both the surge and subsequent decline in tech stocks.

In 2013, SAC capital faced a significant insider trading investigation, which led to a $1.8 billion fine and the eventual closure of the firm in 2016. Cohen responded by restructuring and launching Point72, initially as a family office, which reopened to external investors in 2018. Today, Point72 manages over $30 billion and operates with a multi-strategy approach that combines both quantitative and fundamental trading techniques. The firm emphasizes training and development through the Point72 Academy, nurturing new talent with a strong foundation in risk management and disciplined investment strategies. This structured approach reflects Cohen's resilience and adaptability in navigating market and regulatory changes.

Paul Rotter – The eurex flipper

Paul Rotter, known as the "Eurex Flipper," became a prominent figure in trading by leveraging a unique approach to market behavior and order flow. His technique, called "flipping," involved placing large buy or sell orders to influence other traders' decisions. Once these orders attracted attention, Rotter would often cancel or reverse his position to capitalize on the short-term market shifts his actions generated. This approach relied heavily on market psychology and allowed Rotter to take advantage of brief price movements, bringing in annual profits estimated between $65 and $78 million during his peak years.

Starting his career on the bond desk of a German bank, Rotter transitioned to proprietary trading and quickly achieved significant success. At Greenhouse Capital, a firm he helped establish, Rotter and his partners multiplied their initial funds within a few months. His style involved frequent trades — up to 100 per day — and he was known for his discipline, scaling back when trades didn’t go his way. Rotter emphasized risk management, adapting his strategy to daily conditions, and even stepping away during adverse situations. His influence on trading led to such high market activity that Eurex adjusted its tick sizes, a change believed to address the impact of his techniques on the market.

Mark Spitznagel – Founder of Universa Investments

Mark Spitznagel, founder of Universa Investments, is recognized for his unique approach to hedging against rare and severe market declines, known as "tail-risk" events. This strategy seeks to offset potential losses in regular investments by positioning for significant gains during downturns. Universa’s strategies were notably successful in the 2008 financial crisis and the 2020 market crash, generating returns reported in the thousands of percent. Spitznagel achieves this by using options placed far out-of-the-money, which act as a form of insurance. These options yield substantial returns in volatile periods, protecting portfolios from heavy losses while maintaining a steady position during calmer market times.

Recently, Spitznagel has raised concerns over what he describes as an unprecedented credit bubble, driven by high federal debt and rising market optimism. He has warned that the ongoing market surge, influenced by Federal Reserve policies and global economic stimulus, is unlikely to continue without interruption. Rather than relying on short-term gains, Spitznagel advises building resilience with a focus on long-term security, avoiding attempts to time market movements. His book, The Dao of Capital, outlines this philosophy, promoting a patient, disciplined approach that values defensive strategies. He emphasizes that preparing for downturns, rather than predicting them, is key to navigating unpredictable market cycles.

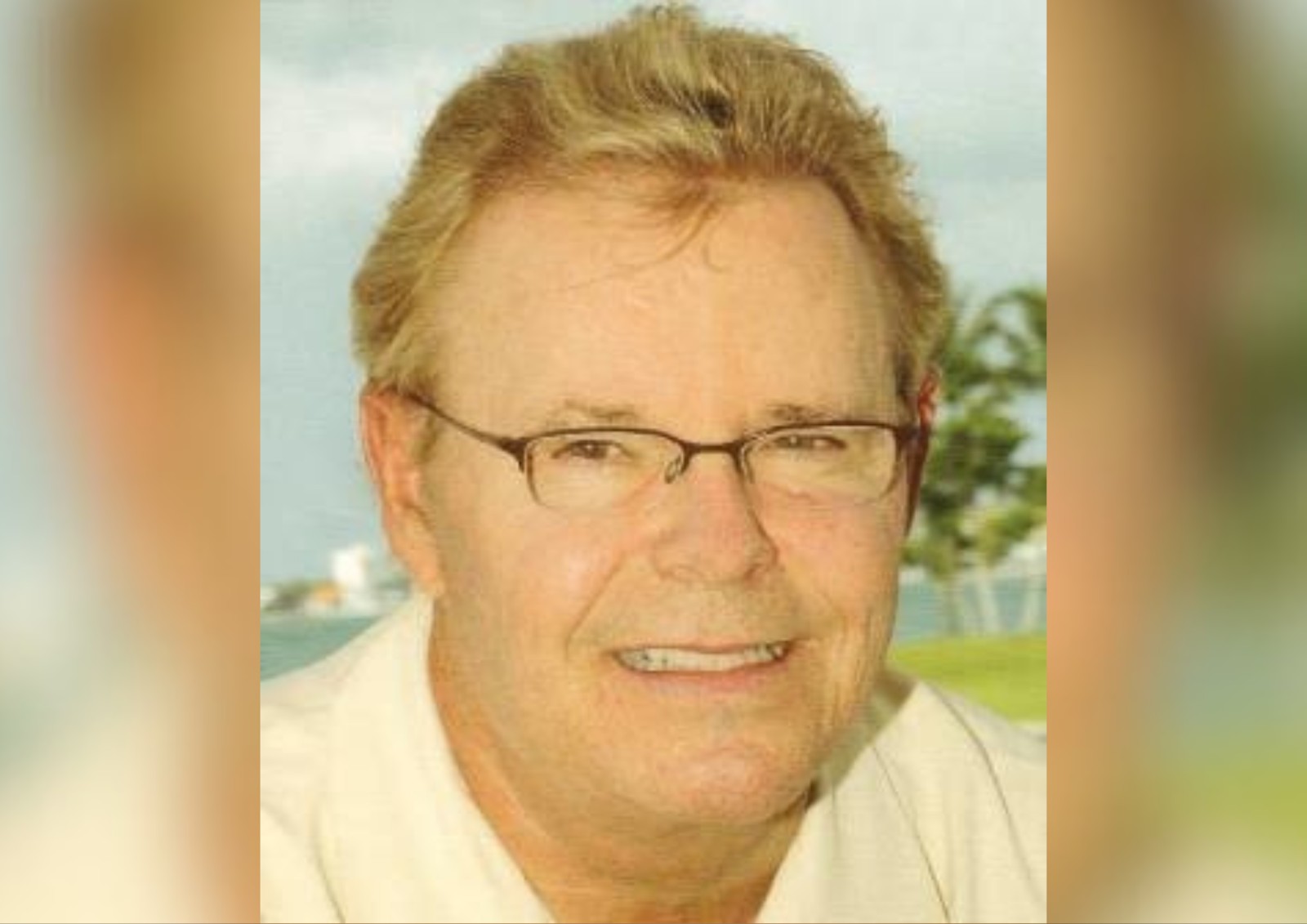

Dan Zanger – Record-breaking trader

Dan Zanger, founder of ChartPattern.com , made trading history by turning $10 775 into over $18 million in under two years during the 1990s dot-com boom. His approach focused on identifying high-momentum stocks and acting during breakout points, using chart patterns like cup-and-handle and high-tight flags. By buying high-growth stocks as they broke out and tracking volume spikes, he capitalized on the intense market activity of the time, achieving a record-breaking 29 000% return on his portfolio.

Starting as a pool contractor, Zanger’s dedication to chart analysis and his willingness to commit significant capital to a few select stocks at a time were central to his success. He now shares his knowledge on ChartPattern.com, where subscribers can access his stock picks, charting strategies, and insights through newsletters. Despite some losses after the dot-com bubble burst, Zanger’s disciplined approach to risk and focus on technical setups has made him a respected figure in trading. His story shows the impact of commitment to understanding market behavior and pattern-based strategies.

Key tips from success stories in prop trading

The following key takeaways from these success stories can help traders of all levels apply successful strategies in their own journeys:

The importance of discipline and patience

Traders like Paladin learned the hard way that emotional decisions often lead to failure. Discipline in following a well-defined strategy is a common trait among successful traders.Leveraging capital to maximize opportunities

Prop traders often make use of the firm’s funding and scaling options to expand their trading scope. The ability to balance the risks and rewards of leveraging firm capital is essential, as it enables traders to grow their accounts without overextending themselves. This approach lets traders capitalize on market opportunities while maintaining manageable risk levels.Continuous learning and adaptation

Whether it’s learning from failures or refining a strategy, all successful traders continuously seek knowledge and evolve their approach. Many of these traders make use of firm resources like mentorship programs and webinars.The role of community and collaboration

Prop trading doesn’t need to be a solo endeavor. Many firms provide collaborative settings where traders can exchange insights, share strategies, and support one another. Having access to mentorship and a peer network can be invaluable for refining trading approaches and overcoming challenges as they arise.

The best prop trading firms offer a combination of competitive funding, educational resources, and strong support networks. These firms help traders not only access capital but also improve their skills and strategies.

| Funding Up To, $ | Profit split up to, % | Min Trade Days | Trading period | Max. Leverage | Open account | |

|---|---|---|---|---|---|---|

| 4 000 000 | 95 | 2 | Unlimited | 1:100 | Open an account Your capital is at risk.

|

|

| 200 000 | 90 | No time limits | Unlimited | 1:30 | Open an account Your capital is at risk.

|

|

| 2 500 000 | 90 | 3 | Unlimited | 1:100 | Open an account Your capital is at risk.

|

|

| 2 000 000 | 95 | 3 | Unlimited | 1:100 | Open an account Your capital is at risk.

|

|

| 400 000 | 80 | 10 | Unlimited | 1:30 | Open an account Your capital is at risk. |

What can I learn from success stories in prop trading?

Success in prop trading involves more than just mastering technical analysis or trading strategies. Here are key lessons:

Risk management is critical

Almost every successful trader emphasizes managing risk as the foundation for long-term profitability. Risking no more than 1-2% of your account per trade is common advice, as seen in stories like Paladin’s.How mentorship shapes success

Many successful traders attribute their progress to mentorship. Learning from experienced traders can dramatically shorten the learning curve, providing insights that help newcomers avoid common pitfalls. Mentorship offers practical, real-world advice that can significantly refine a trader’s strategy and approach.Setting realistic goals

Successful traders often start small, focusing on steady, consistent gains rather than aiming for immediate large profits. By setting achievable goals, traders build a strong foundation, minimizing the risk of overtrading or taking on excessive leverage.

Risk management and adaptability

As someone who has spent years observing and analyzing prop trading, the success stories that stand out the most are those rooted in discipline and strategic thinking. For beginners learning from prop trading success stories, it's crucial to manage risk in ways that fit your style and pace. Successful prop traders often start by setting strict guidelines for themselves, especially around how much they're willing to lose on any trade. Since many prop firms have strict rules on losses, adapting to these limits early on can make trading smoother. Developing steady habits — like sticking to stop-loss limits and avoiding overtrading — helps traders keep a clear head when markets get unpredictable. Practicing on a demo account that mirrors real trading rules can also be incredibly helpful for testing how well your approach holds up without taking on real risk.

Another key takeaway is to keep your strategies fresh and flexible. Markets don’t stay the same, so even the best traders regularly revisit their techniques, updating them based on new trends or recent results. Some traders explore new methods over time, like using statistical patterns or unique strategies, to keep up with shifting conditions. Many traders also emphasize the benefits of connecting with others — whether it’s through forums, learning from peers, or working with mentors — to get new ideas and gain support when things get tough.

Conclusion

Building your own success story in prop trading starts with realistic expectations, discipline, and a commitment to continuous improvement. The stories highlighted here show that it’s possible to achieve financial independence and even career advancement through prop trading. But it requires persistence, learning from mistakes, and managing risks effectively.

Ready to start your journey? Begin by researching the best prop trading firms, setting up a demo account, and developing a strong, disciplined trading strategy. Success may not come overnight, but with the right approach, you can carve your own path to prop trading success.

FAQs

How much money can you make in prop trading?

Prop trading profits vary significantly depending on the firm, the trader’s skills, and market conditions. Many successful traders have scaled their accounts to manage six-figure or even seven-figure capital. However, it's important to note that losses are also part of the journey, and success is determined by risk management and consistency.

How do prop firms evaluate traders?

Most prop firms use an evaluation process where traders are given demo accounts to showcase their skills. They are assessed based on profitability, risk management, and adherence to the firm’s trading rules. Passing this phase often leads to access to live accounts and more capital.

Is mentorship important in prop trading?

Yes, mentorship can be crucial. As seen in success stories like Sarah Johnson’s, mentorship helps traders refine their strategies, learn market behavior, and avoid common pitfalls. Many prop firms offer educational resources and mentorship programs as part of their support system.

What is the biggest mistake new traders make in prop trading?

One of the biggest mistakes is emotional trading — letting emotions like fear or greed drive decisions. As Paladin’s story illustrates, trading based on emotion rather than strategy can lead to significant losses. New traders must learn to detach emotionally from trades and follow a disciplined approach.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Proprietary trading (prop trading) is a financial trading strategy where a financial firm or institution uses its own capital to trade in various financial markets, such as stocks, bonds, commodities, or derivatives, with the aim of generating profits for the company itself. Prop traders typically do not trade on behalf of clients but instead trade with the firm's money, taking on the associated risks and rewards.

Insider trading is the illegal practice of buying or selling a company's securities (such as stocks or bonds) based on non-public, material, and confidential information about the company. This information is typically known only to insiders, such as company executives, employees, or individuals with close connections to the company, and it gives them an unfair advantage in the financial markets.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.