Crypto Day Trading: Halal Or Haram Under Islamic Law

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The permissibility of crypto day trading in Islam is still being thoughtfully discussed by scholars. Some believe it can be halal when done through spot trading where assets are transferred immediately and no interest-based elements or extreme speculation are involved. Others argue it may be haram due to the uncertainty (gharar) and gambling-like nature (maysir) of highly volatile markets. For this reason, Muslim traders should speak to trusted Islamic finance advisors to ensure their approach aligns with Shariah teachings.

Cryptocurrency day trading continues to attract many Muslim participants. Yet, a key question is whether day trading in crypto is halal in Islamic finance. While spot trading, with its immediate ownership transfer, might be permissible in specific cases, short-term speculation and unpredictable price movements raise serious concerns. These characteristics often resemble gambling (maysir) and ambiguity (gharar), both of which are prohibited. This article explores the opinions of Islamic scholars and financial bodies regarding the halal status of such trades and highlights how traders can ensure their practices remain within the bounds of Shariah law.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Is crypto day trading halal?

Let’s directly answer the question: Is crypto day trading halal? Well, crypto trading refers to the practice of buying and selling digital assets within the same trading day to profit from short-term price movements. Under Islamic law, the permissibility of such trading depends on specific conditions being met. To get more clarity on day trading in general, read our full guide on Is Day Trading Halal or Haram?

Definition of crypto day trading and Its characteristics

Crypto trading involves executing trades within a single day, capitalizing on rapid price fluctuations. This type of trading requires careful assessment under Sharia law, given its specific operational features.

Spot trading with immediate transfer of ownership. Transactions must occur in spot markets where ownership shifts instantly once payment is made. This aligns with Islamic finance rules for timely asset exchange.

Absence of margin lending and interest (Riba). Using borrowed funds that involve interest is not allowed. All trading activity should be funded through personal capital. Maintaining this condition is essential for keeping day trading in crypto a halal practice.

Positions of religious scholars and organizations

IslamQA explains that the permissibility of crypto day trading depends on the specifics of each transaction, especially the requirement of immediate ownership transfer and avoidance of speculative practices.

Halal Times warns that short-term trading based on speculation could breach Islamic ethics, as it involves gambling (maysir) and high uncertainty (gharar). They recommend prioritizing long-term investments that stay within Sharia boundaries.

The need for individual assessment of each transaction

Every crypto day trade must be judged individually to determine if it aligns with Islamic values. Traders should seek guidance from certified Islamic scholars or advisors who understand financial markets to ensure religious compliance.

Day trading in crypto may be halal when conducted through spot trading that ensures immediate asset control and avoids borrowed capital. However, each situation must be reviewed carefully to confirm adherence to Sharia rules.

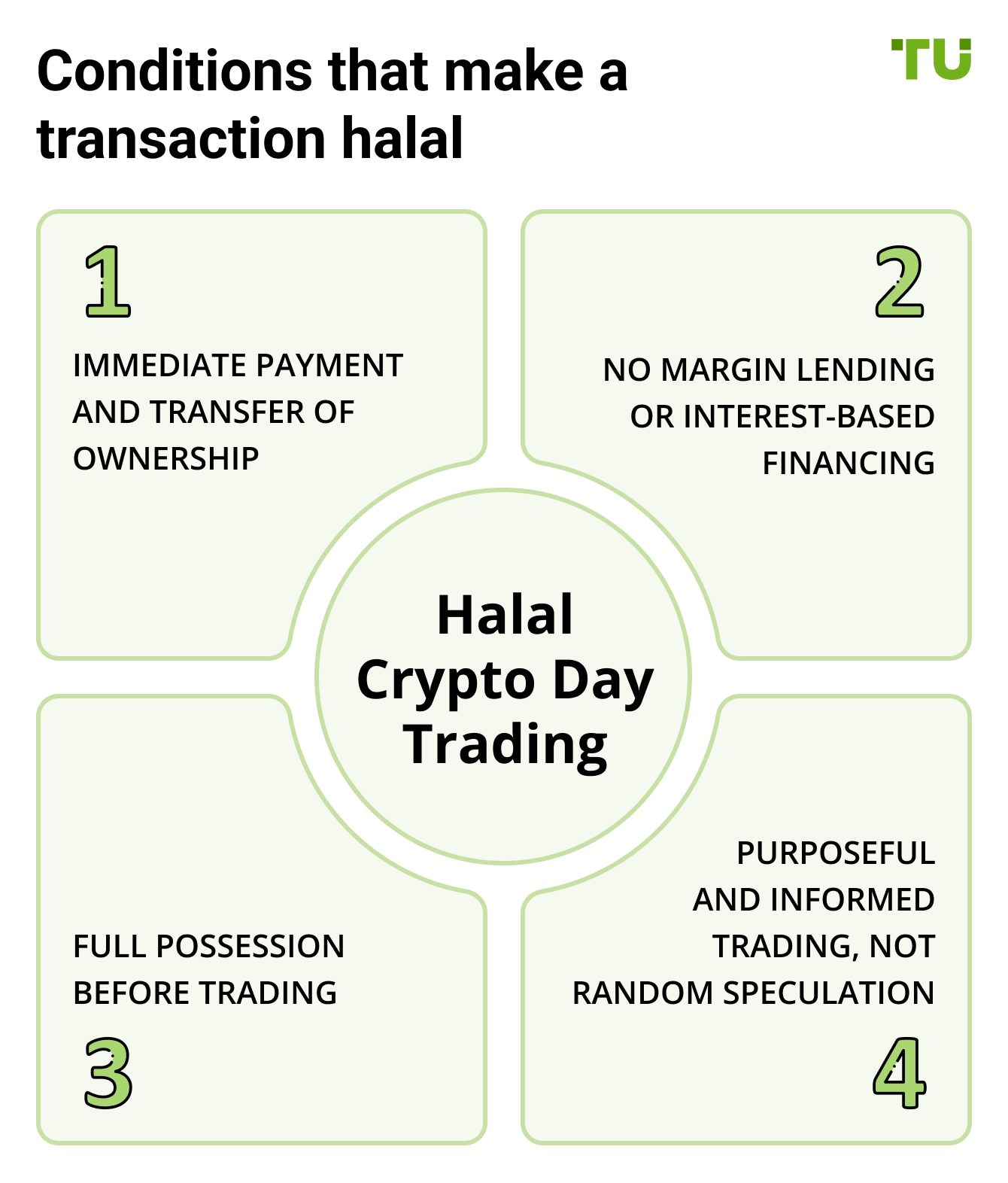

Is day trading crypto halal? Key conditions

We already answered the question of whether day trading crypto is halal, but what are the specific conditions that must be met for such trading to comply with Sharia principles? Note them below:

Conditions for halal crypto day trading

Understanding the true conditions for halal crypto day trading requires more than just avoiding haram tokens. Here’s what most beginners completely miss.

Use actual ownership, not leverage. Shariah doesn’t allow you to sell what you don’t own. Many day traders unknowingly use margin or leverage, which nullifies ownership. Always use spot trading where you fully own the asset.

Verify token utility, not just its label. A token being "listed as halal" isn’t enough. Analyze the actual utility of the token, if it's used in gambling, lending with interest, or NFT speculation, it's problematic. Even meme coins are debatable. You can refer to our list of halal cryptocurrencies to be double sure.

Respect settlement time. In crypto day trading, timing matters. Instant flipping without asset transfer or ownership registration can invalidate the transaction from an Islamic point of view.

Avoid algorithmic trades without intent. Shariah emphasizes conscious transactions. Using bots to execute trades without your knowledge or presence turns it into a form of gambling.

Do your own purification. Even if a platform screens tokens, you should personally calculate how much income needs to be purified based on network activity and transaction sources. Know more through our guide on Zakat on crypto.

Watch the project’s roadmap. Some tokens start halal but shift toward haram models like interest-based staking or DeFi lending. Constantly monitor what the token is backing.

Stay away from market manipulation zones. Many tokens are manipulated by insiders, and engaging with pump-and-dump schemes makes your trade ethically questionable, even if technically compliant.

Understand the scholars behind fatwas. Don’t blindly follow fatwa aggregators. Study how scholars have explained their stance and whether they’ve accounted for intent, risk, and market structure.

If you’re also interested in knowing whether crypto mining is allowed as per Islamic finance, read our guide on Is Crypto Mining Halal or Haram?

Views of traders following Islamic principles

CryptoUmmah explains that day trading in crypto is halal when traders steer clear of investments tied to prohibited sectors and maintain ethical conduct. This includes avoiding margin-based trades, betting-like strategies, and speculative habits that involve excessive risk.

Our experts note that it is important to consider crypto day trading as halal mostly when transactions are made in the spot market without using leverage or earning interest. They underline that the trade should involve real asset ownership and clearly defined, fair terms of exchange.

For those exploring Islamic finance in the digital world, it is important to understand whether liquidity mining is halal or haram and whether blockchain technology itself is considered permissible in Islam. Another unique topic is yield farming, which you can understand through the lens of Islamic finance in our article Is Yield Farming Halal or Haram?

Additional practices for halal trading

When beginners ask about halal trading, they often overlook the deeper habits and checks that define spiritually sound trades.

Use a delayed confirmation strategy. Don’t jump into trades without pausing to think. Set a 5-minute timer before confirming a buy or sell. It helps you trade more consciously, as Islam encourages.

Review company debt levels before every trade. Even if a company is marked halal, its debt levels can shift quickly. Quickly check current data using apps or halal stock trackers to stay updated.

Avoid derivative-heavy assets. Some crypto tokens and Forex trades are tied to complex futures. If you can’t figure out what you're really buying, skip it to stay clear.

Do a weekly earnings purification. If you’re into short-term trades, give a small part of your profits to charity regularly. It builds discipline and sincerity into your practice.

Use ethical alerts, not just price alerts. Set notifications for shady news like layoffs or lawsuits connected to your watchlist. Avoid businesses that seem halal but act shady.

Limit overnight holds in volatile assets. In crypto, news hits fast. If you can’t manage trades while offline, it’s safer to close positions. This is especially important when asking “is day trading in crypto halal?”

Trade with niyyah (intention) and dua. Start each session with a prayer to stay humble and avoid greed. It reminds you that your purpose is more than just money.

If you’re willing to trade crypto, or other financial assets such as stocks or Forex, we recommend you to do so using a broker that offers Islamic accounts. These accounts allow you to trade without compromising on your religious beliefs. In the table below, we have listed the top brokers that offer Islamic accounts for you to compare and choose from:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | No | 70 | 10 | No | 1.97 | Open an account Your capital is at risk.

|

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Is day trading crypto haram?

Several key factors contribute to the classification of such practices as impermissible under Sharia law.

Elements of gambling (maysir) and uncertainty (gharar)

Crypto day trading often involves high volatility and speculative actions that mirror gambling (maysir) and excessive uncertainty (gharar). These characteristics directly conflict with Islamic financial principles, which emphasize clarity, fairness, and predictability in transactions.

Speculative nature of transactions without real economic value

Short-term trades aimed purely at capitalizing on price movements may be seen as speculative behavior lacking contribution to the real economy. This mindset opposes the Islamic financial framework, which supports ethical and productivity-driven financial engagement.

Risk of violating the principle of asset ownership before sale

Islamic law requires a trader to have full ownership of an asset before selling it. In crypto day trading, especially with the use of leverage or derivatives, this condition is often not met, making such practices non-compliant with Sharia’s emphasis on legitimate ownership.

Positions of Islamic scholars

Many scholars maintain that crypto day trading is not aligned with Sharia principles due to its speculative tendencies and the frequent absence of asset possession. These factors, they argue, can produce unethical consequences and undermine core Islamic financial values.

“Is day trading in crypto haram?” is a question that continues to spark debate due to concerns over gambling, ambiguity, and lack of real ownership. Muslim traders should critically evaluate their strategies and seek guidance from experts in Islamic finance to ensure their activities remain within the bounds of Sharia.

Views of religious scholars, researchers, and Islamic financial organizations

This issue has led to differing opinions among Islamic scholars and financial organizations. Below are perspectives from recognized authorities in Islamic law and finance.

Mufti Taqi Usmani: criticism of the speculative nature of cryptocurrencies

Mufti Taqi Usmani, a leading expert in Islamic finance, expresses concerns about the speculative characteristics of cryptocurrencies. He notes that treating currencies as commodities for profit contradicts the philosophy of Islamic economics. According to him, cryptocurrencies lack real intrinsic value and are predominantly used for speculation and illicit activities.

Sheikh Haitham al-Haddad: prohibition of short-term speculation

Sheikh Haitham al-Haddad argues that cryptocurrencies lack real value and are not backed by tangible assets. He asserts that due to their speculative nature and high volatility, cryptocurrencies do not meet Sharia requirements and are considered haram.

Islamic Finance Guru: trading without speculation

Islamic Finance Guru (IFG) emphasizes that crypto trading may be permissible if conducted without speculative elements. IFG recommends avoiding leveraged trading and derivatives, advising instead to invest in projects that provide real economic value.

Opinions from Islamic scholars and financial organizations regarding day trading crypto being halal vary. Some view it as impermissible due to its speculative aspects and lack of inherent value, while others permit it under strict conditions that align trading practices with Sharia principles.

Trading coins without ownership and intention makes it haram

A lot of newbies think that just avoiding leverage keeps crypto trading halal. But here’s the tricky part nobody talks about. If you’re constantly jumping in and out of trades, chasing quick wins without knowing anything about the coin’s actual purpose, that’s not real investing, it’s just guessing. Islam doesn’t support trading, that's all noise and no substance. Start with intention. Don’t just trade charts, trade projects you’ve read about, understood, and believe have some genuine use. When you treat trading like backing a meaningful idea, your intention shifts from gambling to growth.

Here’s another angle that gets overlooked. If you’re using a big exchange and your coins never leave their wallet, it might seem normal, but it creates a problem in Shariah. If you don’t hold the coin in your own wallet, some scholars say you’re not the actual owner. And Islam says you can’t sell what you don’t own. Even if it’s just for a short scalp, this small step makes a big difference. If possible, use platforms that let you control your wallet or at least move the coin into your own wallet before trading. It’s one extra step, but it can mean the difference between haram and halal.

Conclusion

Assessing the permissibility of crypto day trading requires a strict evaluation of each transaction's conditions. Spot trading with immediate transfer of ownership and avoidance of margin-based financing aligns with Sharia requirements. The presence of speculative elements, lack of real asset ownership, and high uncertainty render such operations haram. Islamic scholars emphasize the need for a cautious approach when selecting trading strategies. Consulting qualified Islamic finance experts before engaging in trading activities is recommended. Adhering to Sharia principles helps minimize both religious and financial risks in cryptocurrency markets.

FAQs

Is intraday crypto trading permissible if the assets are fully backed by physical commodities?

Yes, if the cryptocurrency is backed by a physical commodity (such as gold) and immediate transfer of ownership occurs, such trading may be considered halal if all other Sharia conditions are met.

Is it allowed to use automated trading algorithms for crypto day trading?

Automated trading is permissible if the algorithms execute trades that comply with Sharia rules: real asset ownership, no leverage, and avoidance of speculative strategies.

Which types of cryptocurrencies better align with halal trading principles?

Cryptocurrencies linked to real-world projects with transparent, lawful economic activities are more aligned with the requirements of halal trading.

What should a trader do if a transaction unintentionally violates Sharia conditions?

In case of an error, it is recommended to close the position without further action and strictly adhere to verified Sharia guidelines in future trades to prevent repetition.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.