DAO Maker Launchpad: How It Works & How To Join

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

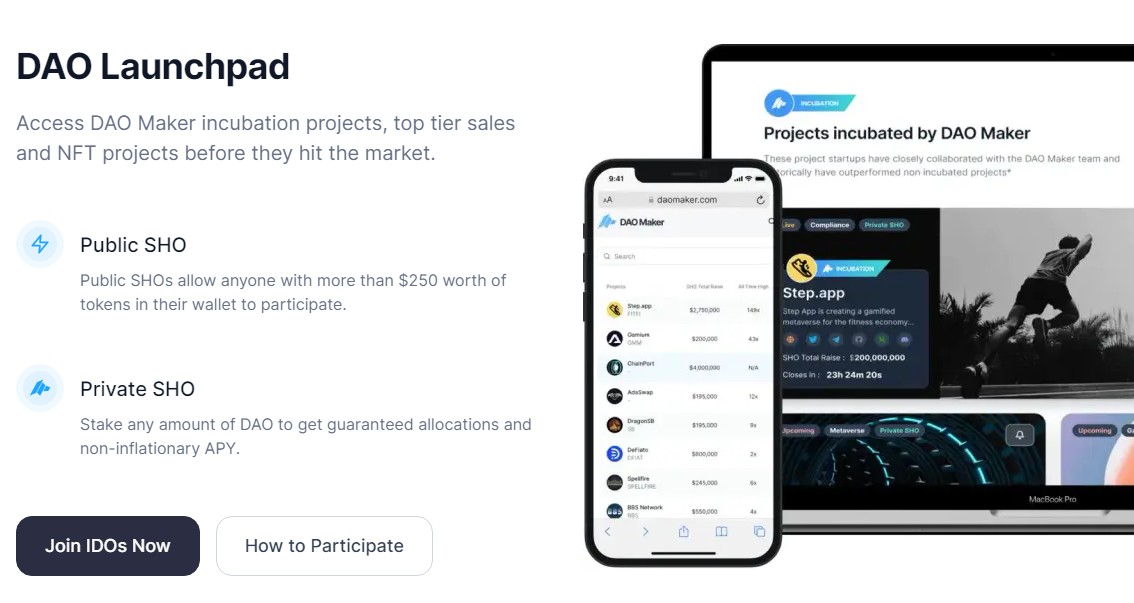

DAO Maker Launchpad is a platform that enables investors to participate in early-stage token sales of vetted blockchain projects. To join, users need to create an account on the DAO Maker website, complete KYC verification, and connect a compatible cryptocurrency wallet. Participating in token sales often requires staking DAO tokens to gain DAO Power, which determines allocation eligibility.

DAO Maker Launchpad is a platform designed to launch and finance blockchain startups with the involvement of retail and institutional investors. It provides projects with access to decentralized financing, and investors with the opportunity to participate early in promising crypto assets. We have reviewed the key principles of DAO Maker Launchpad, the rules of participation and the investment process. The article discusses how to access the platform and what requirements must be met. In addition, an overview of successful projects and recommendations for launching your own crypto project through DAO Maker are provided.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

What is DAO Maker Launchpad

DAO Maker Launchpad is a platform that helps blockchain startups raise funds while providing investors with access to early-stage projects. Established in 2019, it has introduced innovative investment models that enhance security, reduce risks, and create long-term growth opportunities.

Core objectives and fundraising models

The main goal of DAO Maker is to make fundraising more efficient for blockchain projects while ensuring investors have mechanisms to protect their capital. Unlike traditional crowdfunding platforms, DAO Maker offers specialized fundraising models.

Strong Holder Offering (SHO). This model selects investors based on their activity and engagement in the crypto ecosystem. It ensures that projects attract dedicated supporters instead of short-term speculators, leading to more sustainable growth.

Dynamic Coin Offering (DYCO). This model allows investors to reclaim their funds if the project does not meet expectations. By offering refunds under specific conditions, it minimizes financial risk and increases investor confidence.

Support for startups and investors

DAO Maker provides extensive support for both startups and investors, ensuring a structured and secure investment environment.

For startups. The platform connects projects with retail investors, simplifying the fundraising process. It also provides marketing assistance, strategic planning, and incubation services to help projects scale effectively.

For investors. DAO Maker vets projects through strict due diligence processes. Transparent participation conditions and protective mechanisms like DYCO allow investors to reduce risk and gain access to projects with strong fundamentals.

Advantages of using DAO Maker Launchpad

Several factors make DAO Maker a preferred launchpad for blockchain projects and investors.

High transparency and security. The platform enforces rigorous project verification, ensuring only credible ventures receive funding. This reduces the chances of scams or failed projects.

Flexible investment options. The availability of different models like SHO and DYCO provides capital protection. This approach makes investing in early-stage projects more secure while still allowing for high growth potential.

DAO Maker Launchpad combines investor security with innovative funding mechanisms, creating a balanced ecosystem where blockchain startups can grow while investors participate in promising opportunities with reduced risks.

How DAO Maker Launchpad works

DAO Maker Launchpad is a platform designed to help blockchain startups raise funds while giving investors access to early-stage projects. It provides structured support to ensure projects receive the necessary resources while offering investors mechanisms to minimize risks.

Project incubation and support

DAO Maker provides incubation services to blockchain startups, assisting them with community building, marketing, strategic planning, and technical development. This support helps projects establish a strong foundation and increases their chances of success.

Fundraising models

DAO Maker uses innovative fundraising models to align investor interests with project sustainability.

Strong Holder Offering (SHO). This model selects investors based on their engagement in the crypto ecosystem. It ensures that only dedicated investors participate, reducing the risk of early sell-offs.

DynamicCoin Offering (DYCO). This model allows investors to reclaim funds if the project fails to meet expectations. It offers greater financial security and increases investor confidence.

Investor participation

Investors must follow specific steps to engage with the DAO Maker Launchpad.

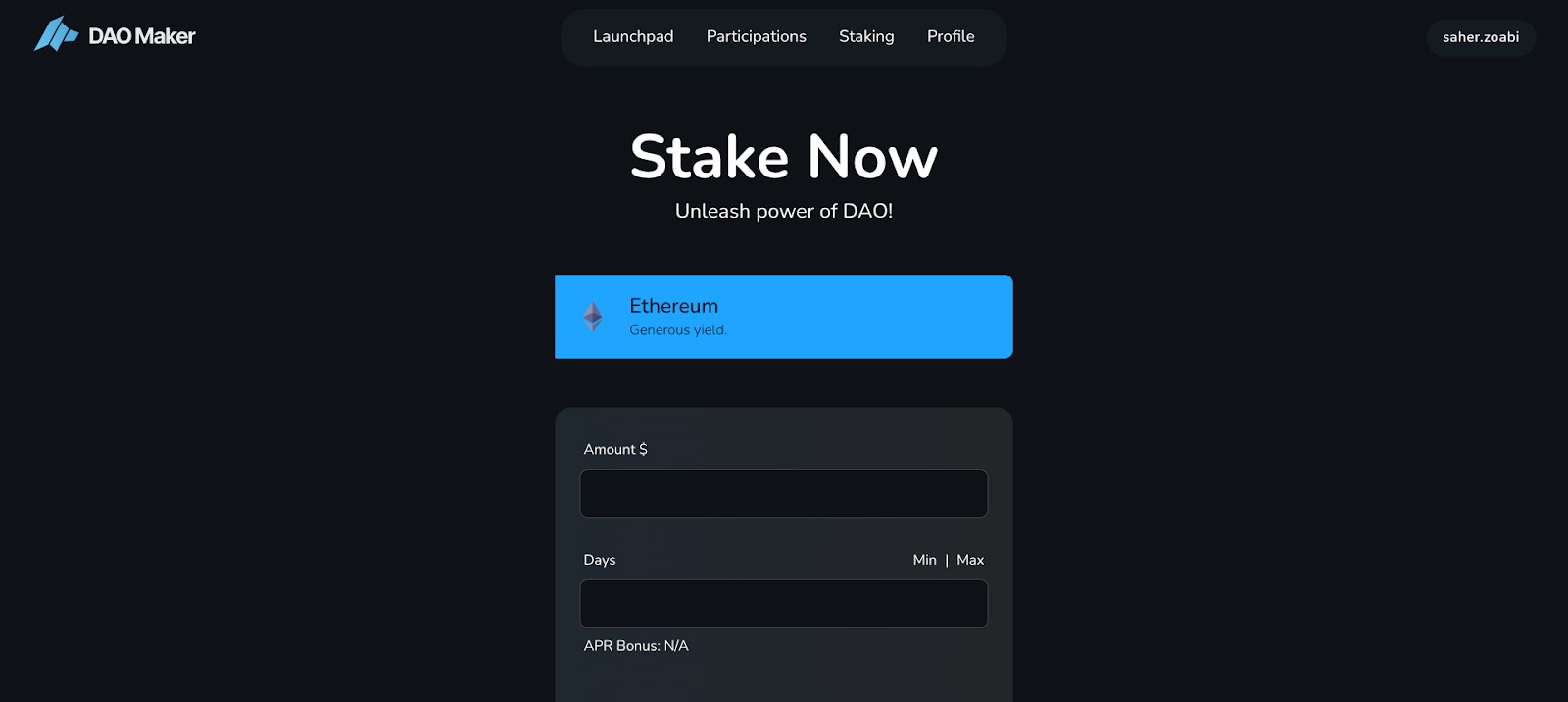

Staking DAO tokens. To participate in token sales, investors must stake a minimum of 500 DAO tokens. Each staked token grants DAO Power, which determines allocation in offerings.

Allocation process. Investors use their DAO Power to enter sales. Higher DAO Power increases the chances of securing an allocation in token offerings.

Security and compliance

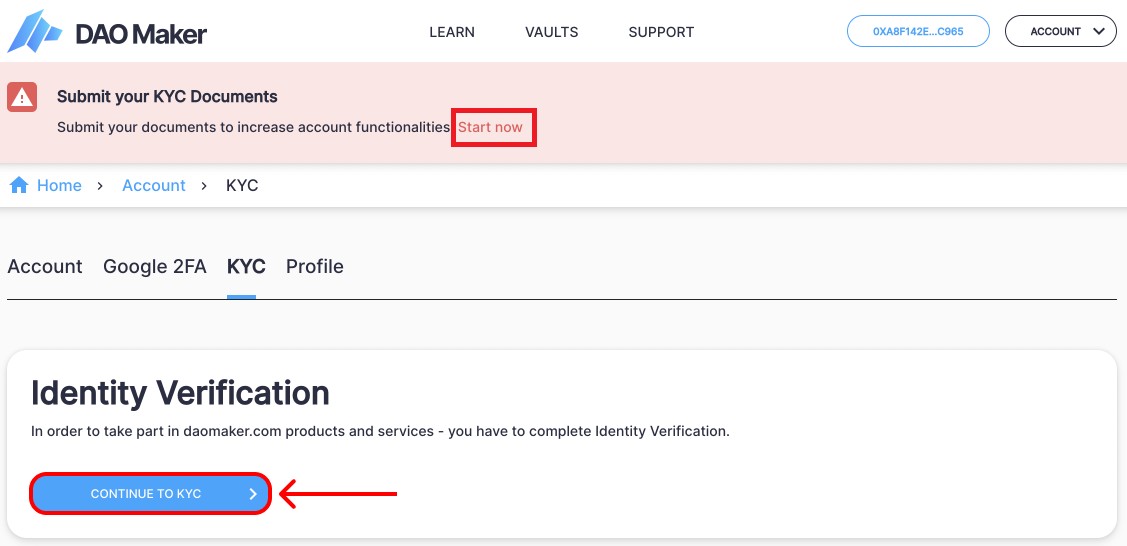

DAO Maker ensures security by requiring projects to undergo thorough due diligence. Startups must provide legal opinions and pass token audits before launching on the platform. Investors must also complete Know Your Customer (KYC) verification to participate in offerings.

By combining structured fundraising models, incubation support, and investor protection mechanisms, DAO Maker Launchpad provides a secure environment for both startups and investors in the blockchain space.

What is Strong Holder Offering (SHO) and how does it work?

SHO is an investment model designed for long-term token holders. The selection process is algorithm-based and considers investors’ blockchain activity, transaction history, and engagement with other projects.

Key features of SHO:

Priority for long-term holders – investors with a strong engagement history get preference.

Transparent and algorithmic selection – participants are chosen based on on-chain data rather than random draws.

Guaranteed allocation – selected investors can invest a predefined amount at an early-stage price.

This approach reduces speculative trading and promotes sustainable project development post-launch.

Role of the DAO token in the ecosystem

The DAO token plays multiple roles in DAO Maker Launchpad:

Access to investment opportunities – holding DAO tokens grants eligibility to participate in SHO and other funding rounds.

DAO Power and staking – investors earn DAO Power based on the amount and duration of their staked tokens.

Governance and voting – DAO token holders influence platform decisions and project selections.

Rewards and incentives – users benefit from lower fees, exclusive allocations, and higher investment limits.

How to join DAO Maker Launchpad

To access investment opportunities on DAO Maker Launchpad, users must complete several steps:

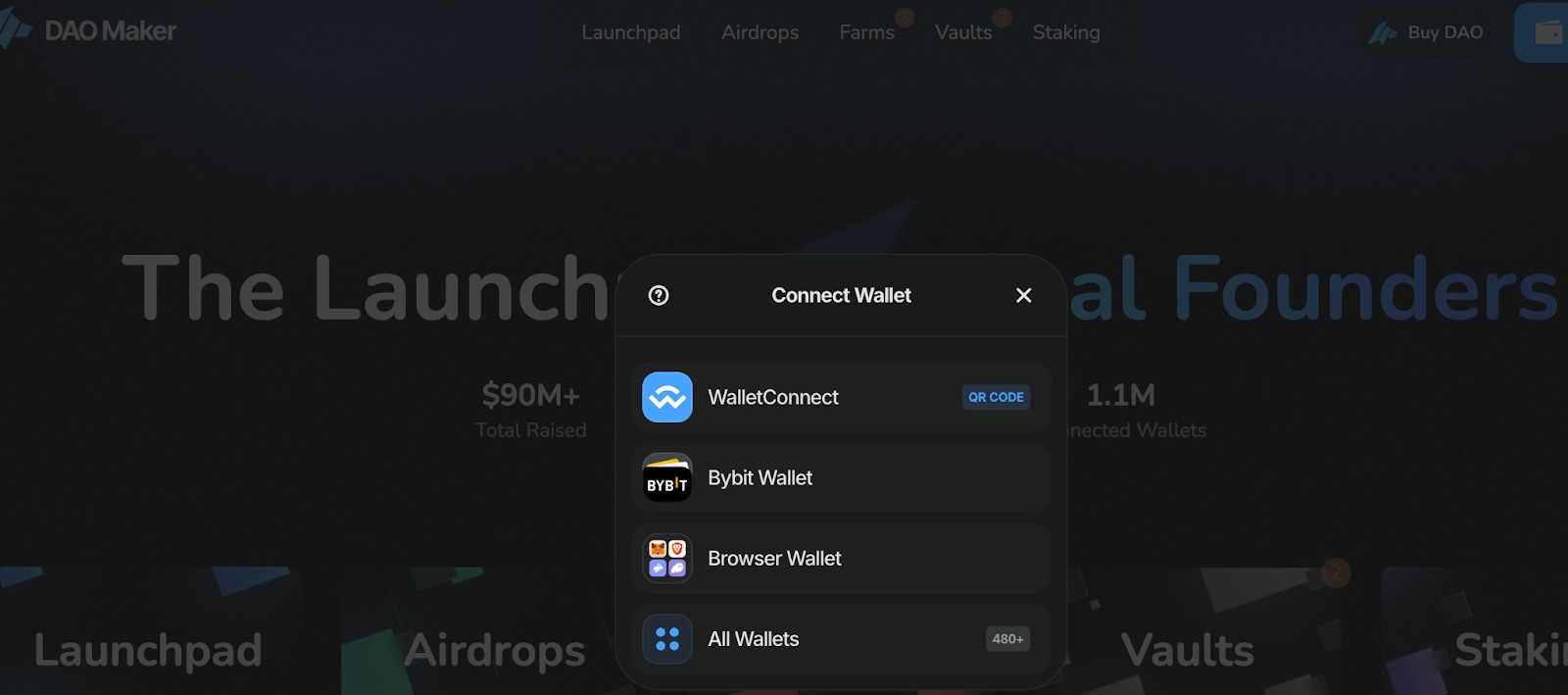

Create an account – register on the DAO Maker platform, link a crypto wallet (such as MetaMask), and complete authentication.

Complete KYC verification – identity verification is mandatory for participating in Strong Holder Offering (SHO) and other investment rounds. Users must upload identity documents.

Stake DAO tokens – investment access depends on the level of DAO Power, which is determined by the number of staked DAO tokens and the staking duration.

For private SHO participation, users must stake at least 250 DAO tokens. Public SHO requires a minimum of $500 in wallet assets.

How to access investment opportunities

Once all requirements are met, investors can participate in project funding. Access to specific projects is determined by DAO Power — higher levels increase the chances of receiving an allocation.

The platform offers two participation formats:

Strong Holder Offering (SHO). Investments are allocated among users with high DAO Power and active engagement in the ecosystem.

Dynamic Coin Offering (DYCO). A model allowing investors to reclaim part of their funds if the project underperforms.

Allocations are distributed either through a lottery system or based on the investor’s DAO Power ranking. Once approved, investors deposit funds and receive tokens upon project launch.

Potential risks and precautions

All crypto investments carry risks, including potential capital loss. DAO Maker Launchpad minimizes fraud risks by pre-selecting projects, but investors should consider several factors:

High volatility – token prices can fluctuate significantly after launch.

Limited liquidity – some projects impose temporary restrictions on token sales.

Regulatory risks – investment rules may vary across jurisdictions.

Before investing, study the project documentation and tokenomics terms, and assess your own risks.

Overview of the successful project on DAO Maker Launchpad

DAO Maker Launchpad has helped several blockchain startups secure funding and gain traction in the market. Some of these projects have gone on to establish a strong presence in the industry.

One successful project is Orion Protocol (ORN), which enables decentralized access to liquidity across multiple exchanges. It attracted significant investor interest and quickly built a solid market position.

DAO Maker Launchpad continues to support blockchain startups, helping them raise funds and develop innovative solutions in the industry.

Investment returns and risk analysis

The profitability of projects launched through DAO Maker Launchpad varies depending on market conditions and development strategies. The average return on investment (ROI) post-listing can reach 13x, with some projects experiencing growth up to 300x. Despite these potential gains, investments carry inherent risks.

Token prices can fluctuate significantly after listing due to market volatility, impacting profitability. Many projects implement a vesting mechanism, distributing tokens gradually to prevent immediate large-scale sales. Regulatory factors also play a role, as changes in legislation may affect the accessibility of certain assets.

Where to track new launches

Information about upcoming projects is regularly updated on the official DAO Maker website, announced through the platform’s social media channels, and covered by analytical resources. Major platforms like CoinLaunch and ChainBroker monitor DAO Maker’s activity, providing insights into new initiatives. These sources help investors assess project potential and make informed participation decisions.

DAO Maker success depends on more than ROI

Investors considering participation in DAO Maker Launchpad often underestimate the impact of tokenomics structure on long-term profitability. A common mistake is focusing solely on post-listing ROI without analyzing the vesting schedule and token unlock mechanisms. If a project has an extended unlocking period with low liquidity, investors may find themselves in a situation where the token price starts declining before they receive their full allocation. Before investing, it is essential to review the token distribution schedule and anticipate potential market movements.

Another frequent issue is misjudging DAO Power requirements. Many investors expect to secure an allocation without considering the competition in SHO rounds. The higher the number of participants and their DAO Power levels, the lower the chances of getting a slot. Before joining investment rounds, it is useful to analyze past launches, assess the average required DAO Power level, and make data-driven decisions rather than relying on expectations.

One more critical factor is evaluating the project team’s actual activity. While DAO Maker filters projects, long-term success depends on the team’s execution. Monitoring team communication, roadmap progress, and technical updates provides insights into the project’s credibility.

Conclusion

DAO Maker Launchpad is a platform for funding promising blockchain startups, providing investors with access to carefully selected projects. Investment opportunities depend on the level of DAO Power, which is formed on the basis of staking DAO tokens. New investors should carefully study the project documentation, consider the risks of market volatility and pay attention to vesting conditions.

FAQs

How can I determine if a project is worth investing in?

A strong project should have a clear business model, transparent tokenomics, and an engaged community. Researching the team, their past projects, and the roadmap is essential. If a project lacks a working prototype or promises unrealistic returns, it may be a red flag.

What should I do if a token drops in price after listing?

Price fluctuations are common in the market. Analyzing liquidity, team activity, and development progress can provide insights. If the project continues to meet its roadmap goals, a short-term correction could be an opportunity to average down.

How can I assess investor engagement in a project?

Monitoring social media, forums, and specialized platforms can help gauge audience interest. High token holder activity and ongoing discussions in the community may indicate strong long-term support for the project.

Are there ways to reduce investment risks?

Diversifying investments, analyzing vesting schedules, and choosing projects with high liquidity can help mitigate risks. Partial exit strategies, securing profits as the token price increases, can also be an effective risk management approach.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.