Commodity Currency Definition And Key Examples

A commodity currency is a currency whose price strongly correlates to the exporting of resources in the currency’s country, and the commodity’s price. Countries like Australia, Canada, and New Zealand rely on the export of various commodities, so their currencies the Australian dollar (AUD), New Zealand Dollar (NZD) and Canadian dollar (NZD) are classed as commodity currencies.

The Forex market contains so many currency pairs, it can be difficult to understand how they all operate and what distinguishes them from each other. Enter ‘commodity currencies’ which tend to perform in correlation with the price movements of various natural resources and goods.

In this article, Traders Union looks at the top commodity currencies in the world and explains how commodity currencies work. We’ll also explain the advantages and disadvantages of trading commodity currencies, so that readers will be better prepared for engaging in commodity currency trading and increase their chances of success.

What is a commodity currency?

To understand what a commodity currency is, we should first look at what each component of the term means.

What is a commodity?

Commodities are basic goods or natural resources that are used in commerce interchangeably with other commodities of the same type and are often used in the production of other goods or services. Traders and investors buy and sell commodities in spot markets or trade commodity derivatives like futures and options. Some of the most traded commodities are crude oil, natural gas, gold, silver and copper. For a deeper look at commodity trading, read Traders Union’s detailed article on how to make money on commodities.

What is a currency?

A currency is a standardization of money that is tied to any particular nation. Each country has its own currency that they use for the exchange of goods, though some groupings of countries might use the same currency, such as the E.U. and the Euro. When one currency is exchanged for another, to facilitate the exchange of good goods between countries, they form a currency pair. For example, if you trade U.S. dollars for euros, you have a currency pair called EUR/USD. Traders and investors trade different currency pairs in an attempt to make a profit on the movements of exchange rates. Read our Trades Union expert article for more information on currency pairs and how to trade them.

Commodity Currencies

Commodity currencies are defined as those whose value has a direct correlation with the price of particular commodities. Major countries which are dependent on the export of raw materials/resources are usually home to commodity currencies. For example, countries like Australia, Canada, and New Zealand rely on the export of various commodities, so their currencies the Australian dollar (AUD), New Zealand Dollar (NZD) and Canadian dollar (NZD) are classed as commodity currencies.

Let’s take a look at some of the most prominent commodity currencies.

Australian dollar (AUD)

Australia is a huge country rich in natural resources and is a major exporter of commodities such as iron ore, coal, gold and uranium. Because it is such a large producer and exporter of commodities, their prices directly impact the price of the Australian dollar (AUD).

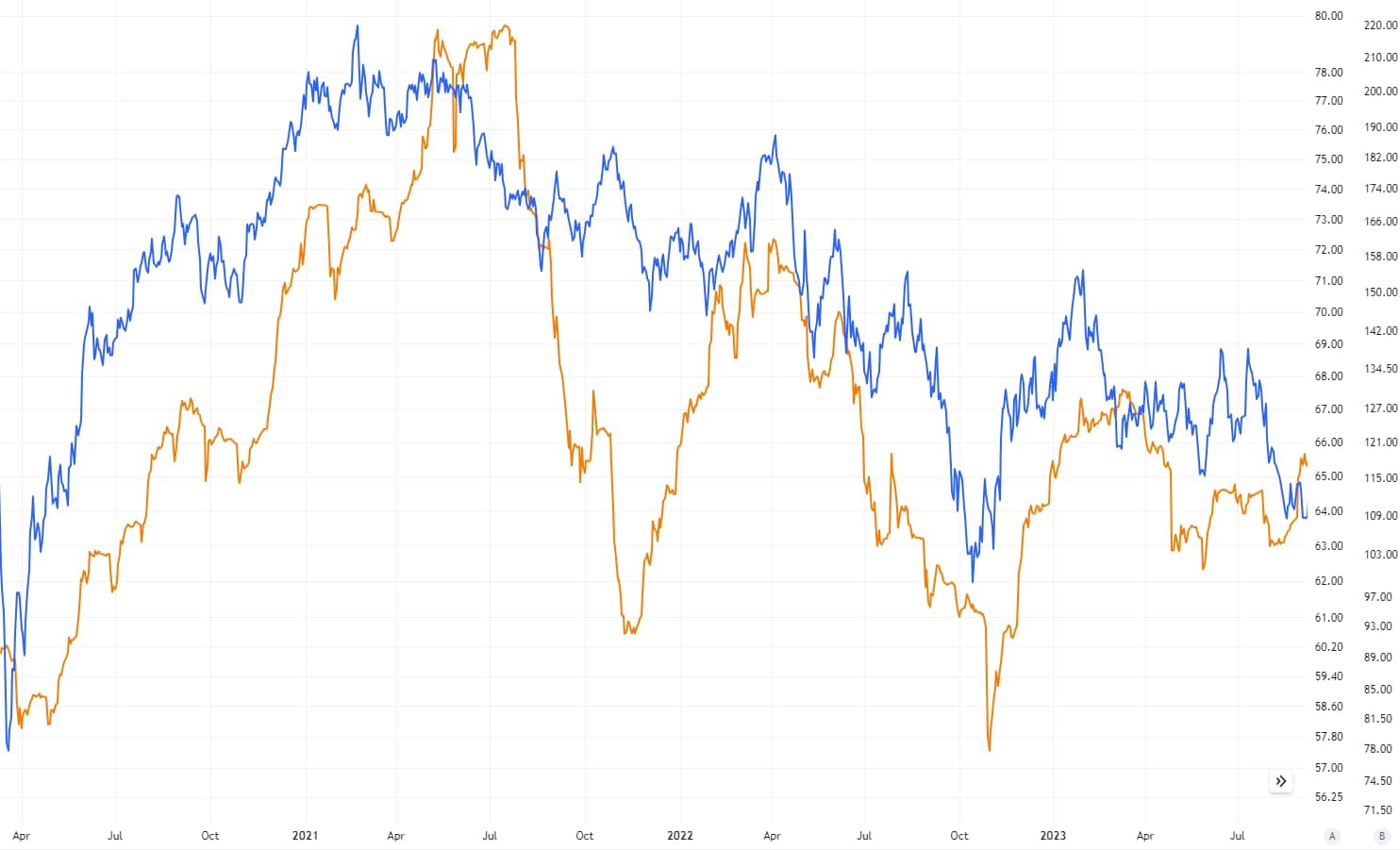

Australian Dollar Index (AXY, blue) and Iron Ore (Yellow) Price Correlation (Source: TradingView)

Australia has strong trade ties to the manufacturing powerhouse that is China, who accounts for over a third of their exports. When China’s economy is performing well, AUD also performs well. Likewise, when there is a dip in the Chinese economy, AUD is likely to depreciate since China’s demand for resources directly impacts Australia’s output.

The price of gold also tends to positively correlate with the value of AUD, so when the price of gold increases, the AUD/USD pair usually goes up in price too. See our up-to-date expert analytics on AUD/USD movements.

Canadian dollar (CAD)

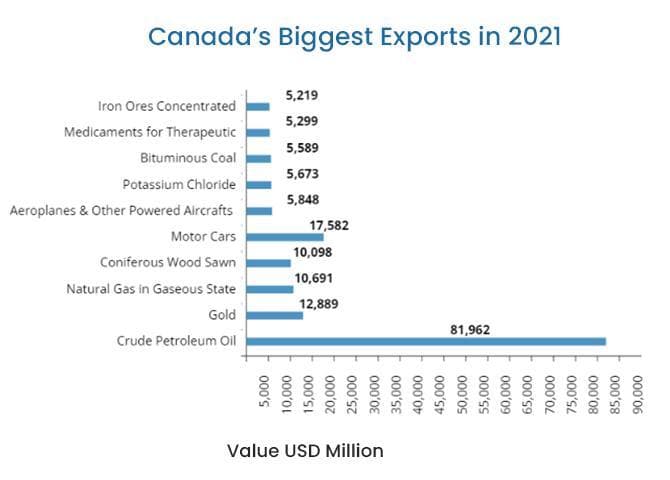

Canada is home to the world’s 9th largest economy and is the 9th largest exporter of commodities. Canada’s main products and exports are crude oil/petroleum, gold, natural gas, potassium chloride and coal, though the export and production of oil exceeds that of these other commodities by several orders of magnitude.

Canada’s Biggest exports in 2021 (Source: ExportGenius)

75% of Canadian overall exports end up in the U.S.A., so their economies are inextricably linked. Canada is the fifth largest producer of oil in the world, with over 4.5 billion barrels produced per day. It’s the world’s third largest oil exporter, and has the fourth largest oil reserves.

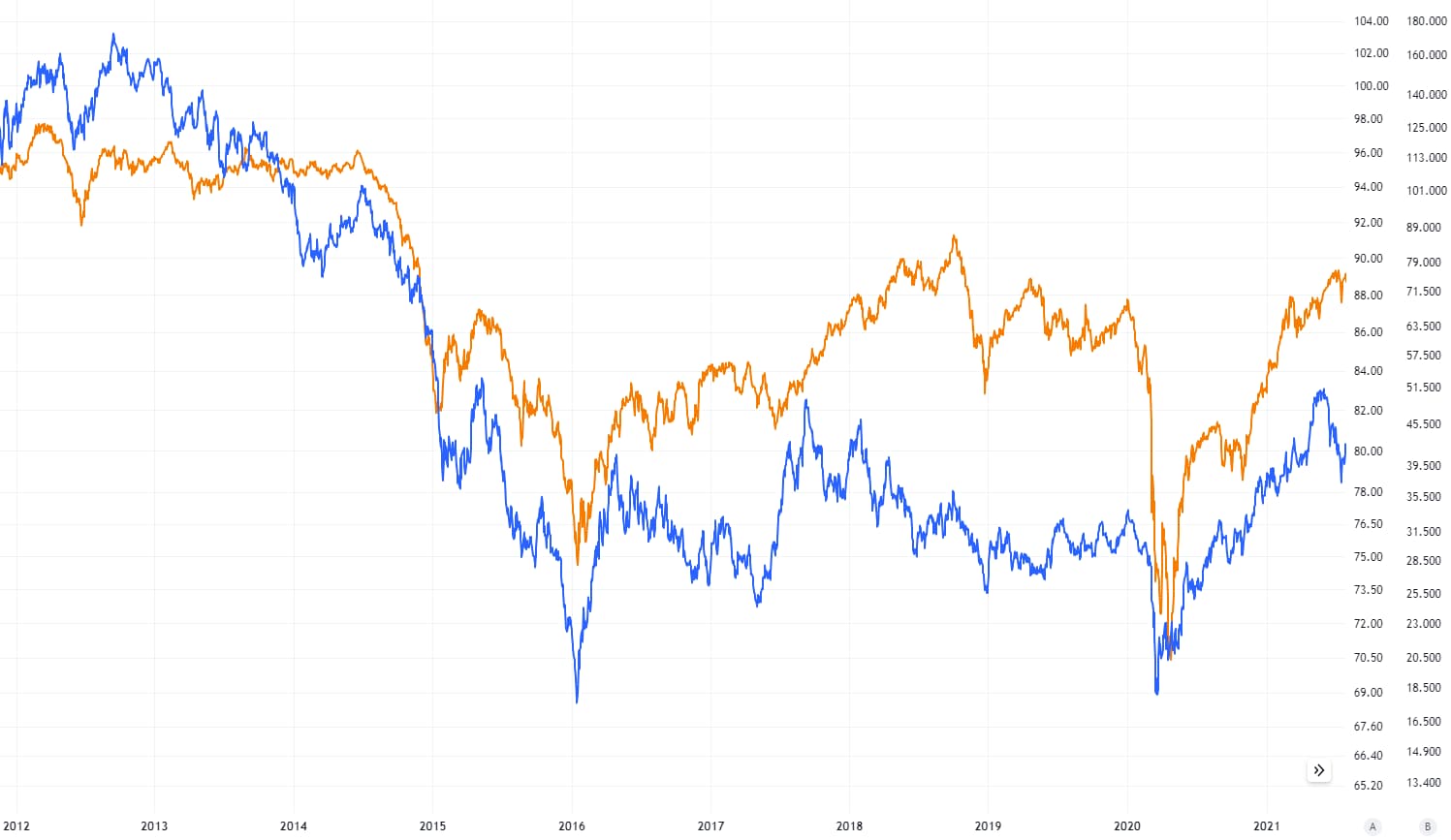

Canadian Dollar Index (CXY) and Oil Price (Yellow) Correlation (Source: TradingView)

The vast majority of Canada’s oil exports end up in the U.S.A, making the USD/CAD currency pair strongly correlate with commodity prices. As crude oil is Canada’s most significant contributor to foreign exchange, when oil prices rise, the Canadian dollar’s movements tend to positively correlate with those of oil prices.

New Zealand dollar (NZD)

New Zealand is a major exporter of dairy products, meat, logs and other wood products. Most of the small Oceanian country’s exports go to China (23%) and Australia (16%) though they also are a major exporter to the U.S.A. and E.U. The New Zealand dollar also has a strong connection to the price of gold.

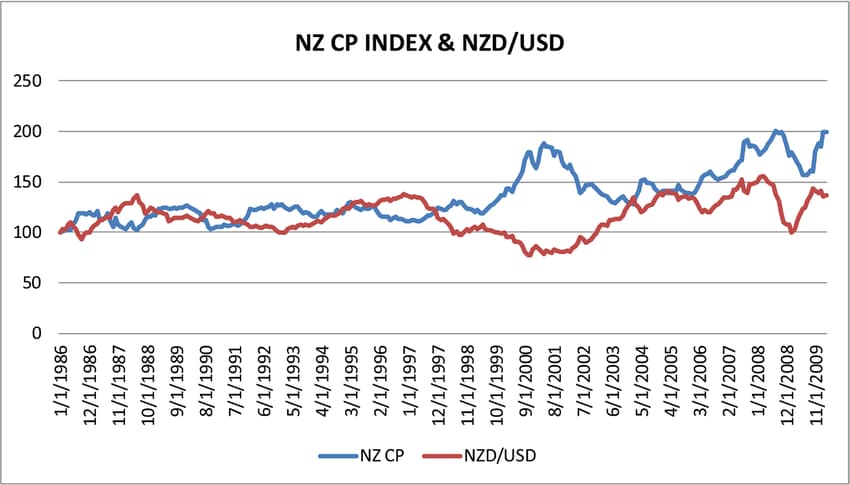

Correlation between New Zealand Commodity Price Index and New Zealand dollar (source: ResearchGate)

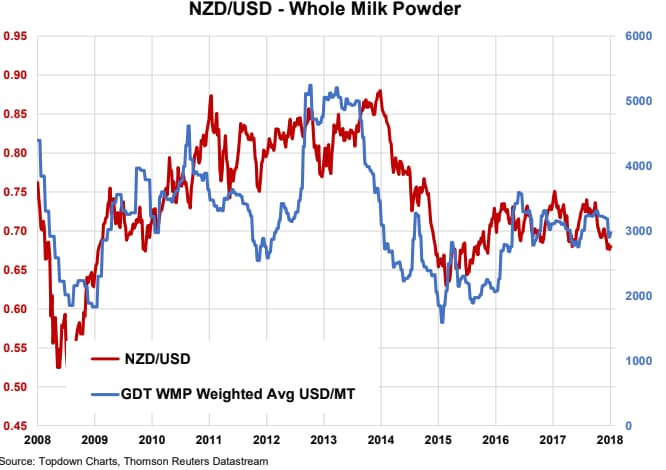

The NZD/USD currency pair, sometimes referred to as “the Kiwi” has historically shown a positive correlation with the performance of New Zealand’s commodity market. The main export of New Zealand is dairy products, specifically milk powder. The price of these commodities can give traders extra insight into price movements of NZD.

Correlation between NZD/USD exchange rate and WMP (Source: interest.co.nz)

Traders Union provides daily insight and analytics on the price of NZD/USD, which you can follow here.

Norwegian krone (NOK)

Although Norway is a small country with a population of only 5.4 million, its economy was one of the fastest growing advanced economies in 2022 according to the IMF. The Nordic country is also rich in resources and is the 8th largest exporter of oil in the world. Its main exports are petroleum gas, crude petroleum, fresh fish, refined petroleum, and raw aluminum.

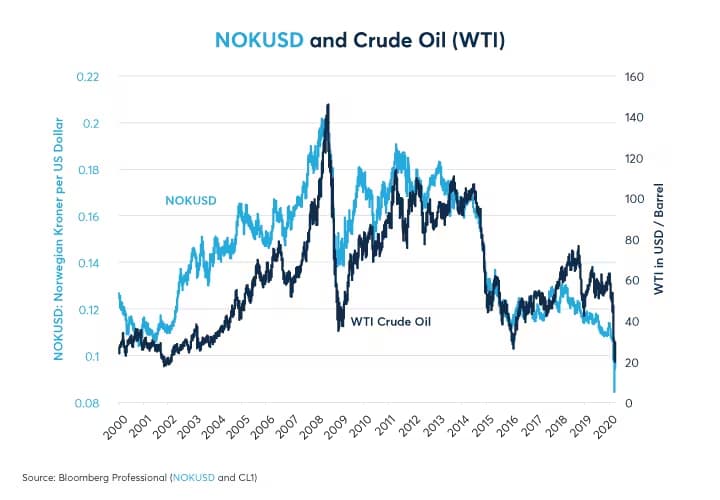

NOK/USD and crude oil prices (Source: CME group)

Norway’s currency is the Norwegian krone (NOK). Most of Norway’s exports are to European countries such as Germany, France, and Belgium, which all use the euro (EUR), and the U.K. where the British pound is used (GBP). They also export to the U.S.A. (USD). As Norway is such a large exporter of commodities, particularly oil, there is a strong correlation between the performance of NOK and the price of oil.

Correlation between EUR/NOK and oil prices (Source: SEB Research)

Currency pairs featuring the Norwegian krone, such as USD/NOK, EUR/NOK, and GBP/NOK often show a positive correlation with the movements of oil prices.

South African rand (ZAR)

South Africa is home to the second largest African economy and is a major producer of key commodities, such as gold, platinum, diamonds and chromium. South Africa is the main exporter of resources to other countries in Africa, though other prominent trading partners are Germany, the U.S.A, China, Japan, the U.K and Spain, resulting in high demand for the South African rand (ZAR).

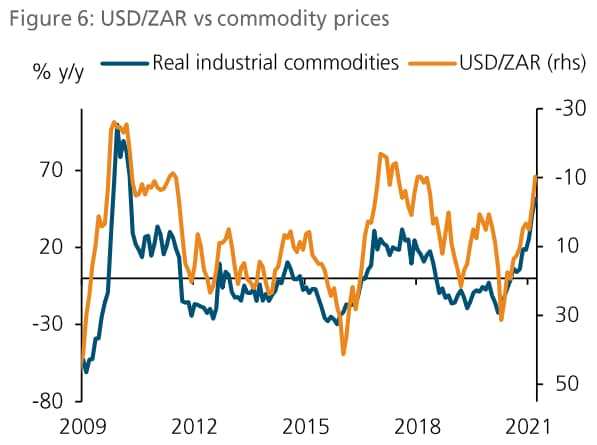

The USD/ZAR currency pair has some correlation with commodity prices, such as those of gold and platinum. However, it’s worth noting that correlation is not as strong as with other commodity currency pairs, according to an analysis by Core Research. However, more up-to-date research shows an inverse correlation between commodity prices and the price of USD/ZAR.

Correlation between inverted changes in USD/ZAR and commodity price changes (Source: PoundSterlingLive)

Pros and cons of trading commodity currencies

As with the trading of all currencies, there are advantages and disadvantages. The importance of each will depend on your strategy as a trader.

👍 Pros

• Attractive Returns: Rises in commodity prices provide unique trading opportunities in trading commodity currencies, due to their correlation. Traders can benefit from trends in both currency and commodity markets.

• Diversified Portfolio: Commodity currencies provide the opportunity for diversification as they are influenced by commodity prices rather than solely economic factors. For example, if the USD weakens, having AUD or CAD can balance the risk because their value is often tied to commodity prices.

• Stability: Commodity-driven economies can experience economic stability and growth during periods of high commodity prices, even when other economic indicators are underperforming.

• Inflation Protection: Commodity currencies tied to countries rich in natural resources can hedge against inflation. As commodity prices rise with inflation, these currencies tend to strengthen, preserving purchasing power and offsetting the impact of rising prices. For example, if the price of iron was increasing (inflation), the price of AUD would likely go up, so possessing AUD would maintain purchasing power.

• Speculation: Commodity currencies can be used to speculate on the future price of commodities. For example, if a trader is expecting higher oil prices, they might invest in the Canadian dollar (CAD), as its price should correlate with the increased oil prices.

👎 Cons

• Volatility: Commodity currencies can be volatile and see large fluctuations. As commodity currencies are sensitive to these movements, traders may be exposed to volatility.

• Economic Dependency: Economies dependent on commodities are more vulnerable to changes in global demand and political instability. This can impact the value of their currencies.

• Correlation Over-reliance: As a trader, becoming overly reliant on correlation between a commodity’s price and a commodity currency can lead to poor decision-making. For example, let’s say Canada had an unexpected political scandal, but commodities continued to perform well. A trader relying too much on correlation might make poor trading decisions based on expectations.

Conclusion

Although trading commodity currencies provides the opportunity to make a profit based on correlations between commodity prices and currency pairs, it does not guarantee a profit. It provides an extra analytical paradigm from which to make more accurate trading decisions, though it is not fool-proof. Trading commodity currencies might be easier to those with experience trading commodities, as they provide an understandable segue into the Forex market.

As always, it is crucial that traders do their own research and carefully manage risk, as commodity currency trading comes with its own unique risks.

Best Forex brokers 2024

FAQs

What is a commodity vs currency?

A commodity is a natural resource or good that is traded in exchange for other goods. A currency is the monetary denomination that is used by any given country to buy said goods.

What are examples of commodity currencies?

The Canadian dollar (CAD), Australian dollar (AUD) and New Zealand dollar (NZD) are examples of commodity currencies, as they are all from countries which are major exporters of commodities.

Is USD a commodity currency?

No, because the value of the U.S. dollar is not tied to commodity prices. USD is a global reserve currency and its value is determined by other factors.

Is gold a currency or commodity?

Gold is a commodity, as it is mined and produced and sold as a good. It is not a traditional currency, though it is used as a store of wealth and was considered money throughout history.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Commodity Currencies

A commodity currency is a currency whose price strongly correlates to the exporting of resources in the currency’s country, and the commodity’s price.

-

4

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).