Understanding And Managing Slippage In Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Slippage in trading refers to the difference between the expected price of a trade and the actual price at which the trade is executed. This usually occurs when there is high market volatility or low liquidity, causing prices to change rapidly. For example, if a trader places a market order to buy or sell an asset at a certain price, but the order is filled at a slightly different price. It can result in a less favorable price than anticipated, potentially affecting trading profits or losses.

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. It occurs when an order is executed at a price different from the expected price due to various factors like market volatility and liquidity.

Slippage = Expected Entry Price − Actual Execution Price

This article aims to provide a comprehensive understanding of slippage, its causes, and how to manage it effectively, catering to both beginner and advanced traders.

What is a slippage in trading?

Slippage can be either positive, resulting in a better price than expected, or negative, resulting in a worse price.

Let's say you intend to buy a stock at $100, but due to market conditions, the order is executed at $101. The slippage would be calculated as:

Slippage = $100 − $101 = −$1

This indicates a negative slippage of $1 per share. If the order was executed at $99, you would have a positive slippage of $1 per share:

Slippage = $100 − $99 = $1

Types of slippage:

Positive slippage. Occurs when the executed price is better than the expected price.

Negative slippage. Occurs when the executed price is worse than the expected price.

No slippage. When the order is executed at the expected price.

Why does slippage occur?

Slippage occurs mainly due to market volatility and liquidity issues. During periods of high volatility, prices can change rapidly, and orders might be filled at different prices than expected. Similarly, in markets with low liquidity, fewer participants are available to take the opposite side of a trade, leading to delays and slippage.

Market volatility and liquidity issues. High volatility and low liquidity can create conditions where slippage is more likely. For example, during major economic announcements or earnings reports, markets can become extremely volatile, causing significant slippage.

Impact of large orders. Large orders can move the market and create slippage. When a large order is placed, it can exhaust the available liquidity at the expected price, causing the remaining order to be filled at less favorable prices.

Factors influencing slippage

Several factors can influence slippage, including:

Market orders: These orders are executed immediately, but try to open at the best available price, which increases the probability of slippage.

Volatility: High volatility can cause prices to change rapidly, leading to slippage.

Liquidity: Low liquidity means fewer buyers and sellers, increasing the chances of slippage.

Trade Size: Large orders can move the market, causing slippage.

Technical problems: Low speed of communication with the broker's server and slow processing of orders - while the order is opened, the price has time to move away from the declared price.

How to reduce slippage in trading?

Reducing slippage involves strategic planning and utilizing specific tools and techniques. Here are some methods to minimize slippage:

Using limit orders vs. market orders. Limit orders allow traders to set the maximum or minimum price at which they are willing to buy or sell.For a limit deal, the broker will be obliged to open your deal strictly at the price specified in the order.This control helps avoid slippage but comes with the risk of the order not being filled.

Timing strategies to minimize slippage. Trading during periods of low volatility and high liquidity can reduce slippage. Avoiding trades during major news events can also help.

Trading during low-volatility periods. Low-volatility periods typically have tighter bid-ask spreads, reducing the chances of slippage. For example, trading major currency pairs like EUR/USD during regular market hours.

Choosing highly liquid instruments. Trading highly liquid instruments ensures that there are enough participants to take the opposite side of your trade, reducing the likelihood of slippage.

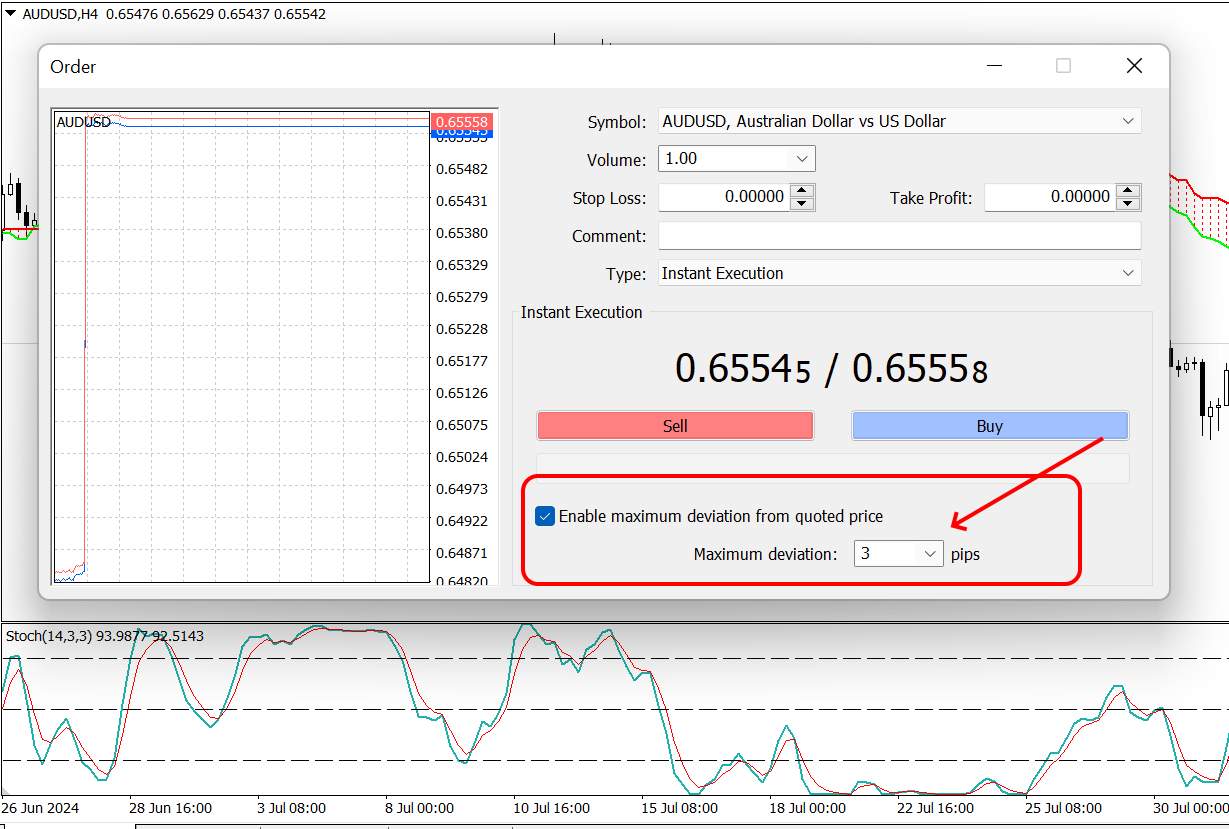

Note: popular trading terminals have an option to limit slippage. For example, in MetaTrader you can set the allowable slippage for market orders (in pips from the current price):

But if the slippage is greater than the level you specify, the request will be ignored and the order will not be opened. If you are ready to accept the market retracement, set this parameter to 0.

Tips for traders

Traders should focus on understanding the basics of slippage and using tools like limit orders to control their trades. Avoiding high-volatility periods and starting with small trade sizes can help minimize the impact of slippage.

Key considerations for traders:

Use limit orders. Control your execution prices.

Start small. Minimize risk by starting with smaller trades.

Avoid volatile periods. Trade during stable market conditions.

Algorithmic trading. Implement algorithms that account for slippage in their execution strategies.

Market analysis. Continuously analyze market conditions to adjust strategies accordingly.

Risks and warnings

Slippage can introduce significant risks to trading. It is essential to understand these risks and implement strategies to mitigate them. Potential risks associated with slippage:

| Potential risks | Description | How to mitigate risks |

|---|---|---|

Increased costs | Slippage can increase the cost of trades by executing at less favorable prices. | Use Risk Management Tools. Implement stop-loss orders to manage risks and limit potential losses. |

Unpredictability | Slippage introduces an element of unpredictability in trade execution. | Stay Informed. Keep up with market news and events to anticipate and react to potential volatility. |

It's essential to use limit orders

As for me, first and foremost, it's essential to use limit orders instead of market orders whenever possible. Limit orders allow you to set the maximum price you are willing to pay or the minimum price you are willing to accept, which can help you avoid unfavorable price movements. While there is a risk that your order might not be filled if the market doesn't reach your specified price, the control it offers is worth it, especially in volatile markets.

Another key strategy is timing your trades to avoid high-volatility periods. Major economic announcements, earnings reports, and other significant events can cause sudden price swings. By planning your trades around these events, you can reduce the chances of encountering slippage. It's also wise to trade during the most liquid times of the day, such as when major markets overlap (e.g., the New York and London sessions in Forex).Conclusion

Understanding slippage is vital for successful trading. Slippage happens when the trade execution price differs from the expected price due to market volatility, liquidity issues, or large orders. While it's impossible to eliminate slippage entirely, traders can minimize its impact through strategies such as using limit orders, trading during low-volatility periods, and selecting highly liquid instruments.

Managing slippage is not just about reducing costs; it's about improving overall trading performance. By staying informed, planning trades carefully, and using the right tools, traders can navigate the complexities of slippage and enhance their trading strategies.

FAQs

How can I avoid slippage during major economic announcements?

To avoid slippage during major economic announcements, refrain from placing trades immediately before and after the announcement. Market volatility tends to spike during these times, increasing the likelihood of slippage.

Is it possible to eliminate slippage entirely?

While it is impossible to eliminate slippage entirely, you can minimize its impact by using limit orders, trading during low-volatility periods, and choosing highly liquid instruments.

How does slippage differ in Forex and stock trading?

In Forex trading, slippage is more common due to the higher volatility and 24-hour market. In stock trading, slippage can occur during earnings reports or major news events but is generally less frequent in highly liquid stocks.

Can automated trading systems help reduce slippage?

Automated trading systems can help reduce slippage by executing trades faster and more efficiently than manual trading. However, they are not immune to slippage, especially during high-volatility periods.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.