How To Use Apple Pay To Start Trading Currencies

Trading currencies with Apple Pay is possible and involves a few steps, as Apple Pay itself is not a trading platform but rather a payment method. However, you can use Apple Pay to fund your trading account if your chosen Forex broker supports this payment option.

Traders are constantly on the lookout for more streamlined, secure, and efficient methods to manage their transactions. The integration of technology in the Forex market has transformed the way currencies are traded, but it has also introduced a complexity that can be daunting for both new and seasoned traders.

The problem lies not only in navigating the volatile waters of Forex trading but in doing so with the convenience that matches today's fast-paced, digital-first lifestyle. This article addresses the crucial question of integrating modern payment solutions, like Apple Pay, into the world of currency trading, offering a beacon of clarity and a path forward for those seeking to harmonize their digital wallet with their investment strategy.

-

Can you use a phone for trading currencies?

Yes, you can use a phone for trading currencies by utilizing mobile apps provided by Forex brokers that support mobile trading.

-

How does Apple Pay work with different currencies?

Apple Pay automatically handles currency conversions at the time of transaction when you use a card from a different currency zone, typically using the bank's exchange rates.

-

How do I deposit money into Apple Pay?

To deposit money into Apple Pay, you add a credit or debit card to the Wallet app on your iPhone, which can then be used for transactions via Apple Pay.

-

What is a deposit in Forex?

A deposit in Forex is the amount of money transferred into your trading account, which serves as your capital for opening positions in the currency market.

Can I trade currencies with Apple Pay?

Yes, trading currencies with Apple Pay is not only possible but has become increasingly accessible thanks to the growing number of Forex brokers who recognize the importance of catering to the tech-savvy trader.

Apple Pay, known for its secure and hassle-free payment method, can be a game-changer for traders looking to deposit funds swiftly into their trading accounts without the traditional hurdles of bank wire transfers or the high fees of credit cards.

The process involves selecting a Forex broker that supports Apple Pay as a funding option. This compatibility is crucial as it ensures that you can manage your investment funds directly from your Apple device, be it an iPhone, iPad, or Mac, providing a seamless link between your financial and trading ecosystems.

The advantages of using Apple Pay include enhanced security features, such as two-factor authentication and the unique transaction codes, which add layers of protection against fraud.

Best Apple Pay Forex Brokers

How do I trade Forex with an iPhone?

To trade Forex with an iPhone, follow these 5 steps:

Step 1. Choose a broker.

Select a reputable Forex broker that is regulated and offers a mobile trading platform. Consider factors such as leverage, commissions, spreads, and ease of deposits and withdrawals.

Step 2. Open and fund your account.

You can use Apple Pay to deposit funds into your trading account. Most Apple Pay deposits and withdrawals are instant, but specific broker processing times may vary. (If you haven’t already, set up Apple Pay on your iPhone. Add your credit or debit card to the Apple Wallet app. Ensure that your bank or card issuer supports Apple Pay.)

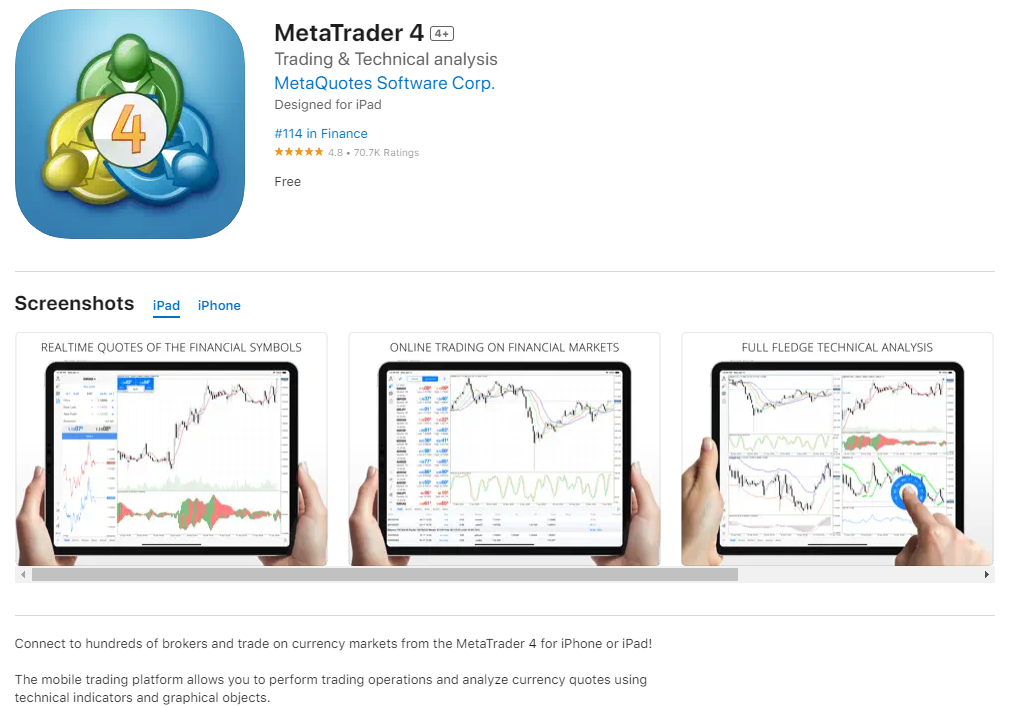

Step 3. Install a trading app.

Download a reliable Forex trading app from the App Store, such as MetaTrader 4, which allows you to access real-time quotes, place trades, and analyze charts on your iPhone.

App Store Preview

Step 4. Research and develop a strategy.

Familiarize yourself with the Forex market, its trends, and trading techniques. Use the app's built-in tools and resources to analyze market data and identify potential trading opportunities.

Step 5. Trade.

Once you've developed a strategy and have a solid understanding of the market, you can start trading Forex on your iPhone. Be sure to monitor your positions and adjust your strategy as needed.

Remember, Forex trading involves risk, and it's essential to understand the market and the broker's terms before making any trades. Always consider your investment objectives, risk tolerance, and financial circumstances before opening an account.

Can I start Forex trading with $100?

Absolutely, starting Forex trading with $100 is feasible and can be a prudent way to enter the market for traders who wish to manage their risk exposure. However, trading with a smaller sum requires strategic planning and smart leverage usage. Here are essential tips to help you maximize the potential of your initial $100 investment:

-

Leverage Wisely: Leverage is a powerful tool in Forex that allows you to control larger positions than your capital alone would permit. But with great power comes great responsibility. Use leverage cautiously; excessive leverage can magnify losses as well as gains.

-

Choose the Right Broker: Not all brokers are created equal, especially for traders starting with low capital. Look for brokers that offer micro or nano lot sizes, which will enable you to trade smaller positions and better manage risk.

-

Focus on Education: Before placing your first trade, invest in your education. Understand the basics of Forex trading, technical and fundamental analysis, and the economic factors that drive currency movements. Knowledge is your most valuable asset.

-

Develop a Trading Plan: A well-thought-out trading plan is crucial. This should include your risk management strategy, including stop-loss and take-profit orders, to help you manage your trades without letting emotions get in the way.

-

Start with a Demo Account: Practice makes perfect. Use a demo account to familiarize yourself with the trading platform and to test your trading strategy without risking your capital. Once you're confident, transition to live trading with your $100.

Expert Opinion

“Trading with a small amount like $100 can limit your potential profits but is a wise approach to take your first steps in the Forex market while learning and building your trading skills. Always trade with money you can afford to lose, and never stop learning.”

Summary

Trading currencies with Apple Pay is a viable option, facilitating swift and secure transactions. By harnessing the power of iPhone apps like MetaTrader 4, traders can embark on Forex trading with as little as $100, applying prudent leverage and education-driven strategies.

Glossary for novice traders

-

1

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

2

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

3

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

4

Take-Profit

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

-

5

Wire transfer

A wire transfer is a method of electronic funds transfer in which money is sent from one bank or financial institution to another, typically across international or domestic boundaries. It involves the sender providing their bank with specific instructions, including the recipient's bank details and the amount to be transferred, and the funds are then electronically moved from the sender's account to the recipient's account.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).