Forex Trading In the UK - A Full Beginner’s Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

In the UK Forex trading is particularly popular thanks to the country’s strict but fair regulations and the presence of London, a major financial center. The FCA, which oversees financial markets in the UK, ensures that the trading environment is secure and trustworthy. Whether you’re just getting started or aiming to sharpen your strategies, this guide will help you navigate the world of Forex trading.

Forex trading is all about exchanging currency pairs to take advantage of changes in exchange rates. With a staggering daily trading volume of over $7 trillion, it's the largest financial market globally. This high level of activity offers traders numerous opportunities to profit from quick price changes or to manage risks associated with currency fluctuations. In this article we will tell you all about Forex trading in the UK.

Forex trading in the UK - a full beginner’s guide

At its core, Forex trading is the exchange of one currency for another at an agreed-upon price in the over-the-counter (OTC) market. Currency pairs are traded in units called lots, with each lot representing a specific amount of currency. The most commonly traded currency pairs include major pairs like EUR/USD, GBP/USD, and USD/JPY.

Leverage is a key feature of Forex trading, allowing traders to control larger positions with a smaller amount of capital. However, leverage also increases the risk, making it essential for traders to understand how it works before using it in their trades.

Why trade Forex in the UK?

The UK is a leading hub for Forex trading, offering several advantages to traders:

Tax benefits you can’t Ignore

In the UK, trading Forex often falls under spread betting, meaning your profits could be tax-free. Yes, you heard that right — no income tax, no capital gains tax. That’s not something you’ll find in many other countries.Safety first with FCA-regulated brokers

When you trade Forex in the UK, you’re not just jumping in blind. The Financial Conduct Authority ( FCA ) has your back, making sure brokers play by the rules. It’s a safety net that gives you peace of mind — something you can’t always count on elsewhere.Forex is the part of the culture here

In the UK, Forex trading isn’t just a hobby; it’s almost a tradition. This means you have access to top-notch resources, communities, and networking opportunities that can really help you up your game.A time zone that works in your favor

Trading from the UK means you’re perfectly positioned to catch the best of both the Asian and American markets. More opportunities, more action — what’s not to like?Legal protection that’s got your back

The UK legal system is built to protect traders like you. If something goes wrong, you’ve got clear paths to sort things out. That’s not a luxury everywhere, making the UK a solid choice for serious traders.

Step-by-step guide to getting started

Opening a trading account. Choose an FCA-regulated broker that offers a user-friendly platform, low fees, and strong customer support. Complete the registration process by providing your personal information and verifying your identity.

Understanding currency pairs. Familiarize yourself with major, minor, and exotic currency pairs. Major pairs like EUR/USD are the most liquid and tend to have lower spreads, making them ideal for beginners.

Basic trading strategies. Start with simple strategies such as trend following or breakout trading. Use fundamental analysis to assess economic indicators and technical analysis to identify market trends and entry points.

Placing your first trade. After selecting a currency pair, decide whether you want to go long (buy) or short (sell). Set stop-loss and take-profit levels to manage your risk. Begin with small trade sizes to minimize risk while you learn.

Tips for success. Success in Forex trading requires continuous learning, disciplined risk management, and emotional control. Use a demo account to practice without risking real money, and avoid trading based on emotions or market rumors.

Forex trading considerations

Choosing the right broker

For beginners, selecting the right broker is crucial. Look for a broker that offers a demo account, educational resources, and easy-to-use platforms. Brokers with low minimum deposits and strong customer support are particularly important for those just starting out. Ensure the broker is FCA-regulated to guarantee a secure trading environment.

| FCA UK | Demo | Min. deposit, $ | Min Spread GBP/USD, pips | MAX Spread GBP/USD, pips | Investor protection | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | Yes | 100 | 0,5 | 1,0 | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 0,4 | 1,4 | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | 0,1 | 0,5 | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | 0,9 | 1,4 | £85,000 | Study review | |

| Yes | Yes | No | 0,5 | 1,5 | $500,000 £85,000 | Open an account Your capital is at risk. |

Risk management

Managing risk is one of the most important aspects of trading. Beginners should start by using stop-loss orders to limit potential losses and avoid over-leveraging their trades. It’s advisable to trade small amounts and gradually increase position sizes as you gain experience.

Trading strategies

Advanced traders can explore more sophisticated strategies such as scalping, which involves making multiple trades throughout the day to profit from small price movements, or swing trading, which involves holding positions for several days to capitalize on larger market trends. To choose the reliable one please, read our article, Which Forex Trading Strategy Is Best For Me?

Leverage and margin

Understanding leverage is crucial for advanced traders. While leverage can amplify profits, it also increases the risk of significant losses. Advanced traders should be comfortable with managing margin requirements and using leverage wisely to avoid margin calls.

Tools

Advanced tools such as automated trading systems, custom indicators, and API access for algorithmic trading can enhance your trading efficiency. These tools allow for greater customization of trading strategies and can help experienced traders gain a competitive edge.

Trading psychology

Maintaining the right mindset is key to long-term success in Forex trading. Advanced traders should focus on discipline, emotional control, and sticking to their trading plan, especially during periods of market volatility. Find out the history of the richest traders in the UK, their success stories, current wealth and ideas on achieving success in our article.

Understanding Forex regulations in the UK

Forex trading in the UK comes with a strong set of rules to make sure traders are protected and the market stays fair. The Financial Conduct Authority (FCA) is in charge of making sure Forex brokers follow these rules. Here’s what you need to know:

FCA approval

Any Forex broker working in the UK needs to be approved by the FCA. This means they have to show they have enough money in reserve and good systems in place to handle risks. They also need to take steps to prevent money laundering.Protection of client funds

Your money is kept safe because the FCA requires brokers to keep it in separate accounts, away from their business funds. If a broker goes bankrupt, your funds are protected up to £85,000 through the Financial Services Compensation Scheme (FSCS).Clear costs and fair trading

Brokers must be upfront about what they charge, including spreads and commissions. They also have to make sure trades are done fairly, so you don’t have to worry about hidden fees or unfair practices.Limits on leverage

To keep traders from risking too much, the FCA sets limits on leverage — 30:1 for major currency pairs and 20:1 for others. This helps prevent big losses.Regular checks

The FCA regularly checks brokers to make sure they’re following the rules. This keeps the market trustworthy and stops any bad behavior.European rules

Besides FCA rules, the UK also follows certain European rules from the European Securities and Markets Authority (ESMA). These rules make sure you don’t lose more money than you have in your account and ban risky practices like binary options trading for most people.

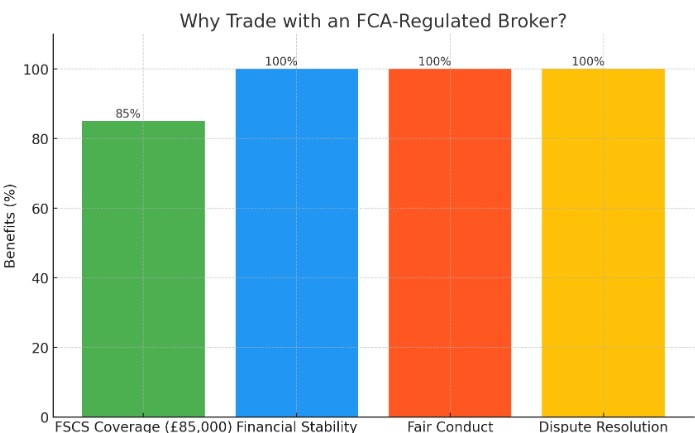

Why trade with an FCA-Regulated broker?

Trading with an FCA-regulated broker provides several benefits, including protection under the Financial Services Compensation Scheme (FSCS), which covers eligible clients up to £85,000 in case the broker fails. FCA regulation also ensures that brokers adhere to strict conduct and financial stability requirements.

Here is a simplified visual representation illustrating the benefits of trading with an FCA-regulated broker. It highlights key protections and assurances such as FSCS coverage of up to £85,000, financial stability, fair conduct, and effective dispute resolution, all of which are ensured under FCA regulation.

Risks and warnings

Market volatility

The UK Forex market is highly sensitive to events like Brexit and Bank of England decisions, causing rapid price swings, especially in GBP pairs. Use stop-loss orders to manage this risk.

Leverage risks

FCA limits on leverage protect against large losses, but leverage still increases risk. UK traders must use it cautiously and be prepared for margin calls.

Psychological risks

Trading in the UK’s fast-paced market can be emotionally challenging. Maintaining discipline, avoiding revenge trading, and sticking to a plan are crucial for long-term success.

Pros and cons

- Pros

- Cons

Regulation. The FCA ensures a secure trading environment with protections like segregated accounts and compensation schemes, offering peace of mind for traders.

Global hub. London’s status as a financial center provides access to high liquidity and tight spreads, especially during overlapping trading sessions with New York.

Favorable time zone. The UK’s time zone allows traders to capitalize on the peak liquidity and volatility of overlapping market sessions, particularly in GBP pairs.

Volatility. The UK market is susceptible to political events like Brexit, which can cause unpredictable swings in currency values, increasing risk.

Leverage caps. FCA limits on leverage can restrict potential profits, though they help prevent excessive risk.

Taxation. Forex profits in the UK may be subject to Capital Gains or Income Tax, impacting overall profitability.

Always choose an FCA-regulated broker

When you’re just getting started with Forex trading in the UK, think about timing your trades to take full advantage of the UK’s prime position in the global market. The best times to trade are when the UK market overlaps with both Asia and the US, particularly between 1:00 pm and 4:00 pm GMT. This is when the action is hot, and you’ll see more price swings, giving you better chances to make profitable trades. Instead of just following the usual advice, focus on learning how to trade during these hours when the market is buzzing.

Another great tip if you’re new to trading in the UK is to look into spread betting. It’s a way to trade without owning the currency, and the best part? It’s tax-free here! This means you can keep more of what you make. Plus, you can start with smaller amounts, which is perfect when you’re still learning the ropes. The FCA keeps things safe and fair, so you can trade with confidence while you build up your skills.

Conclusion

Forex trading is not a get-rich-quick scheme; it requires patience, discipline, and a commitment to ongoing education. Start small, stay informed, and always trade with a strategy in mind. By following the advice and tips provided in this guide, you’ll be better equipped to navigate the challenges and seize the opportunities that Forex trading in the UK has to offer.

FAQs

What is the minimum deposit required to start trading Forex in the UK?

The minimum deposit varies by broker, but many FCA-regulated brokers offer accounts with deposits starting as low as £100.

How do I know if a Forex broker is FCA regulated?

You can verify a broker’s FCA regulation by checking the FCA’s online register, which lists all authorized firms.

What are the tax implications of Forex trading in the UK?

Profits from Forex trading in the UK may be subject to Capital Gains Tax or Income Tax, depending on your individual circumstances. It’s recommended to consult with a tax advisor to understand your obligations.

Is Forex trading in the UK legal and safe?

Forex trading is legal in the UK, and trading with an FCA-regulated broker ensures that your funds are protected and that the broker adheres to strict regulatory standards.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).