Best Apps for Forex Trading in Nigeria

Trading Forex in Nigeria has gained steam over the years. The number of forex traders in Nigeria keeps increasing every day. To help the new traders, we have compiled a review of Nigeria's best forex trading apps.

Do you want to start trading Forex? Open an account on FXTM!Top 8 Forex Trading Apps in Nigeria

Here is a ranking of the best Forex Trading Apps by use case.

| App | Best For |

|---|---|

Best broker for cheap stock trading |

|

Best For advanced traders |

|

Best set of tools for beginners |

|

Best client experience in Nigeria |

|

Best Forex cashback |

|

Highest Forex Leverage |

|

Best No-deposit Bonus in Nigeria |

|

Best local support |

Best Forex Trading Apps in Nigeria Comparison 2024

In this table, we take an in-depth look at the different apps using some factors

| Broker | Minimum Deposit (USD) | NGN Accounts | Forex Regulators | Maximum Leverage | Trading Apps | Swap Free Accounts |

|---|---|---|---|---|---|---|

$10 |

Yes |

CySEC, IFSC |

1:2000 |

MT4, MT5, R Mobile Trader |

Yes |

|

$100 |

No |

ASIC, CySEC |

1:500 |

MT4, MT5 |

Yes |

|

$1 |

Yes |

FCA, CySEC, FSCA, FSA |

1:2000 |

MT4, MT5 |

Yes |

|

$10 |

Yes |

FCA, CySEC, FSCA, FSA, IFSC, FSC |

1:1000 |

MT4, MT5 |

Yes |

|

$100 |

Yes |

FSC, FC |

1:1000 |

MT4, MT5 |

Yes |

|

$1 |

Yes |

IFSC, CySEC |

1:3000 |

MT4, MT5 |

Yes |

|

$1 |

Yes |

CySEC, BVI FSC |

1:1000 |

MT4, MT5 |

Yes |

|

$1 |

Yes |

FCA, ASIC, CySEC |

1:500 |

MT4, MT5 |

Yes |

RoboForex

RoboForex is a brokerage company providing services to financial markets in 169 countries with over 3.5 million users. The International Financial Services Commission Belize regulates it.

Apps and features

RoboForex has MT4, MT5 as well as a unique advanced stock trading app R StocksTrader that offers direct US stocks trading with an extra low fee. It also offers the following:

Minimum deposit of 10 USD

Leverage: up to 1:2000

Free stock exchange market data online

Advanced copy trading tool

Different types of Forex bonuses.

Fees and spreads

RoboForex offers tight spreads from 0.1pips and 0 commissions from deposits and withdrawals. Withdrawal fees depend on the payment method used. For instance, bank transfers have a 1.5% withdrawal fee, while bank transfers carry up to 4% fees. The typical spread for the EURUSD pair on the row account is 0.3 pips for a commission of only $1.5. The commission for trading US stocks ranges from 0.009 to 0.025 cents per share.

Forex bonuses

Regarding Forex bonuses, RoboForex offers a Profit Share Bonus, which can provide an additional 60% bonus. These bonuses may not be canceled when account equity falls below the amount of the additional funds. Those who Join the program can receive up to 20,000 USD of the extra funds, with this without any restrictions.

RoboForex Bonus – How to Get Forex Bonus for FreeIC Markets - Best for Advanced Traders

IC Markets platform

IC Markets is a global forex broker domiciled in Sydney, Australia, founded in 2007. The broker has several branches globally and has regulations including CySEC, FSA, and ASIC (Australian Securities and Investments Commission). The minimum deposit amount on IC Markets is $200, and it provides a demo account for practice.

The advantage of using IC markets is that it is considered to have low forex fees compared to other brokers. Also, the speed and ease with which your account is opened is another feature admired by users and clients. On IC markets, it is free to deposit and withdraw.

The disadvantage of using IC markets is that it has limited product selection and does not have investor protection for NON-EU clients. Also, the live chat support could be improved in terms of speed and promptness.

The standard account offered by IC markets spread only basis from 1.0 pips while the True ECN account, otherwise called the Raw account, provides an opportunity for micro lot trading from 0.01 size. Also, the ECN spreads from 0 pips and has a commission of $3.5 per 100,000 traded.

The spread on the EURUSD currency pair is about 0.1 pips 24/5, and according to experts, it is the tightest EURUSD spread globally.

However, the cTrader ECN account offers the same feature. The difference is that the spread starts from 0.0 pips and has a commission of $3.00 per 100,000 traded. This is why IC Markets is widely preferred and used by professional traders.

IC Markets copy trading reviewExness

Exness is an online CFD trading platform that offers “better-than-market” conditions on the world's financial markets. It is licensed by CySec, FCA, FSA, and the FSCA, which helps ensure the proper regulations are implemented to protect their traders.

Apps and features

Standard accounts are considered feature-rich, commission-free accounts that are perfect for traders' trading/investment needs on all levels. On the other hand, the Raw, Zero, and Pro accounts offer flexible selections among the raw spread model, zero spread, and zero commission. As a result, this platform is best for experienced traders.

Exness has MT4 and MT5. It also offers the following features:

Various account types.

24/7 support.

Access to a Virtual Private Server.

Low Fees.

Social Trading.

Third-party tools.

Fees and spreads

Exness offers Tight spreads in Forex pairs. They offer Raw Spreads, Zero, and Pro Accounts. The minimum deposit for these accounts is $200. The instruments offered are Forex, metals, cryptocurrencies, energies, stocks, and indices. The breakdowns for those fees and spreads are as follows:

Raw Spreads:

Spread: From 0.0

Commission: Up to $3.50 for each side per lot

Maximum leverage: 1: Unlimited

Zero:

Spread: From 0.0

Commission: From $0.2 on each side per lot

Maximum leverage: 1: Unlimited

Forex Bonuses

Exness doesn’t offer any Forex bonuses.

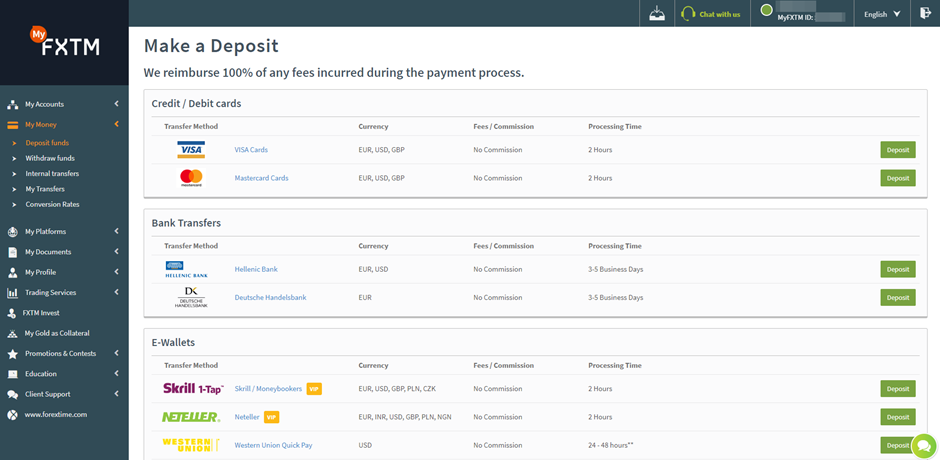

FXTM - Best Client Experience in Nigeria

FXTM platform

FXTM, which is pronounced ForexTime, began operations in 2011. It is regulated by the Cyprus Securities and Exchange Commission (CySEC) and three other regulators. FXTM is a renowned broker with a series of awards, including "Most Innovative Broker" (2018) and "Best Trading Conditions" (2018, 2019).

With FXTM, you can have your account in USD, EUR, GBP, and NGN. The minimum deposit for FXTM is $10, and the spread starts from 0 pips. The instruments available on FXTM include Currency pairs, cryptocurrencies, precious metals, commodities, indices, and CFDs on stocks. FXTM offers a passive earning opportunity for its users through its affiliate program. Users can become partners with FXTM, and with each new user you refer, you get paid $50.

One of the advantages of FXTM is that it has a wide range of trading accounts. Another advantage is FXTM provides a large number of training and educational resources. Also, with FXTM, you can use its automated programs in trading.

A major disadvantage of FXTM is that some of the broker's users have complained about the absence of PAMM accounts. When it comes to investments, they only offer copy trading, which is frowned on by users.

Nigeria dominates the FXTM user base, with 9.62% of its registered users from Nigeria. FXTM is the best for Nigeria because it offers a Naira account for Nigerians, supports local bank transfer, has a local office, and offers local support while also providing swap-free accounts for local Muslims. FXTM's local office is on the 3rd Floor, 5, Allen Avenue, Ikeja Lagos, Nigeria.

AMarkets

AMarkets offers MT4 and MT5. It is a leading Forex and CFD broker providing the greatest trading conditions. In addition, it is a platform known for having the highest percentage of successful traders.

Apps and features

Here are some of the top features on AMarkets:

Initial deposit: $100

Leverage: 1:2000

Order volume: From 0.01 with step 0.01

Trading Time: Monday 00:00 / Friday 23:00 Eastern European Time (EET)

Position accounting: Hedging

Stop Out level: 20%

Trading Instruments: 42 Forex; 7 Metals; 16 Indices; 11 Commodities; 2 Bonds; 425 Stocks

Negative balance protection

Fees and spreads

AMarkets offers spreads and commissions from 1.3 pips on the Standard Account, three pips on the Fixed Account, and 0.0 pips on the ECN Account. When using the ECN Account, commissions of $2.5/€2.5 is charged per lot.

Forex bonuses

AMarkets offers a double trading deposit. This bonus can double your deposit amount by up to $10,000. It is for new clients only. On the other hand, it also offers the ability to add 20% to a partner’s trading account. Users can receive 20% as a trading bonus when they transfer their affiliate reward to their trading accounts. It also offers the ability to withdraw funds with zero commissions to partners.

FBS - Highest Forex Leverage

FBS platform

Founded in 2009 and regulated by ASIC, CySEC, IFSC, and FSCA, FBS has three accounts: the standard account, cent account, and crypto account. These accounts are designed according to the level of experience of the trader. The cent account is more suitable for a new trader who is ready to test their skills with real funds after practicing with the demo account. With the cent account, your account balance reads in cents, and you can place orders with a volume of 0.01.

The standard account is for traders with some experience, and the crypto account is specifically for cryptocurrency trading. You can only access the crypto account through the FBs Trader mobile app.

The leverage for the standard and cent accounts is at 1:30. However, after you have qualified for the rank of a professional trader, you can access leverage of 1:500 or even 1:3000 in some cases. For the crypto account, the leverage is set at 1:2. There is a no deposit bonus for local traders, and all you have to do is open a bonus account, and the funds will be deposited.

One of the primary benefits of FBS is its copy trade and technical indicators.

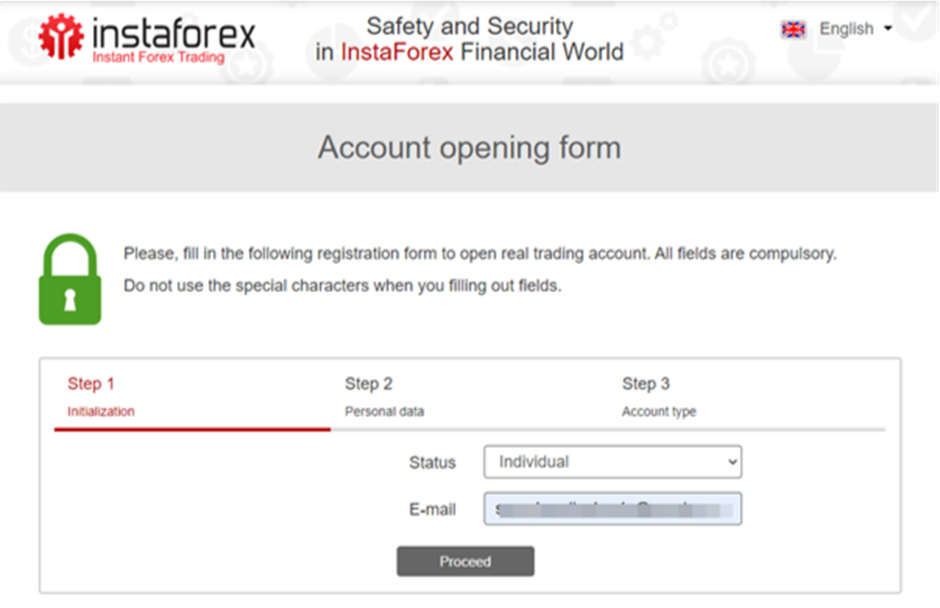

InstaForex - Best No-Deposit Bonus in Nigeria

InstaForex platform

InstaForex is a safe and reliable broker headquartered in Limassol, Cyprus, with a global user base of over 7 million traders. InstaForex is known to provide a wide range of services for any trader at any experience level. Most users prefer InstaForex because of its personalized and comprehensive customer support educational services.

InstaForex allows traders to operate a fixed or floating leverage, which may increase the chances for potential gains. However, with this powerful tool comes the potential for huge losses, so it is advisable to set the leverage according to the corresponding instruments. To access higher leverage like 1:400, 1:500, or 1:1000, you have to sign up on InstaForex through their global entities.

While Instaforex does not have a minimum deposit (i.e., you can start from $1), you should always check the instrument you want to trade as various instruments have their margins.

The InstaForex platform is user-friendly and uses the MetaTrader 4 and 5 software. Also, InstaForex has web, mobile, and desktop trading versions of its platform.

An outstanding benefit of InstaForex is it has a variety of contests and promotions that helps traders access opportunities, gain valuable experience and win prizes.

InstaForex copy trading reviewAdmiral Markets - Best local support

Admiral Markets platform

Admiral Markets is regulated by FCA, ASIC, EFSA, and CySEc, and it has its headquarters in the United Kingdom. It was founded in 2011, and its trading instruments include currencies and metals, including gold and silver, energies, CFDs on cryptocurrencies, stocks, bonds, and CFDs trading on indices.

Due to its international presence through 4 worldwide offices, the leverage available on Admiral Markets differs from 1:30 to 1:1000.

Admiral Markets has a minimum deposit of $200. While trading, it is possible for a trader's losses to exceed their deposit, so you should limit your risk when trading.

The types of accounts offered by Admiral Markets include demo account, mini account, micro account, ECN account, standard account, and STP account.

Also, Admiral Markets has extensive research, support, and educational content that spans video content, articles, daily support, and analytical data for their clients. This gives a bit of confidence and information for a beginner trader on Admiral Markets.

The disadvantage of Admiral Markets is that the Admiral Markets App is not user-friendly and considered unsophisticated.

What to Look For in a Trading App

Responsiveness

Due to the volatility of the forex market, your preferred broker needs to be responsive. This is because if a trader has placed a trade and a high volatility event occurs, causing a gap, this could make the trade execute at a worse value and result in losses for the trader.

Reliability

Depending on the platform you prefer, whether the desktop or mobile application, reliability is an important factor to consider when choosing a broker. As a trader, if your broker's app crashes or freezes, especially in times of global economic events, your trades and productivity will be affected.

User-friendly Interface

The difference between a profit and loss when trading can sometimes be in seconds, and a user-friendly broker will ensure you place or close a trade immediately. Also, it is necessary for the overall navigation of the platform; even with additional charts and tools, you should be able to use the app conveniently.

Analysis Tools

The difference between professional traders sometimes lies in their ability to analyze trades after being executed. This is how you can improve your skill and possibly learn from previous trades, and some tools can help make it easier. When choosing a broker, you should ensure the analysis tools of your preferred broker are in line with industry standards.

Automatic Trading

Some platforms offer suggestions on trades to place, and sometimes they come as algorithms. If these algorithms help you profit more, you should consider allowing the software to make investments for you at the amount you specify.

Automated Trading: How to Build an Effective System?Security of Data

Trading involves money, and the most important factor to consider is the security of your funds and personal information. Therefore, when choosing a platform, you should ensure it has one of the best security protocols.

Asset Offerings

Choose an app that provides a broad range of asset classes and financial instruments.

Make sure it offers the specific assets you are interested in trading.

Customer Support

Reliable customer support is essential for resolving any issues that may arise.

Look for apps with multiple channels of customer support, like chat, email, or phone support.

Mobile Accessibility

A mobile-friendly app allows you to trade on the go. Ensure the app is available on your device and has good reviews regarding its mobile functionality.

How to Choose a Forex Broker’s App in Nigeria?

Learn regulation and reliability

Before you settle on a forex broker, you should ensure you fully assess and learn the regulation behind every broker. Ensuring that the broker you pick is regulated and allowed to operate in Nigeria is necessary. Also, you have to ensure that the broker is reliable by real traders.

Look at offers for local clients

Every broker has a different offer, and the best broker for you as a trader in Nigeria is the one who offers the best services, tools, and other resources to local clients. Your broker needs to accommodate your needs as a Nigerian.

Explore App’s Functionality

Another factor to consider when choosing a broker in Nigeria is to explore the broker app's functionality. This can be done by assessing its execution speed, trading assets, and analytical tools. You will be fully abreast of the broker's features and have a smooth trading experience by checking all these boxes.

Try Demo

You should check to ensure they have a demo account for practice when selecting a broker. Every trader needs to practice to minimize risks, and with a demo account, you can practice as much as you want.

Open an account

The last step after filtering the brokers is to open an account with your broker of choice. You need to check the type of accounts available and those that suit you and your needs.

Best Forex Trading Apps For Beginners in Nigeria

As a beginner trader, the best broker apps for you are the ones that offer copy trading capabilities and educational materials. This is because when starting out, you will need to occasionally rely on the knowledge and skills of other traders to stay afloat. Also, with the educational resources offered by brokers, you can learn and analyses markets for yourself while you shore up your expertise.

The best platforms that fill this gap are AvaTrade, FXTM, and RoboForex.

Best Forex Bonuses in Nigeria

A few forex brokers offer bonuses to their clients, and one of them is FBS. FBS offers a 100% deposit bonus to both new and experienced traders. Also, you can receive a no deposit bonus.

Another good forex bonus is offered by InstaForex. Here, it offers a $500 bonus whether you make a deposit or not. That means all you have to do is open a live trading account, and your bonus will be deposited.

Other Brokers with top Forex Bonuses in Nigeria

There are various Forex bonuses offered in Nigeria. However, the type of bonus you receive depends on the platform you use and what your educational goals are. With that in mind, here is a closer look at some of the top Forex bonuses offered in Nigeria:

XM

XM offers a $30 no-deposit bonus. This bonus is for beginners wishing to try the XM platform risk-free. To receive the bonus, users must make a minimum deposit of $5. Moreover, although the bonus cannot be withdrawn, users can withdraw the profits from using them. Either way, users receive the bonus automatically once they have signed up for an account and made a deposit.

XM Bonus Programs - How to Get Up to $5.000Tickmill

Tickmill also offers a no-deposit welcome bonus of $30. This risk-free does not require full registration or identity verification to access. However, given that the welcome account is only valid for 60 days, users must quickly use the deposit to make a profit which can be withdrawn before the account is closed. Users can withdraw any profits up to $100. Once the profits are withdrawn, the account will be closed.

Tickmill Bonus - How to Get No Deposit Bonus $30Is Forex Legal In Nigeria? Is it Safe?

If you wonder whether Forex is legal in Nigeria, the answer is yes. Nevertheless, it can be somewhat risky. It is not heavily regulated, but it is somewhat regulated by the Central Bank of Nigeria, which means brokers must meet certain restrictions to remain in business. Additionally, earnings from trading activities are taxable in the country. Therefore, traders must pay the Nigerian government 10% of their earnings.

Should I Pay Forex Taxes in Nigeria?

As a Nigerian Forex trader, you are required to report and pay taxes on all income and profits - domestic or foreign. Your forex trading profits will typically qualify as capital gains and should be reported accordingly. The current tax rate for capital gains is 10% of the gross profit, as set by the Federal Inland Revenue Service (FIRS). Therefore, it's important to include any Forex trading income when preparing a tax return.

Can I Trade with internationally regulated brokers in Nigeria?

Yes, it’s possible, but you should be mindful of who you trade with, given the instability of the Nigerian market.

FAQs

What are Forex trading hours in Nigeria?

Forex trading in Nigeria is done on a 24-hour basis, from Sunday at 5:00 PM (17:00) Nigerian Time until Friday at 4:00 PM (16:00) Nigerian time. There are three main trading sessions in Nigeria local time, which include the Asian session, London (European) session, and the New-York session.

The Asian session Forex time in Nigeria starts at 12:00 AM and ends at 9:00 AM The London session Forex time in Nigeria starts at 8:00 AM and ends at 5:00 PM The New York session Forex time in Nigeria starts at 1:00 PM and ends at 10:00 PM

Do Forex apps have Islamic accounts?

Yes, all listed brokers have swap-free accounts, specifically for Muslim clients.

Can I get rich trading Forex in Nigeria?

Yes, it's possible, but you should learn and practice a lot to get rich. In the first stage, your target is to make regular profits and keep your trading strategy.

Which Forex broker allows a Naira account?

FXTM is the only broker that has a Naira account.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.