List of Fake Forex Brokers in Nigeria

Based on the estimates of experts, there are more than 300 thousand traders in Nigeria. This country is the second on the continent after South Africa by the growth of Forex trading popularity. Nigerians are attracted by the massive opportunities to make money by professional and novice traders. Although the trading business is regulated (controlled by the Central Bank of Nigeria), there is — as with the Forex in any other country — a danger of becoming a victim of scammers and losing money. In this material, the Traders Union will provide you with the Forex list of scammers and talk about the ways to tell a fake broker from a real company.

Is Forex legal in Nigeria?

Forex is a highly liquid market with an average daily volume of more than 5 trillion dollars. Here traders buy and sell currencies, precious metals, securities, raw materials, etc. The essence of moneymaking here is the speculation on the changes in the rates of assets. To gain profit, one needs to monitor the market daily, and use fundamental and technical analyses. But the most important thing is to find a good broker, i.e., a professional middleman in making deals.

In Nigeria, Forex trading is considered to be completely legal. Brokers must follow all the rules and requirements put forward by the main regulatory body in that country, the Central Bank of Nigeria. Traders are recommended to choose licensed companies that work fairly and will assume responsibility in case of a breach of the agreement. As for taxation, all profits gained from successful trades must be registered. Traders pay a 10% tax based on the amount of earnings.

Blacklist of Forex brokers in Nigeria

The fast-growing market in Nigeria attracts not only traders and fair brokers, but also financial scammers. They artfully disguise themselves as reliable companies and illegally offer their services to investors. A fake broker can steal a large amount of money, even before the trader understands the essence of the scam. In the tab below is the list of fake Forex brokers in Nigeria. These companies have smeared their reputation. Each of them will be discussed in detail including what signs of fraud were found.

| Name | Foundation year | Minimal loss |

|---|---|---|

STForex |

2014 |

$200 |

KS-Securities |

2019 |

$1,000 |

LibraMarkets |

2018 |

$250 |

RMT500 |

2019 |

$0 |

Atlantika |

2019 |

$0 |

Royaltd24 |

2011 |

$250 |

Axiory |

2014 |

$10 |

ForexCT |

2006 |

$500 |

New Forex |

2014 |

$200 |

Panteon Finance |

2010 |

$200 |

CT-Trade |

2018 |

$250 |

BRFX Trade |

2018 |

$250 |

MaxCFD |

2017 |

$10 |

STForex

STForex has been operating in the international financial market since 2014. It’s an offshore company, registered in Saint Vincent and the Grenadines. As a reminder, in this island state, binary and Forex brokers are not regulated. The company doesn’t have a license. The con artists lured potential victims with the opportunity to take a learning course, and with promises of a lucrative trade in currency pairs, raw materials, precious metals, and other assets. But the company failed to actually fulfill its obligations and simply took possession of other people’s funds. The main signs of fraud are the following:

blocking accounts for no reason;

absence of legal documents confirming lawful business;

fake recommendations from pseudo-analysts;

lots of negative comments on various web resources;

unauthorized opening and closure of trades;

extortion of money.

KS-Securities

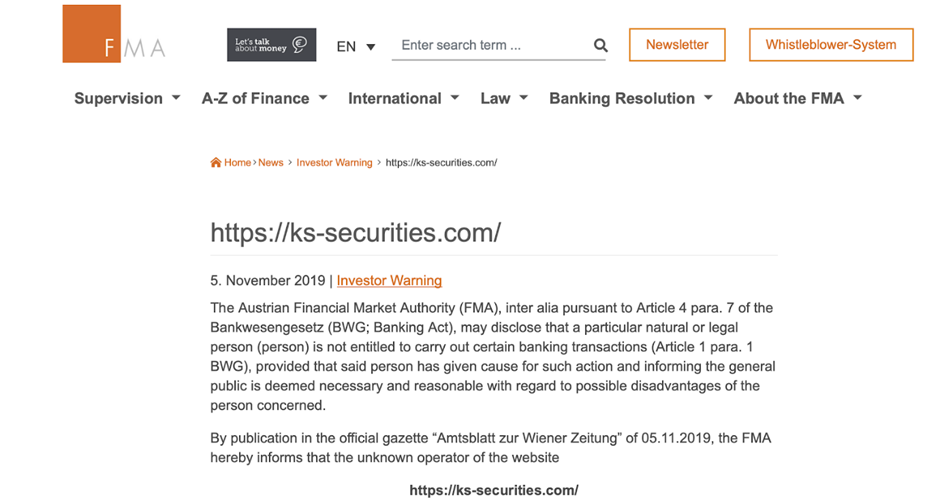

KS-Securities says that the brand is managed by the well-known Austrian company KS-Securities Vermögensverwaltung GmbH. The broker claims to be regulated by the local Financial Market Authority, and to have licenses from CONSOB in Italy and BaFin in Germany. But in fact, those are fake statements. The company has been declared fraudulent. At first, the Austrian FMA issued the corresponding warning:

The corresponding warning by the Austrian FMA

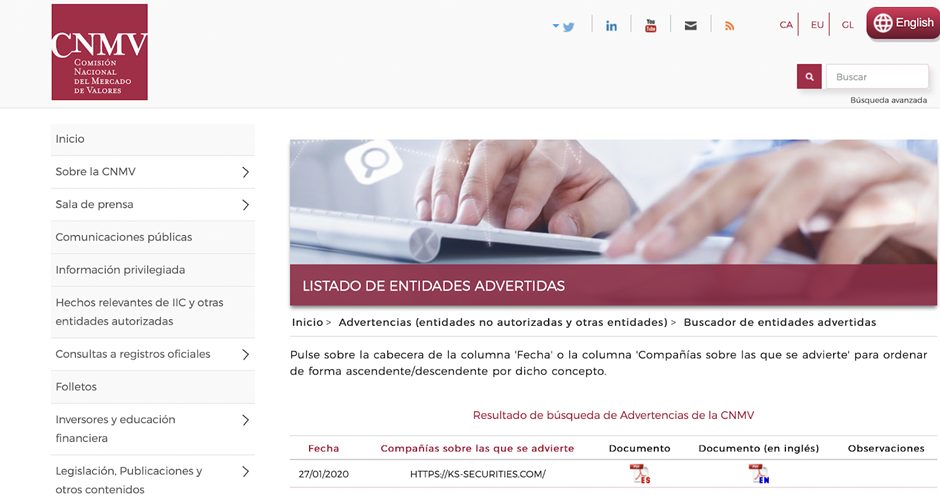

The next one to react was the Spanish regulator CNMV, also calling this broker a fraud:

The corresponding warning by the Spanish regulator CNMV

The main signs of fraud are the following:

lies about licensed business;

is on the blacklist of several regulators;

funds withdrawal is a scam;

full control of the platform by the con artists;

absence of normal client services;

exposing comments.

LibraMarkets

LibraMarkets offers access to trading currency pairs, indexes, cryptocurrencies, raw materials, and CFDs. The company lured beginners by promising to diversify their trading experience and promised favorable terms. The broker started working in 2018, and since then has caused a lot of harm to traders, which is shown by its tarnished reputation and by lots of negative comments on various web resources. Deceived clients were left with nothing because the company isn’t regulated. The main signs of fraud are the following:

the broker blocks accounts for no reason and denies access to clients’ profiles;

money disappears from accounts;

the company’s employees impose bonuses with enslaving terms of working off;

support service doesn’t respond to clients’ complaints;

after big losses, the company offers to deposit more money.

RMT500

RMT500 is a company from the Marshall Islands and started providing services in 2019. On the website, there’s no confirmation that the broker has all the necessary legal documents to do business. There are no minimum deposit requirements on the platform. The all-purpose MT4 is offered as its trading platform. Beginners are promised training programs, a personal manager’s help, daily market surveys, and an individual bonus program. The main signs of fraud are the following:

imposing bonuses and services of a personal manager, who acts exclusively in the interests of the company;

profit withdrawal problems;

paid-for glowing reviews on the broker’s website, which are not consistent with reality;

absence of normal client services;

controlled platform;

absence of regulation.

Atlantika

Atlantika is managed by Tradepoint Systems Ltd from Estonia. The company promises to work within the legal framework, but that has proven to be a lie because the Estonian financial inspection doesn’t have such an organization on its list. Moreover, the broker is already on the blacklist of regulators. In particular, the Italian CONSOB has issued a warning about the fraud.

The fake broker lures beginners by promising them comfortable and safe trading in currency pairs, commodities, stocks, and digital assets on excellent terms and on an advanced web platform. Traders also fall for the qualified support that should help increase their capital. But in fact, that’s a flat-out lie, which is shown by plenty of negative reviews. The main signs of fraud are the following:

absence of a financial business license;

on the blacklist of the reputable regulator CONSOB;

a lot of negative reviews;

secretive policy and anonymity of the project authors;

fake recommendations that lead to the loss of deposits;

no financial responsibility, or guarantee of stable work on the platform.

Royaltd24

The offshore company Royaltd24 based its business on false promises. The broker from the Marshall Islands provides services without a license and has already been put on the blacklists of several regulators, including the Italian CONSOB and the Nigerian Central Bank. Minimal losses in the project are $500. Potential victims were promised fantastic leverage of up to 400x, ultra-tight spreads, and a welcome bonus. The platform also provides Islamic accounts. The main signs of fraud are the following:

absence of legal authority to operate;

no information about liquidity providers;

impossible terms of working off bonus rewards;

controlled trading software, which allows it to manipulate quotations and nullify users’ deposits in record time;

hidden extortion. When a client tries to withdraw money, they demand clients to pay fake insurance, fees, and taxes;

negative reputation on the web.

Axiory

Axiory is a company from Belize, founded in 2014. The minimum entry deposit is set at $10. The broker offers access to transactions with currency pairs, stocks, and contracts for difference. Regulation is performed by the IFSC. According to data from the Traders Union, around 2.48% of the clients of this organization are Nigerian. The main signs of fraud are the following:

false information on the broker’s website;

trading discipline problems (disconnection of servers, transaction errors, slippages);

nonpayment of funds;

no client support;

unilateral refusal from cooperation;

negative reviews from former clients.

Forex CT

Forex CT is an Australian brand that started brokering in 2006 and is managed by Forex Capital Trading Pty Ltd. The company promised traders bonuses, free education, and around-the-clock support. MT4 and IFP were used as trading software. For a time, the organization was licensed by the ASIC. Now, Forex CT’s website is turned off, and the broker itself became fraudulent. The main signs of fraud are the following:

Failure to fulfill obligations;

Refusal to make payments;

Abnormal widening of spreads;

Tarnished reputation;

License annulment;

Trading process manipulations.

New Forex

This brokerage company has been providing services since 2014. It provides not only Forex trading but also a partnership program, learning, consulting on hedging, etc. The brand is managed by Finpark Ltd. The broker attracted beginners with a low barrier of entry, generous leverage, and a variety of payment methods. The company worked in 149 countries, including Nigeria. It got on the blacklist because of the non-fulfillment of obligations and money extortion. The main signs of fraud are the following:

a lot of negative comments;

support problems;

arranged trading platform errors and the flush of users’ deposits;

enslaving terms of working off bonus rewards;

groundless refusal to let clients withdraw profits.

Panteon Finance

Panteon Finance has been known since 2010. It presents itself as a broker in Forex trading and investments. The company is registered in Belize and has an IFSC license for providing services. At first, the broker was getting good reviews, but lately, there have been many complaints about technical problems and non-fulfillment of obligations. The broker got on the blacklists of many independent reviewers. The main signs of fraud are the following:

negative reputation among traders;

trading platform errors;

flush of deposits based on false recommendations from the company’s employees;

absence of payment discipline;

non-fulfillment of obligations;

low rankings on independent web resources;

100XFX

100XFX is a forex and CFD broker offering a variety of financial assets for trading, including forex currency pairs, commodities, precious metals, stocks, indices, and cryptocurrencies like bitcoin. The broker utilizes the popular MT4 platform and requires a minimum deposit of $500 to open an account. However, they do not provide a free demo account, which may impact transparency. Notably, 100XFX is owned by 100XFX Ltd., registered in St. Vincent and the Grenadines, but lacks regulatory licenses from reputable entities like the UK's FCA. Concerns about its legitimacy arise due to suspected fraudulent practices and the absence of proper licensing. The Italian regulator, CONSOB, has issued a severe warning against this broker.

The main signs of fraud are the following:

Suspicious claims of UK location without authorization or registration

Registered in St. Vincent and the Grenadines with lax regulations

Lack of transparency

Suspected scam broker without a valid license

CONSOB issued a serious warning

Misleading investors with fake credentials

CT-Trade

CT-Trade, founded in 2018 and based in St. Vincent and the Grenadines (SVG), is a relatively young broker. SVG's reputation for strict confidentiality and tax laws makes it an appealing location for forex brokers. However, caution is advised when dealing with unregulated online forex brokers operating within SVG.

CT-Trade offers trading services across multiple financial markets, including forex, stocks, commodities, and cryptocurrencies. The broker provides a user-friendly trading platform, educational resources, and customer support. Various account types, including a demo account, cater to different trader needs. While CT-Trade lacks regulation from financial authorities, it has established a reputable track record for offering dependable trading services.

The main signs of fraud are the following:

It is not regulated by any financial authority.

Has a poor reputation and negative reviews from traders.

Does not provide clear information about its ownership, management, or location.

Uses aggressive marketing tactics or promises unrealistic returns.

Requires a large initial deposit or charges high fees.

Does not provide adequate customer support or responds slowly to inquiries.

Engages in unethical or illegal practices, such as insider trading or money laundering.

BRFX Trade

BRFX Trade is a Forex broker that facilitates trading in forex, indices, commodities, and cryptocurrencies. The broker offers the widely recognized MetaTrader 4 platform, accessible across various devices. The platform offers mobile trading, Trading Signals, and Market services to enhance the trading experience. BRFX Trade prides itself on competitive spreads, fast execution, and top-notch customer support. A demo account is available for clients to practice trading without real money risk. It is vital to choose licensed and regulated brokers to avoid potential scams associated with unreliable MetaTrader 4 platforms.

The main signs of fraud are the following:

Guarantee enormous returns with no risks.

No regulation.

It is a clone company.

They don't provide proof of their legitimacy.

They ask for personal information that you don't fully trust.

Bad reputation or negative reviews.

Poor customer service.

Have hidden fees or charges

Offer unrealistic bonuses or promotions.

MaxCFD

MaxCFD is an online trading platform that facilitates the trading of various financial instruments, including stocks, indices, currencies, commodities, and cryptocurrencies. Through MaxCFD, investors can conveniently open, close, and manage their market positions using an online broker as an intermediary. One notable advantage of the platform is its ability to enable trading in both upward and downward-trending markets, allowing investors to potentially generate profits even during market volatility. MaxCFD offers a comprehensive range of investment options, including stocks, options, ETFs, and mutual funds, empowering investors to pursue their financial objectives. The platform provides user-friendly tools, intuitive platforms, and valuable market insights.

The main signs of fraud are the following:

Unsubstantiated claims about a product's efficacy

Misleading consumers via doppelgängers, such as fake dating profiles, phony followers, deep fakes, or chatbots

Scammers taking advantage of major events to create believable stories that will convince people to give them money

Requests for payment upfront before receiving a promised benefit

Poor quality presentation, grammar, and spelling in documents

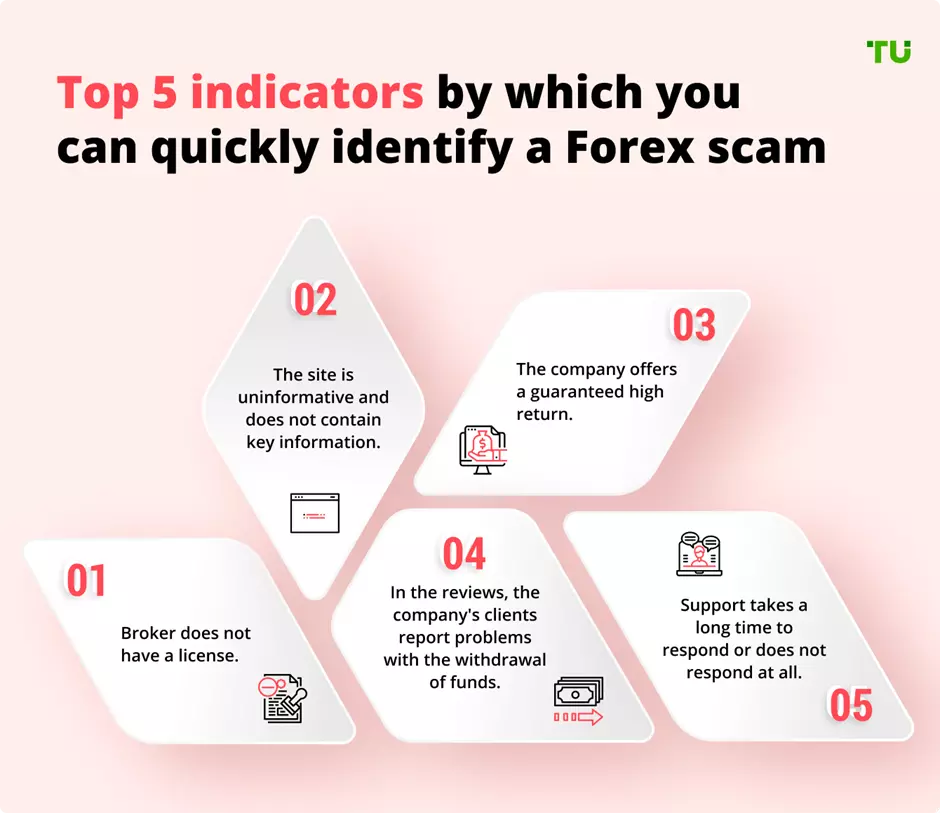

Check if a Forex broker is legitimate in 5 steps

The International Forex market attracts traders, but also scammers, who will not miss an opportunity to empty your wallet. The majority of scammers lure naïve investors with promises of exorbitant income, ‘assistance’ in trading, and good trading conditions.

Forex scams are increasing each year, with scammers coming up with new schemes to trick as many people as possible out of all their money, before a large number of revealing reviews appears on the Internet.

That is why before registering on a trading platform and entrusting a broker with your money, you need to perform a full analysis and evaluate all risk factors. This will help you avoid losing your money and find a truly worthy financial partner. Let’s discuss the key factors you need to consider when choosing a broker.

1. Check regulatory information about your broker

First, you need to check whether the company you are interested in operates legally in Nigeria. This is a guarantee that your broker will provide services in good faith and be held accountable in case of some illegal actions. A potential financial partner providing services in the RSA may also have licenses of reputable regulatory authorities from other jurisdictions (FCA, ASIC, BaFin, etc.).

Brokers operating legally do not try to conceal their legal documents, providing scanned copies of the certificate of incorporation, licenses. In the very least, a company should list the numbers of licenses on its website, so that traders could verify this information. Information about licenses can usually be found in the footer of a broker’s website or in a separate tab or section.

NOTE! Do not believe the provided information right away; always verify it!

2. Check the database on the regulatory authority’s website

You can check the broker's license directly on the website of the regulatory authority. You can search by the document number or company name. This will allow you to learn whether the company is regulated or not.

3. Get to know broker’s website

The next important step involves assessment of the broker’s website. Financial companies that are serious about working successfully with traders will provide the following information:

Project’s roadmap and strategic development plans;

Legal information and internal documents with clearly specified details of cooperation, and key rules;

Risk disclosure;

Specifications of contracts, indicating the minimum deposit, spreads, etc.;

Diversity of payment methods with specification of payment procedures and fees;

A good choice of channels to contact customer support: phone support, live chat, pages on social media, etc.).

4. Does a broker guarantee profit?

A broker cannot guarantee that you will earn a profit, as it acts solely as an intermediary between the Forex market and traders. Brokers are responsible for prompt execution of client orders, stable operation of the platform, quality analytical instruments and good advice from a personal manager, or customer support. The following should not be on a broker’s website:

Guarantees that you will earn a profit;

Promises of colossal profit in a short time and without specialized knowledge;

Stories about ‘unique’ earning algorithms and secret schemes.

5. Read customer reviews

Reviews of real clients can tell you a lot about a broker. If a company has many negative reviews (traders point to extortion, manipulation of trading process, issues with withdrawals and failure to perform obligations), it is best not to go with such a broker. You can find reviews of real clients on the Traders Union website, where users actively share their personal opinions and tell the truth about financial companies.

How To Avoid Forex Scams?

When engaging in Forex trading, it is crucial to be aware of the potential for scams and take measures to protect yourself. Here are several tips to help you avoid Forex scams:

Work With Regulated Companies

Prioritize trading with regulated brokers who are authorized and overseen by reputable financial regulatory bodies. These regulatory authorities set guidelines and monitor the activities of brokers to ensure compliance with industry standards. Research and verify the broker's regulatory status before opening an account.

Be Cautious of Unrealistic Promises

Exercise skepticism towards brokers or trading systems that guarantee high returns with little or no risk. Forex trading involves inherent risks, and there are no shortcuts to guaranteed profits. If an offer sounds too good to be true, it is likely a scam. Avoid falling for exaggerated claims or empty promises.

Conduct Thorough Research

Before opening an account with any Forex broker, research their background and reputation. Look for user reviews, testimonials, and ratings from independent sources to gauge the broker's reliability and credibility. Additionally, check if the broker has been involved in any fraudulent activities or has faced regulatory sanctions in the past.

Avoid Unsolicited Offers

Be cautious of unsolicited emails, phone calls, or social media messages promoting Forex investment opportunities. Scammers often use aggressive marketing tactics to lure unsuspecting individuals. Legitimate brokers typically do not engage in such unsolicited communication.

Educate Yourself

Gain a solid understanding of how Forex trading works, including risk management strategies, technical analysis, and fundamental analysis. By acquiring knowledge and skills, you can better assess the legitimacy of investment opportunities and make informed decisions.

The best Forex brokers in Nigeria

There are many brokers in Nigeria market ready to provide intermediary services. Choosing the best option is rather a challenge. Here is a brief review of the Top 3 trusted brokers in Nigeria that are regulated in this country and in other jurisdictions. These companies provide truly good trading conditions, perform their obligations in good faith and have received positive reviews.

| Name | Minimum deposit | Learn more |

|---|---|---|

eToro |

$200 |

|

Exness |

USD 10 |

|

XM |

USD 5 |

|

eToro

eToro is a broker that is popular not only in Nigeria, but also in many other countries (with geographical coverage of over 140 jurisdictions). The company was established in 2007 and is positioned as a social trading platform. The broker is regulated, with offices in different countries and licenses of the CySEC and FCA.

Key benefits:

-

Demo account to test your capabilities risk-free;

-

Actively developing trading community in Nigeria;

-

Regulated in UK, AU, South Africa and EU Broker;

-

-

User-friendly functionality for passive investing;

-

Many positive reviews;

-

The minimum copy trading amount is USD 1.

Exness

Exness is a trusted broker for trading a wide range of assets. The company was established in 2008 and enjoys popularity thanks to operating in good faith, having a client-oriented policy and an entry threshold that is comfortable even for beginners. You will never say that Forex is a scam if you work with this company.

Key benefits:

-

A physical office in the country;

-

Regulated in UK and EU Broker;

-

Segregated accounts that provide high security level for user funds;

-

Narrow spreads and low minimum deposit;

-

Demo account;

-

Several trading platforms to choose from.

ХМ

XM was established in 2009. The company provides services to traders from 190+ countries, including Nigeria. The broker has earned trust thanks to a client-oriented approach and concern for comfortable and safe trading. XM is constantly working to improve the quality of service. The company operates legally, and holds licenses of several reputable regulators.

Key benefits:

-

Regulated operation;

-

Demo account;

-

Competitive spreads;

-

More than 1,000 trading instruments;

-

No requotes; 99.35% of orders are executed instantly;

-

Multilingual support operating 24/5;

-

Zero deposit/withdrawal fees.

FAQs

How to identify a fraudulent broker

First, you need to check the blacklist kept by the local regulator. Fraudulent companies quickly get on it. Also, you should do a comprehensive analysis of your potential financial partner’s website. See if they have authentic legal documents (you can check that on the web resource of the regulatory body), and study clients’ comments and the quality of the commercial offer. Fair companies provide a road map and give information about their top managers and real seniority. Scammers try to keep a secretive policy and work with every potential victim individually.

Where to look for broker reviews?

Negative comments about a company are the first sign that it cannot be trusted. You shouldn’t believe the feedback posted on the broker’s website. It could be fake. Instead, look for reviews on independent and unbiased web resources, like the Traders Union.

Is Forex trading legal in Nigeria?

Yes, in Nigeria, the Forex market is completely legal. The brokerage business in the country is controlled by the Central Bank of Nigeria. Also, fair companies that provide services to local traders may have licenses from other reputable regulatory bodies.

What are the risks of working with fraudulent brokers?

Dishonest brokers bypass international laws. They can deceive you at any time. Such companies don’t fulfill their obligations, manipulate the trading process, and extort money. You can’t make money with a fake financial partner. Scammers are not going to pay out your profit and won’t even return your initial deposit.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.