How To Create A Winning Trading Plan | Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Trading plan guide in few steps:

Creating a trading plan is a critical step for any trader, whether you're just starting or are an advanced trader looking to refine your strategies. A well-structured trading plan helps you maintain discipline, make informed decisions, and ultimately, achieve trading success.

In this article, we'll guide you through seven essential steps to develop an effective trading plan and offer additional insights for both beginners and advanced traders.

Steps to a winning trading plan

A trading plan is essential because it provides a structured approach to trading, helping you avoid emotional and impulsive decisions. Traders who adhere to a structured plan are more likely to achieve consistent profits compared to those who trade without one.

Outline your motivation

Understanding why you want to trade is the first step in creating a trading plan. Are you trading to achieve financial independence, build a secondary income, or simply for the challenge? Identifying your motivation helps you set clear objectives and align your trading activities with your overall goals.

Here is a table comparing different trading motivations and goals:

| Trading motivation | Goals |

|---|---|

Financial independence | Achieve long-term financial freedom and self-sufficiency. |

Secondary income | Supplement primary income with regular trading profits. |

Career challenge | Master the complexities of trading and achieve personal growth. |

Wealth building | Accumulate substantial wealth through strategic trading. |

Hobby/Interest | Engage in trading as a passion while aiming for moderate profits. |

Define your time commitment

Your available time significantly impacts your trading style and strategy. It's crucial to determine how much time you can realistically dedicate to trading, considering your other commitments such as work, family, and personal activities.The amount of time you can commit will influence whether you should engage in day trading, swing trading, or position trading.

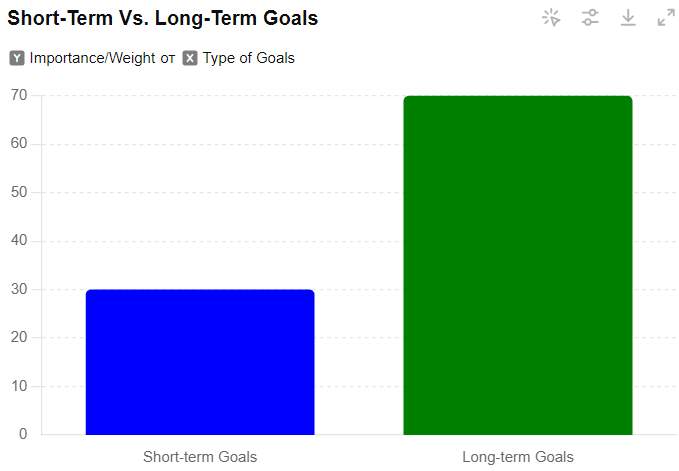

Set realistic goals

Setting realistic goals is a critical aspect of developing a successful trading plan. Achievable goals help maintain motivation, provide direction, and allow you to measure progress effectively. The key is to establish goals that are Specific, Measurable, Attainable, Relevant, and Time-bound (SMART).

Why SMART Goals Matter:

Specific: Clear and unambiguous, outlining exactly what you want to achieve.

Measurable: Quantifiable, allowing you to track progress and measure success.

Attainable: Realistic and achievable within your current resources and constraints.

Relevant: Aligned with your broader trading objectives and personal aspirations.

Time-bound: Defined with a clear deadline or timeframe.

| Type of Goal | Description | Example |

|---|---|---|

Realistic Goals | Achievable targets that consider market conditions and personal capabilities. | Increase trading capital by 5% each quarter. Achieve a 5-10% return on investment annually. |

Unrealistic Goals | Overly ambitious targets that may lead to frustration and poor decision-making. | Double your investment every month. Expect every trade to be a winner. |

Choose a trading strategy

Selecting the right trading strategy is a pivotal step in developing a robust trading plan. The strategy you choose should align with your time commitment, risk tolerance, and market knowledge. Each strategy demands different skills and approaches, so it's crucial to pick one that matches your personal style and objectives.

Key Trading Strategies:

Day Trading:

Overview:Day trading involves buying and selling financial instruments within the same trading day. It requires constant monitoring of the markets and quick decision-making.

Suitable For: Traders who can commit several hours daily to trading and are comfortable making rapid decisions based on short-term market movements.

Swing Trading:

Overview:Swing trading involves holding positions for several days to weeks, capitalizing on short- to medium-term price movements.

Suitable For: Traders who can analyze the market periodically and prefer less frequent trading compared to day trading.

Position Trading:

Overview:Position trading is a long-term strategy where traders hold positions for weeks, months, or even years, aiming to benefit from long-term trends.

Suitable For: Traders with a long-term perspective who cannot monitor the markets frequently.

Determine risk management rules

Effective risk management is essential for protecting your capital and ensuring long-term trading success. Start by defining your risk-reward ratio, aiming for at least 1:3, meaning risk $100 to make $300. Use stop-loss orders to automatically close trades if the market moves against you. For example, if you buy a stock at $50, set a stop-loss at $49 to limit losses. Set take-profit orders to secure gains, like selling at $60 if you bought at $50. Allocate your capital wisely, risking no more than 1-2% of your total trading capital per trade. This approach minimizes significant losses and enhances profitability. For instance, with $10,000, risk only $100-$200 per trade.

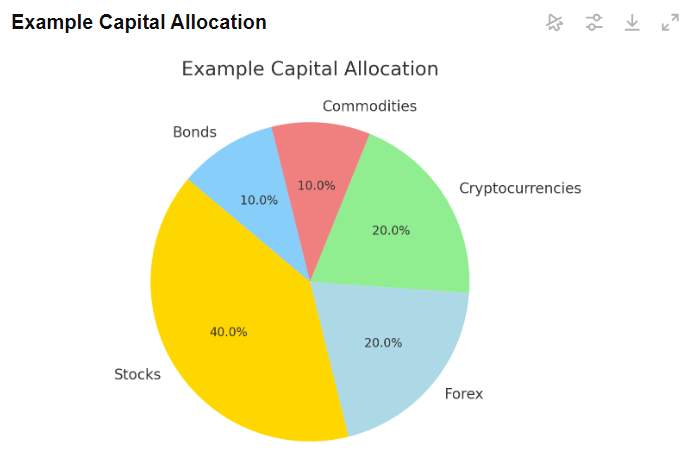

Decide on capital allocation

Allocating your capital wisely across different trades and markets can help mitigate risks and maximize returns. Diversification is key; don't put all your eggs in one basket. Assess your total available capital and decide how much to allocate to each trade and market segment.

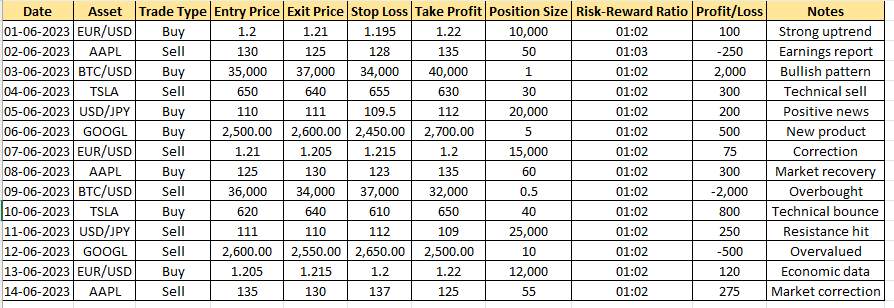

Keep a trading journal

Maintaining a trading journal helps you track your performance, analyze your trades, and identify areas for improvement. Record details such as entry and exit points, trade size, and outcomes. Reviewing your journal regularly can provide valuable insights into your trading behavior and strategy effectiveness.

Tips for beginners

Beginners should focus on simplicity and education. Start with basic strategies, use lower capital, and practice through demo accounts. It's essential to build a strong foundation before diving into more complex trading activities.

Simplicity in strategy selection

When you are just starting out, opt for basic strategies like trend following or breakout trading to avoid being overwhelmed.

Start with lower capital

As a beginner, it's wise to start with a smaller amount of capital. This reduces the risk of significant losses while you are still learning. Trading with lower capital helps you get comfortable with the mechanics of trading, including executing trades, setting stop-loss orders, and managing your positions, without the pressure of risking large sums of money.

Practice through demo accounts

Utilize demo accounts to practice trading with virtual money, which helps in understanding market dynamics and refining strategies without financial risk.

Here is a table of example best brokers with a demo account availability:

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

Max Spread EUR/USD, pips |

0,9 | 1,5 | 0,5 | 1,2 | 0,8 |

|

Regulation |

FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Focus on education

Learn the basics of technical and fundamental analysis. Use online resources, courses, and books to build your knowledge.

Build a strong foundation

Develop a trading plan that aligns with your goals and risk tolerance. Understand risk management techniques and the psychological aspects of trading.

Realistic expectations

Aim for achievable profits and understand that becoming proficient in trading takes time and practice. Avoid get-rich-quick schemes.

Risk management

Even as a beginner, you must incorporate risk management strategies from the start. This includes setting stop-loss orders to limit potential losses and never risking more than a small percentage of your trading capital on a single trade.

Seek guidance and mentorship

Join trading communities and seek advice from experienced traders to enhance your learning process.

Discipline is the cornerstone of successful trading

As a professional trader with many years of experience, I can tell you that the journey to trading success is paved with discipline, continuous learning, and adaptability. These elements are crucial in navigating the ever-changing markets and staying ahead of the game.

First and foremost, discipline is the cornerstone of successful trading. It’s easy to get caught up in the excitement of the markets, but it’s essential to stick to your trading plan. This means following your strategy meticulously, not deviating from your risk management rules, and maintaining a cool head even when trades don’t go as planned.

Adapting to market changes is crucial for long-term success. No single strategy works in all market conditions. For instance, a strategy that works well in a bullish market might fail in a bearish one. Being flexible and willing to adjust your trading plan based on market signals can help you stay profitable. This doesn’t mean abandoning your plan at the first sign of trouble, but rather tweaking and optimizing it to better align with current market realities.

Lastly, keep a detailed trading journal. Recording your trades, the rationale behind them, and the outcomes helps in self-evaluation. By reviewing your journal, you can identify patterns in your trading behavior, understand what works and what doesn’t, and make informed adjustments to your plan.

Success comes from a combination of disciplined execution, continuous education, and the ability to adapt to changing markets. Stay committed to these principles, and you’ll be well on your way to achieving your trading goals.

Conclusion

Trading can be challenging, but having a solid plan simplifies the process. Discipline, continuous learning, and adaptability are key. Start with clear goals and determine how much time you can commit to trading. Select the right strategy and implement effective risk management.

FAQs

What should I include in my trading journal?

Your trading journal should include details such as entry and exit points, trade size, the rationale behind each trade, and the outcome. Reviewing these details regularly helps in refining your strategies.

How do I handle emotional stress in trading?

Develop a routine that includes regular breaks, mindfulness exercises, and physical activity. Emotional stress can cloud judgment, so maintaining a balanced lifestyle is essential.

What tools can help me improve my trading plan?

Utilize trading platforms with robust analytical tools, backtesting features, and access to real-time market data. Additionally, consider software that offers risk management tools and automated trading capabilities.

How often should I review and update my trading plan?

Regularly review and update your trading plan to adapt to changing market conditions and personal growth. Continuous evaluation helps in refining your strategies and improving your overall trading performance.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.