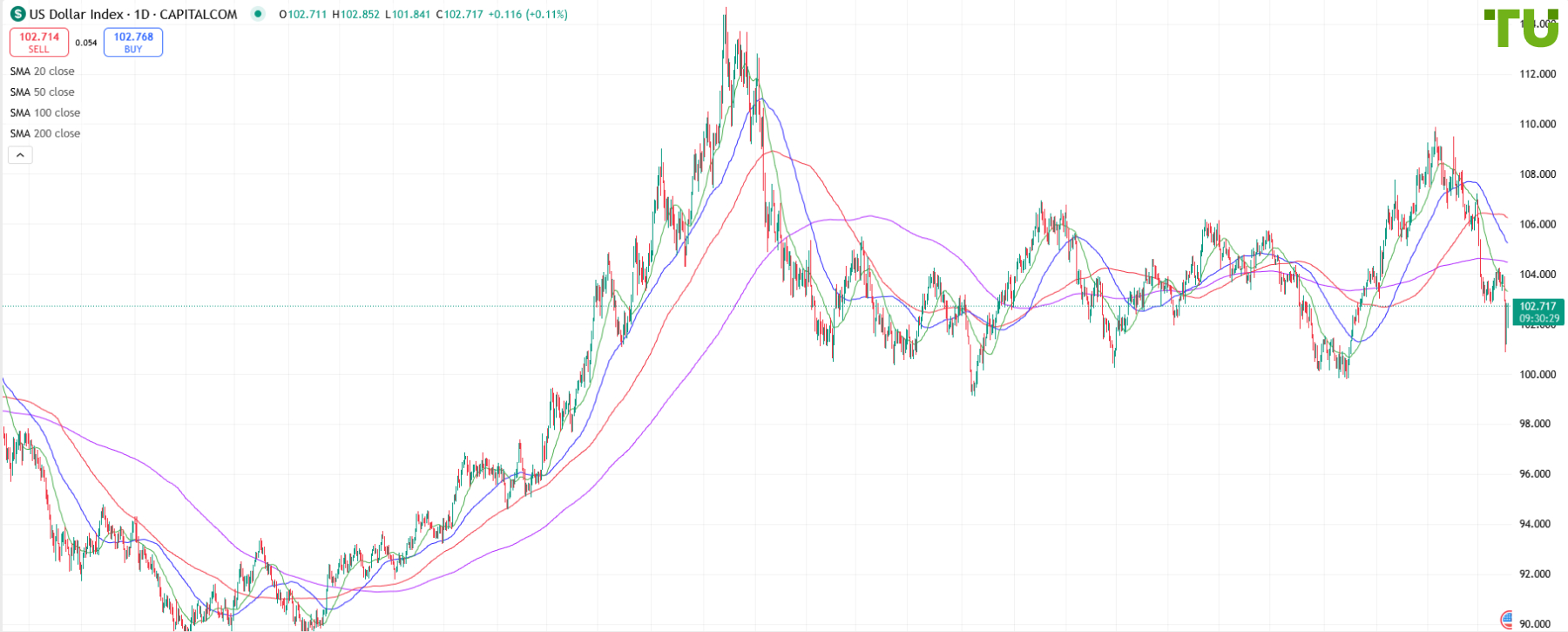

USD Index forecast by Traders Union analysts

The USD Index (USDX) is a measure of the value of the U.S. dollar relative to a basket of other major currencies, including the euro, British pound, Swedish krona, Canadian dollar, Japanese yen and Swiss franc. The countries issuing these currencies are key partners of the U.S. Therefore, the USD Index is a macroeconomic indicator showing the purchasing power of the U.S. dollar. Track the USD Index chart to see live price data, forecast for today and following trading days by TU analysts. This will help you make informed decisions and earn profit in the Forex market.

USDINDEX under bearish control

27.06.2025

USDINDEX trading mixed

30.05.2025

USDINDEX remains under bearish control

23.05.2025

USDINDEX still under pressure

16.05.2025

USDINDEX tested 100.45

09.05.2025

USDINDEX returns to 100.00

05.05.2025

USDINDEX recovers after the drop

25.04.2025

USD Index under selling pressure

18.04.2025

USD Index attempts to extend recovery after drop

07.04.2025

USD Index sold from 104.20

28.03.2025

USD Index in consolidation phase

21.03.2025

USD Index under bearish control

10.03.2025

USD Index sold on rise

03.03.2025

USD Index declines further

21.02.2025

USD Index sells off

14.02.2025

USD Index returns to 107.00 support

07.02.2025

U.S. Dollar Index recovering after drop

31.01.2025

U.S. Dollar Index continues correction

24.01.2025

U.S. Dollar Index attempting to avoid further decline

17.01.2025

U.S. Dollar Index maintains positive momentum

10.01.2025

USDINDEX trading mixed

27.12.2024

USDINDEX under pressure after rise

20.12.2024

U.S. Dollar Index rises again

13.12.2024

USDINDEX under pressure

06.12.2024

U.S. Dollar Index declines after rally

29.11.2024

U.S. Dollar Index soars to 107.72

22.11.2024

U.S. Dollar Index continues to rise

15.11.2024

U.S. Dollar Index rises following Donald Trump’s victory

08.11.2024

U.S. Dollar Index pressured but bought up on decline

01.11.2024

U.S. Dollar Index under pressure after rise

25.10.2024

Why is it important to know the USD Index forecast?

The USD Index is the most popular and heavily traded currency index, and a benchmark used to measure the value of the currency of one of the world’s largest economies. The USDX was first introduced in 1973 after the dissolution of the Bretton Woods Agreement. The index price is updated 24h with the exception of Saturdays and Sundays. Its significance is equated to such popular indices as DAX, Dow Jones, etc.

TU experts study the USD Index using instruments and methods of technical analysis. The price forecast is then made based on them.

Traders can use this measure to assess the condition and strength of the U.S. currency in the international arena. In the Forex market, the USD Index helps understand the expected trend on the price charts of currency pairs with the U.S. dollar. For example, if the index grows, there will be a bullish trend on the USD/CAD chart, and bearish trend on the EUR/USD price chart.