Best Discord Forex Trading Servers For 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best Discord Forex Trading Servers For 2025:

TraderBeast shares real-time signals. Ge t instant alerts for Forex and crypto.

Elite Trader Circle teaches basics. Le arn key trading concepts and strategies.

TradeGang mixes trading and business. Buil d skills for long-term profit.

BK Traders hosts daily live sessions. W atch experts analyze markets in real-time.

Forex MT4 CopyTrade automates trades. Follow top traders using MT4 tools.

Trade Hub is a global community. Connect with traders worldwide and share ideas.

Forex trading moves fast, and the potential for big returns keeps traders hooked — whether they’re seasoned pros or just starting out. But in a competitive market, having an edge matters. That’s where Discord trading servers can help.

These communities connect traders worldwide, sharing live Forex signals, market insights, and strategy discussions. Whether you're looking for trade ideas, tracking trends, or just exchanging thoughts with like-minded traders, Discord has become a go-to platform.

In this guide, we’ll check out some of the best Forex Discord servers, break down their benefits, and see why joining a trading community can be a game-changer.

Top Forex trading Discord servers

The Forex market runs 24/5, making it crucial for traders to stay updated with the latest trends and opportunities. Discord trading servers bring traders together, offering a space to share strategies, trading signals, and market updates in real time. These servers create a dynamic environment where traders can discuss setups, get trade ideas, and learn from each other.

Here are some of the best Forex Discord communities worth checking out:

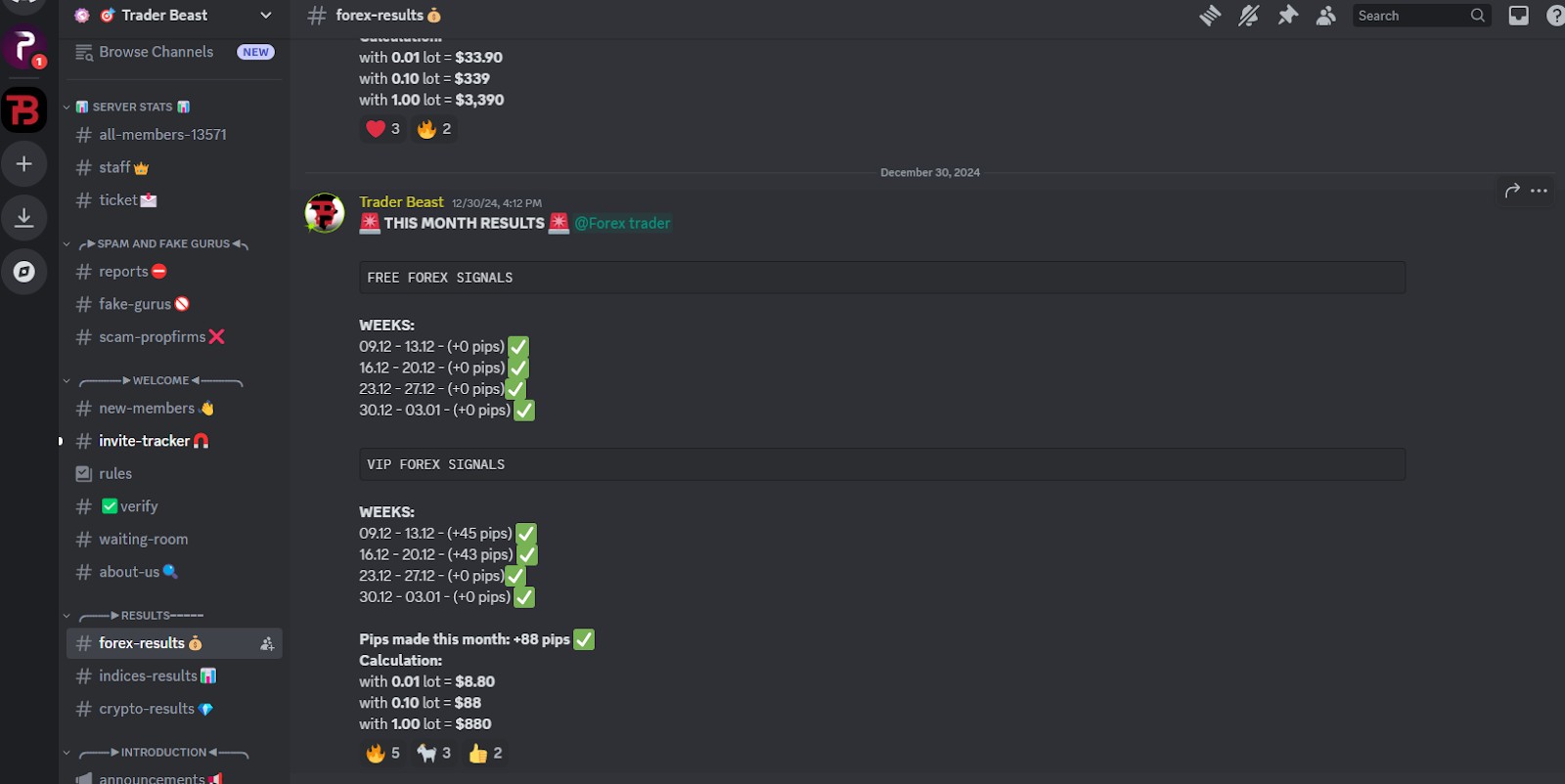

TraderBeast

TraderBeast offers a dynamic community for both Forex and Crypto traders, focusing on practical strategies and mentorship. It caters to all experience levels, providing valuable insights and real-time updates. This Forex Discord server is perfect for traders looking to access real-time signals and learn from experienced professionals

Key features

Real-time trading signals for Forex and Crypto markets.

Trading education with guides, webinars, and discussions.

Mix of free and paid membership options.

Elite Trader Circle

Focused on the basics of Forex trading, Elite Trader Circle is ideal for both beginners and experienced traders. The server emphasizes learning essential concepts, market dynamics, and trading terminology. This Discord server is ideal for Forex traders who want to strengthen their foundation in currency trading while engaging with like-minded individuals.

Key features

Educational content tailored for new traders.

Live discussions about Forex trading strategies and market movements.

Community support to help traders grow their skills.

TradeGang

TradeGang is a community built for growth in both Forex trading and entrepreneurship, with various subscription tiers. It emphasizes long-term success and strategy building. This Discord server is a great choice for traders who want to combine Forex knowledge with entrepreneurial growth.

Key features:

Exclusive channels for premium members.

Mentorship programs with experienced traders.

Focus on long-term success in both Forex and business.

BK Traders

BK Traders focuses on improving profits while minimizing risk through daily live trading sessions and market analysis. It’s perfect for traders who want consistent, real-time updates. Traders seeking real-time insights and a structured approach to increasing profits in Forex trading will find this Discord server interesting.

Key features:

Market analysis for diverse instruments like indices, gold, and oil.

Forex signals to guide decision-making.

Daily live trading sessions with expert traders.

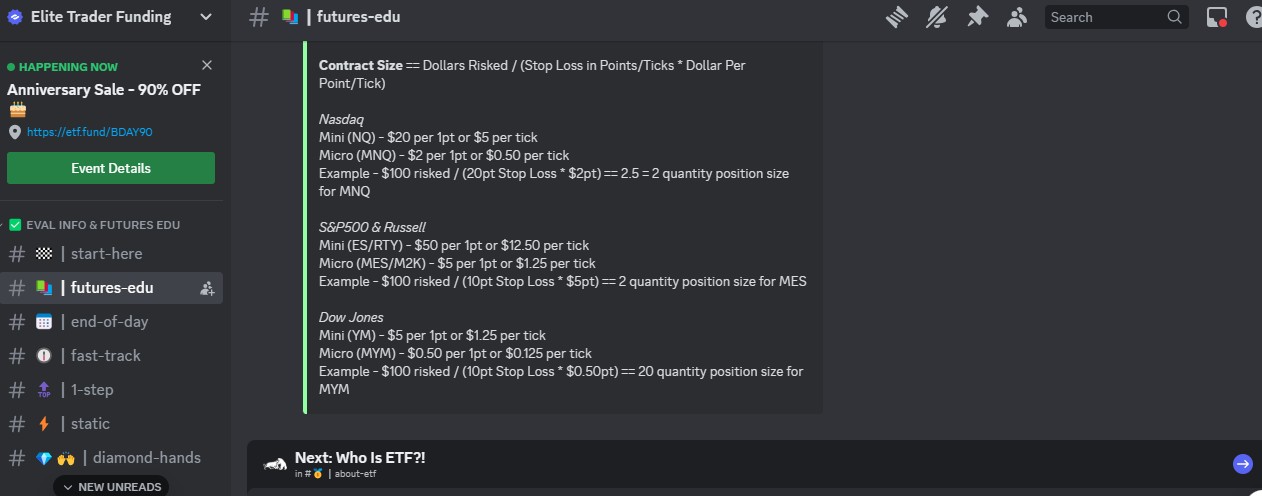

Forex MT4 CopyTrade

Forex MT4 CopyTrade focuses on MetaTrader 4 users, offering a platform for automated trading strategies. It’s geared towards traders who want to mirror successful professionals. This Discord is a great choice for those who prefer automated trading and want to mirror successful traders' strategies

Key features

Copy trading systems for MT4 users.

Live trade discussions to share strategies and insights.

Opportunities to follow successful traders in real-time.

Trade Hub

Trade Hub is one of the largest Forex trading communities with over 11,000 members, offering an active space for traders worldwide to connect and share strategies. This server is ideal for those looking for a large, vibrant Discord community with diverse perspectives in FX trading.

Key features:

Active discussions and a lively community.

Personalized trading dashboards for each member.

Opportunities for member engagement and collaboration.

FinSight

FinSight is a smaller community aimed at new traders, offering educational content, strategy chats, and market analysis. It is ideal for novices who wish to develop their abilities in a friendly setting or for those just beginning their Forex career and seeking a more personal community.

Key features

Educational content focused on Forex basics.

Broker support and IPO reports.

Focus on market analysis and strategy sharing.

How to choose the right Forex discord server

Finding the right Forex Discord server isn’t just about joining a big group. It’s about getting access to real insights, active discussions, and reliable traders who match your learning style.

Look for real-time trade calls. A good server should have experienced traders sharing live trade setups with clear reasoning, not just copy-paste signals.

Check engagement, not just numbers. A small, active community with real conversations is far better than a large server filled with spam or one-word responses.

Find accountability groups. Some servers have members who hold each other accountable for their trading plans, risk management, and emotional discipline.

Avoid “free signals” traps. Many servers offer free signals but push you to pay later. If there's no transparency on their track record, it’s likely a marketing gimmick.

See if they discuss broker execution. A real trading community talks about slippage, order execution speed, and broker reliability — not just charts and predictions.

Look for weekly trade reviews. The best servers have traders who analyze past trades, learn from mistakes, and improve strategies instead of just moving to the next setup.

Check if experts answer tough questions. A quality server has experienced traders willing to explain advanced topics like liquidity zones, market sentiment, and institutional order flow.

Notice the risk management culture. If no one talks about risk per trade, stop-loss strategies, or position sizing, it's not a server worth joining.

Why join Discord servers for Forex trading?

Joining a Forex Discord server isn’t just about trade signals — it’s about getting real-time insights from traders who are spotting moves before they happen. Some servers have bots that track big money movements, scan liquidity levels, and flag unusual price spikes in rare currency pairs. A few even connect with trading tools, letting members test strategies together. You won’t find this level of fast, data-driven analysis in regular trading courses.

- Pros

- Cons

Learn from hidden market patterns. Many experienced traders on Discord share unconventional technical analysis strategies, like liquidity voids and order block theories, that aren’t covered in typical courses.

Access real-time insider sentiment. Unlike news sites, Discord communities discuss market sentiment as it unfolds, helping you gauge how traders are reacting before price moves happen.

Find exclusive prop firm deals. Some servers have direct partnerships with prop trading firms, offering exclusive discounts or funding opportunities that you won’t find elsewhere.

Master risk through battle-tested tactics. Top traders often share their actual risk management plans, including unique position sizing methods based on live volatility changes rather than fixed stop losses.

Stay ahead with algo trading setups. Some members build and share customized trading bots, helping you automate strategies and adapt to market shifts before retail traders even notice.

Get instant feedback on trades. Instead of waiting for a mentor or backtesting for months, you can post your trades and get immediate insights from traders who specialize in your strategy.

Overload of conflicting signals. You might find multiple traders posting opposite trade setups at the same time, leading to confusion and hesitation in execution.

Echo chamber effect. Some groups reinforce bad trading habits by hyping unverified strategies, creating a false sense of security.

Hidden agenda of mentors. Some so-called experts give free advice to build trust, only to sell expensive courses, EAs, or signal services later.

Delayed market reactions. By the time a signal or analysis is shared, the market might have already moved, making the information unreliable.

Risk of emotional trading. Seeing others post big wins can create FOMO, pushing you into impulsive trades that don’t fit your strategy.

Lack of accountability. Many traders delete or ignore losing trade calls, making their track records look better than they actually are.

Using high-engagement Forex Discord servers to learn trade logic and access private strategies

Most newbies think joining a bunch of Forex Discord servers will help them trade better. The truth? More signals just mean more noise. Instead of bouncing between 10 different chats, stick to one or two with real engagement — where traders actually explain their moves, not just dump signals. Watch how the pros talk through their trades, tweak risk on the fly, and react to sudden market shifts. If you’re just copying signals without asking “why,” you’re setting yourself up for failure. The real edge comes from understanding how experienced traders think, not just mirroring their entries.

Another underrated hack? Getting into private test groups where traders drop early-stage strategies before they go public. The best setups don’t hit free chats first — they start in tight circles where high-level traders run backtests and fine-tune their game. Skip the general noise and hang out where pros actually share their raw trading process. Some servers even hold funded account contests, giving serious traders access to real capital. Competing in these can fast-track your skills and put you in rooms with traders who know how to win long-term.

Conclusion

Joining a Forex Discord server can be a game-changer. You get access to trading signals, experienced traders, and a community that actually gets what you're going through. But not all servers are worth your time.

Check out a few before settling in. Join conversations, see if the advice feels legit, and make sure it matches your trading style. A good server isn’t just about signals — it’s about real insights, helpful discussions, and a space where you can grow as a trader.

FAQs

Are Forex Discord servers suitable for beginners?

Yes, many Forex Discord servers cater to beginners by offering educational content, mentorship, and basic trading strategies. Look for communities that focus on teaching foundational concepts and providing support to new traders.

How can I find the best Forex signals on Discord?

Look for servers with a proven track record of accurate signals. Check for user reviews and ask members about their experience with the signals. Transparency and consistent results are key indicators of reliable signal providers.

Do I need to pay to join a Forex Discord server?

Many Forex Discord servers offer both free and paid membership options. Free members often have access to basic content, while paid members might get access to premium signals, mentorship, and advanced educational material.

Can I trust the advice given on Forex Discord servers?

While many servers offer valuable advice, it’s important to verify the information you receive. Always double-check signals and strategies before acting on them. Look for communities with transparent leadership and verified success to ensure the advice is trustworthy.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Proprietary trading (prop trading) is a financial trading strategy where a financial firm or institution uses its own capital to trade in various financial markets, such as stocks, bonds, commodities, or derivatives, with the aim of generating profits for the company itself. Prop traders typically do not trade on behalf of clients but instead trade with the firm's money, taking on the associated risks and rewards.