Fake Forex Brokers List In Pakistan 2025

Fake Forex brokers list in Pakistan:

Miki Forex (1998) – Unregulated broker with frequent withdrawal issues.

NetoTrade (2011) – Falsely claims regulation and manipulates prices.

Opteck (2011) – Uses aggressive sales tactics and restricts withdrawals.

Real Trade Group (2003) – Poor customer support and unverifiable licensing.

Vertical Markets (2015) – Promises false profits and raises scam alerts.

Pakistan, a populous South Asian nation, experienced rapid economic growth of around 7% annually in the 2000s, but the current landscape is more challenging, pushing many to seek alternative income sources. Forex trading has emerged as a popular option, often yielding higher returns than traditional bank deposits with low interest rates. While the country’s legal framework permits investors to engage in international currency trading and earn legitimately, the risk of falling victim to financial scams remains high.

To help traders navigate these dangers, Traders Union provides insights on identifying fraudulent brokers and presents a list of unreliable agencies to avoid.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Blacklist of Forex brokers in Pakistan

When selecting a brokerage firm, several key factors must be considered, including operational history, regulatory compliance, and the transparency of their financial services. However, one of the first steps should be checking the list of fraudulent Forex brokers to avoid potential scams.

Below is a table outlining blacklisted Forex brokers that have been flagged for malpractices. This list includes the year of establishment, minimum reported losses, and the primary reasons why these companies were deemed untrustworthy.

| Broker | Year Established | Minimum Reported Losses | Reason for Blacklisting |

|---|---|---|---|

| Miki Forex | 1998 | $20 | Unregulated, withdrawal issues |

| NetoTrade | 2011 | $500 | Fake regulatory claims, price manipulation |

| Opteck | 2011 | $250 | High-pressure sales tactics, withdrawal restrictions |

| Real Trade Group | 2003 | $20 | Poor customer support, unverified licensing |

| Vertical Markets | 2015 | $30 | False profit guarantees, scam alerts |

| YoutradeFX | 2007 | $100 | Trading manipulation, delayed withdrawals |

| ZarFx | 2013 | $500 | Ponzi scheme elements, false marketing |

| Adamant Finance | 2014 | $10 | Lack of transparency, misleading bonuses |

| AXEForex | 2017 | $100 | Fake testimonials, unregulated |

| Circle Markets | 2016 | $50 | License falsification, unreliable platform |

| InvesTeck | 2006 | N/A | Unverified company details, hidden fees |

| Aduno Capital | 2019 | N/A | Suspicious business model, unlicensed trading |

| Ultrontradefx | 2019 | N/A | Fake trading bots, account access issues |

| UproFx | 2018 | €250 | Fake regulatory certificates, scam warnings |

| WandaFx | 2019 | $1000 | Large-scale financial fraud, fund mismanagement |

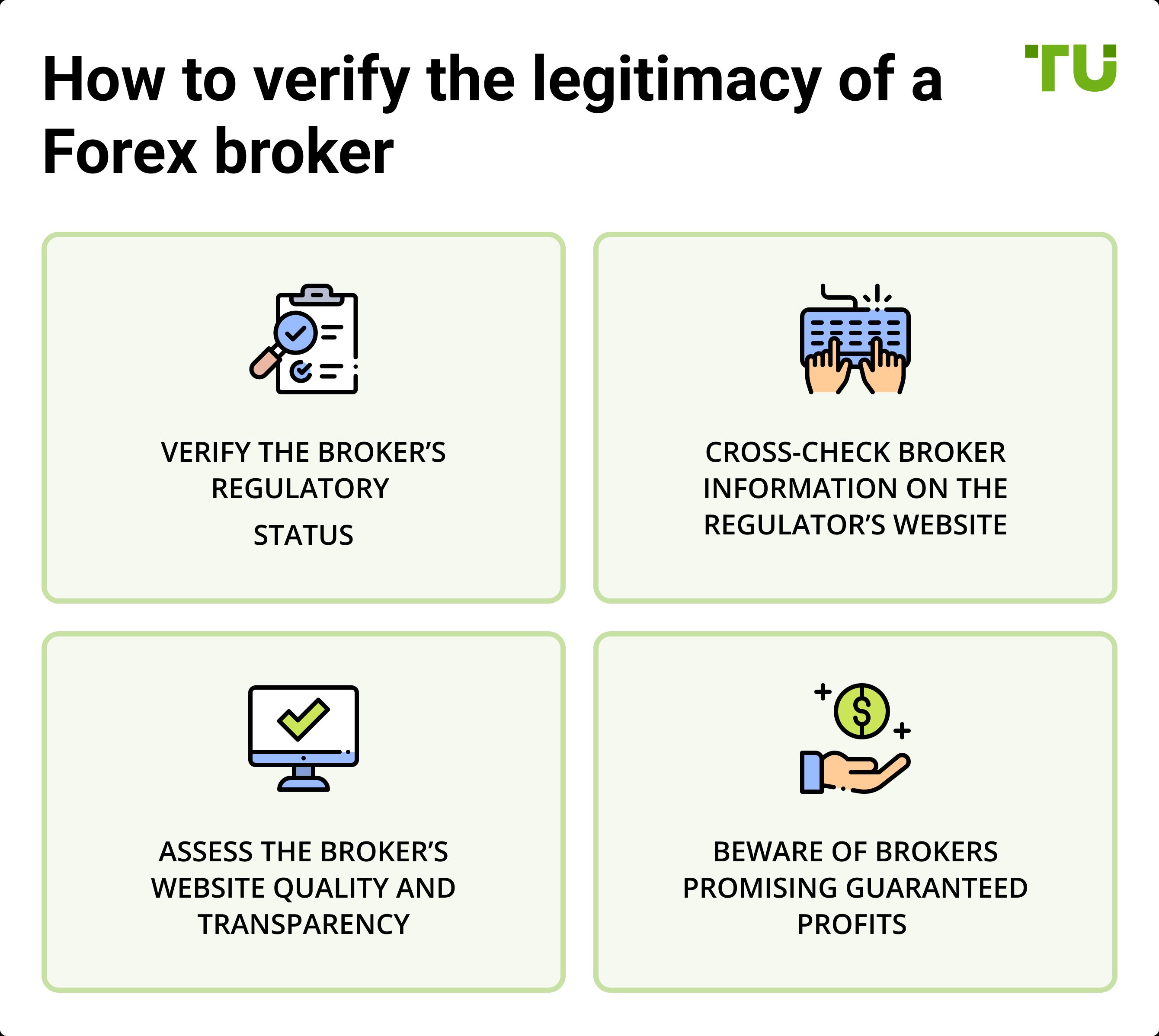

How to verify the legitimacy of a Forex broker: 5 essential steps

The Forex market is a highly attractive space for traders, but it also draws in scammers who are constantly developing new schemes to exploit unsuspecting investors. Many fraudulent brokers lure traders with promises of high returns, personalized trading assistance, and attractive conditions, only to disappear with their funds.

Each year, the number of Forex scams increases as fraudsters adapt their tactics, tricking traders before negative reviews expose them. This is why conducting a thorough background check on any broker before entrusting them with your money is crucial. Below are the key steps to verify if a broker is genuine and reliable.

Verify the broker’s regulatory status

The first and most crucial step is ensuring that the broker operates legally in Pakistan or other well-regulated jurisdictions. A licensed broker is accountable for its actions and must comply with financial regulations.

Many reputable brokers hold licenses from well-known financial authorities such as:

Securities and Exchange Commission of Pakistan (SECP).

Financial Conduct Authority (FCA) – UK.

Australian Securities and Investments Commission (ASIC).

Federal Financial Supervisory Authority (BaFin) – Germany.

Legitimate brokers do not hide their regulatory details. They usually display license numbers on their website, typically in the footer or under a dedicated section. However, do not take this information at face value — always verify it independently.

Cross-check broker information on the regulator’s website

Even if a broker claims to be licensed, always confirm their status by searching for their license number or company name on the official website of the regulatory authority. If the broker is not listed in the regulator’s database, it is likely unregulated and should be avoided.

Assess the broker’s website quality and transparency

A broker’s website is a strong indicator of its professionalism. Trustworthy financial firms provide clear, structured information, including:

Company roadmap & development plans. Outlining their long-term vision.

Legal documents. Clear terms of service, privacy policies, and compliance guidelines.

Risk disclosure statements. Transparent warnings about the risks involved in trading.

Trading conditions. Clear details on spreads, commissions, minimum deposits, and withdrawal policies.

Payment options. Transparent fee structures for deposits and withdrawals.

Multiple customer support channels. Such as phone, live chat, email, and social media.

If a broker’s website lacks transparency, has vague information, or is poorly structured, consider it a red flag.

Beware of brokers promising guaranteed profits

A real broker does not guarantee earnings because Forex trading carries inherent risks. Brokers act only as intermediaries, providing a trading platform, execution services, and market analysis.

Watch out for brokers that claim:

"Risk-free trading with guaranteed profits!"

"Huge earnings in a short time without any expertise!"

"Secret trading algorithms that guarantee success!"

These are clear indicators of a scam. Legitimate brokers focus on order execution, technical support, and risk management tools, not on unrealistic promises.

5 expert tips to avoid Forex scams

To protect yourself from fraudulent brokers, follow these five crucial steps:

Only trade with licensed brokers. Ensure that the broker is authorized by a reputable regulator such as SECP, FCA, or ASIC.

Always verify claims independently. Do not trust website information blindly; confirm details through research and regulatory websites.

Check multiple review sources. Rely on third-party review sites like Forex Peace Army or Trustpilot, not just testimonials on the broker’s website.

Test customer service responsiveness. If a broker ignores support requests or takes too long to respond, it’s a major red flag.

Avoid brokers making unrealistic promises. If a broker guarantees profits, they are likely running a scam. Forex trading involves risk, and no earnings are assured.

By following these steps, you can avoid fraudulent brokers and choose a legitimate, secure financial partner. Always perform due diligence before depositing funds or opening an account, and if anything seems suspicious, trust your instincts and move on.

| Available in Pakistan | Demo | Min. deposit, $ | Max. leverage | ECN Spread EUR/USD, avg, pips | Investor protection | Regulation level | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | 10 | 1:2000 | 0,1 | €20,000 £85,000 | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | Yes | 5 | 1:1000 | 0,2 | £85,000 €20,000 | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | Yes | 10 | 1:500 | 0,2 | No | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 1:500 | 0,1 | No | No | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | 1:500 | 0,3 | No | Tier-1 | Open an account Your capital is at risk. |

Forex trading regulations in Pakistan

Forex trading in Pakistan is legal and operates under a regulatory framework designed to ensure market integrity and investor protection.

Regulatory authorities and oversight

The primary regulatory bodies overseeing Forex trading in Pakistan are.

State Bank of Pakistan (SBP). As the central bank, SBP regulates foreign exchange activities, including Forex trading, to maintain financial stability and prevent illicit activities such as money laundering.

Securities and Exchange Commission of Pakistan (SECP). SECP oversees the licensing and regulation of Forex brokers and trading platforms, ensuring they comply with established standards to protect investors.

Licensing and regulatory framework

Forex brokers operating in Pakistan must obtain licenses from the SECP. The licensing process involves meeting specific criteria and adhering to regulatory requirements set by the SECP. This ensures that only qualified entities offer Forex trading services, promoting a secure trading environment.

Investor protection measures

To safeguard investors, the SECP has implemented several measures.

Regulatory oversight. Continuous monitoring of Forex brokers to ensure compliance with laws and to address any misconduct or fraudulent activities.

Disclosure requirements. Mandating brokers to provide clear and accurate information about the risks associated with Forex trading, enabling investors to make informed decisions.

Client fund protection. Requiring licensed brokers to segregate client funds from their operational funds, protecting investor assets in case of broker insolvency.

Taxation of Forex trading

Profits from Forex trading in Pakistan are subject to taxation. Key points include.

Taxable income. Earnings from Forex trading are considered taxable income and must be reported to the Federal Board of Revenue (FBR).

Tax rates. Forex trading profits are taxed at progressive personal income tax rates, ranging from 7.5% to 35%, depending on the total taxable income.

Filing requirements. Traders are required to file annual tax returns, detailing all trading activities and profits. Maintaining accurate records of transactions is essential for compliance and potential audits.

It's advisable for traders to consult with tax professionals to ensure compliance with current tax laws and to take advantage of any applicable deductions or benefits.

Legitimate brokers never promise guaranteed profits

I’ve seen countless traders fall victim to fraudulent brokers simply because they didn’t conduct proper due diligence. The most common mistake I’ve noticed is that people trust a broker solely based on aggressive marketing, attractive bonuses, or so-called "expert recommendations" on social media.

From my experience, legitimate brokers never promise guaranteed profits — instead, they focus on providing a secure trading environment, fair market conditions, and transparent withdrawal policies. Every trader should verify a broker’s regulatory status before investing. I always check a broker’s license directly on the regulator’s official website, as many scam brokers fake regulatory claims to appear legitimate.

Another major red flag is the withdrawal process. I’ve encountered brokers that allow easy deposits but suddenly introduce "verification issues" or hidden fees when traders try to withdraw their funds. This is why I always test withdrawals with a small amount before committing significant capital.

The truth is, Forex trading is already risky — there’s no need to add extra risk by choosing the wrong broker. If a broker has multiple complaints about withdrawals, account suspensions, or manipulation of trades, I avoid them altogether. In this industry, it's better to be cautious than to lose money to a scam.

Conclusion

Choosing the right Forex broker is crucial for a secure and profitable trading experience. With the rise of fraudulent brokers, traders must take extra precautions to avoid falling victim to scams. To protect yourself, always verify the broker’s regulatory status, research their reputation through independent review platforms, and be skeptical of unrealistic profit guarantees.

A legitimate broker will provide clear trading conditions, transparent fees, and responsive customer support. By staying informed and conducting due diligence before depositing funds, traders can significantly reduce their risk and focus on developing a sustainable trading strategy rather than worrying about broker fraud.

FAQs

How can I determine if a broker is trustworthy?

A reliable broker operates legally and holds a valid license from a recognized regulatory authority, such as the Securities and Exchange Commission of Pakistan (SECP) or another reputable international regulator. To confirm the legitimacy of a broker, always verify their licensing details on the official website of the respective regulatory body.

What tactics do fraudulent brokers use to scam traders?

Fake brokers primarily target inexperienced traders who lack financial expertise. These scammers often avoid providing verifiable legal documents, relying instead on persuasive claims to gain trust. They create an illusion of professional trading while ultimately deceiving traders and stealing their deposits.

How can I identify a fraudulent broker?

Before signing up with a broker and depositing funds, conduct a thorough evaluation of their website’s structure, verify the authenticity of their regulatory documents, and review feedback from actual users. This due diligence helps in assessing the broker's legitimacy and avoiding potential scams.

Who regulates Forex trading in Pakistan?

Forex trading is legal in Pakistan, and traders should only engage with brokers that are licensed by the Securities and Exchange Commission of Pakistan (SECP) or another well-established financial authority. Choosing a regulated broker ensures compliance with financial laws and better protection for traders.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).