Forex scammers list in South Africa

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

South Africa is considered one of the top trading places in the world, with the trader community developing rather well in recent years. The number of those wanting to earn money in the international financial market is rising, but so is the number of scammers. In this article, you will find the Forex Scammer List South Africa, learn about the basic signs of a scam and the fraudulent schemes that are used.

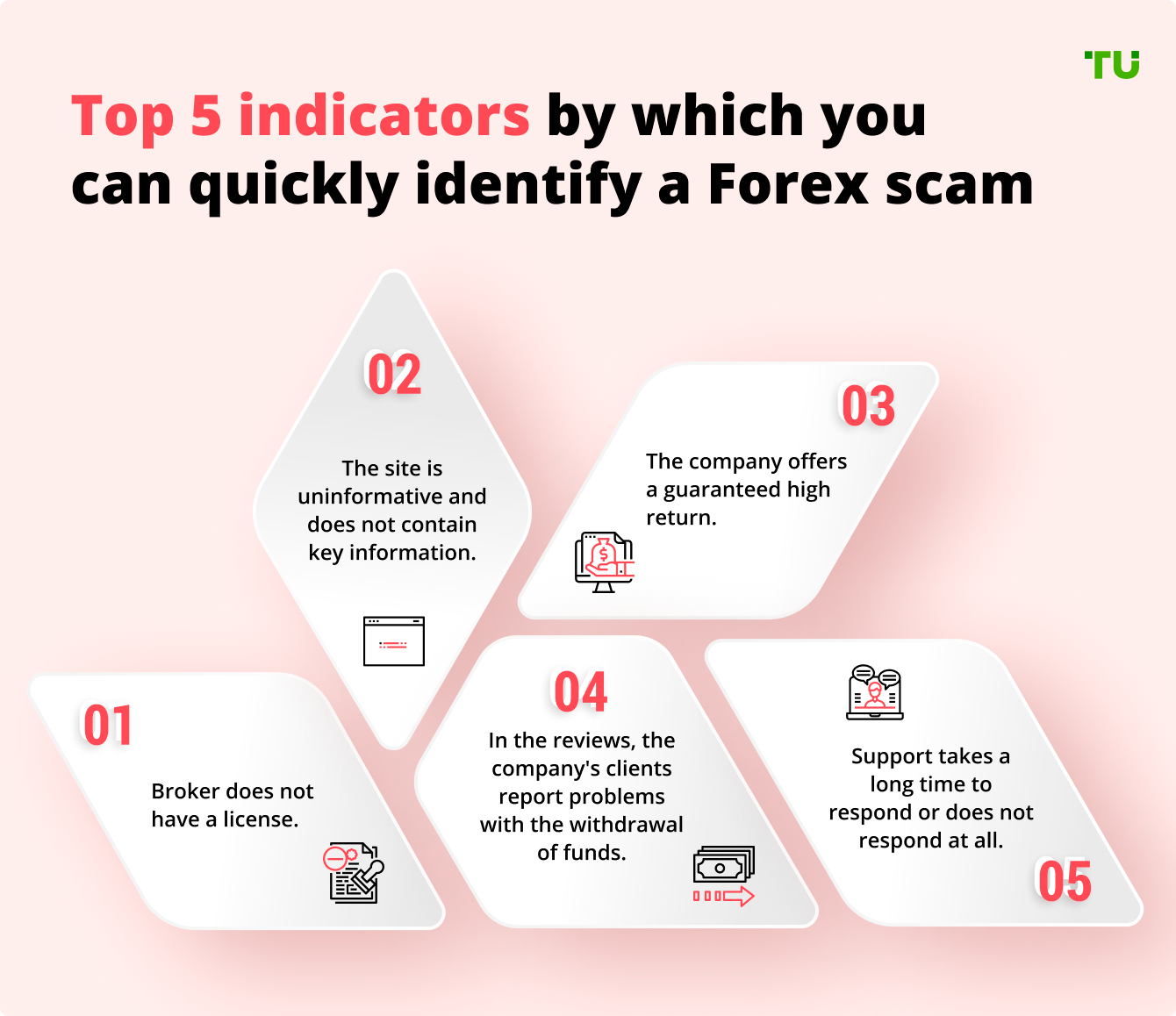

5 indicators of a forex broker scam

5 indicators of a forex broker scamRules and Regulation

Forex regulation in South Africa

The Financial Sector Conduct Authority (FSCA) oversees financial institutions, including Forex brokers, in South Africa. However, the FSCA does not issue licenses to Forex brokers. Forex trading at the federal level is not directly supervised in South Africa.

Investor protection in South Africa

At the governmental level, South Africa regulates the Forex market to some extent, but investors may not receive direct protection from the government. However, investor safeguarding can be sought through international organizations to which Forex brokers may belong.

Taxation in South Africa

In South Africa, traders are subject to income tax on Forex gains, typically at a rate ranging from 18% to 45%. Value Added Tax (VAT) may also be applicable to professional traders.

Forex Scam Broker List in South Africa

90% of novice traders who decided to try Forex trading lose their money. There are several reasons for that: lack of skill to correctly dispose of money, risky transactions, lack of knowledge of technical and fundamental analysis, etc. However, the most frequent reason for novice traders to lose their money is scam Forex brokers, who do not miss an opportunity to get into your wallet and get all your money. We have prepared a Forex Broker Blacklist in South Africa. Here are Top 10 companies that certainly cannot be trusted.

| Name | Date of establishment | Minimum losses |

|---|---|---|

| 24FX | 2013 | $200 |

| Forex-Metal | 2014 | $1 |

| 4XP | 2012 | $200 |

| 770capital | 2021 | $500 |

| ACFX | 2016 | $50 |

| Adamant Finance | 2021 | $200 |

| DV Markets | 2013 | $0 |

| FXcast | 2017 | $200 |

| GAINSY | 2017 | $10 |

| FinFx | 2015 | $100 |

| UFX Markets | 2007 | $10 |

| Panamoney | 2020 | $30 |

| NetoTrade | 2010 | $500 |

| TradInvestor | 2018 | 2500 EUR |

| MYteamFX | 2009 | $500 |

24FX

24FX is registered in Cyprus and is a part of a large financial group Rodeler that has been providing services for over 13 years. Unlike many other scammers, this company is officially registered and has a CySEC license. This, however, did not stop it from scamming traders. You can find revealing reviews on various independent forums. The key signs of a scam are as follows:

Failure to perform obligations to partners and clients;

Refuses user requests for money withdrawals;

This Forex scam received many negative reviews;

Psychological pressure;

Extortion and intimidation of clients.

Forex-Metal

Forex-Metal was established in 2004, registered in the territory of Panama. The company was regulated by the FSA and CySEC. The broker did not have a license in South Africa; it became a scam in 2014. The clients were attracted by the low minimum deposit, multilingual support and generous bonuses. The key signs of this scam are as follows:

Company representatives gave false advice;

Regular slippages and abnormal widening of spreads;

Impossible conditions for using bonuses;

Manipulated trading platform;

Blocking of accounts without a reason.

4XP

4XP was established in 2009 and even obtained a license of the CySEC for legal activity. Forex Place Ltd is the mother company. The broker provided access to trading a wide range of assets ( currency pairs, CFDs, binary options, etc.). The broker’s license was revoked due to improper performance of obligations and low quality of service provision to traders. In 2016, police raided the office of 4XP in Israel. The broker was found to be a participant of a large fraudulent scheme, with average loss per victim exceeding EUR 100,000. The key signs of the scams are:

Numerous complaints of former customers;

Litigations;

Phone scam;

Refusal to allow traders to withdraw their money;

Revocation of the license.

770capital

770capital is also on the list of Forex Scam Brokers. The broker positioned itself as a modern intermediary for working in the financial markets and actively promoted its offer. The company began operating in 2009 and quickly increased its client base in different countries, including the Republic of South Africa. The broker attracted traders with promises of profitable trading and a wide choice of instruments. 770capital is an unlicensed and unregulated financial partner that stopped performing its obligations and was placed on the blacklists of many independent review websites. The minimum loss in the project is USD 500. The key signs of this bucket shop are:

Hidden fees and forcing users to pay a fake insurance;

Refusal to allow traders to withdraw their income;

Rigged technical failures and draining of user deposits;

Fake advice and forecasts;

Low qualification and poor attitude of company employees;

No regulation.

ACFX

The ACFX brand is operated by Atlas Capital Financial Services Limited, a Cyprus-based entity. The broker was established in 2007. Initially, the company obtained a license of the CySEC, but in 2016 the license was revoked for failure to perform obligations and scamming its customers. The company concealed this information and continued to operate without the license. The scam broker lures traders with a demo account, generous leverage of up to 500x, powerful education section and welcome bonuses. The key signs of this scam are:

Revocation of the license and concealment of information about it;

Poor customer service;

Repeated change of domains;

Blocking of accounts of traders who earn a profit and request its withdrawal;

Refusal of withdrawal requests.

Adamant Finance

Adamant Finance was positioned as a brokerage organization providing direct access to the Forex market. Traders were promised an opportunity to trade without intermediaries, latest technologies and the best prices. The company was established in 2014 and was not regulated. It became a scam in 2021. The key signs of this scam are:

Use of no-deposit bonus as a bait;

Regular technical failures of the trading platform and slippages;

Phone scam;

A lot of scammed traders;

Extortion and manipulation of the trading platform.

DV Markets

DV Markets is owned by Forex Financial Services Pty, based in Australia. The company was established in 2008. The broker claimed that it had the license of a reliable regulator – the ASIC, but that turned out to be a lie. The Australian address of DV Markets is also false. This Forex Scam Broker in South Africa attracted novice traders with a demo account for risk-free testing of skills, floating spreads, flexible leverage up to 400x and micro lot trading. The key signs of this scam are:

Draining deposits on a manipulated platform;

A lot of negative reviews;

False license;

Refusal of withdrawal requests;

Repeated change of domains;

Blocking of accounts without a reason.

FXcast

Fxcast began its operation in 2005 and was positioned as the first fully automated Forex broker. Despite that the company claimed to have transparent policy and to be client-oriented, it conducted unregulated activity. This is an offshore company that lured novice traders with fantastic leverage of up to 2000x, possibilities for active trading and passive income earning, ultra-narrow spreads from zero. Traders were guaranteed quality services, while de-facto the broker did not perform its obligations and was placed on the blacklists of many independent review websites. The key signs of this scam are:

Many withdrawal requests remained unanswered;

Company employees arbitrarily performed unprofitable transactions on behalf of clients;

No regulation and access to liquidity providers;

Blocking of accounts without a reason;

Outright rudeness of company employees;

Controlled platform for draining user funds.

GAINSY

GAINSY claims that the broker started working when Forex trading was only starting to gain momentum. According to the legend, the company was established by highly professional traders who tried to make trading as comfortable and safe as it could be. Despite the claims of being established in 1998, the website of the company was registered only in 2012. The broker’s headquarters are located in Hong Kong, although some independent sources mention St. Vincent and the Grenadines. GAINSY does not have a brokerage license. The scam broker lured novice traders with bonuses and a low entry threshold. The following points to a scam:

Enslaving conditions for using bonuses;

Abnormal behavior of the trading platform;

Outdated quotes;

Blocking of withdrawals;

No regulation;

Many negative reviews;

No communication with customer support.

FinFx

FinFx is a scam broker that became a scam in 2015. It was positioned as a well-known Finnish company that provided access to trading currency pairs and commodities through ECN. Traders were promised a low minimum deposit, opportunities for margin trading (leverage 1:200), floating spreads from zero. The broker stopped performing its obligations to partners and clients and was added to the blacklists of independent reviewers. The company is not regulated, as the Finnish regulator revoked its license. The key signs of this scam are:

No license;

No support and outright rudeness of customer support;

Manipulation of the trading process;

Pseudo-managers of PAMM, who drain other people’s deposits;

Blocking of accounts without a reason;

Denial of withdrawal requests;

Links to other scam projects (Win Capital).

UFX Markets

UFX Markets has a reputation in the Forex sector for indulging in forex trade scams. Traders have claimed a variety of problems, including false advertising, unlawful trading, and difficulties withdrawing funds.

One of the major issues with UFX Markets is their lack of transparency and refusal to respect withdrawal requests. Many traders have been unable to access their cash, resulting in substantial financial losses.

Furthermore, unlawful trading on clients' behalf has been documented, indicating a violation of trust and unethical activity.

The firm uses aggressive marketing tactics to entice naive traders with promises of large profits and exclusive trading opportunities. These assertions, however, should be treated with utmost care.

When dealing with UFX Markets, it is critical to exercise utmost caution and properly investigate any broker or trading platform before investing.

Panamoney

Panamoney was a Forex investment program that promised high profits but was a Ponzi fraud. When the scam failed, several investors lost large sums of money. The scheme imploded when it became clear that finances from new investors were being utilised to pay returns to early investors.

This serves as a harsh warning to use caution and scepticism when considering high-return investment possibilities. Before contributing cash to any investment program, it is critical to properly study and verify its legality.

NetoTrade

NetoTrade has been accused of several fraudulent practices. Fund withdrawal concerns, deceptive advertising claims, and misleading trading advice have all been reported by traders.

Concerns have been raised concerning the safety of investors' funds due to a lack of effective regulation and control. It is important to choose a trustworthy Forex broker who is authorised by recognized organisations to protect the security of your funds.

TradInvestor

TradInvestor is a Forex investing platform that has been accused of fraudulent practices. Many investors have claimed large losses and issues withdrawing their funds.

To entice potential investors, the firm has been known to use aggressive marketing practices, including making exaggerated claims.

To say the least, the withdrawal platforms are less encouraging. Not only does the broker provide some of the most antiquated platforms, such as bank wire and credit cards, but it also has a minimum withdrawal amount of $100. This demonstrates that the broker does not want you to receive your earnings anytime you desire.

MYteamFX

MYteamFX is yet another Forex trading firm that has been accused of fraudulent activity. First impressions are important, and MYteamFX's website does not leave us with a favorable taste in our mouths.

The content distribution is hazy and restricted. Because there is no number connected, it is extremely difficult to obtain crucial information such as the comparison of trading accounts or the legality of licenses.

Unauthorized trading, false information, and issues withdrawing cash have all been reported by traders. Concerns about the company's legitimacy are heightened by a lack of regulation and transparency. When selecting a Forex broker, it is critical to choose one that is licensed and provides transparency and safety for your assets.

How to check if a Forex Broker is legit in 5 steps

The International Forex market attracts traders, but also scammers, who will not miss an opportunity to empty your wallet. The majority of scammers lure naïve investors with promises of exorbitant income, ‘assistance’ in trading, and good trading conditions.

Forex scams are increasing each year, with scammers coming up with new schemes to trick as many people as possible out of all their money, before a large number of revealing reviews appears on the Internet.

That is why before registering on a trading platform and entrusting a broker with your money, you need to perform a full analysis and evaluate all risk factors. This will help you avoid losing your money and find a truly worthy financial partner. Let’s discuss the key factors you need to consider when choosing a broker.

1. Check regulatory information about your broker

First, you need to check whether the company you are interested in operates legally in South Africa. This is a guarantee that your broker will provide services in good faith and be held accountable in case of some illegal actions. As a reminder the Financial Sector Conduct Authority (FSCA) is the main regulatory body in South Africa. A potential financial partner providing services in the RSA may also have licenses of reputable regulatory authorities from other jurisdictions (FCA, ASIC, BaFin, etc.).

Brokers operating legally do not try to conceal their legal documents, providing scanned copies of the certificate of incorporation, licenses. In the very least, a company should list the numbers of licenses on its website, so that traders could verify this information. Information about licenses can usually be found in the footer of a broker’s website or in a separate tab or section.

NOTE! Do not believe the provided information right away; always verify it!

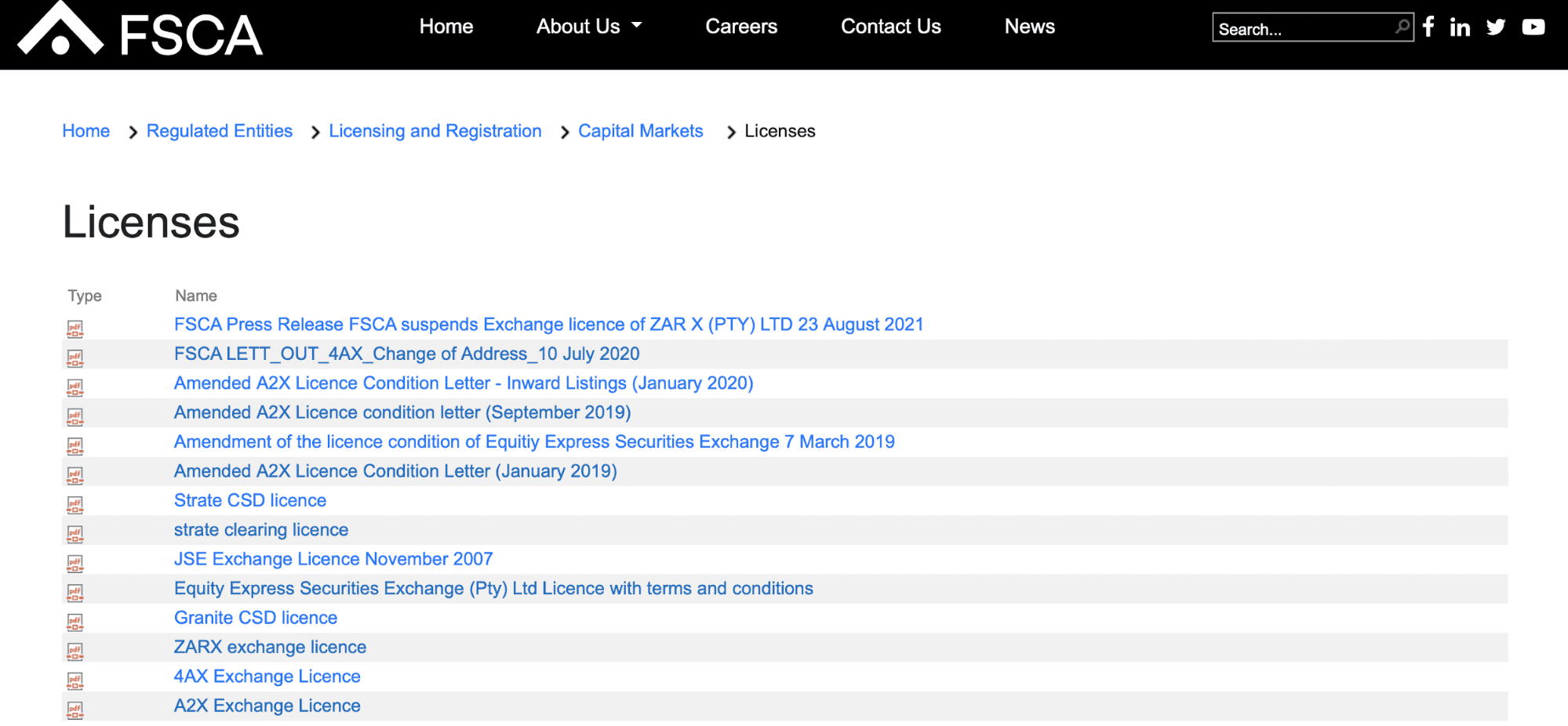

2. Check the database on the regulatory authority’s website

You can check the broker's license directly on the website of the regulatory authority. You can search by the document number or company name. This will allow you to learn whether the company is regulated or not. Here’s how the licensing section looks like on the FSCA’s website:

Information about Licenses

Information about Licenses3. Get to know broker’s website

The next important step involves assessment of the broker’s website. Financial companies that are serious about working successfully with traders will provide the following information:

Project’s roadmap and strategic development plans;

Legal information and internal documents with clearly specified details of cooperation, and key rules;

Risk disclosure;

Specifications of contracts, indicating the minimum deposit, spreads, etc.;

Diversity of payment methods with specification of payment procedures and fees;

A good choice of channels to contact customer support: phone support, live chat, pages on social media, etc.).

4. Does a broker guarantee profit?

A broker cannot guarantee that you will earn a profit, as it acts solely as an intermediary between the Forex market and traders. Brokers are responsible for prompt execution of client orders, stable operation of the platform, quality analytical instruments and good advice from a personal manager, or customer support. The following should not be on a broker’s website:

Guarantees that you will earn a profit;

Promises of colossal profit in a short time and without specialized knowledge;

Stories about ‘unique’ earning algorithms and secret schemes.

5. Read customer reviews

Reviews of real clients can tell you a lot about a broker. If a company has many negative reviews (traders point to extortion, manipulation of trading process, issues with withdrawals and failure to perform obligations), it is best not to go with such a broker. You can find reviews of real clients on the Traders Union website, where users actively share their personal opinions and tell the truth about financial companies.

What Forex Brokers to Choose in South Africa?

It is optimal to trade with brokers that have a stable international reputation, are regulated by the Financial Sector Conduct Authority (FSCA), and offer ZAR as an account currency to avoid conversion fees. We have compared three such brokers that hold the highest positions according to our methodology.

| FSCA Regulated | ZAR accounts | Min. deposit, $ | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Open account | |

|---|---|---|---|---|---|---|

| Yes | Yes | 100 | 0,5 | 0,9 | Open an account Your capital is at risk. |

|

| Yes | No | 1 | 0,6 | 1,2 | Study review | |

| Yes | No | 250 | 0,2 | 0,7 | Study review |

FAQs

How can I understand that a broker is a scam?

Scammers promise huge returns and talk about “top secret” earning algorithms that help increase your capital. Scam brokers are not regulated; they do not provide detailed contract specification and internal documents, and often provide fake communication channels. Also, these companies lie about having a solid experience in the market and conceal the names of top managers.

How do I check if a company is a scam?

In the course of a full analysis, you need to check legal grounds for the company's operation, reviews of real clients, trading conditions and also find out for how long the company has been around.

Is Forex trading legal in South Africa?

Yes, Forex trading is legal in South Africa. The Financial Sector Conduct Authority (FSCA) is the main regulatory body in South Africa. A broker that provides services in South Africa market must have a license of this regulator or another one.

Can a broker guarantee profit?

No, a broker cannot guarantee that you will earn a profit. A broker must publish risk disclosure on its website. On their part, brokers can only guarantee fair order execution and withdrawal of profit, if you traded at a profit.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).