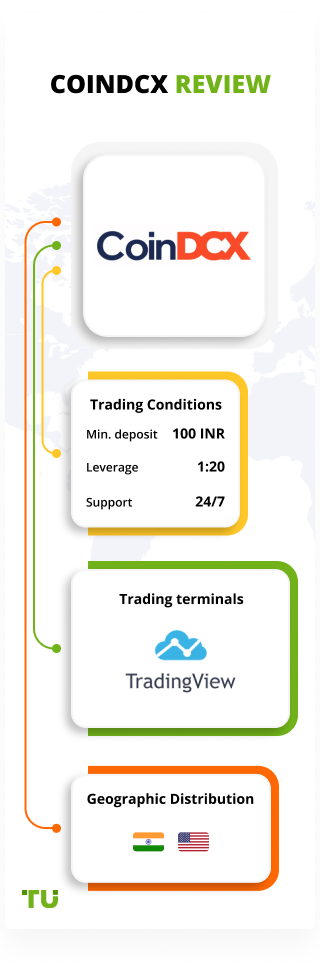

deposit:

- 100 INR

Trading platform:

- TradingView

CoinDCX Review 2024

deposit:

- 100 INR

Trading platform:

- TradingView

- Only Indian rupees are among fiats, low commissions, investment programs with deposit protection, a referral program with one-time payments, moderate leverage

Summary of CoinDCX Crypto Exchange

CoinDCX is a cryptocurrency exchange with higher-than-average risk and the TU Overall Score of 3.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CoinDCX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. CoinDCX ranks 90 among 173 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria.

The CoinDCX exchange offers favorable terms for active trading in cryptocurrencies and tokens, the pool of which is constantly expanding. The trading terminal function is easy to learn, and the minimum deposit of only 100 Indian rupees (or the equivalent) and the availability of training materials shall be considered an advantage for novice traders. There are some of the lowest commissions in the segment, which get even lower as trading volume increases. The advantage for investors is there are several investment options to choose from and the BitGO insurance system. The exchange stores 95% of its assets using the cold storage method, which is combined with deep encryption and ensures the safety of all deposits.

NOTE!

If you are planning to trade cryptocurrencies, and not just keep your savings in crypto wallets, we recommend that you choose one of the top brokers with reliable regulation and access to trading crypto CFDs. This type of trading will help you avoid holding your cryptocurrency in e-wallets of exchanges, which quite regularly get hacked. Also, availability of leverage will allow you to trade crypto CFDs for amounts much higher than your deposit.

Traders Union experts recommend considering Top 3 companies from our rating:

The CoinDCX exchange is a platform for spot, margin, and futures trading using cryptocurrencies and tokens. CoinDCX’s clients have access to Bitcoin (₿), Litecoin (Ł), Ethereum (Ξ), Tether (₮), Ripple, AAVE, NEO, PAX, and many other assets. Only Indian rupees are represented as fiat currency. The leverage for the spot is x6 and x20 for margin trading. Fees for trades are determined by the volume of trades. The largest fee is 0.1% for taker/maker. The exchange offers several options for investing in cryptocurrencies, including staking and lending in addition to cryptocurrency trading. There is a referral program with fixed payments for each partner. An exchange feature is its proprietary academy with an extensive database and guides, including video courses on cryptocurrency trading.

| 💰 Account currency: | Cryptocurrencies, INR |

|---|---|

| 🚀 Minimum deposit: | INR 100 |

| ⚖️ Leverage: | Up to х6 (spot), up to х20 (margin) |

| 💱 Spread: | Market |

| 🔧 Instruments: | Cryptocurrencies, INR |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with CoinDCX:

- the most popular cryptocurrencies and coins are present;

- significant leverage for spot and margin;

- simple and functional TradingView terminal;

- proprietary applications for mobile trading;

- low commission fees (up to 0.04/0.06% for maker/taker);

- several options for investing in cryptocurrency;

- Bug Bounty program with cash bonuses;

- high levels of security;

- funds kept in cold storage;

- referral program with fixed payments;

- an extensive database;

- lots of training materials.

👎 Disadvantages of CoinDCX:

- only Indian rupees are represented in the range of fiats;

- demo accounts are not available;

Evaluation of the most influential parameters of CoinDCX

Geographic Distribution of CoinDCX Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of CoinDCX

CoinDCX is among the largest exchanges in the region. Launched in 2018, the company has headquarters in Singapore and Mumbai. Financial activity is carried out based on local legislation. It works officially and transparently. There was no evidence of fraud or default on obligations to clients.

The exchange offers several options for active and passive earnings on cryptocurrencies and tokens. Active earnings are represented by margin, spot, and futures trading. You can use leverage up to x20 to increase profitability. Lending and staking are passive options for earning money. With a deposit for at least seven days, you can withdraw it at any time, and the yield is floating.

This cryptocurrency exchange has a standard TradingView terminal. Applications for mobile trading are developed for iOS and Android and are downloaded from official digital stores. The exchange operates stably without failures. Transactions are fast and the platform has never been hacked. If you find a bug or vulnerability, the exchange will pay you a reward under the Bug Bounty program.

The main advantages of the exchange are low commissions, a good training program, and high levels of protection. There are several options for depositing/withdrawing funds, including bank cards and e-wallets. Of the disadvantages, only the absence of another fiat besides the Indian rupee can be noted. The exchange is highly appreciated by both traders and Traders Union experts.

Latest CoinDCX News

Dynamics of CoinDCX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Crypto Exchange

The CoinDCX cryptocurrency exchange offers two investment options. The first option is lending. As a client of the exchange, you can provide your funds on credit to the platform to provide margin to other users. Since the funds don’t leave the site, they are completely safe, and you can withdraw your deposit at any time.

The minimum loan term is 7 days. The interest rate depends on the asset. Several dozen of the most popular assets are available for deposits, such as Bitcoin, Ethereum, Ripple, etc. Each asset has its own minimum deposit. For example, you cannot invest less than ₿3.05 into the program. The average interest rate is 1-10%.

It is not possible to withdraw the deposit for 7 days. Later, it can be withdrawn at any time along with the interest accrued. The deposit period is not limited, as well as the deposit itself. You don’t need to go through KYC verification to participate in the program (but it will be required if you want to withdraw more than ₿4).

Staking is the second investment option available to CoinDCX users. You make a deposit in the selected asset, which the cryptocurrency exchange directs to the development of a third-party blockchain project acting as the official partner of the site. All partners undergo a multi-level verification. The exchange has a reserve fund as an extra guarantee.

The estimated staking rate is 1-2% on average, but some programs can yield up to 20%. Each program has its minimum deposit, and there is no upper limit. The contribution period varies by program. Deposits are not blocked. The funds remain in your account; you can trade them and withdraw them. However, if the deposit reserved for staking on the account begins to decrease, payments will also naturally decrease.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

CoinDCX’s affiliate programs:

CoinDCX offers a fixed payout referral program. After registration, you get a partner link. You can copy it to your personal account and publish it on any site. Each user who follows this link and actively trades on the exchange will bring you ₮25 (USDT).

Neither the trader nor his invitee needs to undergo KYC verification. It doesn’t matter how much the referral will trade, immediately after the first transaction, he will provide you with an income of ₮25. However, this will not happen if the client of the exchange who invited the referral made transactions for less than ₿5 in total (transactions can be carried out in any cryptocurrency).

The number of referrals is not limited, the exchange client can invite any number of users to the site and get a reward for each of them.

Trading Conditions for CoinDCX Users

It’s not necessary to undergo verification on the CoinDCX cryptocurrency exchange. To start trading, you need to register and deposit at least 100 Indian rupees (or equivalent in any cryptocurrency) to your account. However, if you do not have KYC verification, there are significant limits for withdrawing funds. Read more in the corresponding section of the site. The leverage is x6 for spot trading and x20 for margin trading. Leverage increases the potential yield of transactions but also increases the size of financial losses in case of their unsuccessful outcome. The technical support of the site works quickly and stably, you can contact it through the site or directly by email (indicated in the footer of the site).

100 INR

Minimum

deposit

1:20

Leverage

24/7

Support

| 💻 Trading platform: | TradeView |

|---|---|

| 📊 Accounts: | Standard |

| 💰 Account currency: | Cryptocurrencies, INR |

| 💵 Replenishment / Withdrawal: | Bank accounts, cryptocurrency, and e-wallets |

| 🚀 Minimum deposit: | INR 100 |

| ⚖️ Leverage: | Up to х6 (spot), up to х20 (margin) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | From 0 |

| 💱 Spread: | Market |

| 🔧 Instruments: | Cryptocurrencies, INR |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | n/a |

| ⭐ Trading features: | Only Indian rupees are among fiats, low commissions, investment programs with deposit protection, a referral program with one-time payments, moderate leverage |

| 🎁 Contests and bonuses: | Yes |

Broker comparison table of trading instruments

| CoinDCX | Bybit | MEXC | Binance | Zoomex | Bitvavo | |

| Forex | No | No | No | Yes | No | No |

| Metalls | No | No | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes | Yes | Yes |

| CFD | No | No | No | No | No | No |

| Indexes | No | No | No | No | No | No |

| Stock | No | No | No | No | No | No |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

CoinDCX Commissions & Fees

Its value depends on your trading level. The level, in turn, is determined by the total trading volume for the previous 45 calendar days. The more you trade, the higher your trading level and the lower the commissions on your transactions. There are 10 levels in total. The taker and maker commissions are equal only on the first level (up to ₿5 traded in 45 days), and it is 0.1%.

Further, the commissions are reduced, for the maker it is faster. For example, at the fifth level, with a trading volume of ₿100-500 in 45 days, the maker's commission is 0.08%, and the taker's commission is still 0.1%. At the highest (tenth) level, with a trading volume of over ₿250,000 in 45 days, the commissions are 0.04%, and 0.06% for the maker and taker, respectively.

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | 0.1% per application | Yes |

The commission for transactions in rupees is fixed and it is 0.1% regardless of the trading volume. The exchange charges withdrawal fees. They don’t depend on your activeness. Fees and withdrawal limits are determined by the asset. For example, the commission for withdrawing Bitcoin is ₿0.001, you will get at least ₿0.0005 to withdraw. Read more on the commissions for each asset in the "Commission structure" section.

| Broker | Average commission | Level |

| CoinDCX | $1 | Medium |

| Bybit | $20 | High |

| Bitfinex | $0.1 | Low |

Contacts

| Foundation date | 2018 |

| Registration address | Mumbai, Maharashtra, India |

| Official site | https://coindcx.com/ |

| Contacts |

Email:

support@coindcx.com,

|

Read also about other cryptocurrency exchanges:

Find out how CoinDCX stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the CoinDCX rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about CoinDCX you need to go to the broker's profile.

How to leave a review about CoinDCX on the Traders Union website?

To leave a review about CoinDCX, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about CoinDCX on a non-Traders Union client?

Anyone can leave feedback about CoinDCX on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!