OKX Copy Trading

OKX Copy Trading enables users to mirror the strategies of skilled traders across spot and futures markets. With over 120 spot pairs and profit-sharing of up to 13%, it offers a comprehensive trading experience. Additionally, beginners can easily start trading by selecting lead traders and initiating copy trades.

In this article, TU experts will discuss the Copy Trading feature offered by OKX, a cryptocurrency exchange. They'll explain how users can replicate the trading strategies of experienced traders in both spot and futures markets. The article covers the process of becoming a Copy Trading subscriber, including eligibility criteria and profit-sharing levels. Additionally, it outlines the benefits and drawbacks of OKX's Copy Trading, such as intuitive usability and potential visibility issues. Overall, the experts will delve into how Copy Trading can enhance trading experiences for users on the OKX platform.

-

How to start OKX copy trading?

To start OKX copy trading, simply log in to your account, navigate to the Copy Trading section, choose a lead trader, and click "Copy."

-

Is OKX copy trading suitable for beginners?

Yes, OKX copy trading is suitable for beginners as it allows them to replicate the strategies of experienced traders automatically.

-

How do I stop copy trading in OKX?

You can stop copy trading in OKX by canceling copied orders through the platform's provided instructions.

-

Is OKX copy trading profitable?

OKX copy trading can be profitable, with lead traders earning up to a 13% profit share for eligible copied trades. However, individual results may vary based on market conditions and strategy.

Can you copy trade on OKX?

OKX, a major player in the cryptocurrency exchange realm, offers a nifty tool called Copy Trading. This feature lets users mimic the trading strategies of seasoned traders, available for both spot and futures markets.

With Spot Copy Trading, users can shadow successful traders across a wide range of spot pairs, potentially earning them up to a 13% profit share. Additionally, OKX extends this functionality to futures markets with Futures Copy Trading, providing traders with even more opportunities.

Lead traders in both scenarios can earn a profit share, making it a win-win situation for everyone involved. It's like having a seasoned trader guide you through the complexities of the crypto market, making trading more accessible and potentially profitable for all users.

How to become a copy trading subscriber on OKX

Becoming a Copy Trading subscriber on OKX is a simple process. Here's a step-by-step guide:

Eligibility

-

First, you need to have an active OKX account. If you don't have one yet, you can easily sign up on the OKX platform.

Deposit Funds

-

Make sure to deposit funds into your trading account. These funds are necessary for participating in copy trading.

Navigate to Copy Trading

-

Log in to your OKX account and head to the Copy Trading section, typically located in the navigation menu.

Choose a Lead Trader

-

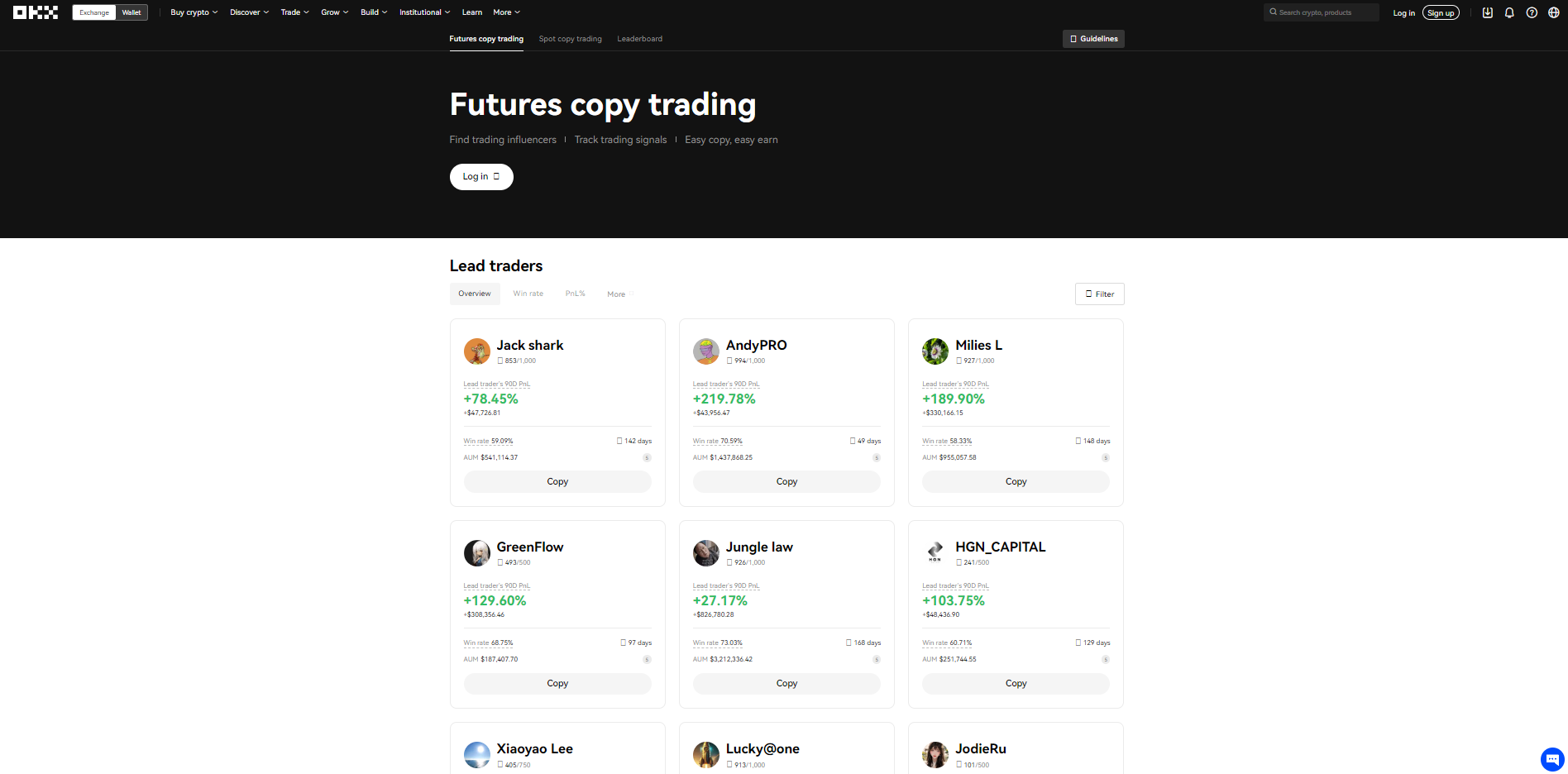

Explore the leaderboard to discover experienced traders whose strategies align with your investment goals.

-

Select a lead trader whose performance you find suitable.

Start Copy Trading

-

Once you've chosen a lead trader, simply click on the "Copy" button next to their profile.

-

Your account will then automatically replicate their trades in real-time.

Profit Sharing

-

When you copy a lead trader, a portion of your profits will be shared with them.

-

Lead traders can earn between 8% to 13% of the profits generated from copy trading, depending on their profit-sharing levels.

Limits and Notifications

It's important to be aware of certain limits and notifications

-

In hedge mode, you can copy up to 10 traders, whereas in one-way mode, you can copy only 1 trader.

-

Various factors such as lead traders' status changes, daily lead trade limits, risk control triggers, and insufficient funds in your account can affect your ability to copy trades.

-

The system will notify you if any of these conditions occur.

How to become a master trader

Becoming a master trader requires a combination of skill, experience, and adherence to guidelines. If you meet the requirements and are passionate about trading, consider applying to become a lead trader on OKX and share your expertise with the community. Here's a breakdown of the requirements and potential earnings

Eligibility and Requirements

| Requirement | Description |

|---|---|

Trading Account Balance |

Maintain a balance of over 500 USDT in your trading account. |

Identity Verification |

Successfully complete the full identity verification process with OKX. |

Achievements and Trading Style

| Achievement | Description |

|---|---|

Profit and Loss (PnL) |

Achieve a Profit and Loss of 135% or more in stocks. |

Crypto Growth |

Increase crypto holdings from 1,000 USDT to 50,000 USDT. |

Copy Traders |

Have 2,000 or more copy traders. |

Max Drawdown |

Keep the maximum drawdown below 30%. |

Trading Style |

Focus on trading mainstream cryptocurrencies like BTC and ETH. |

Duration |

Suggest copying for over 1 month with a maximum total amount of 500+ USDT. |

Risk Management |

Avoid using high leverage. |

Profit-Sharing Levels

-

High-quality lead traders are rewarded with profit shares based on their 90-day average Assets Under Management (AUM).

-

The profit-sharing level increases as the lead trader's AUM grows.

Initial Profit-Sharing Level

-

When a lead trader joins OKX's Copy Trading program for the first time and does not have any 30-day trade records, they start at the initial profit-sharing level, which is level 1.

-

After joining, the lead trader's Assets Under Management (AUM) are calculated based on the funds being copied by other traders.

-

The profit-sharing level is then updated on the following day (T+1) at 00:00 (UTC +8) based on the lead trader's AUM and trading performance.

Rejoining as a Lead Trader

-

If a lead trader quits and later rejoins, their previous AUM history is not considered.

-

They are treated as a new trader in terms of profit sharing.

Assets Under Management (AUM) Calculation

-

The lead trader's AUM is crucial in determining their profit share. It reflects the total value of funds being copied by other traders.

How to choose a master trader on OKX

When selecting a master trader on OKX, it's crucial to consider several factors to make an informed decision. Below are key aspects to evaluate

Performance Metrics

| Metric | Description |

|---|---|

Profit and Loss (PnL) |

Look for consistent positive PnL over time. |

Risk Management |

Assess strategies for minimizing losses during market downturns. |

Duration |

Longer track records often indicate stability and reliability. |

Drawdown |

Prefer traders with low maximum drawdowns, indicating lower risk. |

Trading Style and Assets

| Aspect | Description |

|---|---|

Trading Style |

Evaluate if they focus on specific cryptocurrencies like BTC or ETH. |

Market Coverage |

Check if they trade in both spot and futures markets. |

Preferred Pairs |

Consider the types of trading pairs they specialize in. |

Copy Trader Feedback

| Aspect | Description |

|---|---|

Popularity |

Look for traders with a large number of copy traders, indicating trust and reliability. |

Feedback |

Read reviews from other copy traders to gauge their satisfaction and experience. |

Profit-Sharing Levels

| Aspect | Description |

|---|---|

Profit-Sharing Structure |

Understand how profit-sharing works and how much a trader earns from copy trades. |

AUM (Assets Under Management) |

Higher AUM typically leads to better profit-sharing levels. |

Eligibility Criteria

| Aspect | Description |

|---|---|

Engagement |

Consider if the trader actively engages with their followers. |

Transparency |

Look for traders who share insights and explain their strategies. Transparency builds trust. |

Spot copy trading on OKX

Spot copy trading on OKX allows users to follow and replicate the trading strategies of experienced traders automatically. Here are the main conditions and possibilities:

Conditions

-

Availability: Spot copy trading is available on OKX's platform.

-

Lead Traders: Experienced traders on the platform share their strategies, which users can choose to follow.

-

Execution: Trades are executed automatically in real-time across a wide range of spot pairs.

-

Profit Sharing: Lead traders can earn a profit share for eligible copied trades, up to 13%.

Possibilities

-

Zero Trading Fees: Users can buy and sell crypto with zero trading fees via over 100 payment methods, including Visa, Mastercard, and others.

-

Diverse Payment Methods: OKX supports various payment methods such as Banxa, Simplex, and others for buying crypto.

-

Latest Crypto Prices: Users can view the latest crypto prices, volume, and data on the platform.

-

Deep Liquidity: OKX offers deep liquidity on expiry spreads, custom multi-leg strategies, and block trades.

Futures Copy Trading on OKX

Futures copy trading on OKX allows users to replicate the trading strategies of experienced traders in futures markets. Here's what you need to know:

Main Conditions

-

Availability: Futures copy trading is available on the OKX platform.

-

Lead Traders: Experienced traders share their futures trading strategies, which users can choose to copy.

-

Profit Sharing: Lead traders can earn a profit share for eligible copied trades, with the maximum profit-sharing ratio ranging from 8% to 13%.

Possibilities

-

Leverage Trading: OKX allows users to trade perpetual and expiry futures with leverage, enhancing profit potential.

-

Deep Liquidity: The platform offers deep liquidity on expiry spreads, custom multi-leg strategies, and block trades, ensuring smooth execution.

Comparision table for Lead traders

| Limit | Basic Lead Trader | Intermediate Lead Trader | Advanced Lead Trader |

|---|---|---|---|

Amount per Order (Fixed Amount) |

10 - 100,000 USDT |

10 - 100,000 USDT |

10 - 100,000 USDT |

Amount per Order (Proportional) |

0.01 - 100x |

0.01 - 100x |

0.01 - 100x |

Maximum Total Amount |

10 - 2,000,000 USDT |

10 - 2,000,000 USDT |

10 - 2,000,000 USDT |

Daily Lead Trade Limit |

500 new positions |

500 new positions |

500 new positions |

Maximum Copy Trader Limit |

Up to 100 copy traders |

Up to 500 copy traders |

Up to 1,000 copy traders |

Requirements |

Passed identity verification |

90-day average AUM > 20,000 USDT |

90-day average AUM > 100,000 USDT |

Trading account assets |

At least 500 USDT |

At least 10,000 USDT |

At least 10,000 USDT |

Maximum profit-sharing ratio for Lead traders

| Level | 90D average AUM | Maximum profit-sharing ratio |

|---|---|---|

1 |

0 ≤ X < 100,000 USDT |

8% |

2 |

100,000 ≤ X < 500,000 USDT |

10% |

3 |

500,000 ≤ X < 1,000,000 USDT |

12% |

4 |

≥ 1,000,000 USDT |

13% |

Pros and cons of OKX copy trading

👍 Advantages of Broker:

• Intuitive trading app, great for beginners

• 114 pairs available for copy trading

• Open-door policy for trader feedback

• Detailed statistics for lead traders

• 24/7 customer support

• Up to 13% profit share for lead traders

👎 Disadvantages of Broker:

• Some buttons lack visibility and prominence in UX

Expert Opinion

In my expert opinion, OKX Copy Trading presents a valuable opportunity for both novice and experienced traders to enhance their trading strategies. With features tailored for beginners and advanced traders alike, such as intuitive usability and profit-sharing options, OKX provides a comprehensive platform for users to replicate successful trading strategies.

The ability to mirror trades across spot and futures markets, coupled with extensive support and community engagement features, makes OKX Copy Trading a compelling option for anyone looking to optimize their investment approach. Overall, OKX Copy Trading has the potential to significantly improve trading outcomes and adapt a collaborative trading community.

Summary

OKX offers Copy Trading for spot and futures markets, allowing users to follow successful traders' strategies. Users can replicate trades across various pairs, with lead traders earning up to 13% profit share. Becoming a subscriber involves simple steps like selecting a lead trader and initiating copy trading. The platform provides extensive support and notifications for limits and order cancellations.

Additionally, users can apply to become lead traders by meeting specific eligibility criteria and earning potential profit shares based on their performance. OKX's Copy Trading feature enhances trading opportunities and fosters community engagement for both novice and experienced traders.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).