Don’t risk it.

Always play safe and exit the trade promptly if conditions are unfavorable.

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

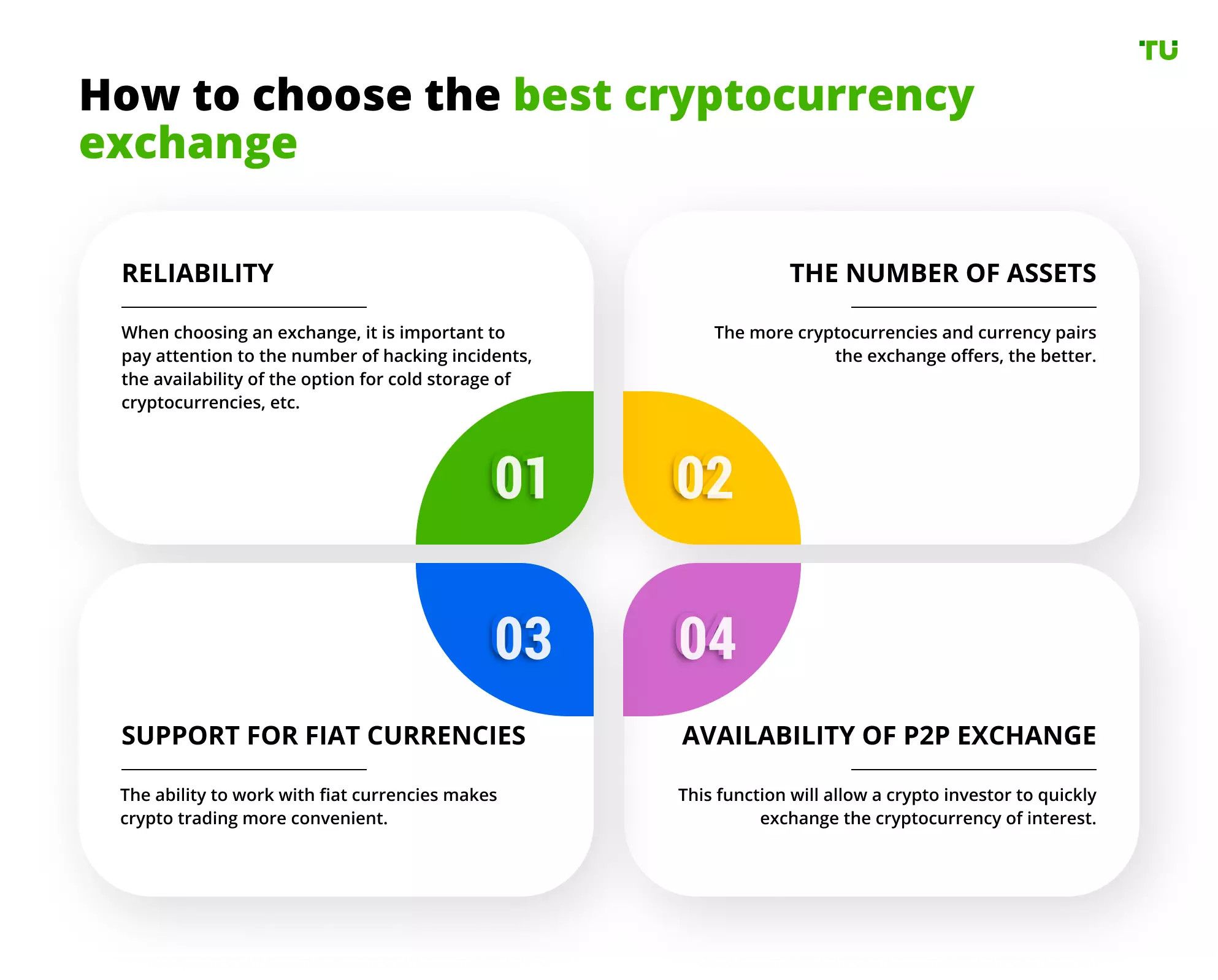

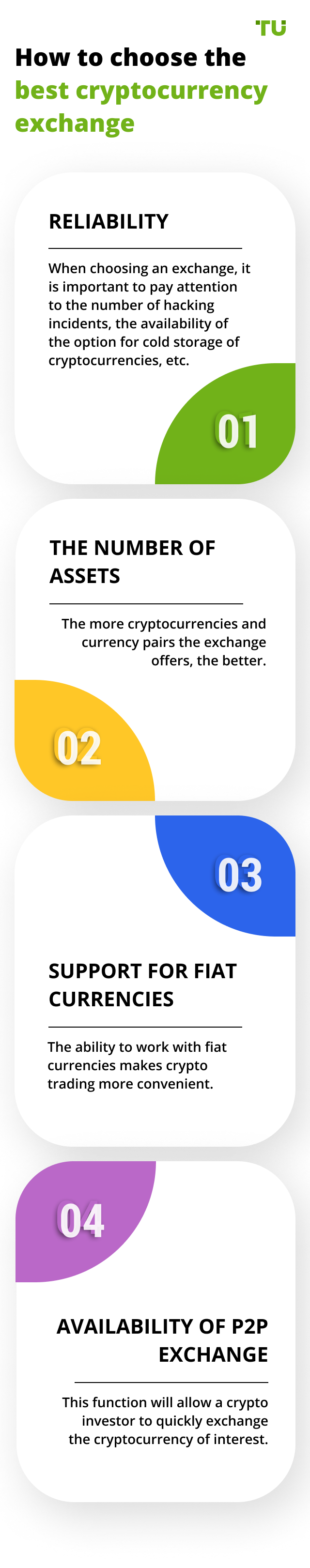

Selecting a trustworthy cryptocurrency exchange is a key step for anyone planning to trade or invest in digital assets. The platform you choose directly affects your trading conditions, access to liquidity, security of funds, and overall user experience.

To simplify this process, we have compiled a comprehensive rating of leading crypto exchanges. Each platform is evaluated based on transparent criteria: regulatory status, trading tools, supported assets, commission structure, and user reviews.

Our rating will help you navigate the crypto market more effectively — whether you're buying Bitcoin, exchanging altcoins, or converting crypto to fiat. Instead of spending days comparing platforms, rely on our expert analytics — and choose a crypto exchange that meets your goals and trading profile.

Best Crypto Exchanges for 2025 (United States)

Your location is United States

We’ve selected Top Crypto Exchanges providing services in your country. If you would like to learn about the best crypto exchanges in a different region, please use the “Find my crypto exchange” service.

The cryptocurrency exchange rating was created by Traders Union experts to provide everyone with objective and independent information about the best crypto exchanges. Traders Union specialists have access to the internal trading and client indicators of a record number of cryptocurrency exchanges, and can also analyze data from thousands upon thousands of traders. This is precisely why the Traders Union rating of cryptocurrency exchanges is the most objective rating available for 2025.

Do you prefer watching videos? Then watch the video summary of this article.

Below you will find all the information.

Just study the cryptocurrency exchange rating compiled by financial specialists and analysts of the Traders Union to choose the best exchange for cryptocurrency trading. Also, you must familiarize yourself with the main crypto-exchange trading terms in its profile. You can then open an account using the referral link of the Union.

Study the available services and trading tools for cryptocurrency trading on the company's website to form an impression of the crypto exchange’s quality of service. It is important to know if a cryptocurrency exchange is available in your country. On the Traders Union website, you will find the best exchanges that operate in different countries and regions - for example, Australia, USA, UK, Europe, etc.

Study the official website of the cryptocurrency exchange in detail to independently conduct a comprehensive analysis of its services and offers.

These are the sections that should be available on a reliable cryptocurrency exchange website:

A section on each cryptocurrency exchange, with a description of its history, its purpose, and mission in the cryptocurrency market, as well as the country and registration address, the name of the financial regulator, and the exchange’s license number and contact details of the crypto exchange.

This section describes the exchange’s trading conditions and trading instruments. Here you can find a list of available cryptocurrencies, price movement charts of a selected asset, current price quotes, as well as information about the fees of the cryptocurrency exchange. In the TU rating, you can find commission-free cryptocurrency exchanges.

An educational section with basic information about the cryptocurrency market, which will help a novice trader learn the basics of crypto trading. Also, there’s a help section with detailed guides for working with the cryptocurrency exchanges, such as instructions for opening a trading account, working with a trading platform, etc.

The section with analytics and the latest news of the cryptocurrency market on the cryptocurrency exchange website will enable you to estimate the market situation in real-time and, as a result, invest in a particular digital asset more effectively, thus, hopefully, making more profit.

The customer support portal ensures prompt communication with representatives of the cryptocurrency exchange when questions arise.

and a 24/7 support service are additional advantages of a crypto exchange.

You can register a personal account on the website of a cryptocurrency exchange. It stores the client's data, information about account verification, trading activity on accounts, the deposit/withdrawal transactions history, as well as extra tools available only to registered users.

Author, Financial Expert

at Traders Union

After the crash of FTX and several other smaller cryptocurrency platforms, investors are paying increasing attention to their reliability. And for a good reason. Of course, investors should focus on the transparency of the exchange data, regulations, and methods of information protection. Traders Union experts, when compiling the rating, dedicated considerable attention and time to evaluating the reliability and stability of exchanges.

The optimal choice of a cryptocurrency exchange also largely depends on the goals of a specific investor. Some exchanges specialize in spot trading, offering a vast selection of coins specifically for spot trading and investing. Others focus on the futures market, where key indicators include commission size, integration of the trading platform with bots, and high liquidity. The third type of exchanges has created comfortable conditions for earning passive income through staking. To make the optimal choice, thoroughly read detailed reviews on the Traders Union portal.

Don’t risk it.

Always play safe and exit the trade promptly if conditions are unfavorable.

Be patient.

Wait for optimal trading signals to start. Patience allows you to avoid unnecessary risks and rash moves.

Controlling the order book with the list of quotes is an extremely important skill since the further profit of the trader depends on the quotes.

Be aware.

Always be aware of information on the volume and capitalization of the market. This will allow you to predict future quotations and market behavior.

Being informed of current conditions in the primary market enables you to minimize the number of unsuccessful transactions. Veteran traders also recommend minimizing trading losses by committing no more than 50% of the amount of money in your trading account at any one time. Close a trade if market conditions become unfavorable.

Important

It is quite difficult to trade large amounts on crypto exchanges, since other traders, having found such orders, always try to be proactive and begin to sell their coins widespread, as they expect new activity in the market. So, divide your application into several small orders, which should not exceed 0.5 BTC.

Keep in mind that cryptocurrency exchanges get their main liquidity from limited groups of participants that can make a significant correction in the rate, and it is very important to be able to detect a change in trend and place appropriate orders promptly.

NFT (non-fungible tokens) allow you to sell objects of art, gaming objects and other singular digital objects. Top exchanges offer NFT marketplaces.

Decentralized Finance (DeFi) are the financial instruments of the 21st century; they enable users to provide services to each other without intermediaries such as traditional banks and insurance companies.

Tokenized assets – cryptocurrency exchanges are increasingly offering access to trade not only cryptocurrencies, but also tokenized Forex pairs, stocks, real estate, and other financial assets. This expands the area of use of the exchanges.

Crypto exchange fees are an essential aspect to consider when choosing a platform. Choosing the crypto exchange with the lowest fees helps give you a bigger profit when trading. Let's explore the different types of fees commonly associated with cryptocurrency exchanges:

Trading fees are charges imposed by exchanges for executing trades on their platforms. They are typically calculated as a percentage of the trade's value or as a fixed fee per trade. These fees can vary significantly among exchanges. It's important to consider the fee structure and compare it with other platforms to ensure you're getting the best value for your trades.

Some exchanges may charge fees for depositing funds into your trading account. These fees can vary depending on the payment method used, such as bank transfers, credit/debit cards, or cryptocurrency deposits. It's advisable to review the deposit fee structure of an exchange before initiating any transactions to understand the potential costs involved.

Similar to deposit fees, withdrawal fees are charges imposed by exchanges when you withdraw funds from your trading account. These fees can also vary depending on the withdrawal method chosen and the cryptocurrency being withdrawn. It's essential to consider withdrawal fees, especially if you plan to move your funds frequently or in large amounts.

Account fees are charges associated with maintaining an account on a crypto exchange. Some exchanges may require users to pay a subscription fee or a fee for accessing premium features or services. It's important to review the account fee structure of an exchange to understand any potential ongoing costs.

Opening a crypto exchange account is a straightforward process. Here is a step-by-step guide.

Go to the crypto exchange website using a web browser of your choice.

Click on the "Sign Up" or "Register" button on the homepage. You will be directed to the registration page.

Enter your email address and choose a strong password for your account. Make sure to follow any specified password requirements.

Check your email inbox for a verification email from your crypto exchange. Click on the verification link provided to confirm your email address.

To enhance the security of your account, set up Two-Factor Authentication (2FA). This typically involves linking your account to an authenticator app, such as Google Authenticator or Authy, to generate one-time verification codes.

Bybit may require you to complete a Know Your Customer (KYC) verification process. This process involves providing personal information and identity verification documents, such as a passport or driver's license. Follow the instructions provided by crypto exchange to complete the KYC verification.

Once your account is verified, you can proceed to fund your account. Select the desired cryptocurrency and follow the instructions to deposit funds into your account.

It's advisable to start with small amounts and gradually increase your trading activity as you gain experience and confidence in the market.

I trade crypto on Camelot and also participate in Nitro pools. I especially like that you can earn additional rewards using xGRAIL. Yields vary by pool, but in some cases, I’ve earned 100–150% annually, which is impressive. Staking returns are around 50% APY for both GRAIL and xGRAIL, making it a good option for passive income. The dynamic fee model helps save money during low-volatility periods. However, there’s no leverage, which could be a downside for high-volume traders. Other than that, the platform is stable and user-friendly, the swap fees are reasonable, and withdrawals are fast.

Raydium runs on the Solana blockchain, meaning all operations are decentralized. Users retain full control over their assets since funds are stored in personal wallets, not on the platform. Thanks to Solana, Raydium offers extremely fast transactions with minimal delays and low fees. This is especially important for traders who value speed. Raydium provides access to numerous tokens built on the Solana blockchain, significantly expanding trading and investment opportunities.

I trade futures on BTCC and occasionally use copy trading. I liked that you can set limits and copy with different ratios, which helps control risk. Order execution is fast, slippage happens but is not critical. The mobile app interface is clear, although delays occur during high volatility. I like that there is a demo account with virtual USDT, which allows me to test strategies freely. There is a lack of fiat currency options, but transfers through the available channels are quick.

WOO Network offers 194 cryptocurrency pairs and a maximum leverage of 1:5. The platform features a staking program and a referral system, which can provide additional passive income. However, it’s worth noting that customer support is not available in real time, and the company is registered in the Cayman Islands without oversight from financial regulators.

Delta Exchange has proven to be a solid choice for active traders: the terminal runs smoothly, trade execution delays don’t exceed one second, and the mobile app allows trading from any device. I appreciated their first deposit bonus of up to $2,500 in USDT, as well as the Bug Bounty program. The platform supports trading bots, which is convenient for algorithmic strategies. On the downside, there’s no fiat support and no call center — customer service is available only through online chat.

I trade cryptocurrencies on Cube Exchange, and find it meets high quality standards. The wide choice of crypto assets and the support for various blockchains make trading both convenient and efficient. I also appreciate its focus on regulation and security, which is important for any investor. The platform's interface is simple and easy to use, making the trading process straightforward. I'm satisfied with my choice and plan to keep using Cube Exchange for my investments.

I use WhiteBIT as a backup platform for operations with altcoins and fiat. Liquidity is decent, and the 0.1% fee comes with no hidden charges. Security deserves special mention: 98% of funds are stored in cold wallets, there’s WAF protection, and the reserve fund is located in the US. Registration and verification didn’t take much time. The main drawback is limited educational content and only one type of investment option, but overall the platform is reliable.

Trading on LATOKEN felt convenient — there are many altcoins, the interface is standard, and the mobile app runs smoothly. The 1:2 leverage for perpetual contracts is suitable for moderate risk. After registration, I received a welcome bonus in tokens, and the referral program offers $50 for an active partner. There are some limitations: fiat trading is not available, there is no phone support, and there’s no demo account.

Camelot caught my attention as one of the leading DEXs on Arbitrum, and it has a few interesting features for passive income. I use xGRAIL tokens for staking, earning around 50% APY, and the process is fairly straightforward. There are no withdrawal fee, just the usual network fees. I wish the platform wasn’t limited to Arbitrum because that restricts access to other blockchains. But for anyone active in this ecosystem, it’s a solid choice.

Raydium is closely tied to the Solana blockchain and makes extensive use of its ecosystem. SOL is the primary cryptocurrency for paying fees and interacting with the platform. It is required for any transaction on the exchange. RAY is Raydium’s token, used within the ecosystem for farming, staking, and participating in liquidity pools. Users can earn RAY by providing liquidity or joining campaigns. Wrapped versions of popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are also available on Raydium, allowing users to trade these assets within Solana’s ecosystem. Users can earn transaction fee shares from liquidity pools and gain additional income through farming.

To buy cryptocurrency, you need to choose a reputable crypto exchange, create an account, deposit funds into your account, select the desired cryptocurrency, and place a buy order at the current market price or a specific price of your choice. Once your order is filled, the purchased cryptocurrency will be credited to your exchange account, and you can choose to transfer it to a personal wallet for added security if desired.

The number of crypto exchanges is continually evolving as new platforms emerge and existing ones evolve or shut down. Currently, there are thousands of crypto exchanges available worldwide, catering to different markets and offering various features and services.

Bybit, one of the biggest crypto exchanges today, is known for its extensive selection of cryptocurrencies, making it one of the exchanges with the most coin options. It offers a wide range of cryptocurrencies, including major ones like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as numerous altcoins and new project listings.

The amount of money required to buy crypto depends on various factors, including the price of the cryptocurrency you wish to purchase, the exchange's minimum investment requirements, and your personal investment goals.

A crypto exchange is an online service where traders exchange similar digital (crypto) currencies at a favorable rate. Cryptocurrency trading is the process of digital assets buying and selling to reap a profit from the difference in their rates.

Pay attention to its position in the ranking when choosing a cryptocurrency exchange. The higher position they are in the rating table reflects their reliability and popularity among traders.