Trading platform:

- Plastic card

- Apple Pay

- Bank account

Wise (TransferWise) Bank Review 2025

- Globally

Currencies:

- 54 currencies

- No

- No

Summary of Wise

Wise (previously TransferWise) is a digital bank founded in 2011. It provides a free multi-currency account, currency conversion at the average daily rate, and the ability to make transfers between banks, organizations, and individuals. Wise supports transfers among 80 countries, and 54 currencies can be stored on the account. All standard features and services are free, but there are some limits. For example, storage of more than €15,000 is subject to a fee of 0.40% per year, and if you withdraw from ATMs more than £200 per month, there is a fee of 1.75% for each subsequent withdrawal. The bank is regulated by the FCA and FinCen and has a valid license.

| 💼 Main types of accounts: | Standard and business |

|---|---|

| 💱 Multi-currency account: | Available for 54 currencies |

| ☂ Deposit insurance: | No |

| 👛️ Savings options: | Free transfers in base currencies, automation of processes on business accounts |

| ➕ Additional features: | Batch payments, spending cards, simplified taxation, payment and transfer automation for a business account |

👍 Advantages of trading with Wise:

- simplified registration via email or social media accounts (ID required);

- you can order a standard Mastercard debit card that is accepted for payment in all countries and at most ATMs;

- the multi-currency account has no restrictions or limits on the storage of funds; in the settings, you can set a priority currency for payment;

- the bank’s mobile application has a simple intuitive interface, which is translated into several dozen languages;

- you can accept direct payments in 7 world currencies, payments in other currencies are automatically converted to those currencies you prefer;

- currency conversions are made not at the current rate, but at the average daily rate, which many experts consider the most advantageous for currency exchange;

- international transfers carry a minimal fee.

👎 Disadvantages of Wise:

- a personal multi-currency account does not provide additional benefits (except for the convenience of holding transfers and funds comprised of different currencies in a single account);

- there are no referral or affiliate programs, interest-bearing deposits, overdrafts, or lending services;

- a bank account is provided free of charge;

- a plastic debit card costs €6.

Evaluation of the most influential parameters of Wise

Video Review of Wise i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Wise

Until February 2021, Wise was called TransferWise. Some, out of habit, still call this digital bank by its old name. It was founded in 2011 and is one of the oldest market participants. At the moment, it already has many worthy competitors, but in some aspects, Wise still confidently holds the lead.

This is not a neobank as many may understand the term. For individuals, it offers one type of account which has no subscription fee. You can keep 54 currencies on your single account, but funding is available only in 7 base currencies, which are EUR, GBP, AUD, NZD, RON, HUF, and SGD. There is no commission for transfers in these currencies. Direct debit without fees is only available for GBP, EUR, and AUD. For other currencies, fees may be calculated using a special calculator.

Also, the presence or absence of a fee depends on the system used by the transferring bank. For example, there are no fees for Stripe and Amazon, but for USD transfers with Wire, the fee is fixed at $7.50, which can be disadvantageous for small amounts. These moments suggest that working with Wise must be approached wisely.

A multi-currency account has some advantages over accounts in other digital banks such as being free and secure. Client funds are kept in JP Morgan Chase and Barclays, which have one of the most secure systems in the world. However, Wise fully reveals its potential only on business accounts, for which an extended banking package and integration with third-party services like Xero are available.

Latest Wise News

Dynamics of Wise’s popularity among

Traders Union’s traders, according to 2024 data

Investment Programs, Available Markets, and Products of Wise Bank

Wise does not offer specialized investment services to individuals. There are no referral or affiliate programs, deposits, or other solutions that could help neobank clients increase their capital. However, there is the OwnWise service. It allows any client of the bank to purchase shares of the company to receive bonuses from them in the future. These shares are traded on the London Stock Exchange, so they can be sold when they rise in price. The peculiarity of the program is that the maximum number of shareholders is 100,000 people. This means that soon it will be impossible to buy Wise shares. A current number of available shares is indicated on the Wise website.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Terms for Cooperation with Wise

The resident of any country can use the services of Wise. It doesn’t matter how the customer funds their multi-currency account, it can be done by direct bank transfers, through Apple Pay, or debit and credit cards. The table below shows the main parameters of Wise as a digital bank.

| 💼 Main types of accounts: | Standard and business |

|---|---|

| 💱 Multi-currency account: | Available for 54 currencies |

| 💵 Deposit terms and conditions: | No |

| 💳 Loan terms and conditions: | No |

| ☂ Deposit insurance: | No |

| 👛️ Savings options: | Free transfers in base currencies, automation of processes on business accounts |

| 📋 Types of payment: | Bank account, plastic card, Apple Pay |

| ➕ Additional features: | Batch payments, spending cards, simplified taxation, payment and transfer automation for a business account |

Comparison of Wise with other Brokers

| Wise | Bunq | Curve Bank | Revolut | Starling Bank | |

| Supported Countries | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | Globally | UK |

| Supported Currencies | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | 30 currencies | GBP, EUR, USD |

| Deposit insurance | No | EUR 100,000 | No | Yes | Yes |

| Minimum deposit | No | No | No | No | No |

| Deposit rate | No | 0.09% APY | No | 6.45% | 15%-35% |

| Loan Rate | No | The bank does not issue loans | No | 0.65%-0.7% | 0.05% |

Wise Commissions & Fees

Personal and business accounts are opened free of charge. Also, the client of the bank can choose additional services that are paid separately. There is no subscription fee for any service, there are only one-time payments. For example, setting up international payments is available for all types of accounts. It is not mandatory, the client has the opportunity to configure everything himself if he is confident in his abilities. Expert setup costs £16 and guarantees hassle-free payments through any bank.

For a business account, there is only one paid service which includes advanced account features. For example, they include an IBAN, withdrawal of funds from platforms such as Shopify and Stripe, and the ability to receive payments from third parties. A small business operating within its own country may well do without these services. But for large internationally-oriented organizations with branches or remote employees in other countries, these options are essential. Their connection costs AUD 22.

Wise offers a few more one-time payments for certain specialized features. For example, if a business owner wants to directly connect their employees’ debit cards to their account to automate payments and transfers, it will cost them £3 per card.

Receiving transfers in these seven fiat currencies — EUR, GBP, AUD, NZD, RON, HUF, and SGD — is free. The commission for making other transfers depends on the currency and the amount. However, US dollars can be received free of charge only by direct transfer from a debit card or ACH, but transfers via Wire cost a fixed USD 7.50, regardless of the amount. Direct debits in GBP, EUR, and AUD are free; for other currencies, the commission is calculated individually, as is the conversion fee.

A neobank client can keep any amount of currency on his account. But if the account has more than €15,000 (or the equivalent in other currencies), a fee of 0.40% of the deposit amount per year will be charged. Also, the client of the bank should take into account that ordering a debit card costs €6, but its maintenance and reissue (for example, in case of loss) are free.

There is a limit on free cash withdrawals which is €200 per month (or the equivalent), then a commission of 1.75% of the transfer amount is charged. Another limitation applies to the number of withdrawals. Two withdrawals per month are free, then they charge £0.50 for each withdrawal (with equivalent values in other currencies). We also compared Wise fees with similar types of fees on other Digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Monzo Bank | 19-39% | Free in the UK In other countries: - up to £200 - free - beyond £200 - 3% | €0.5 | 0.35%-2% |

| Wise | No | Up to £200 - free - beyond £200 - 1.75% | From 0.41% | From 0.41% |

| Chime Bank | No | No | No | 3% (max.$5) |

The Wise digital bank is different from most similar banks in that it has a minimum entry threshold, and opening and maintaining accounts are free. A personal multi-currency account is suitable for storing local and international funds and transfers. A business account has an extended set of functions, and it is optimal for doing business of any level and scale. For some services, Wise takes a one-time payment, and transaction fees are below the average for the segment. Wise is a reliable partner whose security level meets modern standards. It can be recommended for cooperation with individuals and legal entities.

Detailed review of Wise Bank

The Wise digital bank was created with a focus on clients with different levels of financial literacy. This concept has resulted in one of the simplest account management and mobile banking apps. The application contains all the necessary functions. There are relatively few of them, and they are conveniently and intuitively grouped. Transfers and conversions are carried out in a matter of seconds.

Wise mobile banking by the numbers:

-

0 – the cost of opening a personal or business account;

-

54 – the number of currencies that can be kept on the account;

-

19 – the number of currencies in which you can fund the account;

-

80 – the number of countries in which Wise is available;

-

6 – Wise transfers are so many times more profitable than bank transfers.

An important feature of neobank Wise is that it does not provide additional banking services for customers with a personal account. This means that there are no loans and overdrafts, and deposits are not available either. The client can accept and make transfers, convert currencies, and make payments in online and offline stores - wherever Mastercard standard plastic cards work. When ordering a plastic card, it is possible to withdraw cash when using it at any ATM.

Wise Business Account Features:

-

Payment of invoices. Processing one-off invoices, recurring payments, and bulk payouts in 80 countries at an exchange rate that is significantly better than any bank or PayPal.

-

Payments to employees. Connecting the accounts of office and remote specialists to a common account with automated payments and minimal commissions for transfers.

-

IBAN. A business account can be assigned an international bank number, which is necessary for cooperation with banks in other countries, including banks in the USA, the European Union, and Australia.

-

Clients accounts. The owner of a business account can issue invoices to clients and partners, as well as accept invoices from them. Instant transactions have the lowest fees on the market.

-

E-commerce. The Wise client can pay for the services of suppliers around the world and accept payments through Stripe, Amazon, Wire, as well as other international systems.

-

Single account. There is no need to open separate accounts for offices and structural divisions in other countries. You can use the division into pots within the same account with common control.

Advantages:

Simple and functional application. Intuitive interface, high usability, and adaptability.

Multi-account with free storage of dozens of currencies, interaction with banks in most developed countries.

Ability to make instant transfers around the world with minimal commissions.

Free account opening, no subscription fee. Separate services are paid one-time, at the request of the client.

All possibilities and services of modern banking for a successful business are available on a special account.

100% transparent management of any number of accounts, tracking, and control of personal and corporate finances.

Automation of payments to employees, simplified tax reporting, integration with popular financial services.

Types of accounts for individuals and businesses

At the moment, Wise only offers two types of accounts, personal and business.

Apart from keeping currencies in any amount and the ability to make international transfers, the personal account type does not provide any additional services to Wise customers. On the one hand, this is a disadvantage, because many of the features of modern banking are useful and convenient, while most digital banks provide such services without a subscription fee. On the other hand, Wise has a simple and practical functionality that does not imply unnecessary knick-knacks. And it’s completely free.

Also, a business account allows you to generate employee spending cards and connect them to the account. This is convenient when a logistician, a procurement specialist, and an accountant have limited access to a common account within their competence, and the business owner can transparently control their financial activities. However, there are two nuances. Adding an employee’s personal debit card to the organization’s database will cost £3. And if you want to make international payments, their setup by an expert will cost AUD 22.

Banking features

Wise digital bank differs from similar banks in the direction of functional simplification. At the same time, it is based on the concept of automating control over personal and corporate resources common to modern neobanks. All processes are transparent, and their control is simplified as much as possible. The system functions quickly, transactions are carried out instantly, and there is no need to manually fill out documents and create reports. Such organizations are the future of the global banking sector. Wise is equally convenient for private use and businesses of various sizes.

Technical Support

There are sections in the main menu and footer of the site that explain in detail all the features and functions provided by the digital bank. For more information, visit the support center, which is also available in the mobile application menu. There is a standard FAQs section that contains tips and tricks for working with the bank.

You can contact technical support through tickets, online chat in the application, phone, and email. These details are listed in the relevant section. Live chat works 24/7, but phone and email specialists answer only on weekdays during business hours. Wise technical support is considered one of the highest quality.

Social programs of Wise Bank

Since 2020, Wise Mobile Bank has been implementing a program to fight against slavery and human trafficking. Wise actively checks all companies in its crosshairs for compliance with the Modern Slavery Act 2015, adopted in the UK, the neobank is officially registered in. Mobile Bank has developed its own set of policies and procedures for educating the public about the problems of modern slavery, including methods for identifying companies using slave labor.

How to open an account at Wise Bank

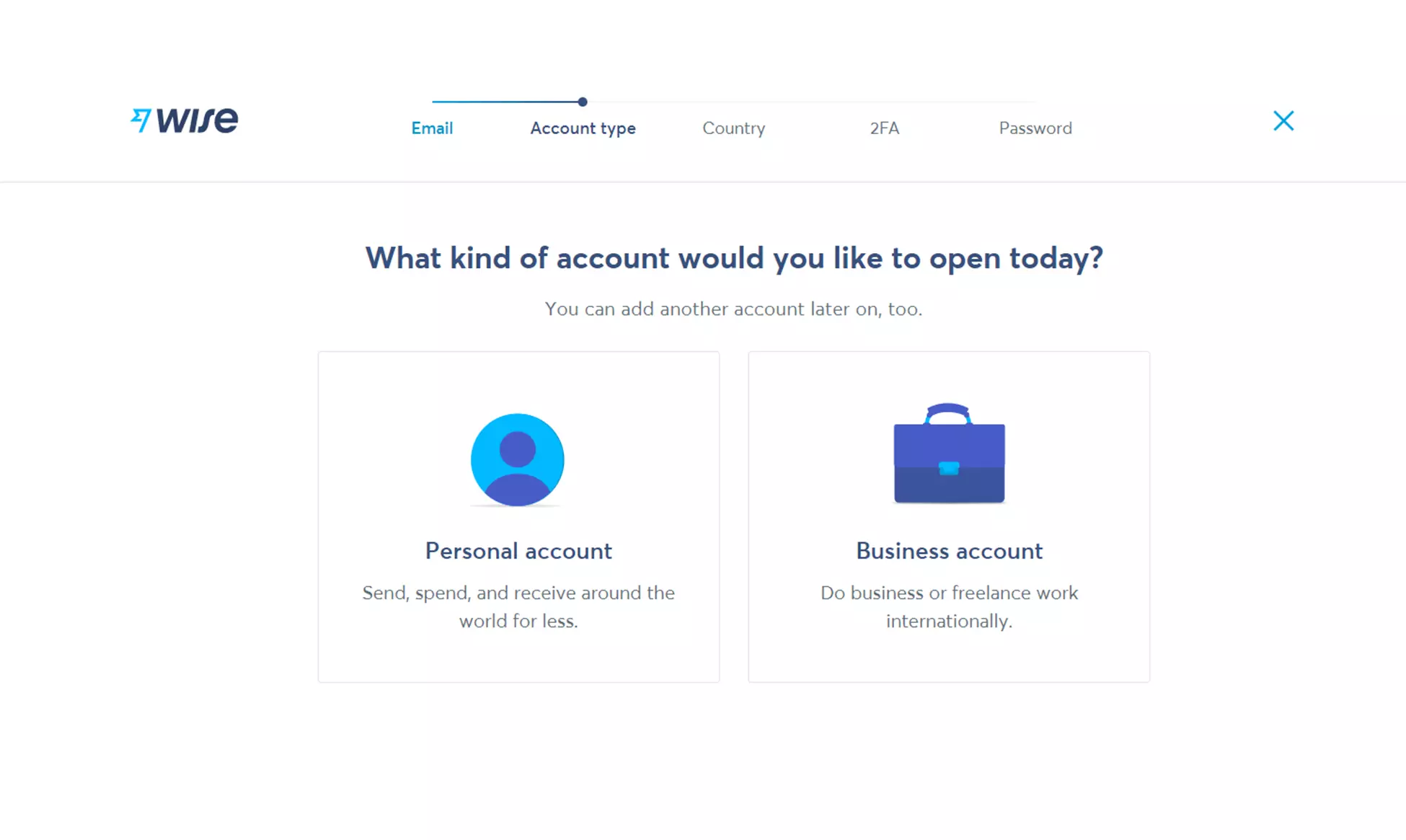

Go to the official website of the digital bank and click the “Register” button in the upper right corner of the screen. You can sign in with your Google, Facebook, or Apple account. An alternative option is to log in by email. For this, you need to enter a valid email address. Next, click the “Continue” button.

Choose the type of account, personal or business. Then indicate your country of residence. Next, enter the phone number to which the bank will send the verification code. After receiving and entering the code, you need to set up two-factor verification and devise a password. The final stage of registration is sending a scan or photo of an identity document (for example, a driver’s license). Once verification is complete, you will receive your multi-currency Wise account.

Registering a business account is slightly different. You must additionally provide information about the company and documents confirming its registration. Please also note that registration and verification steps may vary from country to country due to local laws.

Disclaimer:

Your capital is at risk. Via Wise's secure website. Your capital is at risk.

Articles that may help you

FAQs

How does Wise earn money?

The main income of Wise is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Wise protect its customers?

Wise uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Wise provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Wise?

Yes. Wise allows you to make payments between customers in different countries.