- Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland,

Currencies:

- Euro (16 European currencies in the Easy Money plan)

- 0.09% APY

- EUR 100,000

Summary of Bunq

Bunq is a digital bank offering eight plans for individuals and businesses, including a free plan with a savings account and a 30-day trial period. Clients can open up to 25 international sub-accounts for free. The bank issues a Mastercard card you can use to pay online and offline anywhere in the world (if you pay abroad, there is automatic conversion at the market rate). The bank offers its clients a number of instruments to save money, for example rounding up each payment for automatic savings (the amount is placed on the savings account at 0.09% APY). The accounts are managed from a mobile app (downloaded and installed for free). All transactions can be divided by categories. You can set limits with notifications and there are also joint accounts.

| 💼 Main types of accounts: | Easy Green, Easy Money, Easy Bank, Easy Savings (plus four business accounts with the same names) |

|---|---|

| 💱 Multi-currency account: | Yes (but only in the Easy Money plan) |

| ☂ Deposit insurance: | Yes |

| 👛️ Savings options: | Account statistics, limits and notifications, savings instruments |

| ➕ Additional features: | Automated investing (integration with Birdee), joint accounts, contests with money prizes for the bank’s clients |

👍 Advantages of trading with Bunq:

- Modern-standard online banking: the mobile app, an international account, transaction statistics.

- Eight plans to choose from: four for private clients and four for business accounts. There are plans with zero monthly fee.

- Clients can open 25 sub-accounts additionally, with international IBAN assigned to each of them.

- The accounts are not multicurrency (except for Easy Money), but you can accept transfers in 39 currencies with conversion at market rate.

- bunq bank holds the license of the central bank of the Netherlands (DNB), all client accounts are insured for EUR 100,000.

- You can link several accounts to one card: the account you use to pay depends on the PIN you enter.

- In the app, all transactions are conveniently divided into categories; you can create categories yourself and monitor expenses.

👎 Disadvantages of Bunq:

- There is only one currency available for the majority of plans at bunq, and that currency is euro; transactions in other currencies are automatically converted and the bank charges a fee for that.

- Relatively low fees for SWIFT transfers. For example, the neobank’s clients pay a fixed fee of EUR 5 for transfers up to EUR 10,000, and EUR 10 for transfers up to EUR 100,000.

- At the moment, the digital bank does not offer overdraft and some other services. For example, clients cannot receive a printed bank statement for their accounts.

Evaluation of the most influential parameters of Bunq

Table of Contents

Geographic Distribution of Bunq Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Bunq

Bunq is a digital bank that has been operating since 2014. The bank holds a banking license and operates under the supervision of the National Bank of the Netherlands, and it is also connected to the Deposit Guarantee Scheme. The operation of the organization is 100% transparent; there have not been any registered cases of fraud, hacks or unsettled disputes with the clients.

Bunq can be rightfully considered a typical representative of the digital bank segment, as it fully corresponds to the definition of a neobank.

The interaction between the client and the bank is carried out through a mobile app, which our experts assess as optimized and secure, while bunq clients say it is intuitive and simple. You can use the app to open an account, close it, make transfers, including international ones, pay bills – to fully manage your finances.

Just like most digital banks, bunq offers a number of instruments to track expenses and form savings. For example, the bank provides detailed statistics on all transactions, and the transfers and payments are automatically grouped by categories. Saving is also possible through setting limits with notifications. A client can also round up payments, automatically transferring the rounded amount to his/her savings account. There is one such account offered by the bank, at 0.09% APY. The APY is not high, but there is no minimum deposit, the funds are insured and are not locked; you can withdraw them at any time without penalties.

Unfortunately, bunq offers a multicurrency account only in one plan; in all other plans, all transfers in currency other than the euro are automatically converted. Other commissions and fees are generally acceptable. Some of them are lower than average in the market (for example the monthly fee on the Pro Account for the Easy Money plan is EUR 8.99), and some are higher (for example, the monthly fee for connecting 25 accounts and more is EUR 19). Therefore, based on the sum of factors, bunq bank can be recommended as a reliable digital bank with good conditions.

Latest Bunq News

Dynamics of Bunq’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of Bunq

Bunq bank offers its clients an opportunity to invest money in stocks of the companies traded at major global exchanges. You can access this option from the mobile app regardless of your chosen plan.

Clients of the bank can buy and sell stocks independently without limitations. However, the bank recommends using ‘smart investing’. This option allows you to automate the process of buying stocks: a client sets the risk level and the service selects a diversified investment portfolio for him/her.

Note that the automated investing service is integrated with Birdee, one of the world’s largest platforms for easy investing. Its algorithms allow users to select the most secure and promising portfolios based on the needs of the client. The minimum deposit is USD 50, management fee is 1% of the investment amount.

Portfolio strategies to choose from:

Low risk – very reliable portfolio with lower expected return.

Moderate risk – higher expected return of the portfolio at a proportionally higher risk.

High risk – more risk, but higher expected return.

Clients can set an amount they are prepared to invest and regularity of investing (for example every month). It is also possible to use the funds saved using the bank’s savings instruments (rounding up payments, for example) to buy stocks.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Overdrafts, loans, flexes

At the moment bunq bank does not provide overdrafts, flexes, and other loan options. Bunq clients cannot rely on receiving additional funds from the bank.

Terms for Cooperation with Bunq

Bunq has many strengths, the first one being the full list of online banking services. Clients don’t need to go anywhere, no office and no papers involved. This also applies to business accounts. The app automatically sends data to the accounting department and tax authorities (naturally, upon agreement with the client). The only thing the neobank lacks, according to its clients, is the multicurrency accounts in all plans, not just the Easy Money plan. The table below shows conditions of working with the bank.

| 💼 Main types of accounts: | Easy Green, Easy Money, Easy Bank, Easy Savings (plus four business accounts with the same names) |

|---|---|

| 💱 Multi-currency account: | Yes (but only in the Easy Money plan) |

| 💵 Deposit terms and conditions: | 0.09% APY |

| 💳 Loan terms and conditions: | Loans are not available |

| ☂ Deposit insurance: | Yes |

| 👛️ Savings options: | Account statistics, limits and notifications, savings instruments |

| 📋 Types of payment: | All types of online and offline payments |

| ➕ Additional features: | Automated investing (integration with Birdee), joint accounts, contests with money prizes for the bank’s clients |

Comparison of Bunq with other Brokers

| Bunq | Wise | Curve Bank | Revolut | CIT Bank | Monzo Bank | |

| Supported Countries | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | Globally | UK and EEA | Globally | USA | UK |

| Supported Currencies | Euro (16 European currencies in the Easy Money plan) | 54 currencies | 26 currencies | 30 currencies | USD | GBP |

| Deposit insurance | EUR 100,000 | No | No | Yes | $250 000 | £85,000 |

| Minimum deposit | No | No | No | No | $100 | £500 |

| Deposit rate | 0.09% APY | No | No | 6.45% | 0.1% -1.4% | 1.16%-1.50% |

| Loan Rate | The bank does not issue loans | No | No | 0.65%-0.7% | От 0.1% | 0-19% |

Bunq Commissions & Fees

You can review the fees of bunq in detail in the Fees section on the official website of the bank. We will review the examples of main fees. The bank offers 8 account types (4 for individuals and 4 for businesses); they differ in fee types and amounts. As an example, we will use the Easy Money plan, as it is the most popular personal plan with a standard set of instruments and average fees. The monthly fee is EUR 8.99 (25 sub-accounts included, linking additional accounts will cost EUR 19/month). No fee is charged on sending/receiving payments and online requests, including working with SOFORT, iDEAL and Bancontact systems. SEPA payments are also free. However, receiving payments through bunq.me is charged with a 2.5% fee.

Card replenishment from an ATM is free for up to EUR 500 per month. For amounts higher than that, the fee is 0.5% or 2.5% of the amount (depending on whether the card is issued in the EEA countries). The fees for SWIFT transfers are EUR 5 (transfers up to EUR 10,000), EUR 10 (transfers up to EUR 100,000), or EUR 25 (transfers over EUR 100,000). If you pay with Apple Pay, Google Pay, and FitBit Pay, no fees are charged. If you pay in a foreign currency, the funds will be converted at the market rate with a 0.5% bank’s fee.

The table below shows comparison of basic fees of bunq bank with fees of other digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| Chime Bank | No | No | No | 3% (max.$5) |

| Bunq | Service is not provided | First 10 withdrawals are free, after that EUR 2.99 per withdrawal | EUR 5, 10 or 25 depending on the SWIFT transfer amount | 0.5% of the amount |

Bunq bank offers everything a modern person may need to manage finance. The bank has a convenient app you can use to easily manage all your cards and accounts. You can link up to 25 sub-accounts to your card (plastic or metal) for free and pay from any of them depending on the situation. All online transfers are free, and you can transfer money to clients of other banks. The fees are charged only for SWIFT transfers. Bunq offers 8 plans that allow clients to receive the best set of services. The bank also offers an automated investing service and joint accounts. All client funds are insured.

Detailed review of Bunq

Bunq digital bank is a subsidiary of bunq BV, a fintech company with a European banking license. It is registered and headquartered in the territory of Amsterdam. Bunq is regulated by the central bank of the Netherlands. The company was established in 2012, and the app of the digital bank was launched in 2014. The direct competitors of bunq are Revolut, N26, Wise and Klarna. It is one of the top digital banks in Europe. It provides services only in the territories of the countries specified in the table above. Residents of other countries cannot become clients of bunq (they will not be able to pass verification).

Bunq in figures:

-

2014 – launch of the mobile app;

-

0 – monthly fee for the savings account;

-

0.09% – APY on the savings account;

-

25 – number of free sub-accounts;

-

The bank plants a tree for each EUR 100 spent via the app.

Note that although the main plans of the neobank are paid, private individuals and businesses can try a trial plan. Some options are unavailable in the trial plan (for example, you cannot open sub-accounts), but all main features are available and the clients’ funds are insured for EUR 100,000. There is a free 30-day trial period for other plans of the bank. All clients receive an IBAN account, but if you need a NL, DE, ES, IE & FR account, you will need to activate the Easy Bank plan. A metal card is provided only in the Easy Green plan.

Useful features by Bunq:

-

International transfers. Clients of the bank can use the app to accept, pay and issue invoices. Standard transactions are not charged with a fee (there are fees for SWIFT transfers).

-

sub-accounts. In addition to the main account, clients of the bank can open additional accounts called sub-account. Opening up to 25 of such accounts is free, and more than 25 is charged with a fee of EUR 19/month.

-

Multi-payment. Users can pay for purchases using chosen sub-accounts; for this when you pay, you need to enter the PIN of the needed account and the money will be written off it.

-

Savings account. Clients of the digital bank can open a savings account at 0.09% APY. There is no minimum deposit, and no penalty is charged on early withdrawal.

-

Savings pots. In a few clicks, a savings account can be divided into pots. Funds will be accrued to each pot in accordance with the specified parameters. You can set milestones, limits, notifications.

-

Savings instruments. bunq offers several options allowing clients to save and form savings. For example, you can round up every payment and save the spare change on the savings account.

-

Automated investing. A client can decide to buy stocks independently, but it is easier and more beneficial to do it through a special service integrated in the app. The service is provided by Birdee; it builds diversified portfolios with a predetermined risk level for the clients.

-

Joint accounts.. Several clients of the digital bank can form a joint account from their account with unified reporting. It is convenient, for example, when you pay for goods or services together.

Advantages:

Every client receives an international bank account with IBAN, in the Easy Bank plan, you can open NL, DE, ES, IE & FR accounts.

There is a fully free plan with basic functionality, and there is a 30-day trial period for all other plans.

Bunq clients can open up to 25 sub-accounts (or more, but at a fee of EUR 19/month).

All online transfers and online payments are free, except for SWIFT transfers and some special situations.

The neobank issues a plastic or metal debit card with 10 free cash withdrawals per month.

You can open a savings account without limitations on the deposit amount and at average APY. There are also savings pots.

There is a stock investing service, automated investing in portfolios selected on predetermined parameters, is available.

Bunq insures deposits of its clients (including clients with the free plan) for an amount of EUR 100,000.

Types of accounts for individuals and businesses

These are the plans for individuals. The plans for businesses have the same names, but differ in monthly fees, commissions and fees and some features. All business accounts have instruments for automation of accounting and tax reporting. The most popular business plan is Easy Money, as it provides the most features and offers the highest level of automation.

Banking features

Bunq bank provides the full list of features for online transfers. The clients of the bank install the app and receive a debit card. They can pay with the physical or virtual card or directly from the account through the app. Clients can open additional accounts and pots, including savings pots. The app has many settings for automation of transaction statistics; accounts can be joined for end-to-end display. Notably, all plans do not provide a multicurrency account, except for Easy Money. Also not that the digital bank does not provide overdrafts and flexes.

Technical Support

In the footer of the website, you will find the Help Desk section with answers to the frequently asked questions. Also, the clients of the bank can contact customer support by email: support@bunq.com. However, the simplest way is to use the live chat available in the app. The neobank does not have a call center.

Social programs of Bunq

Bunq is implementing a ‘green program’ in order to neutralize carbon footprint. Every client of the bank, an individual or a business, automatically agrees to participate in the program when they choose the Easy Green plan. For each EUR 100 spent by the client from their account at the neobank, the bank undertakes to plant one tree. The bank provides reports on tree planting. Also, clients with the Easy Green plan receive a metal card made by using sustainable technologies instead of the traditional plastic card.

How to open an account at Bunq

Make sure you are a resident of a country, where bunq provides its services (see table above). Go to the official website of the neobank and in the top right corner click Join us now.

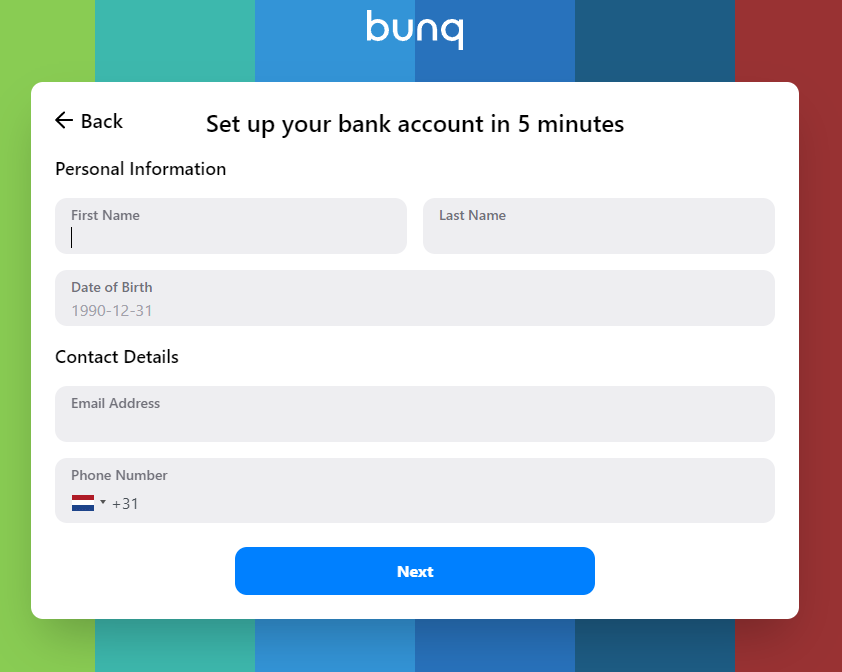

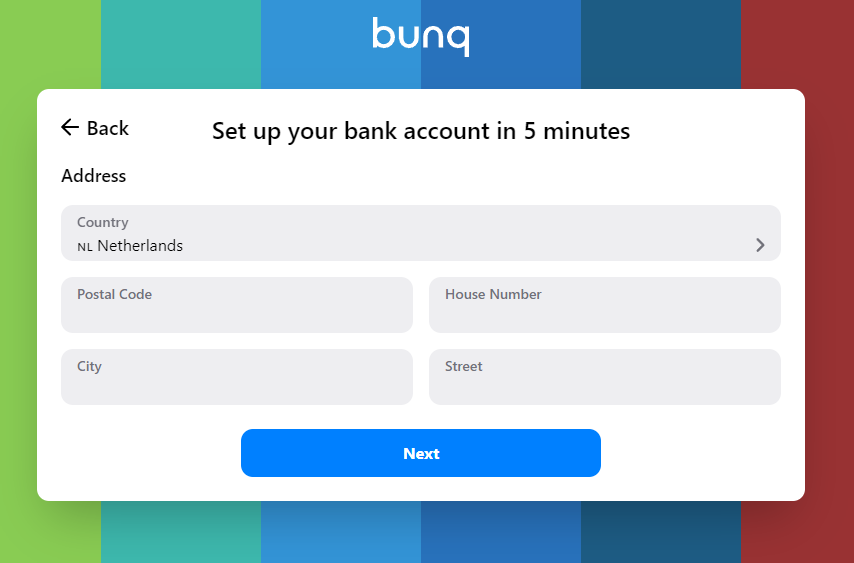

On the next page, you will be offered to download the app of the online bank. Click Get Started. In the next window click Try for free! Next, choose one of the three options: Just for me (personal account), My business (a business account) or Joint account. Next, you need to fill out the form: provide your personal information or your business information.

After that, you need to provide your address with the postal code, and your phone number. Follow the instructions on the screen. Next, you will need to confirm the information you entered and pass identity verification using an identity document (passport or driver’s license). You will not be able to use the app without verification.

You can download the bank’s app from the website (you will be provided with a link at the end of the registration). Or, you can simply open Google Play or App Store, enter ‘bunq’ in the search bar and download the app directly. When you open the app, you will need to enter your registration and login information, and you’ll receive access to online banking services as per your plan. Initially, you will have a free or trial plan and you will be able to change it in the settings.

Disclaimer:

Your capital is at risk. Via Bunq's secure website. Your capital is at risk.

Articles that may help you

FAQs

How does Bunq earn money?

The main income of Bunq is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Bunq protect its customers?

Bunq uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Bunq provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Bunq?

Yes. Bunq allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.