Trading platform:

- ING Platform

ING Bank Review 2024

- All EEA members, the Philippines, Australia, Turkey, and several other countries

Currencies:

- USD, EUR, and regional currencies

- Up to 3.30% per annum depending on the region

- Depends on the region (for example, 250,000 AUD for Australia)

Summary of ING Direct

ING Bank is part of ING Groep N.V., which is the largest group of banks in the Netherlands, and it has been on the list of the European systemically important banks since 2011. ING provides services to residents of the countries of the European Economic Area (EEA) and has offices in other regions as well. This company offers all features of online banking and has a proprietary mobile app through which its clients manage their finances. The services of this digital bank include savings and investment accounts, mortgaging and lending, and insurance and retirement funds. ING Bank has over 38 million clients and is a contemporary neobank with favorable conditions of cooperation.

| 💼 Main types of accounts: | Orange, Discounted Orange, Starter, and Business |

|---|---|

| 💱 Multi-currency account: | Yes |

| ☂ Deposit insurance: | Yes |

| 👛️ Savings options: | Account statistics and analytics, saving funds, notifications, and cashback |

| ➕ Additional features: | Lending, online mortgages, automated investments, leasing apartments, retirement funds, and insurance |

👍 Advantages of trading with ING Direct:

- It takes less than 10 minutes to open a new account, which costs 1.90 EUR or more per month.

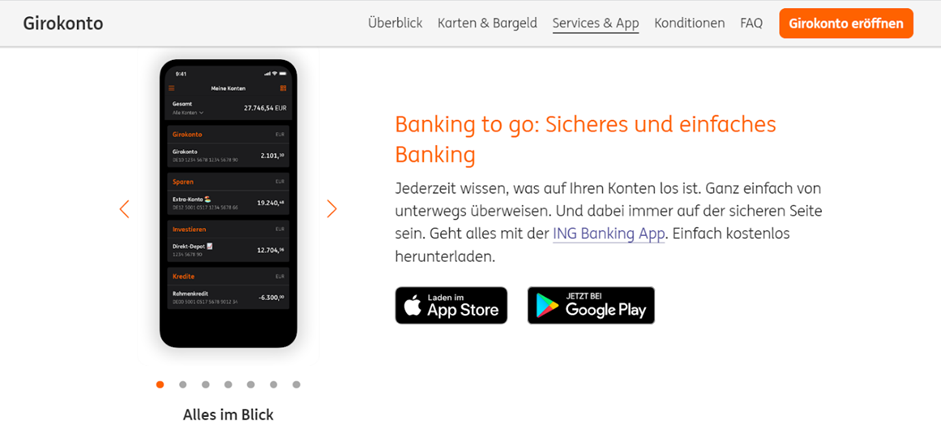

- The mobile app is free and has a full set of functions for online banking.

- All debit accounts and loans are aggregated in the app for centralized control.

- Clients can take out loans and mortgages or buy insurance via the mobile app.

- Favorable investment solutions, leasing apartments, and other options for increasing one’s capital.

- Special account types such as children’s accounts are controlled by parents.

- User accounts for businesses with free accounting packs that allow clients to automate routine transactions.

👎 Disadvantages of ING Direct:

- There are no free rate plans.

- Not all regions have call centers.

- The company operates in only 40 countries.

Evaluation of the most influential parameters of ING Direct

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of ING Direct

At first, ING Bank only worked in the European region but then it opened its branches in other countries, including Australia, Turkey, and the Philippines. Today, this neobank provides services to residents of 40 countries. Its geographical distribution is not the widest but ING makes statements about its ambitious expansion plans and gradually executes them.

Its main functions in the field of mobile banking are standard. A client can open an account and link to it his accounts at other banks. Accounts support multiple currencies and have international bank account numbers (IBANs). The mobile app allows one to make all types of transactions, including the reception of international transfers and payment of bills. ING charges a monthly service payment of 1.90 EUR or 2.35 EUR. The more expensive rate plan is more favorable because all withdrawals from ATMs in the EEA are free. In other regions, the rates may differ.

In the mobile app, a user can convert currencies, open savings accounts, and set up purposes and notifications. Depending on the rate plan and transaction type, a client receives a cashback. For example, there is a 1% cashback on utility payments. The bank offers several types of savings accounts and an integrated investment platform. Clients can invest in stocks, indices, and funds. There are personal plans and financial consultants.

ING Bank provides services that other digital banks usually don’t have. For instance, the company has its own retirement fund (available not in all regions), and its clients’ money is mandatorily insured. ING has an insurance system that covers everything from homes to mobile devices. Most clients think it’s convenient when all or almost all financial problems can be solved at one bank.

Dynamics of ING Direct’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of ING Bank

ING Bank offers its clients two options for investments. In the app, there is a tab with quotations of stocks, indices, and funds. A client can compile his investment portfolio himself by investing funds in any available asset. The other option is to use the built-in services such as Simple Investing, ING Easy Investing, or ING Asset Management.

Simple Investing includes several diversified portfolios. This solution is convenient because the portfolios were compiled by the bank’s experts, and the investment process itself is automated. A fixed amount will be debited from the specified account every month and distributed among the selected portfolios.

ING Easy Investing offers a client to invest in one of the four funds created by the bank’s experts. ING Asset Management also simplifies investments by distributing funds according to the chosen strategy. There are stable, current, income, and index strategies. If a client chooses Easy Investing, he gets free 50 EUR for investments.

Overdrafts, loans, and flexes

ING Bank offers standard overdraft conditions. A client can overpay when making online or offline payments and then return the overpaid funds to the bank with a little interest. Funds can be returned in three, six, nine, or twelve payments. The overdraft amount and interest depend on the region. For instance, in Turkey, one can use overdrafts from 100 to 5,000 Turkish liras at 1.8%, and the first payment must be made within 1 month.

ING has several options for lending, and the most popular option for private individuals is an individual loan. Loan amounts for the European region are 2,500-75,000 EUR. The annual rates are 4.80%-9.70% depending on the amounts. One can apply for a loan through the mobile app with just a few taps on the screen. Loan terms can be from 6 to 120 months. These conditions are among the most favorable in all digital banks. But don’t forget that conditions may differ regionally.

Terms for Cooperation with ING Direct

ING digital bank is licensed in all regions where it has its branches. The clients’ funds are mandatorily insured. For example, in Turkey, under deposit insurance regulations, every deposit is insured for 100,000 Turkish liras. In other regions, the bank provides other insurance amounts in local or international (euros, dollars) currencies. Every regional branch has its official website that presents the conditions of cooperation. Unfortunately, local call centers are not available everywhere but one can always contact tech support by email or through LiveChat in the app.

| 💼 Main types of accounts: | Orange, Discounted Orange, Starter, and Business |

|---|---|

| 💱 Multi-currency account: | Yes |

| 💵 Deposit terms and conditions: | For private individuals, up to 3.30% per annum depending on the region |

| 💳 Loan terms and conditions: | 4.80%-9.70% depending on the region |

| ☂ Deposit insurance: | Yes |

| 👛️ Savings options: | Account statistics and analytics, saving funds, notifications, and cashback |

| 📋 Types of payment: | All methods of online and offline payment |

| ➕ Additional features: | Lending, online mortgages, automated investments, leasing apartments, retirement funds, and insurance |

Comparison of ING Direct with other Brokers

| ING Direct | Wise | Curve Bank | Revolut | Quontic Bank | CIT Bank | |

| Supported Countries | All EEA members, the Philippines, Australia, Turkey, and several other countries | Globally | UK and EEA | Globally | USA | USA |

| Supported Currencies | USD, EUR, and regional currencies | 54 currencies | 26 currencies | 30 currencies | US dollar | USD |

| Deposit insurance | Depends on the region (for example, 250,000 AUD for Australia) | No | No | Yes | $500,000 | $250 000 |

| Minimum deposit | Depends on the region (for example, 10,000 AUD for Australia) | No | No | No | €100 | $100 |

| Deposit rate | Up to 3.30% per annum depending on the region | No | No | 6.45% | 3%-4,45% | 0.1% -1.4% |

| Loan Rate | 4.80%-9.70% | No | No | 0.65%-0.7% | Individually | От 0.1% |

ING Direct Commissions & Fees

Fees and commissions at ING largely depend on the region in which a client opens an account. In the vast majority of regions, all online transactions are free, including international transfers. Exceptions are international transfers in foreign currencies for which the bank charges 3% of the amount.

Withdrawals of funds from regional ATMs are free but customers may be required to fulfill certain conditions. For example, in Australia, one has to deposit at least 1,000 AUD to their account and make 5 or more purchases per month. In that case, cash withdrawals will be free, otherwise, the fee will be 3 AUD or 3% of the amount. The same conditions apply to international transfers. If a client actively uses his account, there will be no charges.

The first card is issued, serviced, and replaced for free. The second and the following cards cost $10 per year. Withdrawals of funds from ATMs outside of one’s country – or outside of the EEA for accounts that were opened in Europe – are only possible if the settings in the app are changed to “World”. Then every withdrawal costs $5.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| Chime Bank | No | No | No | 3% (max.$5) |

| ING Direct | Depends on the region | Free or 3 AUD, or 3% of the amount | Free or 3% of the amount | 1.40% |

ING Bank is a contemporary digital bank that allows its clients to open international accounts and make online payments worldwide. The bank also issues its own debit and credit cards and offers investment projects, private retirement funds, and online mortgages. Based on the number of the provided features, this is certainly one of the leading neobanks. Its geographical distribution, however, is limited to only 40 countries, so accounts at ING can not be opened in all regions.

Detailed review of ING Bank

ING Bank, as a division of ING Groep N.V., received a powerful technological and customer base from its parent company. For the same reason, ING can afford to provide its clients with a rich variety of services. Very few digital banks have their own exchange indices and retirement funds. On the other hand, such a large infrastructure needs permanent support. That’s why ING doesn’t have free rate plans, whereas many neobanks provide at least basic functions without subscriber fees.

ING Bank by the numbers:

-

38 million clients;

-

There are branches in 40 countries;

-

Subscriber fees start at 1.90 EUR;

-

Up to 3.30% interest paid on savings;

-

4 proprietary exchange indices.

It is important to note that most online transactions are free of charge. Even the 3% fee for international transfers in foreign currencies can be removed if you actively use your card or account opened at ING. That’s why, although some of the charges at this neobank are above the market average (for instance, a $20 duty for card expiration), generally, its conditions are comfortable. The basic rate plan without a discount is often more favorable than with a discount because it allows one to withdraw cash without limitations or fees.

ING’s useful functions:

-

Control of finances. In the mobile app, a client follows full statistics on his ING account and linked accounts. He can assort income and expenses and set up limits and notifications.

-

Savings fund. Besides savings accounts, a client can open funds into which his monetary assets will be deposited following the set conditions.

-

International accounts. Such accounts have IBAN numbers. It means that their owners can interact with banks in all counties directly and without intermediaries.

-

International transfers. Transfers to and from ING’s clients through the mobile app are made instantly and for free. The charges for transfers in foreign currencies can be removed if a customer uses his account actively.

-

Visa cards. Debit cards are provided free. Payments with them can be made wherever Visa and Maestro cards are accepted.

-

Credit cards. A user can open a credit account at low-interest rates. ING Bank will deliver a credit card linked to the account free of charge.

-

Overdrafts. A client can pay for goods or services with more than he has in his account and then return the overpaid amount to the bank in several payments.

-

Cashback. There is a cashback on certain transactions with ING Bank cards. The rate depends on the region but on average it’s 1%.

-

Online mortgages. Through this digital bank’s mobile app, a user can apply for a home loan with a few taps on the screen.

-

Private retirement funds. ING has its own retirement fund. A customer can agree on his desired terms and organize his pension savings himself.

-

Smart investments. ING’s users can invest in stocks, indices, and funds directly or select one of the four indices formed by the bank’s experts.

-

Additional options. ING Bank offers accounts for children and students, as well as personal loans, insurance, and notary services.

ING’s advantages:

-

International bank accounts, credit accounts with cards, and free debit cards.

-

Free of charge international transfers. On certain conditions, the fees for transfers in foreign currencies may be absent.

-

Convenient functions for the control of finances, as well as savings funds, limits, and notifications.

-

Personal loans at low-interest rates and low-interest mortgages.

-

Private retirement funds with a transparent system of savings and insurance with extended features.

-

The app can be highly optimized and has an intuitive interface.

-

There are several options for investing, including ready-made portfolios and diversified indices.

-

Tech support works without breaks or days off, and there are several ways to contact it.

Account types for private individuals and legal entities:

Banking features

ING is a model online bank. Its clients can open accounts and order cards without leaving their homes. It also has a mobile app that allows users to be in full control of their finances. They can transfer funds within their countries or abroad, receive payments, make online purchases without limitations, etc. A customer can get a free debit card, link it to his account, and use it to make payments offline.

ING offers overdrafts, cashback, savings accounts and savings funds, and grants personal and business loans. The additional functions that don’t belong to internet banking include online mortgages, retirement funds, and the service of leasing apartments. For legal entities, ING Bank provides all features for the reception of payments, as well as an accounting pack that helps to simplify document circulation and automate business taxation.

Technical Support

The channels through which a client can contact tech support differ regionally. Not all regions have call centers. To see the contacts for tech support, click “Contacts” or “Contact us”. You can find the button at the top or in the footer of the regional website’s home page. You can also contact tech support by email provided on the same page or via LiveChat available in the app.

Social programs of ING Bank

ING Bank has developed its ESR (environmental and social risk) policy. Under this policy, the bank doesn’t work with companies that produce natural fur products, devastate tropical forests, test cosmetics on animals, or produce weapons. The bank cooperates with the UN within the framework of environmental protection under the financial initiative UNEP FI (United Nations Environment Programme Finance Initiative). The bank’s Terra Approach program aims to eliminate the influence of greenhouse gasses on the atmosphere by 2050.

How to open an account at ING Bank

Visit the official website of ING Bank in your region. To find this website, simply enter “ING Bank + the name of your country” in the search box of your browser. The regional website will have a corresponding domain (possibly, second-level). For example, the website of the Australian branch is: ing.com.au, and the website of the Dutch branch is: ing.nl.

Get acquainted with the regional conditions for opening accounts for private individuals or legal entities. If the conditions suit you, select a rate plan and click «Open Account» (this button may have a slightly different name).

You will get to the page with the requirements you have to meet to open an account. Click «Download app» in the lower part of the screen. Select your operating system: iOS or Android. You will be redirected to the app page on the AppStore or Google Play for downloading.

If you enter the browser on your smartphone, tap «Install». If you enter the browser on your PC, which is synced with your smartphone, you can download and install the app on your phone remotely. Otherwise, you have to enter the digital store on your mobile device, find the ING Bank app manually, and then install it. Then just follow the on-screen instructions. Registration will take no more than 10 minutes. You will need to provide your personal data.

Articles that may help you

FAQs

How does ING Direct earn money?

The main income of ING Direct is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does ING Direct protect its customers?

ING Direct uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

ING Direct provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through ING Direct?

Yes. ING Direct allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Curve's secure website.