Trading platform:

- Mobile Apps

- Citi Personal

Citibank Review 2024

- Almost all developed countries

Currencies:

- US dollar, euro and other currencies (regionally)

- 0.50-1.01% APY

- Yes, the amount depends on the region

Summary of Citibank

Citibank operates in North America, Europe, Asia and other regions. In the U.S., the bank works in 43 states out of 50. It does not have representative offices in California, Connecticut, Maryland, Nevada, New Jersey, New York and Virginia. It is one of the largest neobanks in the country, specializing in credit cards. Citi offers 13 types of cards, including free ones (no monthly fee). The cards of the Visa and Mastercard standards are accepted all around the world. Cash withdrawal is free from 65,000 ATMs. Citibank allows its clients to shop online and offline, and make international transfers. The mobile app features detailed analytics on the accounts and cards; as well as options for systematizing expenses. Also, the digital bank offers savings accounts at up to 1.01% APY.

| 💼 Main types of accounts: | Citi Custom Cash, Citi Double Cash, Citi Diamond Preferred, Costco Anywhere, Costco Anywhere Visa, Citi Rewards+, Citi Premier, Citi Simplicity, Citi Secured Mastercard, AAdvantage, Airlines AAdvantage Mastercard, AAdvantage Executive World Elite Mastercard, CitiBusiness |

|---|---|

| 💱 Multi-currency account: | No |

| ☂ Deposit insurance: | Yes, the amount depends on the region |

| 👛️ Savings options: | Account statistics, limits and notifications, savings accounts and instruments, interest-free overdraft |

| ➕ Additional features: | Integrated investing service, home mortgage service |

👍 Advantages of trading with Citibank:

- The digital bank offers the full list of online banking services in line with modern standards;

- Functional mobile app with intuitive interface and high level of optimization;

- 13 types of credit cards to choose from, including free cards, cards for traveling and big purchases;

- There is a cash bank on most cards, including a universal one on all types of purchases (online and offline);

- Several types of savings accounts with flexible conditions, APY up to 1.01%;

- The banks provides interest-free overdraft – a client repays the exact amount he paid on top of what he had on his card at a store;

- Specialized investing programs, plus robo advisors and latest analytics.

👎 Disadvantages of Citibank:

- Citi digital bank does not issue debit cards (pre-paid); it focuses on providing various types of loans (including home mortgage);

- The interest rate (APR) for most credit cards of the bank is rather high, up to 26.49% (however, loan conditions can be improved);

- not all investment solutions offered by the bank are comfortable for beginners.

Evaluation of the most influential parameters of Citibank

Table of Contents

Geographic Distribution of Citibank Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Citibank

Citibank is a part of Citigroup Inc., which was established in 1812. It is one of the oldest banking enterprises in the country with rich culture and a focus on cutting-edge trends. Therefore, it is not surprising that the bank has 110 million clients all around the world. Important notice: the organization is registered in the U.S. territory, but provides banking services also to residents of other countries. However, if you are not a U.S. citizen or resident, the bank's conditions may not be as beneficial, because the ATMs of the bank’s partners are mostly located in North America, and the same applies to the organizations Citibank offers special conditions for, for example Costco.

The biggest advantage of the bank is its specialization. The neobank offers over a dozen of credit cards, many with no monthly fee, and almost all of them with cash back. The APR can be considered relatively low. The maximum APR is 26.49%, which is average for the country, but with a good credit score, this rate can be reduced, up to 15.25%. A lot depends on the type of card, but it is easy to order a new one. You can do it in the app literally in a few clicks. In terms of this, Citibank complies with the top online banking standards. There are also pleasant perks like interest-free overdraft and the bank’s own mortgage service with exclusive offers.

The investing service deserves special mention. Market News & Insights will tell you about market trends and provide fundamental analytics, and Investor Learning Center will teach you the basics of investing in securities. Investors can invest in stocks and ETFs. The bank also offers free robo-advisors that help diversify your portfolio. All in all, in this sector Citibank offers many interesting services that allow you to practically fully automate the process of investing. Therefore, in terms of the sum of factors, this digital bank can be recommended.

Latest Citibank News

Dynamics of Citibank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of Citibank

The digital bank offers its clients an integrated platform Citi Personal Wealth Management. The platform allows you to trade in the securities market directly from the neobank’s mobile app. Clients receive access to the most popular stocks and ETFs in the global market. They can trade independently or use automated features and a robo-advisor. There is no minimum deposit and the transaction fee is 0%.

The Citi Self Invest account is taken into consideration for calculation of the credit score of a bank’s client and the score can be significantly improved with regular use of the account (the bank does not reduce the score even if the investment is unsuccessful). It is recommended to use investment automation, including a robo-advisor. The robot has quite a few options. Simply speaking, its algorithm of operation looks as follows: a client sets goals and budget limitations, and also sets a risk level he/she is prepared to tolerate. Based on this information, the robot builds a ready-made investment portfolio, which can be adjusted at any time.

Clients of the bank can automate investing, choosing the periods and the amounts that will be written off their accounts to replenish an investment portfolio. There are paid services, but at the basic level, standards tools and analytics published by the bank are enough.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Overdrafts, loans, flexes

Overdraft is when you don’t have enough money in your account, but the bank allows the transaction, and your balance turns negative. The majority of digital banks that offer the overdraft service charge interest for it, specifying the term and number of payments. In the past, Citi offered a fixed payment of USD 34 per each unit of product purchased with the use of the overdraft. The full price of the product did not matter. However, on June 19, 2022, the neobank canceled all fees on the overdraft, and now this service is 100% free. As for the loans, we will discuss their conditions below.

Terms for Cooperation with Citibank

The accounts of the neobank’s clients are not multicurrency ones. If a client is in the U.S., the US Dollar will be the account currency. If the client is in Singapore, the Singapore dollar will be the account currency. Transactions with other currencies are automatically converted at market rate (the bank may charge a fee; you can learn about it from a regional manager). In terms of insurance, everything also depends on the region. For example, the Singapore office is a member of CDIC, as is the Canadian office. Under the charter of the organization, its members must provide coverage for the funds of their clients for the amount of USD 75,000. There are many banks that offer better insurance coverage, but Citibank has never had any issues in this area and the company’s conditions are viewed as good.

| 💼 Main types of accounts: | Citi Custom Cash, Citi Double Cash, Citi Diamond Preferred, Costco Anywhere, Costco Anywhere Visa, Citi Rewards+, Citi Premier, Citi Simplicity, Citi Secured Mastercard, AAdvantage, Airlines AAdvantage Mastercard, AAdvantage Executive World Elite Mastercard, CitiBusiness |

|---|---|

| 💱 Multi-currency account: | No |

| 💵 Deposit terms and conditions: | Up to 1.01% APY |

| 💳 Loan terms and conditions: | 15.25-26.49% APR |

| ☂ Deposit insurance: | Yes, the amount depends on the region |

| 👛️ Savings options: | Account statistics, limits and notifications, savings accounts and instruments, interest-free overdraft |

| 📋 Types of payment: | All types of online and offline payments |

| ➕ Additional features: | Integrated investing service, home mortgage service |

Comparison of Citibank with other Brokers

| Citibank | Wise | Curve Bank | Revolut | Monese Bank | Quontic Bank | |

| Supported Countries | Almost all developed countries | Globally | UK and EEA | Globally | UK and EEA | USA |

| Supported Currencies | US dollar, euro and other currencies (regionally) | 54 currencies | 26 currencies | 30 currencies | GBP, EUR, RON | US dollar |

| Deposit insurance | Yes, the amount depends on the region | No | No | Yes | Yes | $500,000 |

| Minimum deposit | No | No | No | No | No | €100 |

| Deposit rate | 0.50-1.01% APY | No | No | 6.45% | 28.2% | 3%-4,45% |

| Loan Rate | 15.25-26.49% APY | No | No | 0.65%-0.7% | Individual | Individually |

Citibank Commissions & Fees

Commissions and fees of Citi fully depend on the chosen plan (card). There is no monthly fee for many cards, and all cards are issued and delivered for free. A client receives a virtual card linked to his account with the IBAN number for free. The annual fee for paid cards is from USD 95 to USD 450 (for some cards, the fee is charged only for the first 12 months).

There are no fees for the majority of online transactions, including international transfers. Also, no fee is charged on cash withdrawals from 65,000 ATMs around the world. You can withdraw cash from Visa and Mastercard cards at all ATMs, but, if the ATM is not a partner of Citibank, the bank that owns the ATM may charge a fee. The same applies to electronic payment systems and other services, which operate independently from the neobank.

The operation of Citi is 100% transparent. The bank’s clients learn about all commissions and fees in advance, before making a transaction. There is a corresponding tab in the mobile app with information about the fees. There are no hidden payments.

The table below shows a comparison of basic fees of Citibank with fees of other digital banks.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| Chime Bank | No | No | No | 3% (max.$5) |

| Citibank | No | Zero fee at 65,000 partner ATMs; at other ATMs, the fee is charged by the bank that owns them | No, or calculated individually | No, the exchange is performed at the market rate |

Citi has a loyal fee policy. The reason for that is that Citibank Inc. is one of the leading financial structures in North America. The bank can afford not to charge fees for overdraft, international transfers and currency conversion. Nonetheless, the credit rate of this digital bank is average for the majority of clients, and only clients with high credit scores can access better conditions.

Detailed review of Citibank

At the moment, this digital bank is ranked among the top institutions in its segment in the USA and is regarded as one of the best banks in the world. However, it is a credit bank and it does not issue debit cards. Only the virtual card issued for each client of the bank for free is considered as such. The APR of the bank is average, but additional features are extremely beneficial. For example, the bank offers a cash back in cash of up to 5%, bonus points from partners and double-bonus miles for American Airlines in the corresponding plan. In addition, Citibank helps choose the best mortgage conditions. Clients can transfer their loans to this bank and receive refinancing under better conditions, which is confirmed by user reviews.

Citibank in figures:

-

110 million clients around the world;

-

65,000 ATMs with free withdrawal;

-

13 types of credit cards;

-

Up to 1.01% APY on savings accounts;

-

0 – monthly fee for standard accounts.

Clients of the bank name automated investing as a particular advantage of the bank. Today, it is becoming a new standard for digital banks, and Citibank is most certainly on the cutting edge. Although users can invest on their own, using the integrated functionality in the mobile app, the bank recommends using automation instruments. For example, the robo-advisor was developed by top US financial experts and indeed allows you to obtain well-diversified investment portfolios in accordance with your requirements.

Useful features by Citibank

-

International transfers. Just like all neobanks, Citibank provides its clients with an international account IBAN. This account allows you to make and accept transfers all around the world.

-

Credit cards. The clients of the bank can use the app to block one of 13 credit cards. Each card has its own conditions, and many don’t require a monthly fee.

-

Automated investing. The service is integrated in the digital bank’s app. It allows you to buy/sell securities manually or set up the process using a robo-advisor.

-

Home mortgage. The digital bank has its own service, designed for the clients, who take out home mortgages. There are also exclusive offers.

-

Loan refinancing. A loan taken out at any other bank can be transferred to Citi and refinanced at a lower APR.

-

Savings accounts. The bank offers several types of savings accounts. The annual percentage yield depends on the deposit period and is up to 1.01%. The minimum deposit is USD 500.

-

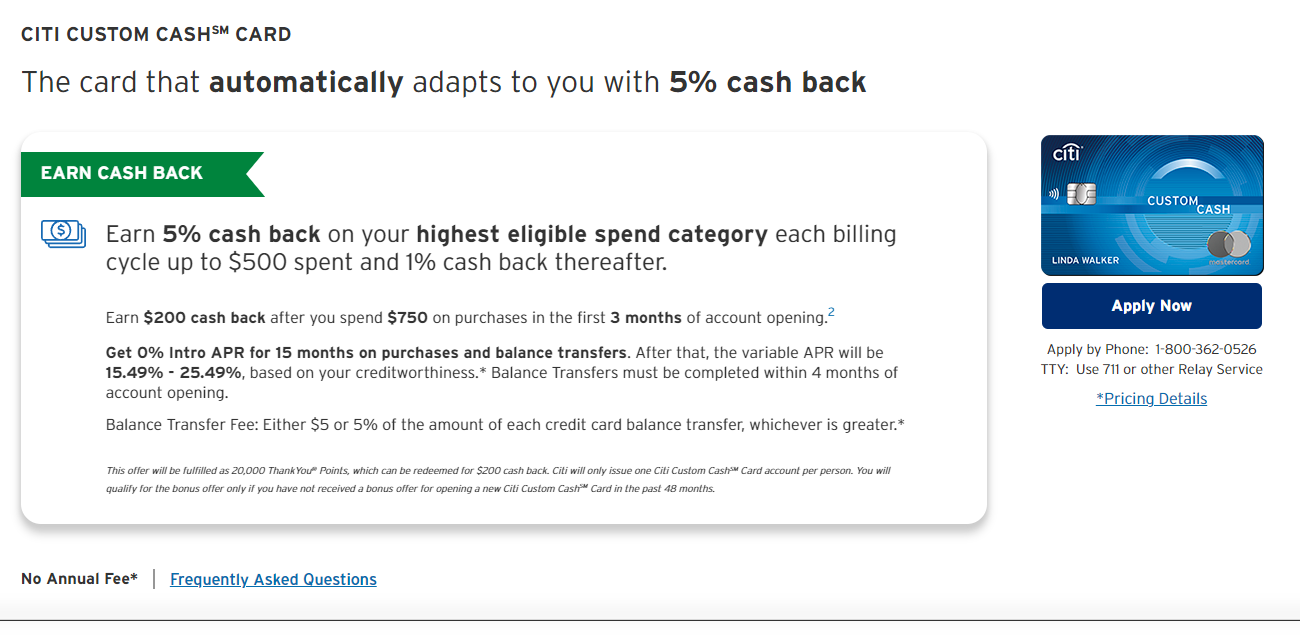

Cash back. Almost all credit cards of the digital bank have the cash back feature. Depending on the type of the card, cash back can amount to 1-5% on all purchases or certain types of purchases.

-

Business accounts. Businesses are offered special conditions for opening an account at Citibank. These include reduced fees, accounting and tax reporting automation.

Advantages:

This digital bank has a huge client base and a developed community; it is regarded by users as a reliable and comfortable bank to work with.

The bank provides several types of credit cards and savings accounts, and also dozens of additional features. Clients receive the most customized offers.

The full list of online banking services, including international transfers, overdrafts and cash back. At that, many services are charged with zero fees (for example, you don’t have to pay extra for the overdraft).

The company has its own mortgage services. Clients can take out a home mortgage on conditions that are considered some of the best in the U.S. (for other regions, this feature is optional and is not provided everywhere).

Investment solutions of Citibank are recognized as friendly to novice investors (not applicable to all programs, some require good knowledge of the market).

Citi has many partners. Thanks to this, cash withdrawal at 65,000 ATMs is free. Also, if you often shop at Costco, you can receive an increased cash back and unique discounts.

Citibank is known for quick and quality technical support. There is a list of numbers of a multi-channel call center for each region, and there is also a live chat in the app and email.

Types of accounts for individuals and businesses

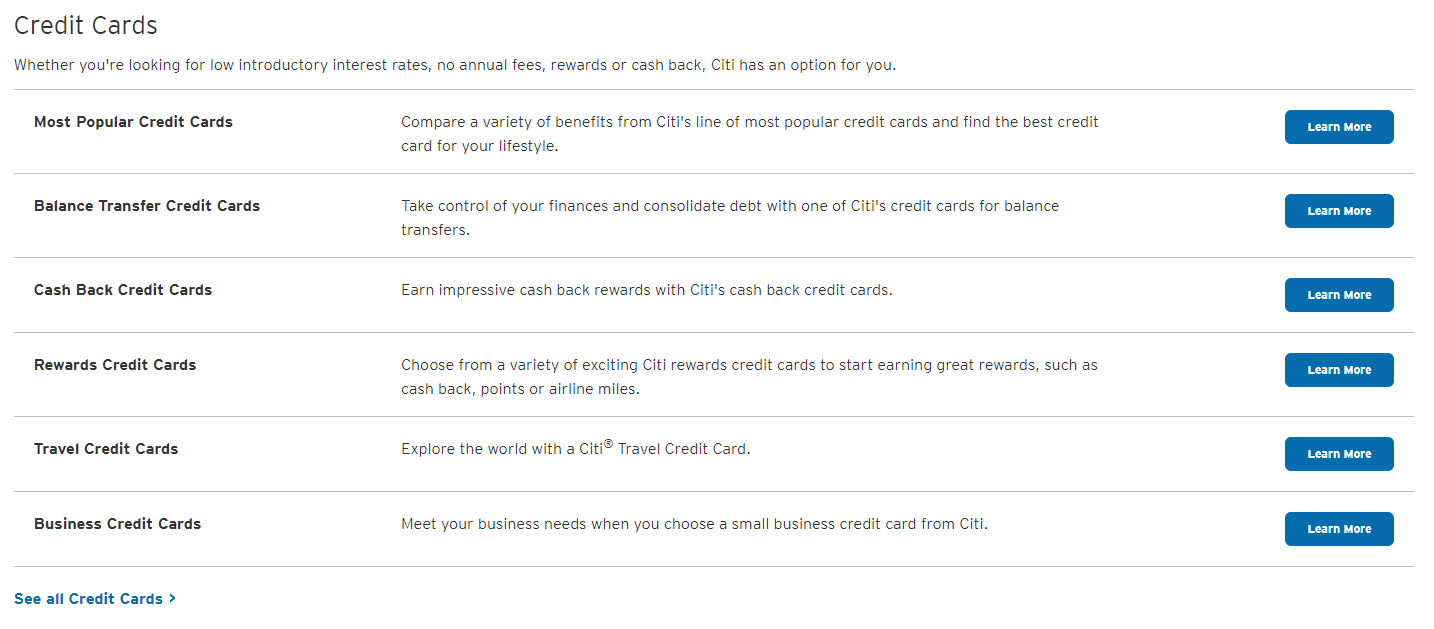

Citibank also has other plans, including offers for travelers and small businesses. You can learn about them in the Credit Cards section on the official website of the digital bank.

Banking features

Citibank fully corresponds to the definition of a digital bank. A card can be obtained remotely, all you need is a PC or a smartphone. No offices or red tape. The bank allows its clients to make transfers inside the country and international transfers. There are several types of credit cards with a virtual analogue linked to the account. You can pay online and offline, and withdraw cash from ATMs around the world without limitations. Additional offers include an investing service (including a unique feature of a robo-advisor), home mortgages and a possibility to refinance a loan taken out at a different bank.

Technical Support

You can contact managers and specialists of the digital bank using several means of communication. If you are a registered user, the simplest option is to write in a live chat, which is available in the mobile app. You can also always call the Citibank call center. Note that the contacts are different for different countries; you can find them on the bank’s website for your region. There is a dedicated number for each category of questions. Finally, you can contact customer support by email or through the Contact Us service, which features FAQ and tickets.

Social programs of Citibank

Citi does not implement social programs. However, partners of the bank and its daughter companies participate in social responsibility and environmental safety programs. Many clients of the bank support the concept of reducing carbon footprint that is damaging to the planet. You can find more information about this on the official social media accounts of the digital bank.

How to open an account at Citibank

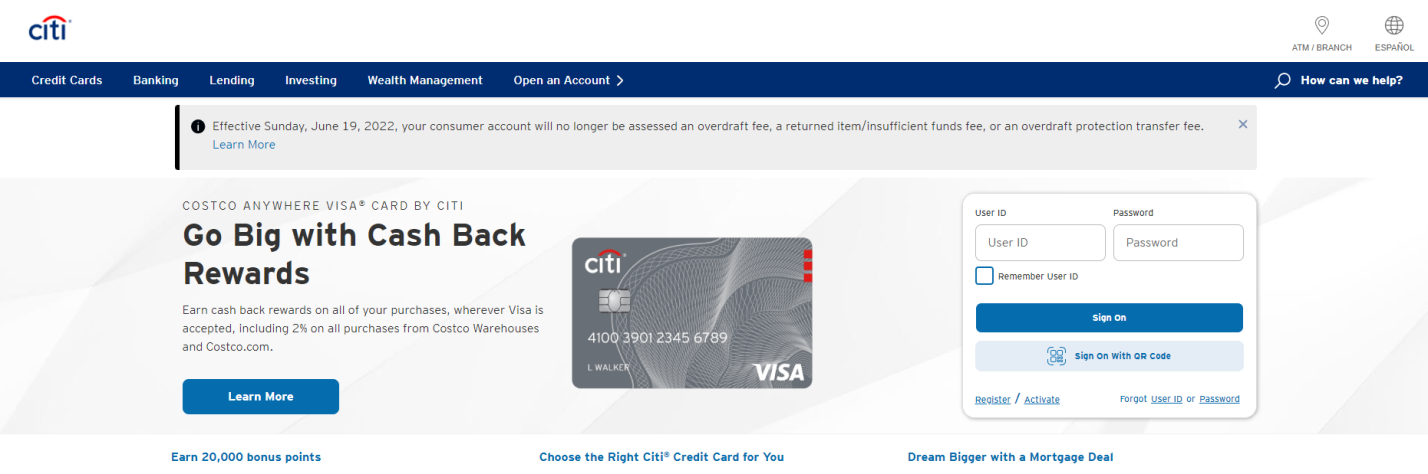

Go to the official website of the digital bank Citi in your region. The following steps may slightly differ, but the general algorithm is the same. We will use the example of registration in the U.S.

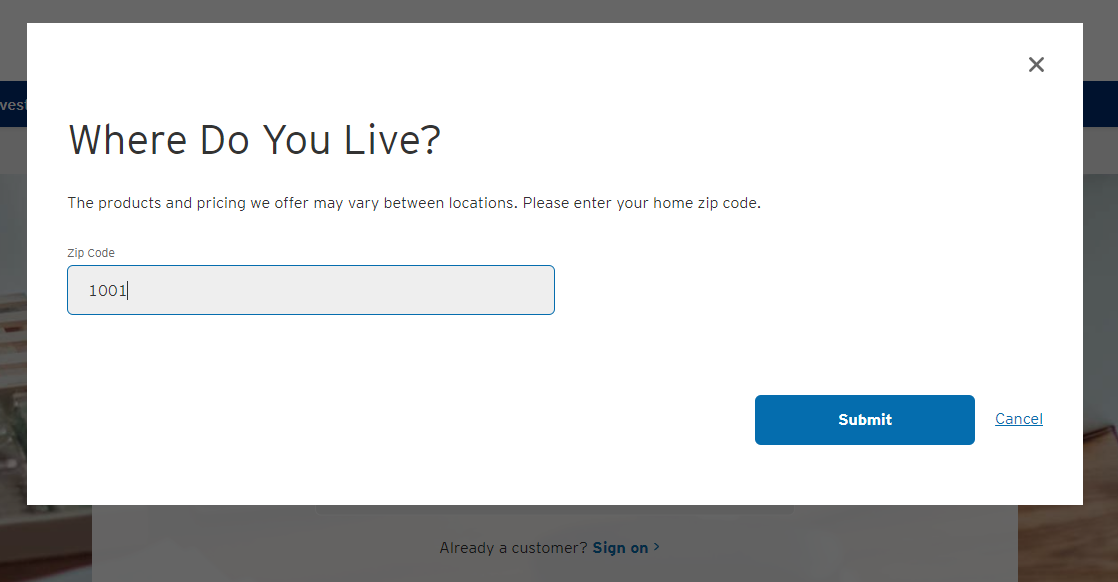

At the top of the screen click Open an Account. In the next window, enter your Zip Code.

In the next window, choose your account category; below you will see the types of cards you can open. Click Learn More for the category you are interested in.

Once you’ve chosen the card, review its conditions once again and click Apply Now. Follow the instructions on the screen. You will need to enter your personal information, including your phone number, Social Security Number and other information. Registration will be completed once the information you provided is verified (checked and confirmed).

You can manage your account at Citibank using your Personal Account on the website, but it is more convenient to do it in the bank’s mobile app. At the end of the registration, you will be offered to download the app by scanning the QR code. You can also find the code and direct links to the app stores on the official website of the digital bank. The third option is to simply open the App Store or Google Play on your device and enter Citibank in the search bar to find the app.

Articles that may help you

FAQs

How does Citibank earn money?

The main income of Citibank is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Citibank protect its customers?

Citibank uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Citibank provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Citibank?

Yes. Citibank allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Curve's secure website.