Trading platform:

- Banking Platform

Barclays Bank Review 2024

- The U.K., the U.S., and more than 50 other countries

Currencies:

- AUD, HKD, NZD, ZAR, CAD, DKK, NOK, SEK, USD, EUR, CHF, and JPY

- 1.09-2.90% per annum

- 100,000 EUR

Summary of Barclays

Barclays is an international digital bank (Barclays) with headquarters in London. It offers one of the highest deposit interest rates. Deposits in the U.S. are insured by the FDIC, and funds can be withdrawn at any time. Additional charges are sometimes collected for early withdrawal. There are standard savings deposits and certificates of deposit. A client can link up to 25 accounts at other banks to his Barclays user account and make free money transfers between them through the mobile app or use them for online and offline payments. The app has a set of functions for the control of finances. Overdrafts and other features of online banking are available.

| 💼 Main types of accounts: | Standard and Premier |

|---|---|

| 💱 Multi-currency account: | Yes |

| ☂ Deposit insurance: | By the FDIC, for 100,000 EUR |

| 👛️ Savings options: | Account statistics and analytics, limits, notifications, and cashback |

| ➕ Additional features: | Savings and CD accounts, online mortgages, smart investments, children’s savings accounts, and automation of taxation |

👍 Advantages of trading with Barclays:

- A simple and convenient app with free service, and the absence of surplus charges.

- Online savings accounts and certificates of deposit at up to 2.90% per annum.

- Clients can link up to 25 accounts, make quick transfers, and track their income and expenses.

- Depositors’ funds at the American branch are insured by the FDIC.

- There are all options for mobile banking, including international bank accounts and international debit cards.

- Debit cards are welcome wherever Visa cards are applicable. Payments can be made online.

- Tech support works 24/7 through a multichannel call center.

👎 Disadvantages of Barclays:

- Verification can take a lot of time.

- All transfers are made through an intermediary.

- High charges for depositing funds to international accounts.

Evaluation of the most influential parameters of Barclays

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Barclays

Having analyzed the features of Barclays, TU’s experts found several conceptual advantages for private customers. The first thing to note is the rate on online savings accounts. Depending on the term of the deposit it can be up to 2.90%. Indeed, this is one of the highest rates in the world. Moreover, deposits are insured by the FDIC, and Barclays has a license, which guarantees the security of your savings.

Based on the typical functions of contemporary digital banks, Barclays is among the world’s leaders and it successfully competes with the best analogs. This bank allows its clients to aggregate many accounts in one app and gives them full control of their financial flows at a high level of automatization. Overdrafts of up to 15 GBP are free, and customers can take out online loans and mortgages via the app.

Note that international accounts with an IBAN can be opened only in two currencies: euros and U.S. dollars. Most standard transactions are free of charge. But such transactions as SEPA transfers are paid, although there are no additional charges for direct euro transfers to debit cards through SEPA. These are the specialties of Barclays, which most other neobanks don’t have.

Besides the many positive aspects, clients of this organization point out some negative ones. For instance, the fees for international transactions can be quite high. Adding funds to IBAN accounts costs 7 EUR. Note the several special rate plans. For example, under the Dream rate plan, you can use only three accounts. These drawbacks are not crucial but you should mind them if you have decided to work with the Barclays online bank.

Latest Barclays News

Dynamics of Barclays’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of Barclays Bank

Barclays offers its private clients two options for passive earnings: standard online savings accounts and certificates of deposit (CDs). The annual percentage yield (APY) rates on savings accounts are 1.09% and 1.10%. The APY rates on CDs depend on deposit terms and don’t depend on amounts. For example, deposits for 12 months have APY rates of 1.88% and 1.90%, and deposits for 60 months have APY rates of 2.86% and 2.90%.

On the bank’s website and in its mobile app, there is a calculator that determines the profits on investments. At Barclays, the APY rates on CDs are the highest in the U.K. and among the highest in the world. Besides that, there is no minimum deposit. Interest is accrued daily and not at the end of the deposit term. The funds are not frozen, so a client can withdraw part of his deposit or the whole deposit at any time. But in the latter case, an additional fee is charged.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Overdrafts, loans, and flexes

Accounts at Barclays are opened and serviced free of charge. There is no payment for overdrafts of up to 15 GBP or equivalents in other currencies. And if an overdraft is higher, the payment depends on the amount and term.

For instance, if the overdraft is 500 GBP, then in 7 days a client will pay 2.88 GBP; in 30 days the payment will be 12.45 GBP; and in 60 days it will be 25.21 GBP. Thus, the annual interest rate is 35%, which is average in this segment. But if a client selects an overdraft limit in the app in advance, he can reduce the interest rate.

Regarding credit cards, Barclays grants loans of four types at the interest rates of 0%, 72.4%, 23.9%, and 33.9% The rates are flexible and can be reduced. Cashback depends on the card type and the total amount of expenses in the reference period.

Terms for Cooperation with Barclays

Barclays digital bank is registered in the U.K., and its American branch has a license from the FDIC. This organization provides services in over 50 countries, and its clients don’t have to be residents of the U.K. or U.S., although there are special conditions for residents of these countries. The company's head offices are in Philadelphia and London. Barclays cards are accepted wherever Visa cards are welcome. Barclays has all the functions of neobanks, including international transfers and online payments via the app. The bank’s basic conditions are in the table below.

| 💼 Main types of accounts: | Standard and Premier |

|---|---|

| 💱 Multi-currency account: | Yes |

| 💵 Deposit terms and conditions: | Up to 2.90% interest per annum |

| 💳 Loan terms and conditions: | From 23.9% to 72.4% interest depending on the loan type; also, the rates can be reduced |

| ☂ Deposit insurance: | By the FDIC, for 100,000 EUR |

| 👛️ Savings options: | Account statistics and analytics, limits, notifications, and cashback |

| 📋 Types of payment: | Most methods of online and offline payments |

| ➕ Additional features: | Savings and CD accounts, online mortgages, smart investments, children’s savings accounts, and automation of taxation |

Comparison of Barclays with other Brokers

| Barclays | Wise | Curve Bank | Revolut | Suits Me Bank | Emirates NBD | |

| Supported Countries | The U.K., the U.S., and more than 50 other countries | Globally | UK and EEA | Globally | UK and worldwide | AED |

| Supported Currencies | AUD, HKD, NZD, ZAR, CAD, DKK, NOK, SEK, USD, EUR, CHF, and JPY | 54 currencies | 26 currencies | 30 currencies | GBP, EUR, RON, SEK (for transactions with other currencies, automated conversion is made) | UAE |

| Deposit insurance | 100,000 EUR | No | No | Yes | No | 100,000 AED |

| Minimum deposit | No | No | No | No | No | 500 AED |

| Deposit rate | 1.09-2.90% per annum | No | No | 6.45% | No | 2% |

| Loan Rate | From 23.9% to 72.4% | No | No | 0.65%-0.7% | No | Individually |

Barclays Commissions & Fees

Accounts are opened and serviced free of charge. The Travel Pack costs 12.50 EUR or 18 EUR (extended version) per month. The Tech Pack with additional functions costs 9 EUR or 14.50 EUR (extended version) per month. There is also a pack of options for emergencies, which costs 9 EUR per month. All the packs can be set up for at least 6 months.

Personal debit cards of this neobank cost 10 EUR, and temporary cards cost 12 EUR. The cards are delivered free but clients can order a quick delivery for 1.99 EUR. The replacement of lost or damaged cards costs 5 EUR. The annual interest rate on an arranged overdraft of up to 1,200 GBP is 35%, which can be reduced to 19.5% in Premier accounts.

Online payments are free of charge. Payments made at the bank’s branches or by phone cost 25 EUR, and canceled payments are charged at 20 EUR. SEPA credit transfers in amounts up to 100,000 EUR are free of charge, and for larger amounts, the charges start at 6 EUR. All online transactions through SEPA are free but if an international transfer is made at a branch or by phone, then a client pays 25 EUR. There are additional services such as payment tracking, which have fixed costs. For example, the special service of document safekeeping costs 10 EUR upon activation and then 3 EUR per month.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Revolut | No | Up to $350 - free - beyond $350 - 2% | 0.3% (min. $0.30, max. $6) | From 0% to 1% |

| Chime Bank | No | No | No | 3% (max.$5) |

| Barclays | Up to 15 GBP free, and then 35% per annum (can be reduced to 19.5%) | 45 pence (there may be additional charges) | 25 EUR (online transfers are free) | 2.99% per conversion, except EUR/USD conversions |

Detailed review of Barclays Bank

It’s important to understand that Barclays digital bank is an enterprise of Barclays Bank Plc. This is one of the most influential financial conglomerates in the United Kingdom with a vast network of offices in Europe, Asia, and the U.S., which explains the abundance, high quality, and flawless technical optimization of the services offered by the digital bank. Its app has the highest level of security. Personal data and funds of its clients are insured. All transactions are made as fast as technically possible. Like most neobanks, Barclays issues debit and credit cards for its clients.

Barclays by the numbers

-

48 million clients;

-

0 EUR payment for account service;

-

Up to 2.90% interest on CD accounts;

-

Up to 25 accounts linked to a user account;

-

100,000 EUR insurance.

Barclays is a digital bank, which means you don’t have to visit an office to create a user account and link your accounts at other banks to it. All transactions are made in the app that can be installed on any iOS or Android mobile gadget. Also, a client of this neobank can manage his finances through his user account on the website. This requires a device – not necessarily a PC, it can be a tablet – with an internet connection and a browser.

Barclays’ useful functions:

-

Control of finances. In his user account and app, a client sees all his transfers and expenses in each account. He can aggregate and assort data and set up limits for expenses in separate accounts. There is also a function of notifications that warn the user when he reaches a set mark or limit, or when an important event takes place.

-

International bank account. A client of this neobank can open an IBAN account. This is an international account that allows one to make and receive transfers to and from all banks in the world. Also, a client can get an international bank card that is linked to his international account.

-

International online transfers. Clients of this digital bank can transfer any amount of money to other private individuals online without limits or fees. A payment of 25 EUR is charged only in the case when a client makes a transfer not online but at a branch of the bank, by phone, or by mail.

-

Savings and CD accounts. Clients can make deposits to their online savings or CD accounts in any amount and at any time to earn passive income. The annual interest rate varies from 1.09% to 2.90% depending on the deposit term. Deposits are not blocked and can be withdrawn. Interest accrues daily.

-

International reserve account. This is a savings account accessed by a client with just one tap on his smartphone screen. This account is available in three currencies. It differs from ordinary savings accounts in that withdrawal of all funds before the term expires is free of charge. The cost of opening this account is 1 GBP.

-

Smart investments. This service is integrated into the Barclays app. It allows a client to collect all data on all of his investments and analyze his current portfolio. The portfolio can be adjusted. The analytical system offers the best option but the choice is made by the client.

-

Online mortgages. Barclays offers several mortgage programs for private individuals. There are programs with fixed, flexible, and hybrid rates. Mortgage conditions can always be made more favorable due to access to the best offers in the international mortgaging market.

-

Overdrafts. If a client accidentally overdraws his account, Barclays will give him a free overdraft of up to 15 GBP. The overdraft limit is 1,200 GBP. If a client agrees with the bank on overdrafts in advance, the standard rate of 35% can be reduced.

Advantages:

Barclays’ advantages:

-

This neobank is a subsidiary of one of the largest financial holding companies in the U.K.

-

The bank has a high trust rating. It’s perfectly protected and has never been hacked.

-

Its mobile app has an intuitive interface. It’s convenient and reliable.

-

All transactions are made in minimum time without any delays or additional reviews.

-

Clients can make international transfers in major currencies without limits.

-

Funds can be withdrawn free of charge from 60 thousand ATMs of Barclays’ partner banks.

-

With the bank’s Visa debit and credit cards, one can pay online and offline.

-

Barclays offers control of finances, notifications, an overdraft system, and loans; i.e., all the features for the effective management of your finances.

-

The highest interest rate on CD accounts allows clients to earn considerable passive income.

Account types for private individuals and legal entities:

Note that to open an account in the U.K., you have to be a resident, whereas the American branch works with different countries. To open a Premier account, you need to earn 75,000 GBP or more yearly or at least 100,000 GBP if you want to participate in special investment programs.

Banking features

Barclays offers a full list of online banking services. Clients can aggregate up to 25 accounts in their profile and open a separate IBAN account. This neobank issues several types of cards, including Visa, debit, and credit cards. These cards are accepted by ATMs worldwide, and cash withdrawals from ATMs of partner banks are free.

Barclays became well-known thanks to its passive income solutions. Private customers can open online savings and CD accounts at rates of up to 2.90% per annum. There is no minimum deposit, and funds are not frozen and can be withdrawn at any moment. The app has an integrated service of smart investing, which allows users to do a deep analysis of their investment portfolios.

Technical Support

The «Contact us» section on the American website of this digital bank provides phone numbers for tech support, which works around the clock without breaks or days off. The primary phone number (not international) is also included in the footer. This neobank has profiles on Facebook, Twitter, Instagram, and YouTube. One can contact the company representatives through these social media. Extended contact information and access to the help center are provided on the official British website of the company.

Social programs of Barclays Bank

Barclays doesn’t offer social programs but regularly holds events that explore the social aspect of the financial services field. In particular, Barclays has the Social Innovation Lab, which engages over 100 of the bank’s own specialists. The lab develops advanced solutions to make the process of getting banking services as simple as possible worldwide.

How to open an account at Barclays Bank

You can visit the official website of this holding company at barclays.co.uk or the American website of the online banking platform banking.barclaysus.com. In the former case, navigate to “Digital Banking” and then click on “Register for Online Banking”.

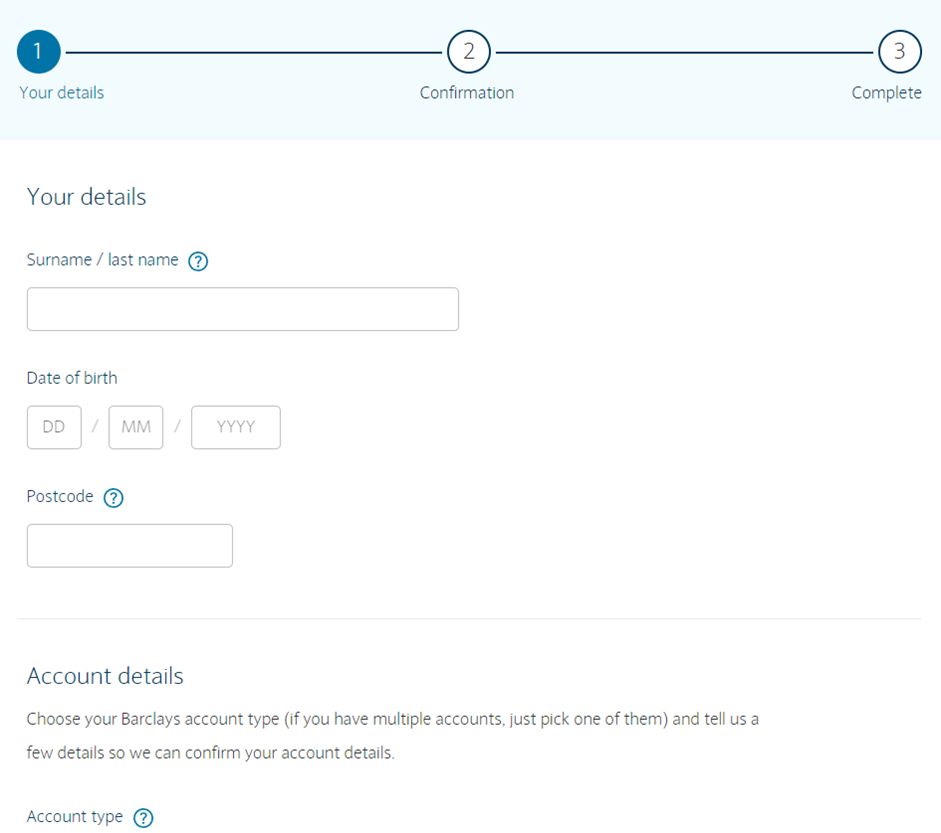

Step 1. On the screen, you will see the requirements to open an account. Click «Start» in the lower part of the screen. At this point, you cannot open an international account. You need to link a bank card to your Barclays account. Enter the card data, choose your account type, provide personal information, and click the “Next” button.

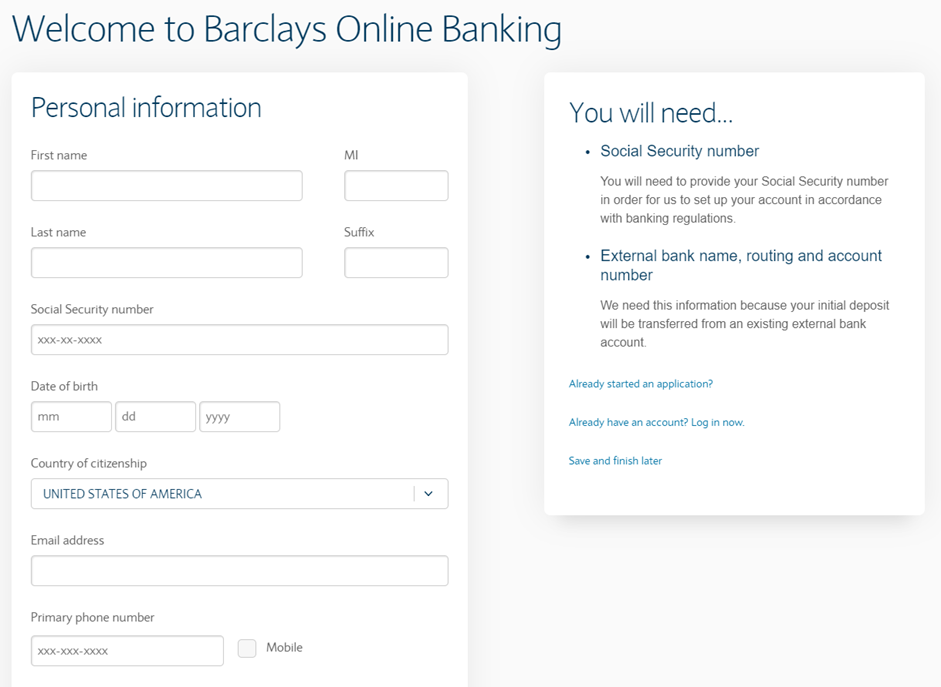

Step 2.You will get full access to the functions of online banking only after your data is verified. If you want to register an account on the American website of this digital bank, click “Open Account” on its home page. Enter your card information and personal data. Click “Submit” and wait till the review is finished to get access to all functions of the account.

Step 3. On the websites barclays.co.uk and banking.barclaysus.com, you will also find the links to this neobank’s mobile app (on barclays.co.uk, the link is in the “Explore mobile banking” section). You can download this app from the App Store or Google Play after entering the title of this digital bank in the search box. Registration is also possible in the app. The procedure is the same as on the website.

Articles that may help you

FAQs

How does Barclays earn money?

The main income of Barclays is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Barclays protect its customers?

Barclays uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Barclays provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Barclays?

Yes. Barclays allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Curve's secure website.