Bell Direct Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $300

- Multi order pad (web platform)

- Bell Direct’s mobile apps

- Iress ViewPoint

- Iress Professional

- The required margin is 40-75% of the asset value

- Access to ASX and Cboe Australia, margin lending, integration with CHESS (Clearing House Electronic Subregister System)

Our Evaluation of Bell Direct

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Bell Direct is a high-risk broker with the TU Overall Score of 2.39 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Bell Direct clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Bell Direct is an Australian high security broker providing access to local and international securities markets. Its commission structure is transparent, and the platforms offer in-depth asset analysis and support for various order types.

Brief Look at Bell Direct

Bell Direct provides access to shares of over 2,200 companies listed on the Australian Securities Exchange (ASX). Clients can also invest in hundreds of exchange-traded funds (ETFs), bonds, options, and managed funds through the mFund service. Additionally, the broker offers access to U.S. securities trading through its regulated partner, DriveWealth.

Founded in 2006, Bell Direct is regulated by the Australian Securities and Investments Commission (ASIC). The company offers various accounts and trading tools, professional analytics, high-quality support, and investment protection. Currently, only Australian residents can become Bell Direct clients.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Reliable regulation and investment capital protection.

- Lower commissions with increased trading activity.

- Access to U.S. and Australian markets.

- Margin lending services.

- User-friendly proprietary web platform, mobile apps, and advanced Iress trading platforms.

- Daily trading ideas from Trading Central.

- Qualified support through multiple communication channels.

- Limited in-depth educational materials.

- High fees for phone-based trades.

- There is no demo account available.

TU Expert Advice

Financial expert and analyst at Traders Union

Bell Direct offers many interesting and useful features. For example, Auto-Update automatically refreshes portfolio data, such as corporate actions and asset changes, enabling investors to receive up-to-date information without manual updates. This feature simplifies portfolio management and ensures analytical accuracy.

Active and experienced investors can access the Bell Direct Advantage program, which includes personalized trading solutions and premium services. Program participants receive tailored fee schedules, professional trading platforms, daily trading insights, and exclusive investment opportunities, such as IPOs and private placements. Additionally, each client benefits from a dedicated manager for investment activity support and optimization.

Bell Direct provides a comprehensive self-managed superannuation fund (SMSF) solution, combining trading and administration. This service offers daily online reporting, access to diverse investment instruments, and tax and audit support. SMSF users receive personalized advice and access to Bell Potter research, streamlining retirement savings management and improving investment efficiency.

Bell Direct Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Multi order pad (web platform), Bell Direct’s mobile apps, Iress ViewPoint, Iress Professional |

|---|---|

| 📊 Accounts: | Direct Investment Account, Macquarie Cash Management Account, Margin Lending Account, International Trading Account |

| 💰 Account currency: | USD, AUD |

| 💵 Deposit / Withdrawal: | BPay, bank transfers within Australia via BSB |

| 🚀 Minimum deposit: |

$500 for Australian market $300 for the U.S. market |

| ⚖️ Leverage: | The required margin is 40-75% of the asset value |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: |

$500 for Australian market $300 for the U.S. market |

| 💱 EUR/USD spread: | Depends on the market and trading activity of the trader |

| 🔧 Instruments: | Australian and U.S. equities, ETFs, stock options, warrants, bonds, mFunds, IPOs |

| 💹 Margin Call / Stop Out: | Margin Call occurs when the margin loan is fully used and the total value of the portfolio decreases by 9.1% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market order, Conditional order |

| ⭐ Trading features: | Access to ASX and Cboe Australia, margin lending, integration with CHESS (Clearing House Electronic Subregister System) |

| 🎁 Contests and bonuses: | No |

Bell Direct offers a transparent fee structure for online trading on the Australian Securities Exchange (ASX). Deposits and withdrawals are exclusively processed through Australian bank accounts and the domestic BPay electronic payment system. Furthermore, investors have the option to transfer securities from another brokerage to their Bell Direct account.

Bell Direct Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

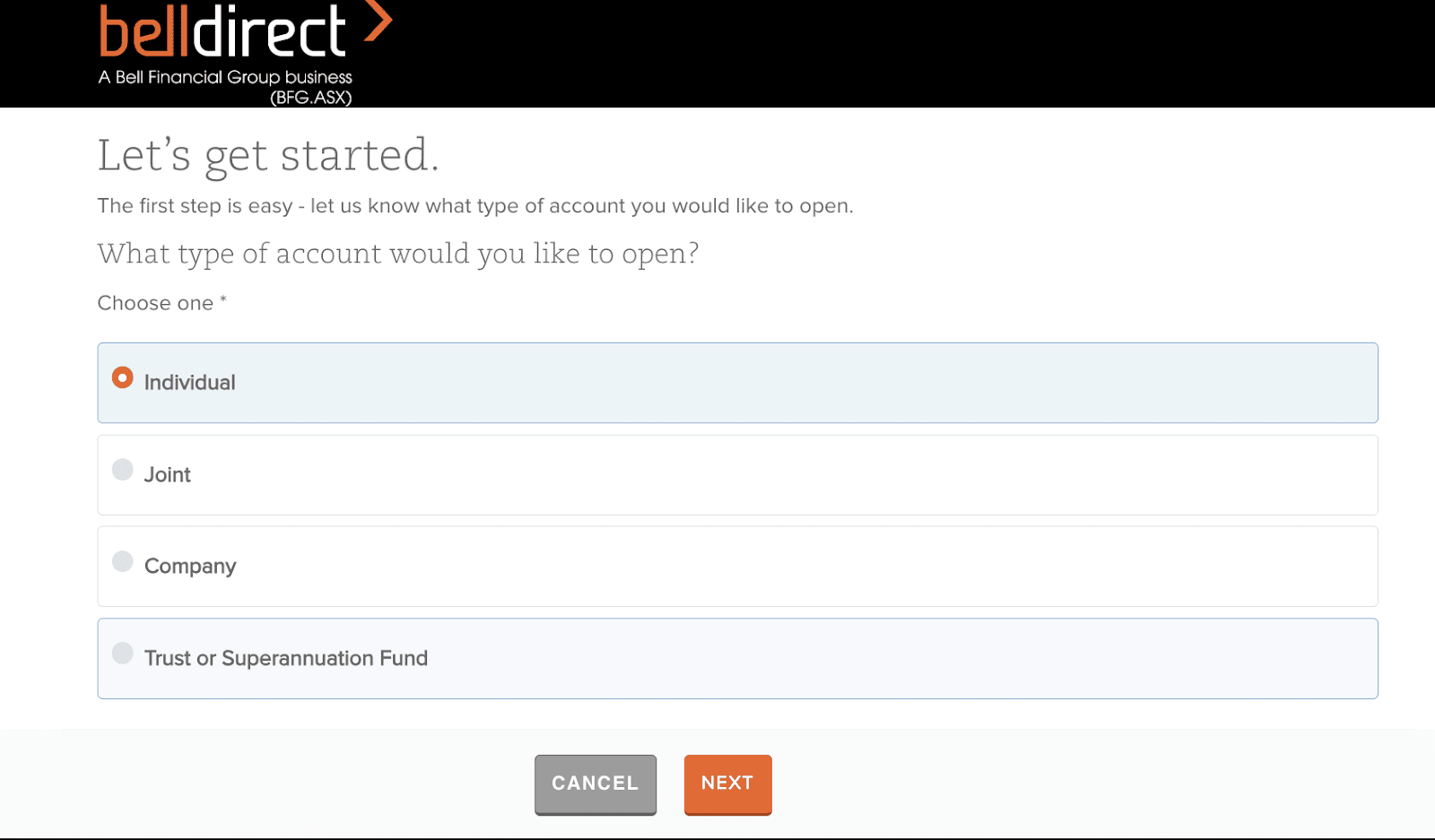

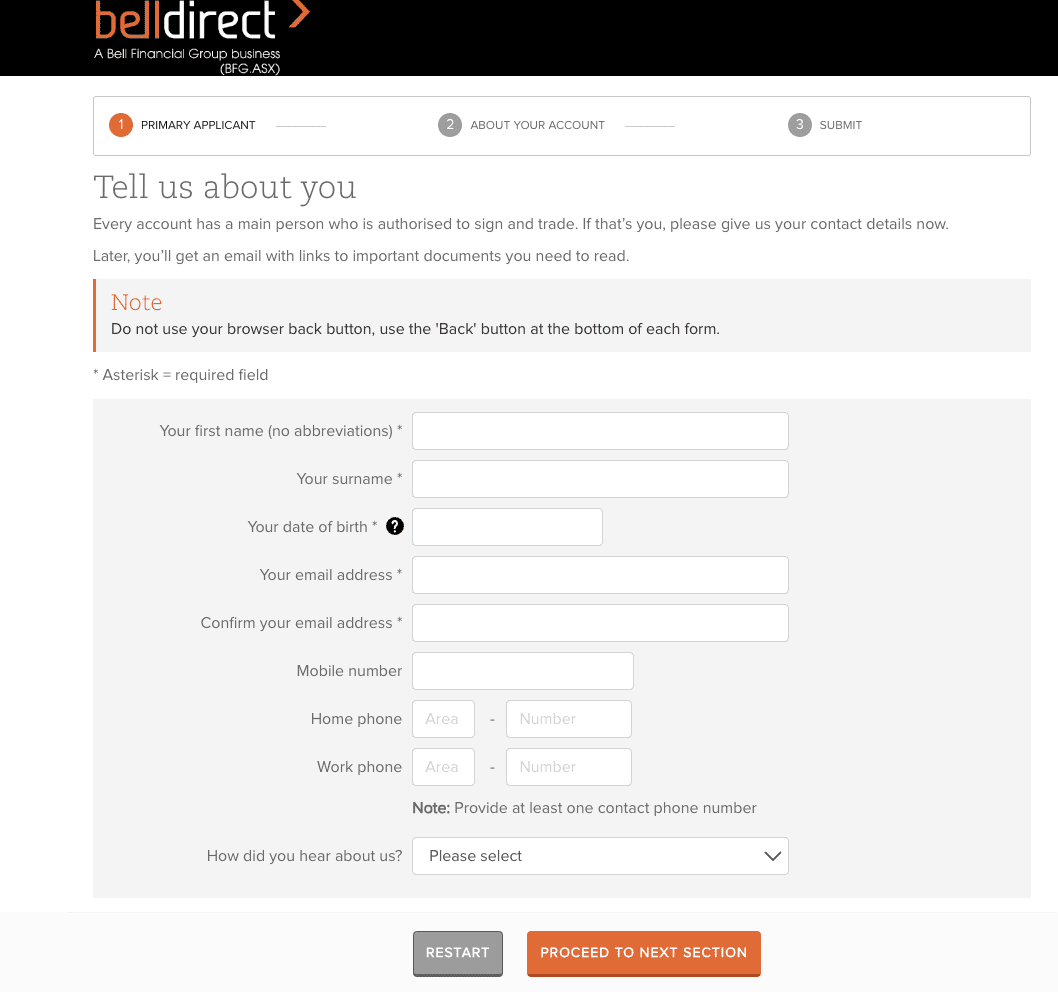

Trading Account Opening

To create a Bell Direct user account, follow these steps:

Click "Join" at the top of the website.

Select "Individual" as the account type.

Complete the account application form and upload documents for identity and address verification.

Additional features of Bell Direct’s user account allow traders to:

-

Deposit funds into the account.

-

Place trades via the web platform.

-

View trading statistics.

-

Request profit withdrawals.

-

Contact client support.

Regulation and safety

Bell Direct is a brand of Third Party Platform Pty Limited (ABN 74 121 227 905), which holds an Australian Financial Services License (AFSL 314341) issued by the Australian Securities and Investments Commission (ASIC).

Bell Direct’s clients are protected by the Securities Exchanges Guarantee Corporation (SEGC), which manages the National Guarantee Fund (NGF). This fund provides compensation in specific cases, such as broker insolvency, failure to deliver assets or unauthorized trades.

Advantages

- Operating under an ASIC license ensures compliance with strict standards of security and transparency

- Official trading on Australian stock exchanges

- Protection of investors from broker’s misconduct or bankruptcy

Disadvantages

- The Bell Direct broker is focused on Australian residents

- Although affiliation with Bell Financial Group strengthens its position, it also limits Bell Direct's brand autonomy

- Lengthy account opening and identity verification process

Commissions and fees

When using a Macquarie Cash Management Account, the commission is $19.95 or 0.12% for any trade amount. The commission for trading U.S. securities is $10 or 0.1%. The margin lending rate is 9.9% per annum.

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Direct Investment Account | $10 or 0.08% | No |

| Macquarie Cash Management Account | $19.95 or 0.12% | No |

| International Trading Account | $10 or 0.1% | No |

| Margin Lending Account | $10 or 0.08% + 9.9% annually | No |

Basic real-time quotes are free, but access to advanced market-depth data requires a monthly subscription fee, which varies based on the selected data package.

Below is a comparison of Bell Direct’s trading fees against other brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$12.5 | |

|

$2 |

Account types

To open a live account, investors must be 18 years or older and officially registered in Australia. Registration can be completed online via the broker’s website. A Holder Identification Number (HIN) and proof of address are required.

Account types:

Deposit and withdrawal

-

There are no fees for non-trading operations.

-

Withdrawal requests require PIN code confirmation.

-

When processing a request, the current cash balance is considered, as well as open buy orders. Sales funds will only become available for withdrawal once they have been finalized (T+2, between 12:00 and 17:00 AEST).

-

Requests submitted before 14:30 AEDT on business days are processed the same day, with funds credited to the bank account on the next business day.

-

Requests submitted after 14:30 AEDT or on non-business days are processed at 14:30 on the next business day.

Investment Options

Bell Direct offers the following options for generating passive income:

-

Interest on account balances. The Bell Direct Investment Account offers an annual interest rate of 1.45% for balances up to $100,000 and 1.6% for balances exceeding $100,000. The Macquarie Cash Management Account provides a fixed 2.75% annual interest rate, regardless of the account balance.

-

Dividends. These are profit distributions paid to shareholders by companies they invest in. Regular dividend payments allow investors to earn passive income without active participation. Dividend reinvestment programs further enhance the power of compound interest. This option is ideal for long-term income, particularly with stable companies that have a strong history of consistent payouts.

-

mFund. This platform enables the buying and selling of units in unlisted managed funds through Bell Direct. Investors can use mFund to generate passive income by selecting funds with suitable income strategies, such as dividend-focused or interest-bearing funds.

Bell Direct’s partnership program

Currently, there is no publicly available information on an official partnership program on Bell Direct’s website.

Customer support

There are several ways to contact Bell Direct support, including by phone for clients who are not only in Australia but also overseas. Operators are available from 08:00 to 19:00 Monday to Friday (AEST).

Advantages

- Live chat on the website

- Telephone line for international calls

Disadvantages

- There is no access to 24/7 support

- Popular messengers are not available

Bell Direct provides multiple ways to contact client support:

-

telephone.

-

online chat on the website.

-

e-mail.

-

feedback form.

-

regular mail.

Contacts

| Registration address | GPO Box 1630, Sydney, NSW, Australia, New South Wales |

|---|---|

| Regulation |

ASIC

Licence number: AFSL 314341 |

| Official site | https://www.belldirect.com.au/smarter/ |

| Contacts |

1300 786 199 (for Australia), +61 3 8663 2700 (International)

|

Education

Bell Direct does not offer in-depth training on securities trading, but its website includes a FAQs section covering the basics of trading, platform usage, and brokerage conditions.

The FAQs section helps beginner investors understand key processes such as opening an account, placing orders, and managing portfolios. However, for advanced education or professional development, traders are advised to use external educational resources.

Detailed review of Bell Direct

Bell Direct is a participant of the Australian Securities Exchange (ASX) and Cboe Australia. It is part of Bell Financial Group (ASX: BFG), a company with a strong reputation in Australia’s brokerage industry since 1970.

Additionally, Bell Direct has expanded its services to include access to the U.S. market through its partnership with DriveWealth, a broker regulated by FINRA and a member of SIPC. Plans for the future include expanding access to more international markets and exchanges.

Bell Direct by the numbers:

-

Regulated by ASIC since 2006.

-

Access to over 2,200 trading instruments.

-

Professional analysis of 150+ ASX-listed stocks.

-

Six daily trade ideas from Trading Central.

Bell Direct is a broker for Australian investors with U.S. market access

Bell Direct has several unique offerings, including access to mFund, a service enabling investors to transact units in unlisted managed funds. Each morning, Bell Direct provides up-to-date trading ideas derived from technical analysis conducted by experts at Trading Central. These recommendations, distributed via email, help investors identify potential market opportunities.

To facilitate efficient investment management, Bell Direct provides a suite of trading platforms. Basic options include a user-friendly web platform and mobile applications for iOS and Android devices. Active traders can leverage the Iress ViewPoint platform, which offers a customizable interface and advanced technical analysis tools. Furthermore, Iress Professional, designed for professional traders, provides enhanced analytical and trading capabilities, along with access to a diverse range of markets and instruments.

Bell Direct’s analytical services:

-

Auto-Update. This service automatically updates portfolio information and corporate actions such as dividend payments and stock splits.

-

Interactive advanced charts. This service allows investors to easily analyze complex price data and technical indicators to support informed investment decisions.

-

Convenient filters. Those allow you to compare funds across various parameters and quickly determine how well they fit your chosen investment strategy.

-

Valuable stock movement data. This service is useful for any investor, even without in-depth knowledge of chart analysis or short-term trading skills.

Advantages:

CHESS integration for secure asset registration.

ETF and mFund screening tools.

Advanced charting and technical analysis.

Specialized solutions for SMSF (Self-Managed Super Funds).

User-friendly web trading platform for beginners.

Transparent fee structure.

Bell Direct caters to both retail and professional investors, offering margin trading options and advanced market analysis tools.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i