Bolero Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- No

- Web platform

- Mobile Apps

- Varies by instrument, risk level, etc.

- Access to 20+ global exchanges, including Euronext, and those in the U.S. and Canada

Our Evaluation of Bolero

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Bolero is a high-risk broker with the TU Overall Score of 2.4 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Bolero clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Bolero offers a wide range of investment products, including stocks, ETFs, bonds, and options, through user-friendly web and mobile platforms. Regulation by Belgian state supervisory authorities ensures a high level of security, making the broker suitable for both novice and experienced investors who prefer traditional exchange-traded instruments.

Brief Look at Bolero

Bolero is part of KBC Group, a major Belgian financial group established in 1998, serving over 13 million clients. Regulated by the FSMA (the Financial Services and Markets Authority), Bolero provides access to over 20 exchanges and offers trading stocks, ETFs, bonds, options, and leveraged instruments. A web interface and mobile applications for iOS and Android are available. Bolero offers educational materials, including articles, videos, and webinars, as well as analytical reviews and daily news. The service is geared towards investors who prefer traditional exchange-traded instruments and does not provide access to over-the-counter (OTC) products.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Part of one of the largest financial institutions in Belgium;

- FSMA and NBB (the National Bank of Belgium) regulation;

- Access to over 4 million financial instruments on 20+ global exchanges;

- User-friendly and intuitive web platform and mobile apps;

- Daily analytical insights and investment ideas from KBC Securities experts;

- Extensive educational materials, including webinars and articles for novice investors;

- Access to leveraged exchange-traded instruments, including turbos and options.

- No partnership or referral program;

- Limited client support hours.

TU Expert Advice

Financial expert and analyst at Traders Union

Bolero offers leveraged derivatives trading alongside traditional stock market assets, including stocks, bonds, ETFs, and others. This enables investors to capitalize on underlying asset price fluctuations, particularly stocks, currencies, indices, or commodities. Due to the partial financing option, investors only contribute a portion of the position's value, which increases both potential returns and associated risks.

The broker provides seamless access to stock exchanges and portfolio management via its website and dedicated mobile applications for iPhone, iPad, and Android. It supports a comprehensive range of exchanges and trading instruments, alongside various order types, encompassing market and stop-limit orders.

Investors benefit from daily analytical resources, encompassing overviews of top-traded Euronext stocks, in-depth market trend analyses, thematic reports, and insights from KBC Securities analysts. By subscribing to the newsletter in the user account, they can receive these materials directly via email free of charge. Basic delayed quotes are free, while active investors can subscribe to real-time prices.

Bolero Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Web platform and mobile apps |

|---|---|

| 📊 Accounts: | Individual, Joint, and Corporate |

| 💰 Account currency: | EUR and 14 other currencies |

| 💵 Deposit / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Varies by instrument, risk level, etc. |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | From €2.5 |

| 🔧 Instruments: | Stocks, bonds, ETFs, options, warrants, and leveraged products |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Best execution by KBC Securities |

| ⭐ Trading features: | Access to 20+ global exchanges, including Euronext, and those in the U.S. and Canada |

| 🎁 Contests and bonuses: | Yes |

Bolero offers a wide choice of exchange-traded products, including stocks, bonds, options, ETFs, warrants, and leveraged derivatives, notably turbos, speeders, and sprinters. This facilitates creating a flexible investment portfolio tailored to individual goals and strategies. Furthermore, adhering to stringent regulatory standards, Bolero prohibits direct cryptocurrency investments, protecting its clients from high-risk assets.

Bolero Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

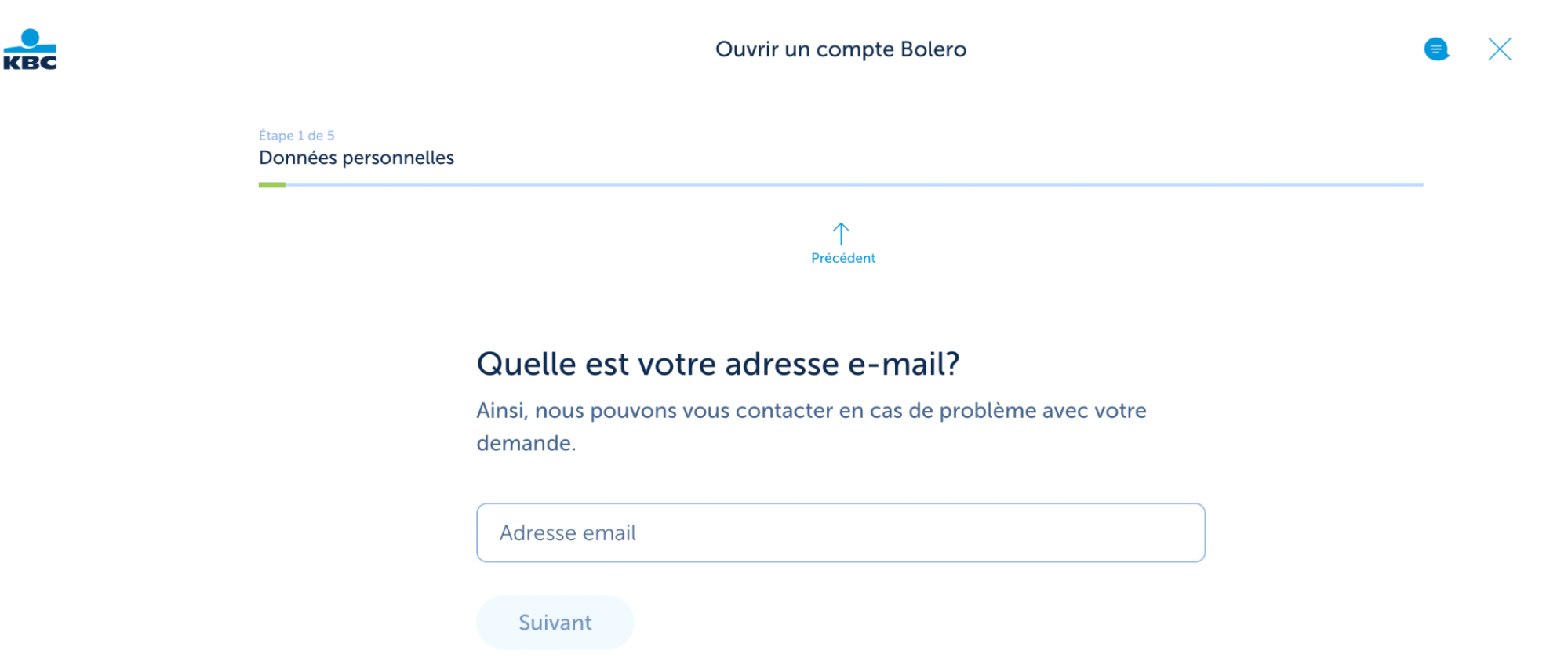

To log in to Bolero’s user account, register with the broker, following the instructions below:

Accounts can be opened either through your existing KBC user account or directly on the Bolero website.

Register your user account using the itsme app. First, download the app, link it to your identification, and then complete the registration form.

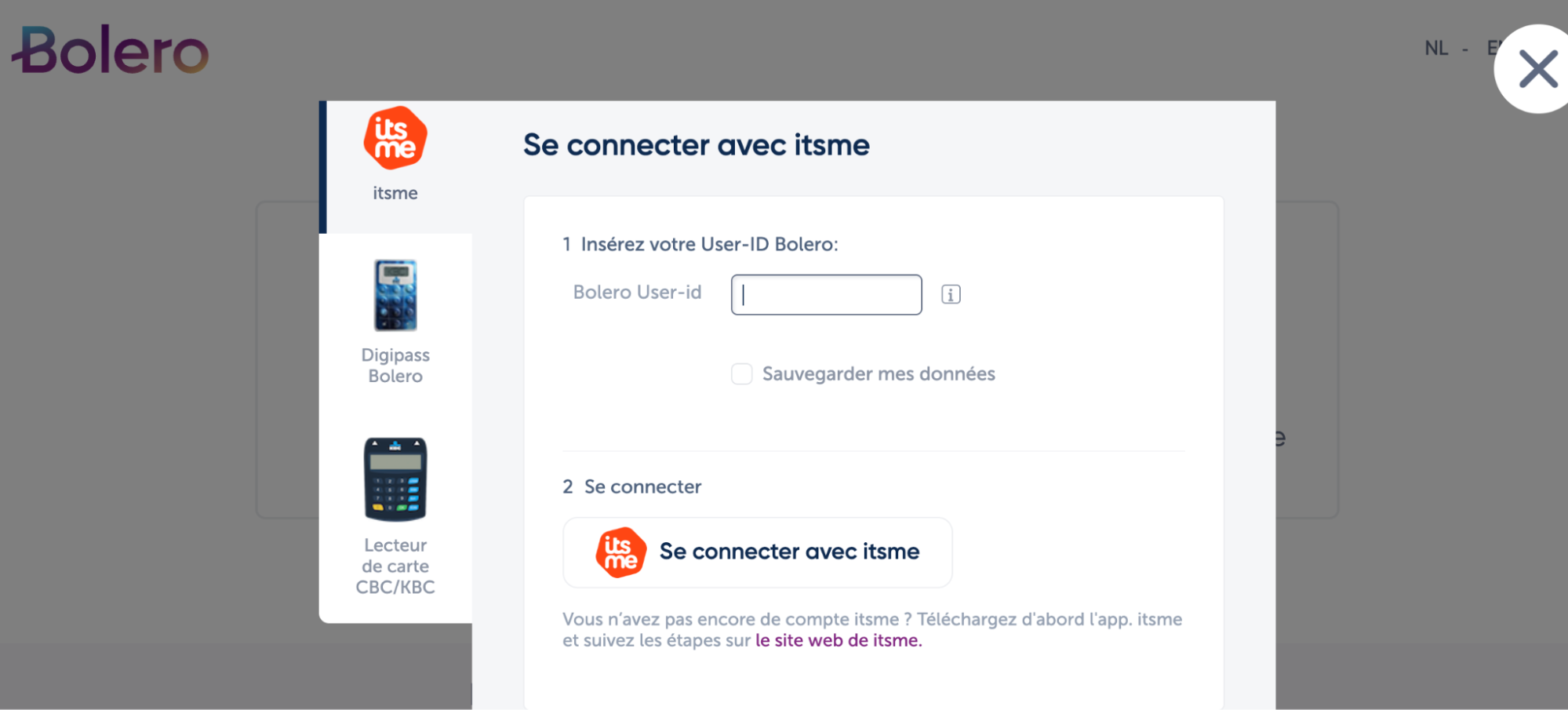

Next, choose the option to log in via itsme on the Bolero website, and enter your Bolero User ID and your mobile phone number linked to itsme. Finally, confirm the login through the itsme app on your smartphone.

To log in to the Bolero platform, use the itsme app, a digipass device, or the KBC Touch interface available for KBC clients.

User Satisfaction i