eToro Funding and Withdrawal Review

eToro is an online brokerage platform that allows users worldwide to trade various assets, including stocks, commodities, foreign currencies, and cryptocurrencies. Currently, over 3,000 tradeable symbols are available on eToro.

One of the great things about eToro is that it offers a variety of deposit and withdrawal methods, which makes it convenient for users from different countries. In this article, we will look at the different eToro deposit and withdrawal methods, the transaction speeds, and the fees associated with each method.

eToro Funding Methods, Speed, and Fees

After opening your eToro account, you will need to fund it to start trading. eToro offers a variety of funding methods, which include:

Bank transfers (wire transfers)

Debit cards and credit cards

Electronic wallets (PayPal, Neteller, Skrill, iDEAL,Klarna, POLi, Przelewy 24)

Online banking

Depositing funds into your eToro account is free of charge. The broker has no deposit fee whatsoever. However, your bank or payment processor may charge you a fee for processing the transaction.

However, since the eToro account is denominated in USD, if you deposit funds in a currency other than USD, eToro will convert the funds into USD at the current market rate. eToro will then charge you a currency conversion fee.

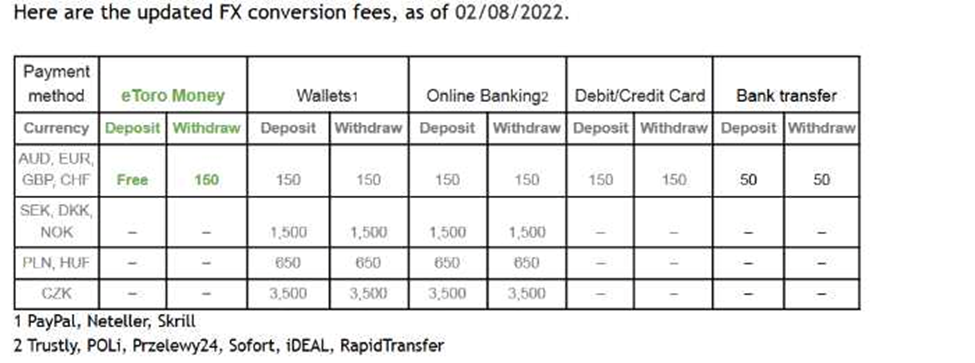

Here's an image showing eToro's conversion fees for different payment methods and currencies.

eToro's conversion fees for different payment methods and currencies

Note: There is an exception to the currency conversion fee when you deposit funds using a bank transfer. The fees for bank transfers stand at 50 pips.

The deposit speeds will depend on your chosen eToro funding method. For bank transfers, it may take a few days for the funds to appear in your eToro account. Other methods, such as e-wallets and debit/credit cards, are instant.

A summary of eToro funding methods, speed, and fees is shown below.

| Method | Speed | Fee | |

|---|---|---|---|

Bank cards |

YES |

Instantly |

free |

Wire transfer |

YES |

4-7 business days |

free |

Payment services (PayPal, Skrill, Neteller, iDEAL, Klarna) |

YES |

Instantly |

free |

Crypto |

No |

- |

- |

eToro Withdrawal Methods, Speed, and Fees

eToro offers the following withdrawal methods:

Bank transfer

Debit or credit card

Electronic wallets

Bank transfers are the most popular withdrawal method from any brokerage platform, and eToro is no different.

A great feature of eToro is the ability to withdraw funds to e-wallets such as PayPal, Skrill, iDEAL, POLi, Neteller, and Klarna. This feature is rare among online brokerages and is a huge convenience for eToro users.

Unlike most deposit speeds, which are instant, eToro withdrawals can take up to 10 business days.

While eToro deposits are free, eToro withdrawals come with a fee. The withdrawal fee is $5 for all methods.

Here's a summary of eToro withdrawal methods and their respective speed and fees.

| Method | Speed | Fee | |

|---|---|---|---|

Bank cards |

YES |

Up to 10 business days |

$5 |

Wire transfer |

YES |

Up to 10 business days |

$5 |

Payment services (PayPal, Skrill, Neteller, iDEAL, Klarna) |

YES |

Up to 2 business days |

$5 |

Crypto |

NO |

- |

- |

What Is eToro Minimum Deposit and Withdrawal Amount?

The eToro minimum deposit amount depends on the country of residence and the payment method used. If you're in the United Kingdom or the United States, the minimum deposit amount is $10. In other countries, the minimum deposit amount is at least $50.

The table below shows eToro minimum deposits for different countries.

| Users residing in: | Minimum first deposit: |

|---|---|

United Kingdom, United States |

$10 |

Australia, Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, Estonia, Finland, France, Germany, Greece, Guernsey, Hungary, Indonesia, Ireland, Italy, Latvia, Liechtenstein, Luxembourg, Malaysia, Malta, Monaco, Netherlands, Norway, Philippines, Portugal, Singapore, Spain, Sweden, Switzerland, Taiwan, Thailand, United Arab Emirates, Vatican City, Vietnam |

$50 |

All other eligible countries |

$200 |

Cayman Islands, French Polynesia, Gibraltar, Iceland, Isle Of Man, Jersey Island, Kuwait, Lithuania, Reunion Island |

$1,000 |

Israes |

$10,000 |

The Bank Transfer method allows a minimum of $500 for a deposit.

For a corporate trading account, the eToro minimum deposit required is 10,000.

The minimum eToro withdrawal amount is $30.

What Are eToro Deposit and Withdrawal Currencies?

The eToro platform only allows deposits and withdrawals in USD.

You can deposit certain supported local currencies into eToro but must be converted to USD before trading. They include:

EUR

GBP

AUD

RMB

THB

IDR

MYR

VND

PHP

SEK

DKK

NOK

PLN

CZK

How to Deposit Money to eToro

The eToro deposit process is pretty straightforward.

Log in to your eToro account

Click on the "Deposit Funds" button

Enter the amount you wish to deposit and the currency

Choose the preferred payment method (bank transfer, PayPal, debit card, etc.)

Review and complete your transaction

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

"Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more"

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQ

Is eToro safe?

eToro is a safe and regulated broker. It operates under strict financial regulations set by multiple authorities, including the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

Can I deposit funds under a 3rd party name?

No, eToro does not allow 3rd party deposits. All deposits must be made under the name of the eToro account holder.

What is eToro Money?

eToro Money is a mobile app that allows users to send and receive money using eToro's social trading platform.

What is the maximum withdrawal amount on eToro?

There's no maximum withdrawal amount on eToro. You can withdraw all the funds in your eToro account, minus any margin used.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).