How to Use Stop-loss Order on eTrade: Full Guide

How to use Stop-loss order on eTrade:

-

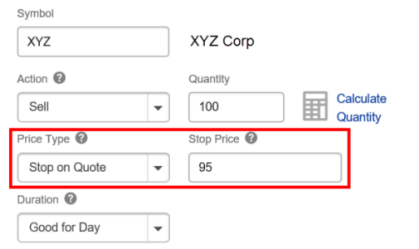

Enter the stock symbol.

-

Select “SELL” along with the quantity.

-

Choose “Stop on Quote” under the price type.

-

Set the stop price.

-

Review your order details and submit.

In times of market turbulence, fear and panic can impair judgment. This is why having a strategic risk management tool like the stop loss order is crucial when trading stocks, as fortunes can change dramatically in an instant. Etrade's web and mobile trading platforms support stop-loss orders, along with other order types such as market limit and trailing stop. Regardless of your level of experience, TU experts have created this guide to help you take full advantage of Etrade stop-loss order power.

-

What is the difference between a stop and a limit order on Etrade?

A stop order on Etrade acts like a safety net, selling a stock when it hits a certain price. In contrast, a limit order lets you set a specific buying or selling price in advance

-

How do you implement a stop-loss in a trade?

To implement a stop-loss, you will have to set a predetermined price level at which a security is automatically sold to minimize losses. This protects against adverse market movements beyond a tolerable level.

-

Why don't traders use stop-loss?

Some traders skip stop-loss orders because they worry about market tricks, sudden price swings, or missing out on potential gains if they get kicked out of a trade too early.

-

Does Etrade have trailing stop-loss?

Yes, Etrade offers trailing stop orders. Trailing stops move with the stock price, protecting the downside while locking in profits as prices rise.

Is stop-loss available at E*TRADE?

Yes, Etrade does indeed offer a stop-loss order feature on both their web and mobile trading platforms. Besides stop-loss orders, Etrade provides several other order types, including:

-

Market order: Executes at the best available price in the market.

-

Market on close: Executes at the closing price.

-

Limit order: Allows you to specify a maximum or minimum price at which you’re willing to buy or sell.

-

Stop-limit order: Combines elements of a stop order and a limit order.

-

Hidden stop orders: A fixed stop order that is held at Etrade and sent to a market center only upon being triggered, which happens when the security's bid or ask crosses the stop price.

-

Trailing stop orders: Trailing Stop orders allow you to buy or sell a security when its market price reaches a trailing stop price in order to lock in profits or limit losses as the price of a security moves

How do you set up a stop loss at E*TRADE?

Here’s a step-by-step process for setting up a stop-loss order on Etrade by TU experts. It will guide you through the process with clear instructions:

-

Log in to your Etrade account: Visit the Etrade website or open the Etrade mobile app. You will have to log in using your credentials.

-

Navigate to the trading platform: On the Etrade website, click on the “Trading” tab. On the mobile app, tap the “Trade” icon in the bottom menu.

-

Select the stock you want to set a stop loss for: Enter the stock symbol of the security you own or plan to buy.

-

Choose the action: Under the “Action” section, select “Sell” since you’re setting up a stop-loss order. Next, choose “Stop on quote” as the price type. This is your stop-loss order.

-

Specify the stop price: Under “Stop price,” enter the price at which you want your stop-loss order to be activated. This price represents the trigger point at which the system will automatically take you out of the trade.

-

Review and confirm: Click the “Preview” button on the website or review the order details on the mobile app. Ensure that all information is accurate, including the stop price. Confirm the order to execute it.

Etrade website

Are stop-loss orders at E*TRADE a good idea?

Yes, stop-loss orders at Etrade can be a valuable risk management tool for investors. Here’s why they are considered a good idea:

-

Limiting losses: Stop-loss orders help limit potential losses. If the stock price drops below the stop-loss price you have set, Etrade will automatically sell some or all of your holdings. This shields you from sharp drops in value, much like insurance.

-

Passive risk management: If you don’t actively monitor stock prices or use Etrade frequently, stop-loss orders provide a passive way to manage risk. They execute automatically without requiring your active involvement.

-

Avoiding emotional decisions: Investors often make emotional decisions during market volatility. A stop-loss order helps you stick to your predetermined strategy by enforcing a sell order when the price reaches a certain level.

-

Long-term perspective: While temporary stock declines are normal, setting stop-loss orders too conservatively may lead to unnecessary losses. It’s essential to consider your long-term investment goals like most successful investors and avoid triggering stop-loss orders too close to the current market price.

Risks of using stop-loss orders at E*TRADE

There are risks associated with using stop-loss orders at Etrade. TU experts have outlined some of these risks and precautions below:

-

Triggered by temporary price fluctuations: A significant risk with stop-loss orders is that they can be triggered by short-term price fluctuations. If the stock price briefly drops due to market volatility, your stop-loss order may activate, leading to an unnecessary loss. Investing in a put option can help reduce the risk of being stopped at a bad price. This enables you to sell your stock on a set date at a fixed price. Unlike stop orders, put options allow you to wait and assess market direction before making a decision.

-

Missed profit opportunities: When a stop-loss order executes, it locks in your loss. However, if the stock rebounds after hitting your stop level, you might miss out on potential gains. Avoid setting overly conservative stop-loss levels. Consider using trailing stop orders, which adjust dynamically as the stock price rises, allowing you to capture profits while still protecting against losses.

-

Market gaps and slippage: In fast-moving markets or during after-hours trading, stop-loss orders may execute at prices significantly different from your specified level due to gaps or slippage. Be aware of market conditions and consider using limit orders instead. Limit orders allow you to set a specific price at which you’re willing to sell, avoiding unexpected execution prices.

Conclusion

In summary, stop-loss orders can be powerful risk management tools for investors using Etrade. However, they come with their own set of risks and considerations. TU experts advise that you customize your stop-loss strategy based on your risk tolerance and investment goals.

Team that worked on the article

Winnifred Emmanuel is a freelance financial analyst and writer with years of experience in working with financial websites and businesses. Her expertise spans various areas, including commodities, Forex, stocks, and cryptocurrency. Winnifred tailors her writing to various audiences, including beginners, while also providing useful insights for those who are already familiar with financial markets.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).