Sterling Capital Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- KES 100,000

or $1,000

- Online Share Trading web platform

- Sterling Plus mobile apps

- 1:2

- Limited choice of markets

- Brokerage fees for trading stocks depend on the trade amount

- No demo account.

Our Evaluation of Sterling Capital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Sterling Capital is a high-risk broker with the TU Overall Score of 2.76 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Sterling Capital clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Sterling Capital is one of the oldest Kenyan investment banks and brokers, providing a wide range of services in financial markets. These services include trading, investing in fixed-income instruments, lending, research and analytics, and corporate consulting.

Brief Look at Sterling Capital

Sterling Capital is a limited liability brokerage company established in 1981 to provide investment and financial consulting services. In addition to buying and selling stocks and bonds listed on the Nairobi Stock Exchange (NSE) on behalf of its clients, the broker offers margin trading, securities lending services, passive income tools, and proprietary platforms for securities trading. Sterling Capital has been regulated by the Capital Markets Authority of Kenya (CMA) for over 30 years. It is also a member of NSE and the Investor Compensation Fund.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Regulated activities and membership in the main stock exchange of Kenya;

- Funds protection for retail clients;

- Direct access to trading on NSE;

- Trading fixed-income instruments;

- Wide choice of stocks listed on stock exchanges of various African countries;

- Lending services to increase client investment capital;

- Passive income options.

- Derivatives market is not available and the range of securities is limited;

- High minimum investment requirements;

- No demo account or training materials on investment.

TU Expert Advice

Author, Financial Expert at Traders Union

Sterling Capital offers a variety of brokerage services, focusing on stock trading, bond investments, and margin trading through its platforms, including the Online Share Trading web platform and Sterling Plus mobile apps. Its clients can trade via brokerage or margin accounts denominated in KES or USD, with a minimum deposit requirement of KES 100,000 or $1,000. The company provides direct access to the Nairobi Stock Exchange and offers passive income opportunities for investors in the Kenyan context.

However, there are several drawbacks associated with Sterling Capital, including a high minimum investment requirement, limited market choices, and the absence of a demo account or training materials for novice investors. Despite being regulated by the Capital Markets Authority of Kenya, the limited compensation model may not appeal to conservative traders. Therefore, Sterling Capital may better suit experienced investors accustomed to the Kenyan financial landscape rather than those seeking extensive resources for international or diverse market trading.

Sterling Capital Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Online Share Trading web platform and Sterling Plus mobile apps |

|---|---|

| 📊 Accounts: | Brokerage, Margin, and CDSC (Central Depository and Settlement Corporation) |

| 💰 Account currency: | KES and USD |

| 💵 Deposit / Withdrawal: | Bank transfers and M-Pesa |

| 🚀 Minimum deposit: | KES 100,000 or $1,000 |

| ⚖️ Leverage: | 1:2 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 1 share |

| 💱 EUR/USD spread: | Exchange |

| 🔧 Instruments: | Stocks, bonds, and ETFs |

| 💹 Margin Call / Stop Out: | 100%/30% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Exchange |

| ⭐ Trading features: |

Limited choice of markets; Brokerage fees for trading stocks depend on the trade amount; No demo account. |

| 🎁 Contests and bonuses: | No |

To cater to different trader needs, Sterling Capital offers account types in two currencies for trading with borrowed funds and with trader’s own capital. Stock trades can be executed by phone and through electronic platforms that allow traders to monitor their portfolios, market data, and stock trading activities online. For investing in stocks, the broker charges a percentage of the position size. There are no minimum fee rates.

Sterling Capital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

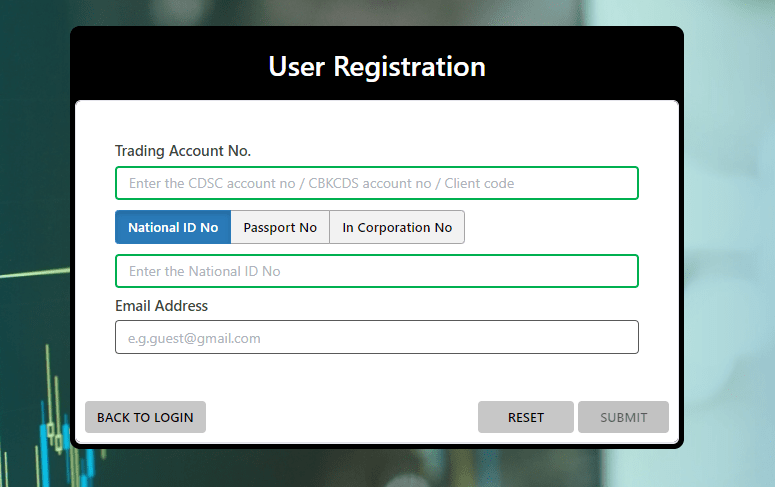

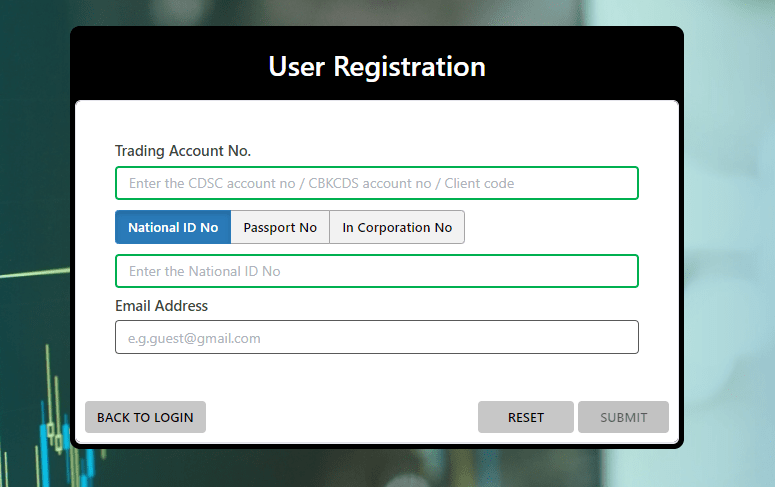

Upon opening a live account with Sterling Capital, traders gain access to their user accounts designed for executing trades, account management, and monitoring portfolio efficiency.

To sign into the user account, open a web platform and download the Sterling Plus mobile app. Enter your login credentials received during a trading account registration.

If you are not the broker’s client yet, register online by clicking the “Sign Up” button and filling in the account opening form.

Regulation and safety

Sterling Capital is a Kenyan brokerage firm regulated by CMA, with license number 021. CMA promotes investment and financial development in Kenya, contributing to the nation's economic growth by fostering capital market activity.

CMA offers the proprietary Investor Compensation Fund, however, unlike protection schemes in other countries, it does not provide comprehensive insurance coverage for investments held with licensed banks, companies, or brokers. The maximum compensation amount per client is limited to KES 50,000.

Since 1994, Sterling Capital has been a member of the Nairobi Securities Exchange, formerly known as the Nairobi Stock Exchange. NSE is a part of the East African Securities Exchanges Association and the African Securities Exchanges Association, as well as the World Federation of Exchanges.

Advantages

- Direct access to the market

- Publicly available financial reports

- Many years of experience under strict supervision

Disadvantages

- Limited compensation for traders if the broker violates its obligations

- Limited funding of up to 50% of the instrument value

- The broker may reject account opening

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Brokerage account | 1.8% of the portfolio value | Payment providers fees |

| Margin account | 1.8% of the portfolio value | Payment providers fees |

Sterling Capital does not charge fees for investing in bonds. However, traders pay a 10% or 15% income tax.

The average fee for trading stocks is 1.95%. For example, a $1,000 trade incurs a $19.5 fee. Below is the comparative table with average fees of Sterling Capital and two stockbrokers registered outside Africa.

| Broker | Average commission | Level |

|---|---|---|

|

$19.5 | |

|

$2 |

Account types

Prior to opening a trading account with Sterling Capital, open the CDSC account that provides for registration and processing of securities in Kenyan financial markets. The CDSC account is crucial for digital registration of securities, settlements, and transfer of rights for stocks and other investment instruments. Retail and professional investors are required to have CDSC accounts to maintain records of their investments and ensure smooth trade execution. Once the CDSC account is registered, traders gain access to other account types offered by Sterling Capital.

Account types:

The available accounts can be opened in KES or USD.

Sterling Capital is a licensed broker offering stock trading and investing in bonds and other fixed-income instruments.

Deposit and withdrawal

-

Traders can withdraw their profits by submitting requests in their user accounts or sending emails to the broker.

-

Funds are transferred to the initial funding source.

-

While the broker itself does not charge withdrawal fees, traders pay fees imposed by their banks or the M-Pesa system.

Investment Options

Sterling Capital specializes in stock trading and passive investment. The broker offers a variety of passive income strategies, focusing on the Kenyan stock market and partnering with reliable entities.

Passive income options from Sterling Capital

The broker caters to securities investors, rather than active traders interested in short-term speculative trading. Currently, Sterling Capital offers the following passive income options:

-

Chapaa’ Halisi (Legit Funds). This is an investment tool that allows traders to get 14% per annum by simply holding their funds in their accounts. It is similar to bank savings accounts with the possibility to withdraw invested funds before the maturity date, unlike deposits with a mandatory lock-up period. The minimum investment is KES 100,000 and the investment period ranges from 3 months to 2 years.

-

Nawiri. Similar to Chapaa’ Halisi, this tool allows traders to lock up USD along with KES. Annual rates are 10.5% for KES and 4% for USD. The minimum investment is $1,000.

-

Fixed-income instruments. These include treasury bills, as well as government and corporate bonds. The issuer of government bills and bonds is the Central Bank of Kenya (CBK) that guarantees income payments at the end of investment period. Treasury bills are issued weekly for a period of 91, 182, or 364 days; government bonds are issued monthly for a period from 2 to 30 years; and corporate bonds are issued for a period of 3-7 years.

All the above options allow investors to receive guaranteed passive income with CBK acting as a payment guarantor.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Sterling Capital:

The broker does not offer any partnership programs.

Customer support

Sterling Capital’s technical support is available from 08:00 to 17:00 (GMT+3) Monday through Friday.

Advantages

- Non-registered users can also contact support with any issues

- Multi-channel call center

Disadvantages

- No live chat

- Support team is not available on weekends

Available communication channels are:

-

Phone;

-

Email;

-

Fax;

-

Feedback form.

If you prefer personal communication with a Sterling Capital representative, visit its office.

Contacts

| Registration address | Delta Corner Annex, 5th Floor, Ring Road, Westlands Nairobi, Kenya |

|---|---|

| Regulation |

CMA

Licence number: 021 |

| Official site | https://sterlingib.com/ |

| Contacts |

Education

There are no dedicated sections with articles, videos, tips, or recommendations for novice investors on the Sterling Capital website.

The broker does not hold educational seminars or webinars. Also, it does not offer paid courses for novice or experienced investors.

Detailed review of Sterling Capital

Sterling Capital is a brokerage company with a long presence in financial markets of Kenya, Nigeria, Uganda, Tanzania, and other African countries. Its services are popular among private and corporate investors due to its high reliability and a client-oriented approach. Sterling Capital has a team of analysts who conduct comprehensive market research for the broker’s clients.

Sterling Capital by the numbers:

-

Over 43 years in the market with 30 of them under the CMA regulation;

-

Total assets exceed KES 705 million as of June 2023;

-

Loans are issued within 24 hours as of application.

Sterling Capital is a broker offering a wide range of African stocks

Sterling Capital allows its clients to trade stocks on NSE, including through the Sterling Plus mobile apps introduced in June 2020. These apps are HTTPS (HyperText Transfer Protocol Secure) platforms that protect confidential information, such as personal data, financial information, and user passwords, when transmitted over the internet. SSL protocols ensure transaction security on Sterling Plus.

The broker also partners with Imara Capital Limited, a large financial services company in Kenya and Africa. Imara offers investment, asset management, and financial consulting services. This partnership allows Sterling Capital clients to trade on stock exchanges of Nigeria, South Africa, Angola, Namibia, Zimbabwe, Zambia, Botswana, and Eastern Africa.

Useful services offered by Sterling Capital:

-

Market Reviews. Every week, Sterling Capital’s analysts conduct in-depth market research and publish macroeconomic indicators, capitalization, and prices on the most tradable stocks, bonds, and indices.

-

Stock Reports. The broker’s clients receive data on stocks from different sectors: bank, telecommunication, production, etc. Quotes for stocks listed on NSE and information on dividend dates are published on weekdays.

-

Investment Instrument Research. The broker’s analytical department focuses on analysis of fixed-income assets and real estate investment trusts (REIT).

-

Lending. This service is available to Sterling Capital clients with existing investment portfolios. Loans are provided for a period of three months and do not require additional documents.

Advantages:

Accounts in KES and USD provide for saving on conversion fees;

Proprietary mobile apps with real-time access to various data, including portfolio assessment, and transaction and trading reports;

Loans secured by existing client assets with low-interest rates;

Availability of passive income options;

Free analytical research.

Sterling Capital does not manage assets of private investors. However, it provides abundant market information and data for succeeding in trading financial instruments.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i