According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $0

- CQG

- NinjaTrader

- TradingView

- Proprietary Tradovate platforms

- Jigsaw Daytradr

- Collective Two

- Subject to the contract

- Futures trading is only available

Our Evaluation of Tradovate

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Tradovate is a high-risk broker with the TU Overall Score of 2.74 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Tradovate clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Tradovate is a regulated U.S. futures broker offering access to derivatives trading on the world’s largest specialized exchanges. It is primarily suitable for experienced futures traders.

Brief Look at Tradovate

Tradovate, a U.S.-based broker specializing in futures trading, was founded in 2015. It is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). The broker supports margin trading on various futures contracts, including E-Mini, Micro, and Nano contracts. Tradovate offers its clients the flexibility to trade on both proprietary and third-party platforms, such as NinjaTrader, CQG, TradingView, Jigsaw Daytradr, and Collective Two (C2). The broker provides diverse fee plans, including options without monthly or annual maintenance fees.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Highest level of regulation in the U.S.;

- Wide choice of stock futures contracts;

- Access to the 8 largest derivatives exchanges in the U.S., Europe, and Canada;

- Reasonable daily margin requirements;

- Free deposits and withdrawals through the ACH (the Automated Clearing House) system;

- Variety of trading platforms from different developers;

- Availability of a free demo account and zero-maintenance fee plan.

- Client investments are not protected by the Securities Investor Protection Corporation (SIPC);

- Lower fees require a $99 monthly or $1,499 lifetime subscription;

- There are no educational courses on derivatives trading.

TU Expert Advice

Author, Financial Expert at Traders Union

Tradovate is a U.S.-regulated broker focusing on futures trading, offering contracts on currencies, indices, and commodities. The platform supports both proprietary and popular third-party platforms like NinjaTrader and TradingView, providing a variety of trading tools and order types. Traders can benefit from flexible fee structures, a zero-maintenance fee option, and the convenience of no minimum deposit requirements. The broker also offers a free demo account, allowing users to hone their strategies before committing real funds.

However, Tradovate's brokerage services come with some drawbacks. The absence of SIPC protection may be a concern for some investors, and accessing lower fees requires subscription plans, which may not appeal to cost-sensitive traders. Additionally, the lack of educational resources may not cater to beginners seeking comprehensive guidance. Tradovate is best suited for experienced traders with a particular interest in futures markets, who can utilize its robust platform offerings and competitive trading conditions.

Tradovate Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Proprietary Tradovate platforms, TradingView, NinjaTrader, Jigsaw Daytradr, Collective Two, CQG, etc. |

|---|---|

| 📊 Accounts: | No |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, ACH, and bank checks |

| 🚀 Minimum deposit: | $0-$1,499 subject to the fee plan |

| ⚖️ Leverage: | Subject to the contract |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 1 futures contract |

| 💱 EUR/USD spread: | Exchange |

| 🔧 Instruments: | Futures on currencies, cryptocurrencies, indices, energies, metals, agricultural products, bonds, event contracts, micro indices, and E-Mini indices |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Exchange |

| ⭐ Trading features: | Futures trading is only available |

| 🎁 Contests and bonuses: | No |

Tradovate offers three fee plans differing in subscription costs, payment schedules, and trading fees. These plans can be paid for using bank cards, however, deposits are made via ACH, bank transfers, or bank checks. While the account currency is USD, Tradovate accepts deposits in other currencies converting them to dollars. A demo account is available. The broker’s proprietary platform is available in desktop, web, and mobile versions.

Tradovate Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To access Tradovate’s user account, become the broker’s client. You can log into your user account through a browser platform or mobile app.

To get login credentials for your user account, fill in the account opening form.

To start registration, click the “Open Account” button in the right upper corner of any page of Tradovate official website. Enter and confirm your email. Typically, verification of a new user account takes up to 2 business days. Some account types require additional documents and information, which Tradovate requests by email.

Once signed in, traders can:

Additional features of Tradovate’s user account that allow traders to:

-

Pay the required fee;

-

Make a deposit;

-

Submit withdrawal requests;

-

Generate trading reports;

-

View trade history.

Regulation and safety

The U.S. futures market is regulated by NFA and CFTC. In 1974, the CFTC was authorized to supervise futures exchanges, stockbrokers, and all market participants to ensure fair activities, transparency, and efficiency in the financial industry. Initiated by CFTC, NFA was established in 1982. It is responsible for registering market participants, supervising their activities, and providing education and information for investors.

Tradovate is registered with NFA as a futures commission merchant under number 0309379. Tradovate, LLC is an introducing broker registered with NFA under number 0484683.

SIPC is the U.S. compensation scheme that implies exclusively to securities. Clients of derivatives brokers, including Tradovate, are not covered by this scheme.

Advantages

- Tradovate’s activities are supervised by the most reputable U.S. futures regulators

- NFA and CFTC websites provide financial reports of licensed brokers

- Tradovate clients can file complaints with regulators

Disadvantages

- Futures contracts are not covered by the SIPC scheme

- Broker can refuse to open an account if traders fail the suitability test

- Profits received from futures trading are subject to taxation

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Free | Standard — $1.29 Micros — $0.35 Nano & Event Contracts — $0.2 |

Bank transfer costs 30 units of the original currency |

| Monthly | Standard — $0.99 Micros — $0.25 Nano & Event Contracts — $0.15 |

Bank transfer costs 30 units of the original currency |

| Lifetime | Standard — $0.59 Micros — $0.09 Nano & Event Contracts — $0.05 |

Bank transfer costs 30 units of the original currency |

Tradovate clients pay clearing fees, exchange fees, and NFA fees. Also, they pay a subscription for real-time market data.

The broker charges $12.9 per 10 standard contacts for the Free plan, $9.9 for the Monthly plan, and $5.9 for Lifetime. The average cost per contract across these plans is $9.6. The table below provides a comparison of average fees for three stockbrokers.

| Broker | Average commission | Level |

|---|---|---|

|

$9.6 | |

|

$2 |

Account types

Tradovate offers a variety of accounts, including Individual, Joint, IRA, Corporate, LLC, Trust, and Partnership. For individual investors, there are three fee plan options: Free, Monthly, and Lifetime. To ensure compliance with trading rules, maintain the required daily margin, which varies based on the account type: $10 for Nano, $25 for Small, $50 for Micro, and $500 for Standard.

Fee plans:

Upon opening the basic account, traders can request additional account types to suit certain strategies. A demo account is also available.

Tradovate offers various fee plans and trading fees to meet the needs of every trader.

Deposit and withdrawal

-

Withdrawal requests are submitted through the trading platform.

-

Requests sent by 12:00 Central Time are processed the same day if the required margin is maintained.

-

Available withdrawal methods are bank and ACH transfers.

-

Bank transfer fees are $30 or equivalent in the used currency applicable to both domestic and international transfers.

-

If the margin is sufficient, traders can leave their positions open when submitting withdrawal requests.

Investment Options

Being a futures broker and not an investment advisor, Tradovate is not authorized to provide trading advice. The company focuses on active trading, offering third-party automated trading platforms. The Tradovate proprietary platform supports the group order functionality, which allows traders to simultaneously execute identical trades on several account types.

Collective Two (C2) for generating passive income

C2 is an online platform for automated and copy trading in financial markets. It allows traders to develop, test, and automatically execute trading strategies, and share them with other participants.

Main features of C2:

-

Strategy development and testing. Traders can develop and optimize their trading strategies using various analytical and testing tools.

-

Automated trade execution. The platform supports automated execution of trading strategies based on pre-set rules.

-

Copy trading. Users can copy successful trades placed on the platform by other traders.

-

Strategy monitoring and evaluation. C2 provides tools to monitor trading strategies and to evaluate their performance.

-

Community and knowledge exchange. The platform offers a trader community where traders can exchange their ideas, discuss strategies, and share experiences.

Therefore, Collective Two provides an infrastructure for automated and social trading in financial markets.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Tradovate:

Currently, Tradovate doesn’t offer any partnership programs.

Customer support

Tradovate’s technical support is available from 06:30 to 16:30 (Central Time) Monday through Friday. The trading department processes orders 24 hours a day from Sunday evening to Friday noon.

Advantages

- Live chat is available

- A free phone number is provided

Disadvantages

- Support’s availability is limited

- No callback option

Available communication channels to contact technical support are:

-

Live chat;

-

Phone;

-

Email.

Traders can use a feedback form to send tickets to a certain department. Responses are sent via email.

Contacts

| Registration address | 222 N La Salle St., Suite 1450, Chicago, IL 60601 |

|---|---|

| Regulation | CFTC, NFA |

| Official site | www.tradovate.com |

| Contacts |

1 (844) 283-3100, (312) 283-3100

|

Education

The broker’s website provides over 50 video guides on working with the Tradovate platform. Additionally, traders can go to the CME resource center which offers opportunities for gaining trading experience and skills for futures trading.

To learn how to trade futures without risking real funds, use a demo version of the Tradovate platform. This trading simulator offers a virtual deposit and broadcasts real market data.

Detailed review of Tradovate

Tradovate client funds are held in segregated bank accounts with NinjaTrader Clearing. BMO Bank, established in 1882 as BMO Harris Bank, is its official depository. Tradovate offers access to CME (the Chicago Mercantile Exchange), NYMEX (the New York Mercantile Exchange), CBOT (the Chicago Board of Trade), COMEX (the Commodity Exchange), Eurex (the European Exchange), Coinbase Derivatives Exchange, ICE (the Intercontinental Exchange), and MGEX (the Minneapolis Grain Exchange). The broker operates according to strict financial supervision rules applied in the U.S.

Tradovate by the numbers:

-

9+ years of operation;

-

3 fee plans with different conditions;

-

The minimum deposit ranges from $0 to $1,499 depending on the chosen plan;

-

Daily margin starts from $50 for Micro contracts and from $500 for Standard;

-

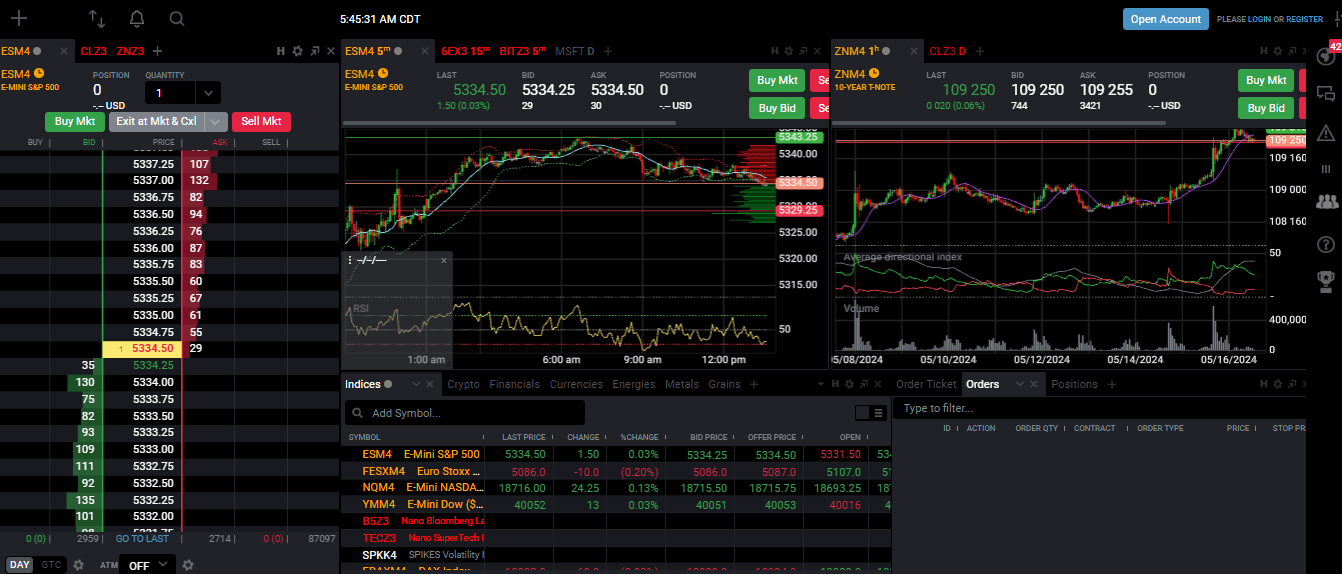

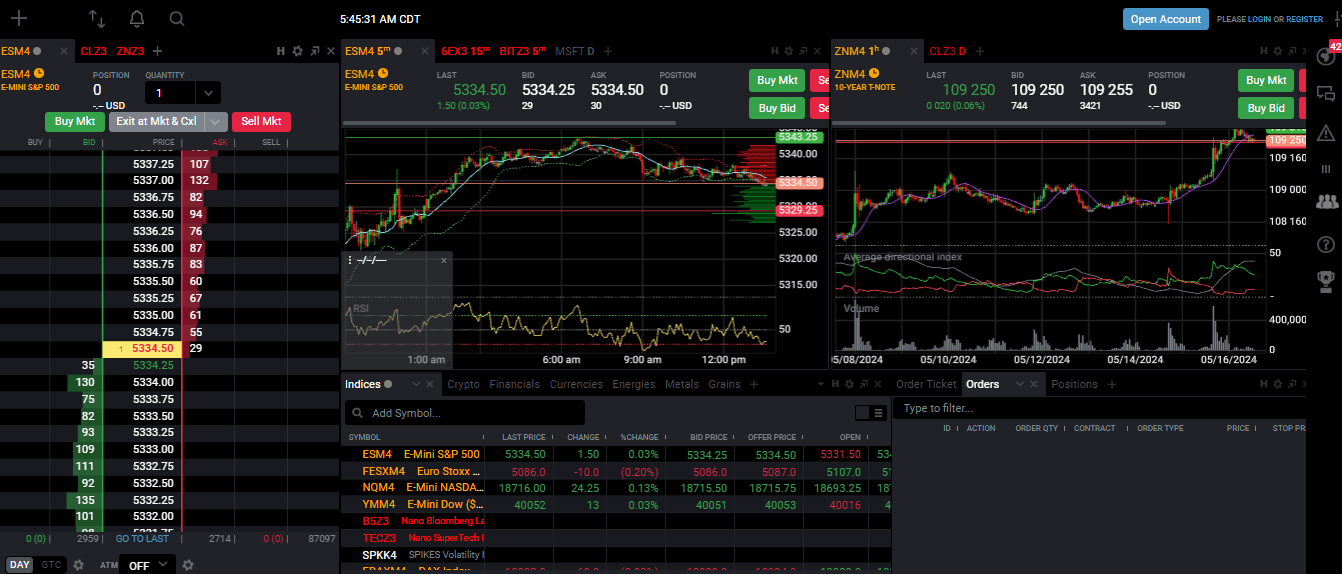

The proprietary platform supports over 10 trading order types and 40 analytical tools.

Tradovate is a brokerage company for trading various stock futures

Tradovate is a Futures Commission Merchant (FCM), a licensed intermediary that executes futures trades on behalf of its clients. As a key player in futures trading, FCMs ensure order execution and provide access to exchanges, market information, and analytics. Additionally, Tradovate handles clearing procedures, including settlements, margin funding, and trade execution. The broker acts as an intermediary between traders and clearing houses, facilitating secure and efficient futures trade execution.

Due to similar margin requirements and fee structures, traders can seamlessly switch between Tradovate and NinjaTrader user accounts. Furthermore, Tradovate clients can connect their accounts to TradingView, Jigsaw Daytradr, and Collective Two.

Useful services offered by Tradovate:

-

Community. It is designed to gather requests for new trading tools, indicators, and platform features, as well as to process user feedback on available features.

-

Tradovate Trial. This two-week free option allows traders to test the broker’s proprietary platform, using real-time market data.

-

Built-in trading tools. Tradovate platforms offer the depth of market, live quotes, options chains, Spread Matrix, multi-account trading, customizable alerts, strategy templates, two-factor authentication, etc.

-

Blog. It contains articles with data necessary for futures trading. They help traders conduct fundamental market analysis and adjust their trading strategies based on market movements.

Advantages:

Traders can execute trades, conduct market analysis, and monitor their trading performance on any device;

Tradovate platforms support a demo version, which allows its potential clients to explore their functionality without depositing funds;

Trading orders are held in the cloud, so they can be restored if the internet connection drops;

The broker’s clients trade Mini, Micro, and Nano contracts, which is especially useful for testing new strategies and methods;

Real-time data is broadcast for stock futures from the S&P 500, Nasdaq-100, and Dow Jones indices. Also, historical tick, minute, and daily data for 20 years are available.

Tradovate specializes in stock futures, therefore its features are tailored to the needs of stock futures traders.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i