Your capital is at risk.

ArgoTrade Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- WebTrader

- FSA

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- WebTrader

- FSA

Our Evaluation of ArgoTrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ArgoTrade is a broker with higher-than-average risk and the TU Overall Score of 3.47 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ArgoTrade clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

ArgoTrade is a broker with a large number of financial instruments and account types suitable for both novice and experienced traders.

Brief Look at ArgoTrade

ArgoTrade is a broker that offers a wide range of financial assets, including fiat currencies and cryptocurrencies, metals, stocks, indices, bonds, ETFs, and commodities. The company's operations are regulated by the Financial Services Authority (FSA) of Seychelles (license number 8413415-1). In addition to its presence in Seychelles, the company has an office in Nicosia, Cyprus.

- There are over 2100 financial instruments available for trading.

- The broker offers five different trading account types.

- There are no commissions for depositing or withdrawing funds.

- Access to detailed information about spreads on all accounts for different trading assets.

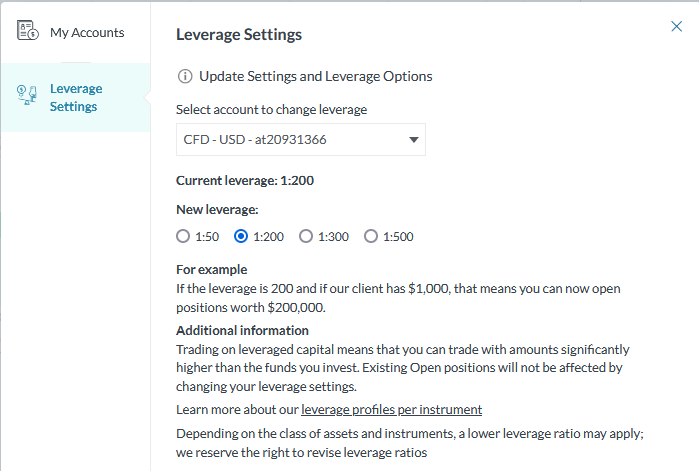

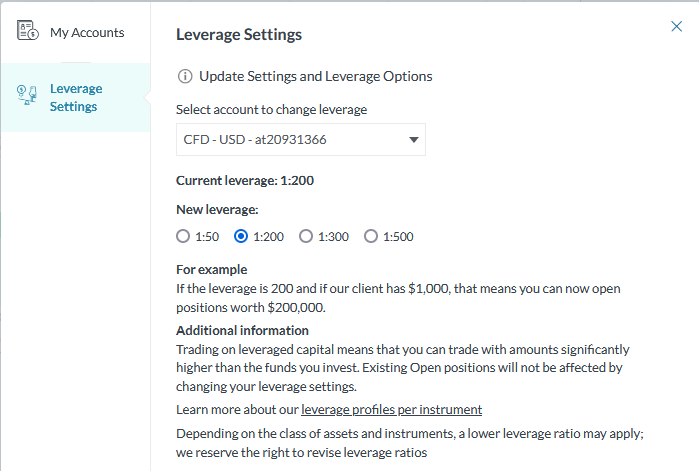

- Customizable leverage of up to 1:500.

- There are no PAMM and MAM accounts for passive investing.

- There are no cent accounts for novice traders.

- The company lacks an education section, analysis from professionals, or tools to calculate margin, potential profit, currency conversions, etc.

TU Expert Advice

Financial expert and analyst at Traders Union

ArgoTrade stands out for its openness and transparency. All legal information and trading conditions are available on the website. The company has two offices in Cyprus and Seychelles. The broker conducts its professional activities based on an FSA (Financial Services Authority) license. The trading conditions offered by the broker are not the most favorable due to high spreads, especially on accounts with an accessible deposit amount. To trade with reduced commissions, you need to open Platinum and Exclusive accounts, with minimum amounts of $50,000 and $100,000, respectively.

ArgoTrade provides clients with leverage up to 1:500, with the ability to customize it in the user account. The broker offers a variety of financial instruments for trading, including currency pairs, cryptocurrencies, securities, and commodities. The lowest spreads are for trading metals, while the highest are for stock indices.

The company does not offer the opportunity to invest in PAMM- and MAM-managed accounts, as well as affiliate programs for introducing brokers. The only option for passive income is using social trading platforms. In addition to the availability of essential information on the ArgoTrade website, more detailed conditions and issue resolution can be addressed by contacting client support.

ArgoTrade Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. ArgoTrade and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | МТ4, WebTrader |

|---|---|

| 📊 Accounts: | Demo, Micro, Silver, Gold, Platinum, Exclusive |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Credit and debit cards, Neteller, Skrill, AstroPay, Perfect Money, cryptocurrency wallets |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 depending on the financial asset and account type |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.8 pips depending on the account and type of instrument |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, bonds, precious metals, energy resources, ETFs, commodities, and cryptocurrencies. |

| 💹 Margin Call / Stop Out: | Margin call is 50% |

| 🏛 Liquidity provider: | Proprietary suppliers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Most trading strategies are allowed |

| 🎁 Contests and bonuses: | Bonus on first deposit |

ArgoTrade offers over 2,100 financial assets across seven different categories. For trading, the MetaTrader 4 trading platform is available, along with a simplified version called WebTrader for browser-based and mobile device trading. In addition to five different types of trading accounts, there are also swap-free accounts for Muslim traders and a demo account for practicing with virtual currency. Leverage can be customized in the user account, with a maximum leverage of 1:500.

ArgoTrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

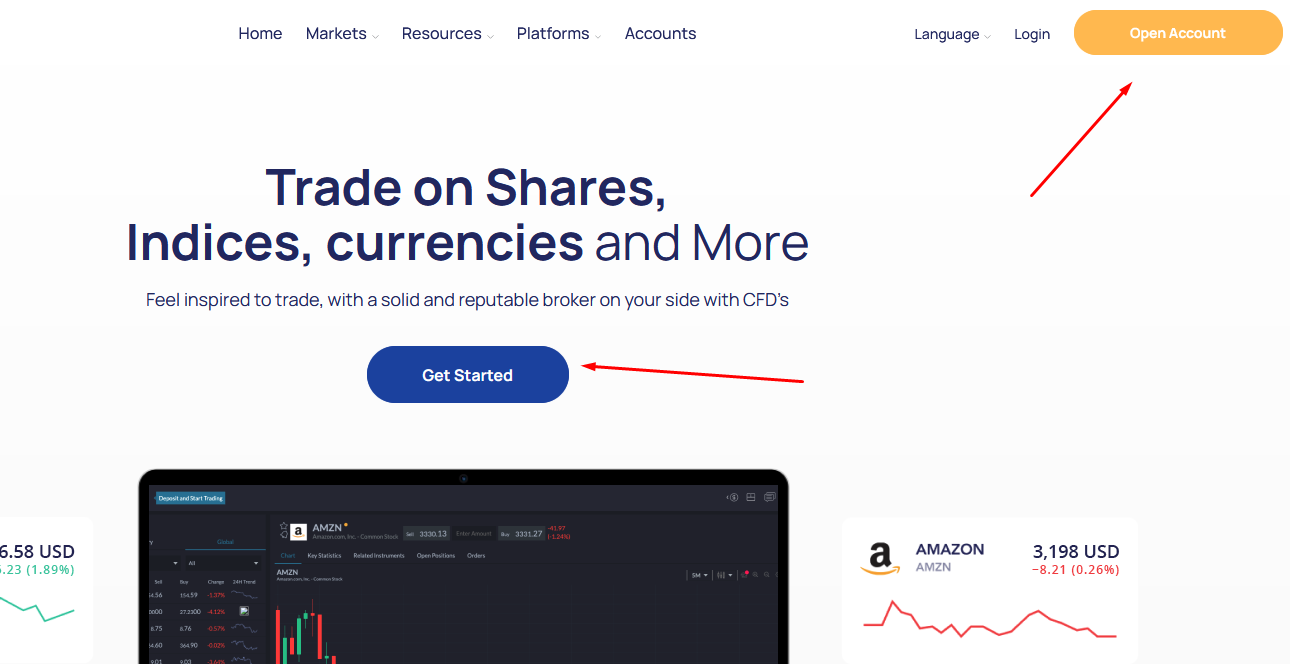

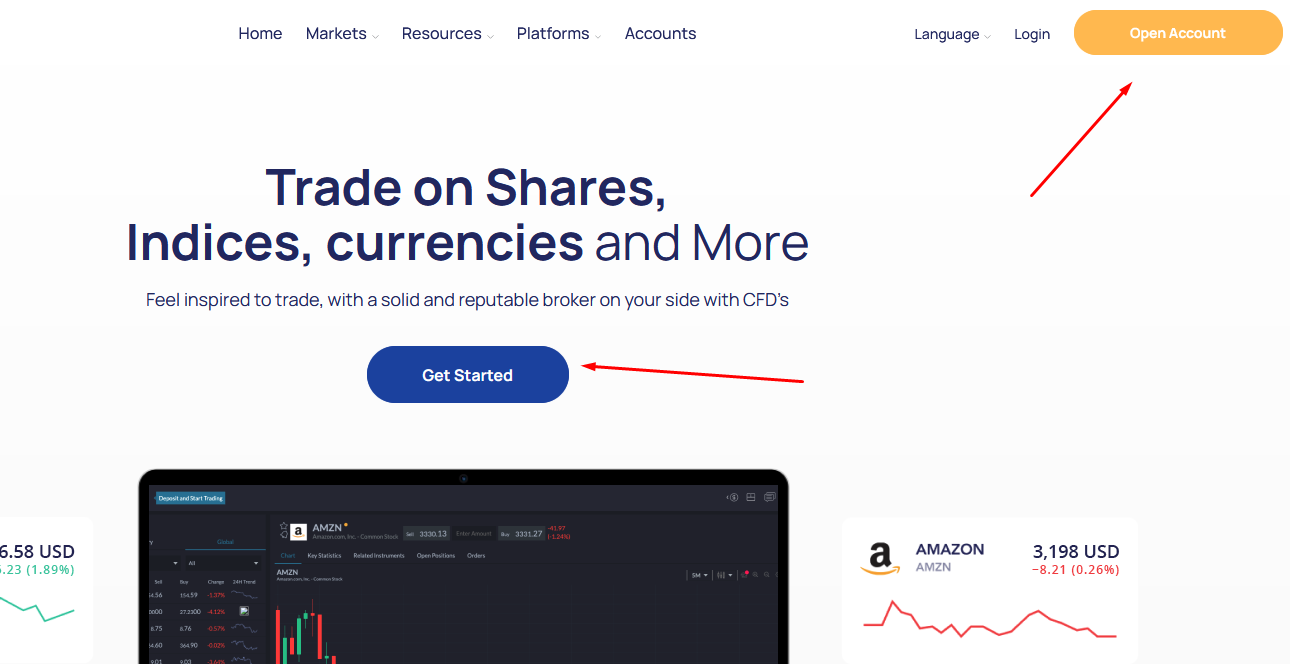

Trading Account Opening

To start trading with the broker ArgoTrade, register on the company's website and open a trading account.

On the homepage of the website, click on "Open Account" or "Get Started."

Fill out the form with your name, surname, phone number, and address, as well as tax and financial information (tax ID, sources and amount of income, desired trading volume).

Features of the ArgoTrade user account:

Your ArgoTrade user account also provides access to:

-

Deposit and withdrawal of funds.

-

Detailed information about the account’s status, including net profit, account balance, margin size, and the amount available for withdrawal.

-

Notification settings allow you to choose a channel (SMS, email, internal mail) and type of company news.

-

Trade history allows you to close and cancel positions with the ability to select a specific time period.

Regulation and safety

ArgoTrade has two branches, one in Cyprus and the other in Seychelles. Both branches operate professionally within the laws of their respective jurisdictions. Leadcapital Corp Ltd operates under license number 8413415-1 issued by the Financial Services Authority of Seychelles (FSA). Upon registration in Cyprus, the company was assigned the number HE 332817.

Advantages

- Client funds are stored in segregated bank accounts separate from the company's capital.

- The broker is regulated by the FSA, meaning that in case of any breaches of obligations by ArgoTrade, clients can file a complaint with the regulator.

- ArgoTrade accepts client complaints and maintains neutrality in resolving disputed situations.

Disadvantages

- During registration, it is necessary to fill out a detailed questionnaire with information about sources and amounts of income.

- Clients do not have the option to set up two-factor authentication to enhance account security.

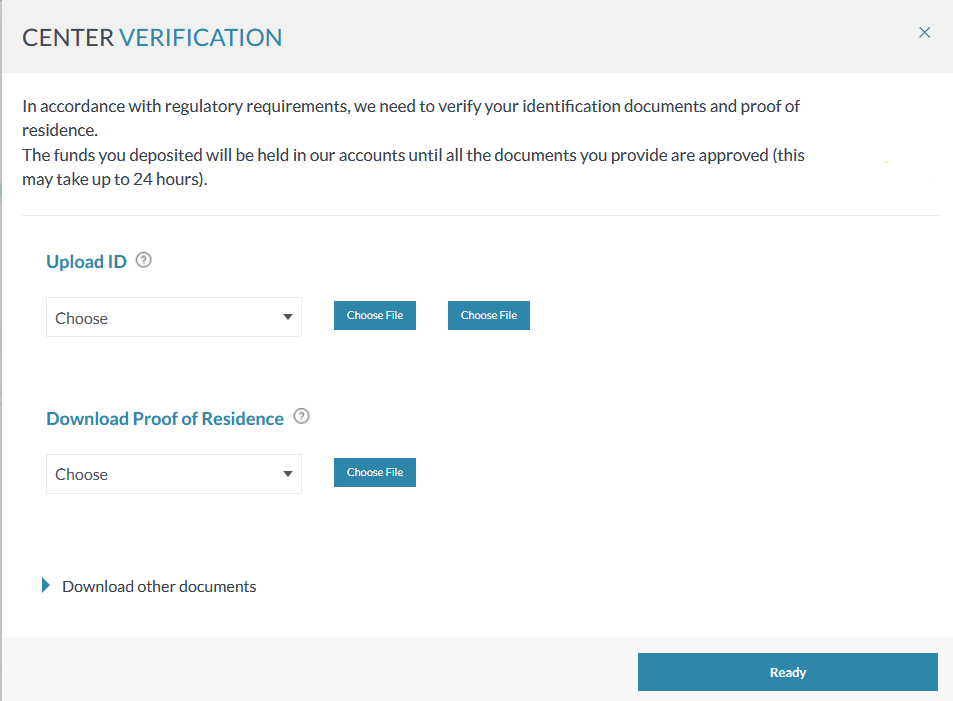

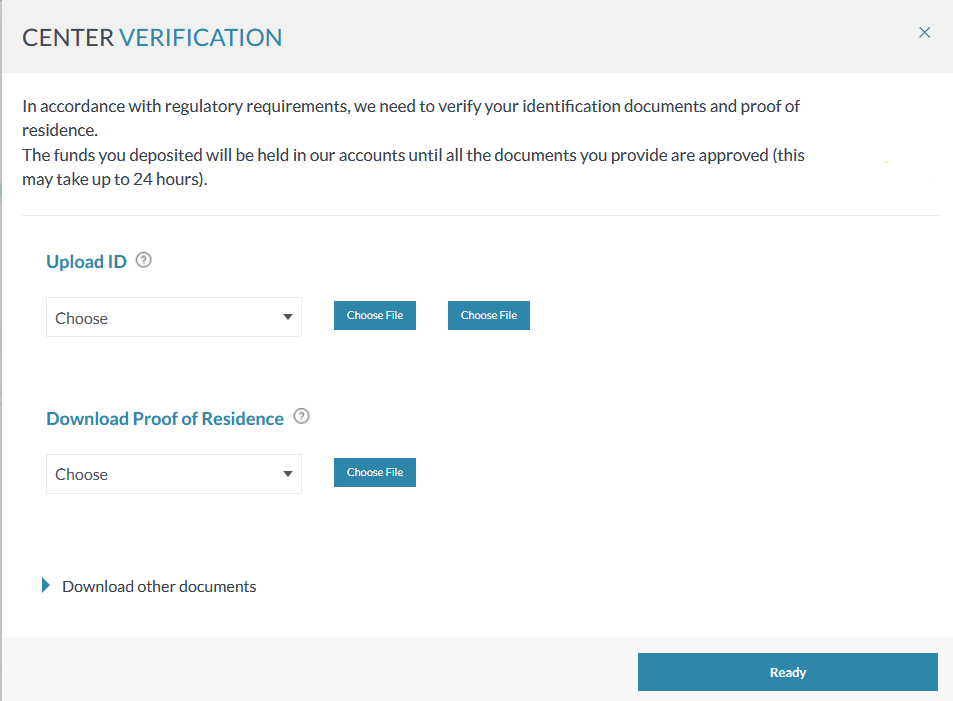

- Withdrawals are only available after completing the verification process.

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Micro | From $30 | No |

| Silver | From $19 | No |

| Gold | From $14 | No |

| Platinum | From $10 | No |

| Exclusive | From $8 | No |

There are swaps for holding orders open overnight.

TU analysts, when comparing average spreads of ArgoTrade, RoboForex, and Pocket Option, used indicators for the popular EUR/USD pair because commissions vary across all types of accounts and significantly differ depending on the asset. The results are presented in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$16.2 | |

|

$1 | |

|

$8.5 |

Account types

ArgoTrade offers five account types, and each is available for the broker's offered trading platforms. Commission and spread sizes depend on the account type and financial asset.

Account types:

Deposit and Withdrawal

-

For withdrawals, the company offers the following methods: credit/debit cards, AstroPay, Perfect Money, Neteller, Skrill, and cryptocurrency wallets.

-

The broker does not impose withdrawal fees.

-

Withdrawals can be made by clients who have completed verification by uploading copies of their ID and a document confirming their registered address.

-

The company charges a conversion fee if the withdrawal is processed in a currency different from the base currency.

Investment Options

ArgoTrade primarily works with active market participants; thus, it does not offer the opportunity to invest in PAMM- or MAM-managed accounts. For passive income, one can use social trading platforms. Simply select a professional with high profitability indicators and subscribe to their signals. All their trades will be replicated in the trading platform, allowing investors to adjust the opening/closing of orders at their discretion and deposit or withdraw funds at any time.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ArgoTrade's partnership program:

-

Refer a Friend. For five new clients who come through the referral link and fund their accounts, the company grants a partner reward. For a deposit of $100-499, the partner receives 20% of the amount; for $500-1999, $150; for $2000-9999, $250; and for $10,000-20,000, $400.

Payouts are made in the account's base currencies: USD, EUR, or GBP. Funds earned through the partner program are available for trading and withdrawal. To participate in the program, the partner needs to open a real account, fund it, and engage in trading.

Customer support

Client support representatives are available around the clock from 5:00 PM (EST) on Sunday to 4:00 PM (EST) on Friday.

Advantages

- In the WhatsApp messenger, support responds very quickly.

- You can contact them via email in many languages.

Disadvantages

- Operators are available 24/5

- There is no live chat for immediate communication with support.

The broker provides the following communication channels:

-

WhatsApp.

-

Email.

Any trader, including those without an account on the company's website, can ask support representatives at ArgoTrade a question.

Contacts

| Registration address | Leadcapital Corp Ltd., Suite 3, Global Village, Jivan's Complex, Mont Fleuri, Mahé, Seychelles |

|---|---|

| Regulation |

FSA

Licence number: 8413415-1 |

| Official site | https://www.argotrade.com/ |

| Contacts |

Education

The ArgoTrade website lacks a section with education materials, except for the FAQs section, which include answers to common questions about using the trading platform and descriptions of actions when opening/closing orders.

The broker does not offer cent accounts, so novice traders can reinforce their knowledge and skills using a demo account.

Comparison of ArgoTrade with other Brokers

| ArgoTrade | RoboForex | Pocket Option | Exness | FxPro | InstaForex | |

| Trading platform |

MT4, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $100 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.8 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / No | 60% / 40% | 30% / 50% | No / 60% | 25% / 20% | 30% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of ArgoTrade

ArgoTrade is geared towards active trading, offering five different types of accounts that traders can choose based on their financial capabilities. The company allows the use of advisors and any trading strategies. All collaboration-related queries can be discussed with the competent client service representatives who provide the necessary information.

ArgoTrade by the numbers:

-

There are over 2,100 trading instruments.

-

Broker offers 5 trading account types.

-

Minimum deposit of 100 USD/EUR/GBP.

ArgoTrade is a broker designed for active trading and social trading

ArgoTrade strives to create comfortable conditions for clients with varying financial capabilities, offering accounts with different deposit amount requirements. Leverage can be adjusted in the user account from 1:50 to 1:500, with a default setting of 1:200 upon account opening. Individual conditions may be offered to each trader, and negotiated with a personal manager. ArgoTrade emphasizes transparency, providing all information on spreads and not imposing hidden fees. Social trading platforms are available to all clients for profit through copying signals from successful market participants.

ArgoTrade provides software for MT4 and WebTrader, allowing clients to trade on computers, browsers, and mobile devices. Trading platforms can be customized, offering auto-trading capabilities, as well as tools like Trader Insights (analytics and forecasts) and Trader Trends (assists with trend-based trading strategies).

ArgoTrade’s analytical services:

-

Economic calendar is a schedule of significant global political and financial events that may impact market conditions.

-

FAQs provide answers to frequently asked questions regarding the technical aspects of trading platforms, registration, deposits, etc.

-

Account history contains statistics on all trading operations.

-

Trading platform customization with the option to choose language and time zones.

Advantages:

24/5 client support.

Availability of a demo account for risk-free trading with virtual currency.

Bonus for new clients on their first deposit.

Partner program with a bonus for referring clients.

Client funds are stored in segregated accounts in reputable first-tier banks.

In case of issues, all clients can file a complaint by filling out a special form provided by ArgoTrade.

User Satisfaction