According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MetaTrader5

Our Evaluation of Aron Groups

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Aron Groups is a moderate-risk broker with the TU Overall Score of 5.18 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Aron Groups clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Aron Groups is a broker with trading conditions suitable for both novice traders and professionals.

Brief Look at Aron Groups

Aron Groups is a company that has been providing brokerage services for two years while offering 1,000 financial instruments for trade. The broker is registered in the Marshall Islands (Banking Commission RMI) under number 118046 and in Saint Vincent and the Grenadines (SVG FSA) under number 542LLC2020. The company's head office is located in Cyprus.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A wide range of financial assets for trading;

- A minimum deposit amount of $1;

- Four types of trading accounts with different trading conditions;

- PAMM and MAM accounts for earning through passive investments;

- A wide range of payment systems for depositing and withdrawing funds.

- Not all accounts allow the use of advisors;

- The broker has the right to change spreads, swaps, and fees without notifying clients;

- Only one trading platform — MT5, is available for trading.

TU Expert Advice

Author, Financial Expert at Traders Union

Aron Groups provides a wide range of financial instruments, including currency pairs, cryptocurrencies, stocks, indices, metals, and energies, through the MetaTrader 5 platform. With four trading account types, including cent and swap-free, the broker accommodates various trading needs and experience levels. The minimum deposit starts at $1, offering accessible entry for beginners, and leverage is available up to 1:1000. The broker also supports passive investments through PAMM and MAM accounts along with offering a social trading platform for copying signals.

Drawbacks include the lack of Tier-1 regulatory oversight and possible spread and fee adjustments without prior notice, which may be challenging for some traders. Additionally, the broker only supports MT5, limiting platform diversity. Aron Groups may suit traders looking for varied trading instruments and those comfortable with higher risk levels due to lesser regulatory protection. Nonetheless, traders who prioritize tight regulatory compliance may find the broker less suitable.

Aron Groups Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Aron Groups and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MetaTrader 5 |

|---|---|

| 📊 Accounts: | Nano, Standard (ECN), Swap Free (ECN), VIP (ECN), demo |

| 💰 Account currency: | USD, toman (~1 USD = 59,546 toman) |

| 💵 Deposit / Withdrawal: | Visa/Mastercard cards, bank transfers, cryptocurrency wallets, Perfect Money, ADVcash, Iraq Exchange, exchange (toman), Payeer, Skrill, PayPal |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to 1:1,000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Currency pairs (101), CFDs on indices (17), stocks (125), metals (14), energy resources (3), cryptocurrencies (157) |

| 💹 Margin Call / Stop Out: | 100%/5% (Swap Free), 100%/40% (VIP), 100%/50% (Nano and Standard) |

| 🏛 Liquidity provider: | Own providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Limit and market |

| ⭐ Trading features: | Inactivity fee of $2 per month for accounts inactive for more than 90 days |

| 🎁 Contests and bonuses: | Yes |

Aron Groups offers access to hundreds of financial instruments, including currency pairs, cryptocurrencies, stocks, indices, metals, and energy resources. The broker provides four types of user accounts with different trading conditions, including swap-free accounts (for Muslim traders). A demo account is available for testing trading strategies and learning trading techniques.

Aron Groups Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To trade with this broker, register on its website and open a trading account. The procedure for opening an account looks is set out below.

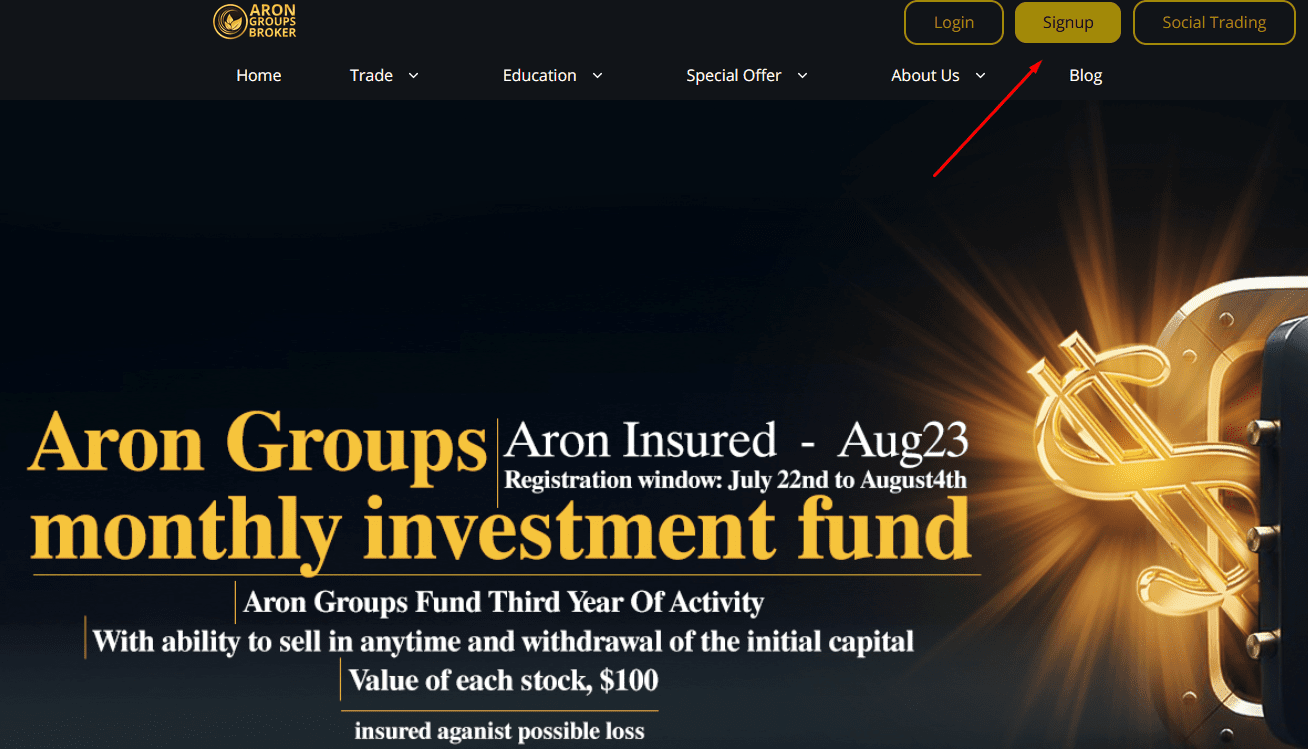

Go to the company's website and click on "Sign Up”.

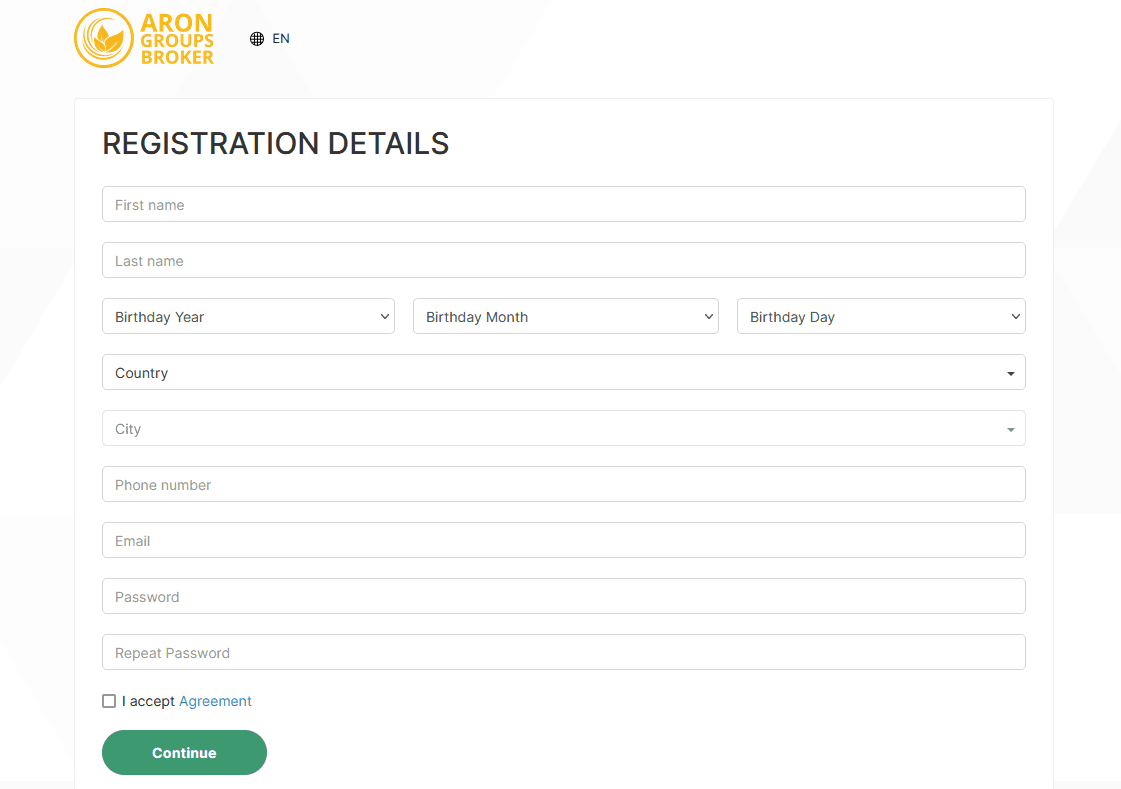

Fill out the form with your first name, last name, date of birth, country, city, phone number, and email. Then create a password and enter it twice, accept the terms of the agreement, and click on “Continue”.

Aron Groups user account functions:

In the user account, clients have access to the following options:

-

An economic calendar displaying events that may impact financial markets;

-

Deposit and withdraw funds, plus transfer funds between trader’s accounts;

-

Review of opened trading accounts with statistics and balances;

-

Subscribe to signal providers;

-

Set up two-factor authentication using Google Authenticator.

Regulation and safety

Aron Groups has a safety score of 1.5/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Flexible trading conditions with high leverage and less bureaucracy

- Not tier-1 regulated

- Not regulated

- No negative balance protection

- Track record of less than 8 years

Aron Groups Security Factors

| Foundation date | - |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Aron Groups is Not a Regulated Broker

Commissions and fees

The trading and non-trading commissions of broker Aron Groups have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Aron Groups with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Aron Groups’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Aron Groups Standard spreads

| Aron Groups | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,6 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,9 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Aron Groups RAW/ECN spreads

| Aron Groups | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,50 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,30 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Aron Groups. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Aron Groups Non-Trading Fees

| Aron Groups | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 50 | 0 | 0 |

Account types

Aron Groups offers four account types such as cent, ECN, those with varying fee sizes, and those with or without swaps. The broker allows opening up to 10 user accounts and up to four demos. However, it's essential to note that clients can open only one of the presented types of trading accounts.

Account types:

A demo account can only be opened for the Standard account.

Aron Groups provides diverse trading conditions suitable for clients of any experience level and size of capital.

Deposit and withdrawal

Aron Groups received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Aron Groups provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Minimum deposit below industry average

- Bitcoin (BTC) accepted

- USDT (Tether) supported

- BTC available as a base account currency

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

- PayPal not supported

What are Aron Groups deposit and withdrawal options?

Aron Groups provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, BTC, USDT, Ethereum.

Aron Groups Deposit and Withdrawal Methods vs Competitors

| Aron Groups | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Aron Groups base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Aron Groups supports the following base account currencies:

What are Aron Groups's minimum deposit and withdrawal amounts?

The minimum deposit on Aron Groups is $1, while the minimum withdrawal amount is $20. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Aron Groups’s support team.

Markets and tradable assets

Aron Groups offers a wider selection of trading assets than the market average, with over 2000 tradable assets available, including 80 currency pairs.

- 2000 assets for trading

- 80 supported currency pairs

- Crypto trading

- Bonds not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by Aron Groups with its competitors, making it easier for you to find the perfect fit.

| Aron Groups | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 2000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Aron Groups offers for beginner traders and investors who prefer not to engage in active trading.

| Aron Groups | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The support representatives work 24/7.

Advantages

- Online chat support responds to all traders, even without an account

- Operates 24/7

Disadvantages

- No option for requesting a callback

- Waiting time for a response in the online chat can take up to 1 hour

Various communication channels are available to reach support:

-

Phone;

-

Feedback form;

-

Email;

-

Online chat on the website;

-

Tickets in the user account.

For consultations, inquiries can also be made via support groups on social media platforms like Telegram and WhatsApp.

Contacts

| Registration address | Aron Markets Ltd, 59 Agios Athanasios Avenue, D. VRACHIMIS BUILDING, Limassol, 4102, Cyprus |

|---|---|

| Official site | https://arongroups.co/ |

| Contacts |

00442037475808, 0035725654181

|

Education

On the Aron Groups website, there's an Education section offering guides on Forex trading, working with the MT5 trading platform, and other useful information.

The broker offers demo and cent accounts, so traders without experience are recommended to start trading on these to avoid risking large sums.

Comparison of Aron Groups with other Brokers

| Aron Groups | Bybit | Eightcap | XM Group | Exness | FxPro | |

| Trading platform |

MetaTrader5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $1 | No | $100 | $5 | $10 | $100 |

| Leverage | From 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | No / 50% | 80% / 50% | 100% / 50% | 60% / No | 25% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of Aron Groups

Aron Groups aims to provide clients with the most comfortable collaboration conditions, focusing on long-term mutually beneficial relationships. Traders have access to four account types, allowing them to choose the most suitable one based on their financial capabilities and trading experience in financial markets. The website offers numerous useful tools and diverse information.

Aron Groups by the numbers:

-

Over 5 billion transactions every day;

-

More than 50,000 active client accounts;

-

Maximum leverage is 1:1,000.

Aron Groups is a brokerage for active trading and passive earnings

The company uses ECN technology, enabling small market participants to trade directly with liquidity providers. This grants its clients advantageous quotes and swift trade execution. The broker offers a wide variety of financial assets for trading: fiat currencies, cryptocurrencies, energy commodities, metals, indices, and stocks. It has its own signal copying service and provides an opportunity to invest in managed accounts.

Traders operate on the informative and multifunctional MetaTrader 5 platform, which can be installed on PCs and mobile devices running on Android and iOS. Before using automated advisors and scripts, it's advisable to verify whether this is allowed according to the rules for each specific account.

Useful functions of Aron Groups:

-

Mobile MetaTrader training. A section with educational videos for working on the MT5 mobile platform;

-

Economic calendar. A schedule of news releases and various events that can influence financial markets and price movements;

-

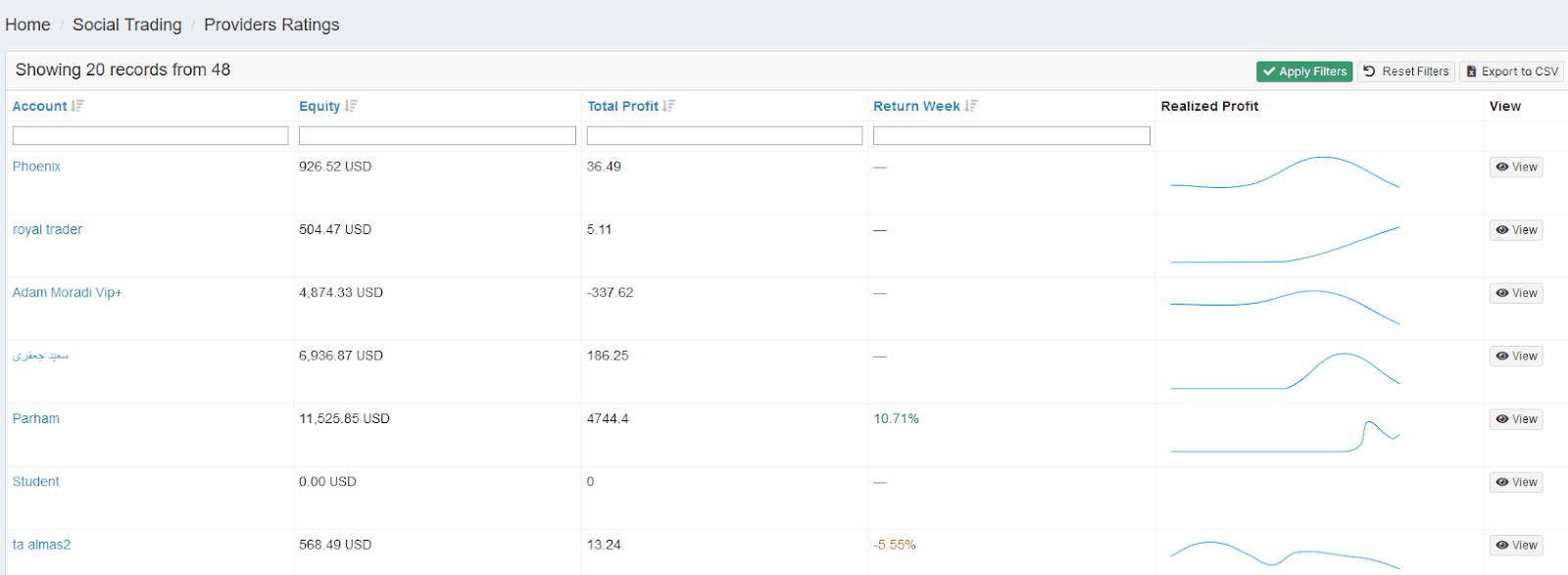

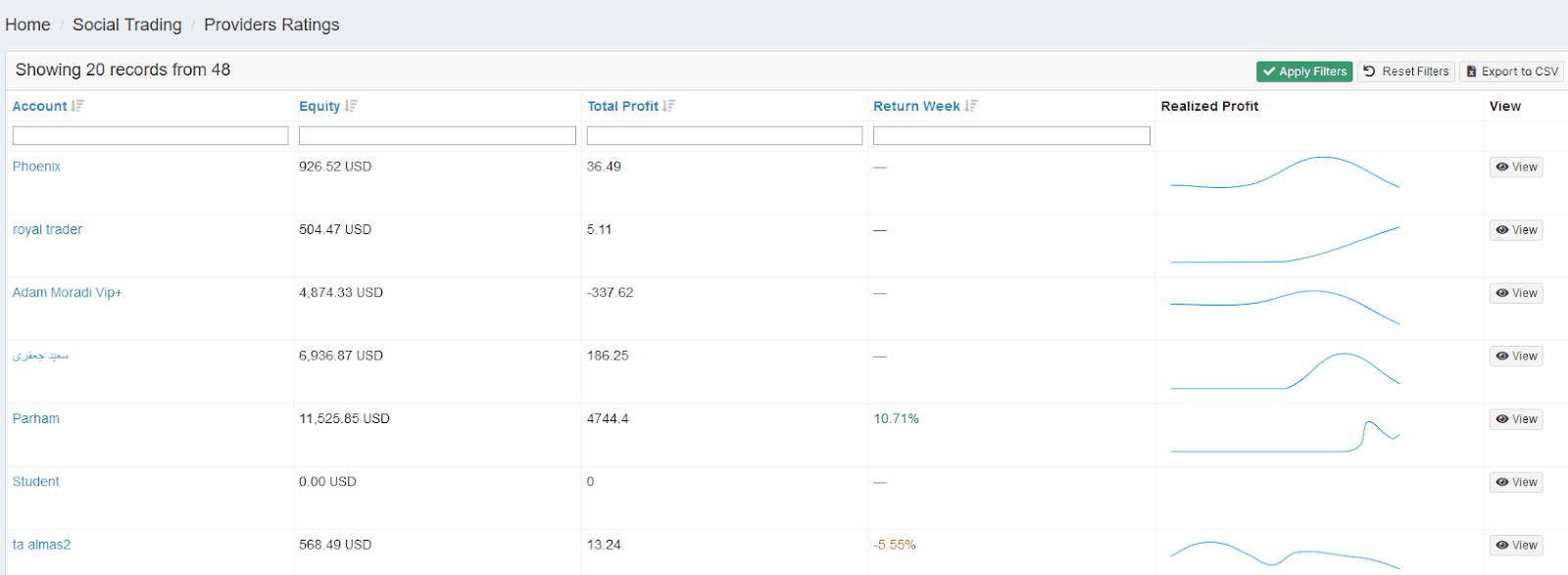

Providers' ranking. A convenient service in the Client Area to review the trading statistics of signal providers on the social trading platform;

-

Credit fund. Clients who purchase a share in the fund can obtain credit from these funds, starting from $500, depending on the investments.

Advantages:

There is a cent and demo account for trading with minimal financial risks or without them;

Protection against negative balance is in place;

A social trading platform is available for passive earnings;

The broker conducts contests and promotions, and offers a bonus on the first deposit;

Interest accruals on deposits are available on all accounts except Nano.

All clients have access to free webinars on various topics related to trading in financial markets.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i