Axi Copy Trading is a modern platform provided by the Axi broker, allowing traders to copy the trades of successful investors and profit from their strategies. Suitable for both beginner and experienced traders, it offers flexibility and accessibility with minimal risk. There is no minimum deposit for copiers, and fees depend on profits, reaching up to 30%

Axi's copy trading platform allows users to replicate the trades of successful traders through a mobile app, offering a simple way to follow top performers by tracking their historical profits, strategies, and markets. With the ability to copy trades at the click of a button, users can adopt a hands-off approach, paying a small commission on profits made. This article will cover the essential features of Axi's platform, regulatory status, fees, and more.

Axi Copy trading review

The Axi Copy Trading platform from Axi broker offers a user-friendly and efficient way for traders, particularly beginners, to replicate the trades of seasoned investors. Here are its key features:

Social trading feature. Axi lets users follow top traders and automatically mirror their trades in real time. It’s a simple way to benefit from the knowledge and experience of seasoned investors without having to manually execute trades.

Risk management with flexibility. Users can tweak their trade size and risk levels to match their account balance, giving them the flexibility to align copied trades with their personal risk tolerance.

Diversification. Traders can follow multiple signal providers across various asset classes, making it simple to diversify their portfolios. This is especially helpful for spreading risk across different strategies.

Transparency and performance tracking. Axi gives detailed insights into each trader's performance, including their success rates, risk management methods, and historical results. This level of transparency helps users make informed choices about which traders to follow.

Broad asset range. Axi supports trading in multiple asset classes like Forex, indices, commodities, and cryptocurrencies. The platform offers access to over 50 Forex pairs, with competitive spreads starting from as low as 0 pips on pro accounts.

Seamless integration with MT4. Axi works with MetaTrader 4 (MT4), offering advanced tools like automated trading with Expert Advisors (EAs), powerful charting features, and integration with MyFxBook for tracking performance.

Affordable cost. Copy trading on Axi is free, though users still need to account for standard spreads and commissions. For instance, pro accounts have a $7 commission per lot, with spreads on popular pairs like EUR/USD as low as 0.2 pips.

Regulatory status

Axi operates under the oversight of several reputable regulatory bodies. The broker is licensed and regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Dubai Financial Services Authority (DFSA). This multi-regulatory approach not only ensures the platform's credibility but also enhances investor confidence, offering a secure and transparent trading environment.

These regulations require Axi to maintain client funds in segregated accounts, a vital safeguard ensuring traders' funds are protected even if the company encounters financial difficulties.

Minimum deposit

One of the notable features of Axi's copy trading platform is its accessibility, with no minimum deposit requirement for copiers. This means that traders can start copying trades with an amount they are comfortable with. However, signal providers must deposit at least $500 to offer their trading strategies, ensuring they have a sufficient stake in their trades.

Commissions and fees for copy trading

Axi offers competitive and transparent pricing. While there are no direct commissions on trades copied through the platform, there may be performance fees, which are typically agreed upon between the Signal Provider and the Copier. These fees usually range from 20% to 30% of the profits generated by the copied trades. Performance fees are deducted monthly, providing clarity on trading costs and allowing traders to plan their finances accordingly.

For instance, if a Copier makes a profit of $200 by following a Signal Provider with a 25% performance fee, they would be charged $50 as a fee. This transparency ensures that traders are aware of the costs associated with their trading activities.

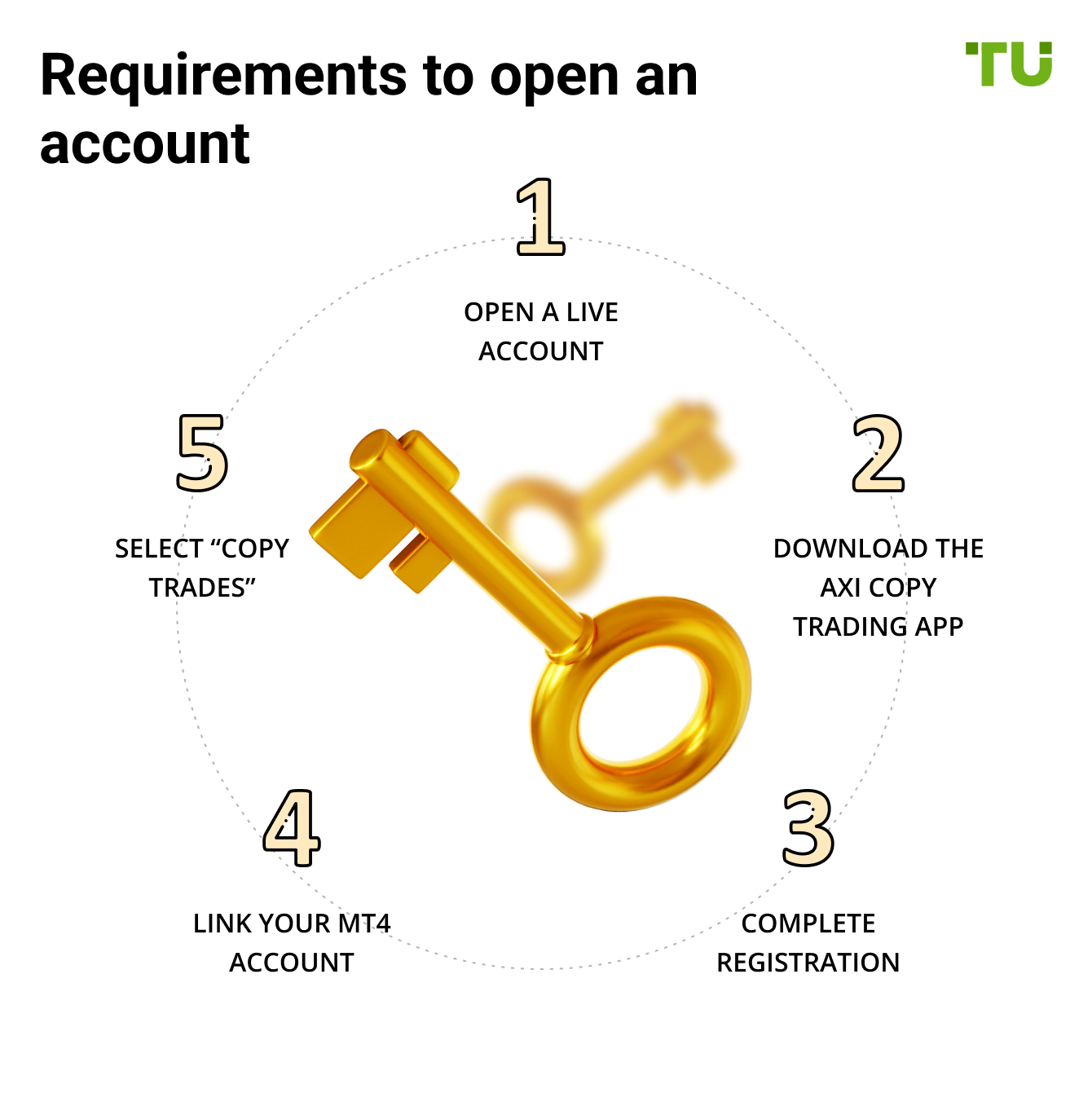

Requirements to open an account

To get started with Axi Copy Trading, traders must have an active Axi live trading account. Here’s a detailed step-by-step guide:

-

1

Open a live account. Visit the Axi website to create a live trading account. Demo accounts are not eligible for copy trading, highlighting the need for real-market experience.

-

2

Download the Axi Copy trading app. The app is available on the Apple Store and Google Play Store, providing seamless access to Axi's services.

-

3

Complete registration. After downloading the app, fill in your details, accept the terms, and verify your account via email.

-

4

Link your MT4 account: For existing Axi clients, linking your MT4 account is straightforward—simply enter your account number and password within the app.

-

5

Select “Copy trades”. Once linked, choose the “Copy Trades” option to access copy trading features and start your journey.

Setting up an Axi Copy trading account

Setting up an account is straightforward and user-friendly. After registering and downloading the app, follow these steps:

-

1

Launch the app. Click on the "First time here?" button and fill in your personal information.

-

2

Verify your email. A confirmation email will be sent; click "Verify" to confirm your registration and activate your account.

-

3

Link your trading account. Select the server where your MT4 account is located, enter your details, and finalize the setup process.

-

4

Choose your role. Decide whether to "Copy Trades" or "Provide Signals," allowing flexibility in how you wish to engage with the platform.

-

5

Authorize. Confirm your understanding of the Social Trading Authorization and Subscription Terms (STAST) to proceed.

Setting up an account as a сopier

To set up as a copier, follow these steps:

-

1

Navigate to the discover tab. Explore the wide range of Signal Providers available for copying, offering diverse strategies and approaches.

-

2

Analyze providers. Review profitability, return history, markets traded, and performance fees. Axi's platform provides a comprehensive leaderboard that showcases various metrics for each provider.

-

3

Select “Copy”. Choose a provider and adjust trade settings, such as Fixed Size, Mirror Master Size, or Proportional by Equity, based on your risk tolerance and financial goals.

-

4

Finalize settings. Decide between "Round up to minimum trade size" or "Copy existing trades" as needed, ensuring alignment with your strategy.

-

5

Agree and copy. Confirm your settings, adjust max drawdown levels, and start copying, with the flexibility to stop at any time.

Pros and cons of Axi copy trading platform

👍 Pros:

• Regulatory compliance. Axi's adherence to stringent regulatory standards ensures a secure and trustworthy trading environment.

• User-friendly app. The intuitive interface is designed for traders of all experience levels, making it easy to navigate and start copying trades.

• Diverse signal providers. With access to a wide range of successful traders, investors can diversify their portfolios across various strategies and asset classes.

• Flexible risk management. Traders can customize trade sizes and risk levels to align with personal investment goals, providing a tailored trading experience.

👎 Cons:

• Performance fees. While there are no direct commissions, performance fees can reduce overall profits, impacting long-term gains.

• Market risk. As with any trading activity, past performance does not guarantee future success, posing inherent risks that must be managed carefully.

Diversify your trading styles for best results

An unique way beginners can use Axi Copy Trading is by focusing on trading styles, not just copying multiple traders. While many new users spread their money across different traders, they often end up with traders who have the same risk approach or market focus. To really reduce your risk and benefit from different market trends, try copying traders who use totally different strategies — like some who do quick, short-term trades, others who stick to longer trends, and even those who trade in less popular markets like commodities or Forex. This mix will help you when the market takes unexpected turns.

Another thing to watch out for is the emotional patterns of the traders you’re copying. A lot of traders are great in stable markets, but they might panic when things get wild. Check out how they perform during stressful times or big market drops. If you notice that they struggle or make bad decisions in those moments, it’s a sign they may not handle pressure well. Keeping an eye on this can help you pick traders who will do well even when the market isn’t easy.

Conclusion

Axi Copy Trading platform offers a decent solution for traders looking to leverage the expertise of successful investors. With its regulatory compliance, user-friendly interface, and diverse Signal Providers, it caters to a wide range of trading preferences. However, traders must remain cautious about risks and performance fees. By adopting a strategic approach, diversifying investments, and utilizing Axi's flexible features, traders can enhance their trading journey and achieve financial goals.

FAQs

Is Axi Copy trading safe?

Axi Copy Trading is generally safe, as it operates on a regulated platform. However, risks still exist due to market volatility and reliance on the performance of the trader you're copying. It's important to do thorough research on the traders you follow and understand potential losses.

Are there any hidden fees in Axi Copy trading?

While there are no direct commissions, performance fees may apply depending on the agreement with Signal Providers. These fees are usually a percentage of profits and are deducted monthly.

Can I stop copy trading at any time?

Yes, traders can stop copy trading at any time. The platform offers flexibility in managing trades, allowing you to cease copying whenever you choose.

What makes Axi Copy trading different from other platforms?

Axi's platform stands out due to its regulatory compliance, ease of use, and flexibility in risk levels when it comes to its copy trading offering.