deposit:

- $1

Trading platform:

- SmartTrader

- Derivix

- Deriv bot

- Deriv Trader

- Deriv MT5

- MFSA

- LFSA

- VFSC

- BVI FSC

- 0%

deposit:

- $1

Trading platform:

- SmartTrader

- Derivix

- Deriv bot

- Deriv Trader

- Deriv MT5

- MFSA

- LFSA

- VFSC

- BVI FSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Deriv Trading Company

Deriv is one of the top brokers in the financial market with the TU Overall Score of 8.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Deriv clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the broker’s clients are fully satisfied with the company. Deriv ranks 15 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Deriv is a broker for beginners and professional traders who prefer to make trades on their own, as well as use auxiliary programs for more efficient trading.

Deriv is a brokerage company that started its activities in 1999. Deriv's mission is to make trading accessible. For this reason, the company has low minimum deposit requirements, but high-quality working conditions. DTrader is one of the broker's several proprietary trading platforms. Two others are Deriv bot and Deriv MT5. Deriv offers its clients to trade Forex assets, stocks, indices (including synthetic ones), CFDs, commodities, and options. Deriv is an international broker licensed and regulated by the following bodies: Vanuatu Financial Services Commission (VFSC, 14556), Malta and Labuan Financial Services Authority (MFSA, 71479 and Labuan FSA, MB/18/0024), BVI FSC (SIBA/L/18/1114). The rights of traders are guarded by the Financial Commission, of which Derive is also a member.

| 💰 Account currency: | Fiats, cryptocurrencies |

|---|---|

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:1000, multipliers available (leverage levels may vary depending on the client's account and country of residence) |

| 💱 Spread: | Fixed, floating |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, CFDs, indices, stocks, synthetic indices, commodities |

| 💹 Margin Call / Stop Out: | 100% / 50% |

👍 Advantages of trading with Deriv:

- Low level of the minimum deposit.

- A wide range of payment agents for replenishment of the deposit and withdrawal of earned funds.

- Availability of trading instruments of different groups: currency pairs, stocks, indices, metals, etc.

- Broker regulation by several authorities from different countries.

- Round-the-clock client support.

- Choice of three convenient trading platforms.

- No commission for maintaining a trading account and using its platforms.

👎 Disadvantages of Deriv:

- The tutorials provided on the site may not be enough for novice traders.

- Deriv has only a few ways to contact support.

- The broker does not serve clients from several countries, such as the USA, Canada, Malaysia, Israel, and others.

Evaluation of the most influential parameters of Deriv

Trade with this broker, if:

- Your goal is to maximize your profits through derivatives. Deriv offers a unique function called multipliers, which allows traders to increase their profits when the market moves in their favor. Additionally, if the market trends against the trader, they won't lose more than their initial stake.

- You are looking for a reputable and well-established company. Deriv was founded in 1999 and is currently regulated by MFSA, VFSC, and Labuan FSA. Reviews of the platform are generally positive.

Do not trade with this broker, if:

- You prefer not to use MetaTrader 5 and cTrader platforms. Currently, Deriv does not support MetaTrader 4, RTrader, NinjaTrader, or other popular trading solutions. Deriv also has a proprietary platform, but the opinions about it are divided.

- You require specific tools and analytics. The Deriv website lacks features like an economic calendar, trader's calculator, and other services. There is no educational content or expert analytical materials available, only a sporadically updated blog.

Geographic Distribution of Deriv Traders

Popularity in

Video Review of Deriv i

Deriv, formerly known as Binary.com, is a well-established, well-regulated, versatile brokerage platform serving more than 2.5 million global clients in the world of derivatives. For just a $5 minimum deposit, Deriv traders can access Forex, commodity, and index CFDs and multipliers along with proprietary synthetic indices not found elsewhere.

A standout feature for Deriv is its proprietary trading platform, DTrader, with a user-friendly interface perfect for beginners. Advanced traders have access to DTrader2 with advanced charting tools and technical analysis indicators.

For those who prefer a more traditional trading experience, Deriv offers MetaTrader 5 (MT5), a popular platform among professional traders, known for its comprehensive charting capabilities and automated trading options. Deriv does not offer MT4.

Deriv offers educational resources including tutorials, webinars, and articles, though they are somewhat limited compared to other top brokers. However, it does have a live community forum allowing you to interact with other traders. In addition, all traders have access to its free demo account to practice short-term trading strategies.

Overall, Deriv is a solid, reputable broker that combines cutting-edge technology, regulatory compliance, with more than 20 years of experience to provide a robust trading environment for novices and experienced traders who give it an excellent 4.5-star rating on Trustpilot. Its only flaw may be that it does not serve clients from the USA, Canada, UK and Israel.

Expert Review of Deriv

Deriv is an international broker that has been providing its services on the market for over 20 years. During this time, more than 2.7 million traders from different countries have become the company's clients, Deriv opened about 10 real offices and modernized the interfaces of trading platforms (Trading App).

Deriv clients can trade the following instruments: fiat currency pairs, cryptocurrencies, commodities, indices, synthetic indices, CFDs, stocks, and digital options. The broker offers the choice of several proprietary terminals for trading different instruments. It also gives you the ability to create your own trading strategy for trading options using a special bot. A passive way of making money is also available to Deriv clients, such as subscribing to trading signals to copy the trades of professionals. The minimum deposit in Deriv starts from USD 0 if the user replenishes the account through a cryptocurrency wallet. There are other ways to replenish your account, in which case the minimum deposit varies from $5 to $10.

The owners of Deriv consider their main task to be to make trading convenient. The company offers comfortable conditions for both novice and professional traders. However, the section with training materials is not sufficiently substantive or structured, and communication with the support team is difficult since Deriv only offers an online bot or a visit to an offline office, which is not available to all clients of the broker.

Dynamics of Deriv’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Deriv is committed to providing clients with the best possible conditions for independent trading. However, the broker also offers a program to help traders make profits without having to actively trade.

Deriv MT5 Signals

Deriv MT5 is one of Deriv’s proprietary trading platforms that allows traders to make a profit even if they do not have trading experience or time to study the market and construct a strategy. With Deriv MT5, You just need to choose a provider and subscribe to its trading signals.

-

The service is as simple as possible. The user subscribes to a professional trader, after which his trades will be automatically copied to the user's trading account.

-

The client can choose the provider of trading signals at his discretion.

-

The Deriv MT5 platform provides statistics and complete information about providers so that traders can evaluate the effectiveness of the provider.

-

The subscription to the provider will automatically expire after one month, after which it can be renewed.

-

The broker allows you to choose providers of trading signals via the Deriv MT5 platform. Deriv's extended provider base is available for traders who are registered in MQL5.

-

Deriv MT5 works with both traders who copy trades and providers of trading signals.

Important.

If you have subscribed to trading signals from suppliers, you will not be able to trade independently from the same trading account.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Deriv’s affiliate program:

-

Deriv’s affiliate program is presented in three types: a trader can (i) receive additional earnings for the monthly income of his referees, (ii) for the probability of payments on options, as well as (iii) for inviting new users to the Deriv broker.

The income of the participants in the affiliate program depends on the type of program, as well as on the performance of the clients. For example, if the referral's monthly income is up to $20,000, the member will receive a commission of 30%; and if the income is more than $20,000, the commission will rise to 45%. To receive $100 income for referring new clients to Deriv, it is important to comply with two conditions: the new user must initialize the deposit with $100, and both clients must be EU residents. As a consequence, this type of affiliate program is not valid for traders from other countries.

Trading Conditions for Deriv Users

Deriv offers its clients several trading platforms for trading. Each of them is intended for trading specific assets and assumes different trading conditions. So, the leverage can reach 1:1,000 (Deriv MT5 Synthetic) or 1:100 (Deriv MT5 Financial STP). Leverage levels may vary depending on the client's account and country of residence. The company's trading instruments include fiat currency pairs, cryptocurrencies, indices, stocks, commodities, and options; and synthetic indices are available. To start working on a real account, it is enough to replenish the deposit with USD 5.

$1

Minimum

deposit

1:1000

Leverage

24/7

Support

| 💻 Trading platform: | Deriv MT5, Deriv X, Deriv Trader, SmartTrader, Deriv bot |

|---|---|

| 📊 Accounts: | Real account, demo account |

| 💰 Account currency: | Fiats, cryptocurrencies |

| 💵 Replenishment / Withdrawal: | Online banking, bank cards, cryptocurrency wallets, electronic payment systems |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:1000, multipliers available (leverage levels may vary depending on the client's account and country of residence) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | From USD 0.35 |

| 💱 Spread: | Fixed, floating |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, CFDs, indices, stocks, synthetic indices, commodities |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Trading with synthetic indices and options is available; Cryptocurrencies trading. |

| 🎁 Contests and bonuses: | Yes. Traders Union bonuses |

Comparison of Deriv with other Brokers

| Deriv | RoboForex | Pocket Option | Exness | AMarkets | FxGlory | |

| Trading platform |

Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, AMarkets App | MT4, MobileTrading, MT5 |

| Min deposit | $1 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | 1.00% | No | No | No | No | 8.00% |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 2 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 50% / 20% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Deriv | RoboForex | Pocket Option | Exness | AMarkets | FxGlory | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | No |

| Stock | Yes | Yes | Yes | Yes | Yes | No |

| ETF | No | Yes | No | No | No | No |

| Options | Yes | No | No | No | No | No |

Deriv Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Real account | From $1 | Yes - established by trading platform and payment system |

For the transfer of trading positions to the next trading day, the broker charges a swap fee.

The Traders Union analysts also compared the size of the Deriv trading commission with the indicators of RoboForex and FXPro to objectively assess the trading commission set in DTrader.

| Broker | Average commission | Level |

| Deriv | $1.6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Deriv

Deriv is a company that cooperates with traders all over the world. The broker provides variable trading conditions and specialized trading platforms so that the client can choose the necessary trading instruments, a convenient trading platform and if desired, use services that will make trading faster and more efficient, such as trading signals or the DTrader bot.

Deriv’s success by the numbers:

-

The company has been providing services since 1999.

-

Deriv has over 2.7 million trading accounts.

-

The broker has more than 10 real offices in different countries.

-

To get started, a trader will need from USD 0 to 10.

-

The volume of all Deriv contracts is approximately USD 10 billion.

-

The maximum leverage is 1:1,000.

Deriv is a broker for traders who value variability and choice

Deriv is ready to cooperate with traders regardless of their level of professional training. To get started, the client can deposit from $1 to $10 to the account (depending on the payment system). The primary trading platform is DTrader and the conditions for all traders are the same for beginners who made a $10 deposit and for professionals who made a $1,000 deposit. Deriv offers a wide range of trading instruments for trade, such as currency pairs, indices, stocks, cryptocurrencies, CFDs, commodities, synthetic indices, and digital options.

Deriv clients have access to several trading terminals, which differ in interface, functionality, and trading tools. The trader can choose from DTrader, Deriv MT5 , DBot, Deriv X, or SmartTrader. The terminals are presented in the web version, and it is possible to install a mobile application and trade from a smartphone. It is not necessary to choose only one platform for trading. Deriv clients can use all terminals in their work.

Useful services of the Deriv broker:

-

Calculators. On the Deriv website, traders can use this tool to calculate margins, swaps, pips, as well as PnL calculation services for margin contracts and contracts with multipliers.

-

Deriv bot. The service helps the broker's clients create their trading strategy for trading digital options. There are also ready-made strategies and tools that you can use.

-

Help Center. A section with answers to frequently asked questions from traders about trading, opening an account, replenishing it, deactivating it, etc.

Advantages:

The broker offers a choice of several trading terminals with different features.

The company presents assets of different groups: from currencies to indices and digital options.

The broker's activities are governed by regulators in different countries.

A trader can open accounts for different trading platforms at Deriv and switch between them in the personal account.

The company has many fast and convenient payment systems available for replenishing a deposit and withdrawing funds.

Deriv cooperates with the Financial Commission, which is an independent body that resolves disputes between a broker and a client.

How to Start Making Profits — Guide for Traders

Deriv offers two main account types: demo and real. However, the real account is divided into several categories, since traders need a separate trading account for each of the trading platforms. Learn more options how to make money on Deriv.

Account types:

When registering on the Deriv website, traders must open a demo account.

Deriv is an international broker, however, there are some countries where the broker is not legally allowed to provide its services. The list includes the United States, Hong Kong, Canada, Israel, Rwanda, Paraguay, Malta, Jersey, Malaysia, and the United Arab Emirates.

Deriv - How to open, deposit and verify a trading account | Firsthand experience of TU

Bonuses Paid by the Broker

At the moment, Deriv clients do not have access to trading bonuses directly from the broker.

Investment Education Online

The broker's website has a section that contains information useful for both beginners and experienced traders. Access to the information is free, just go to the “Resources” section and select the “Academy” subsection.

All Deriv clients can open a demo account upon registering, practice trading without time restraints, test different trading strategies, and — when ready — open a real trading account.

Security (Protection for Investors)

Deriv provides services on an international level, and therefore the broker's activities are licensed by several bodies, including the MFSA (Malta Financial Services Authority), Labuan FSA (Labuan Financial Services Authority), VFSC (Vanuatu Financial Services Commission). In addition, Deriv is a member of the Financial Commission which deals with disputes between financial institutions (in this case, a broker) and their clients.

The broker uses the services of financial institutions to store client funds. Thus, if Deriv becomes insolvent, its clients will have their funds returned. The broker also takes care of the traders’ personal data protection. They can also activate two-factor authentication to protect the account from hacking.

👍 Advantages

- Client funds are held in segregated accounts

- The broker is licensed and regulated by several regulatory bodies

- Deriv cooperates with the Financial Commission

👎 Disadvantages

- The broker does not guarantee clients the return of lost funds in the event of an account hack

Withdrawal Options and Fees

-

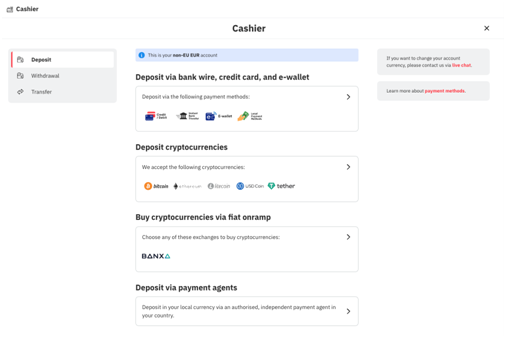

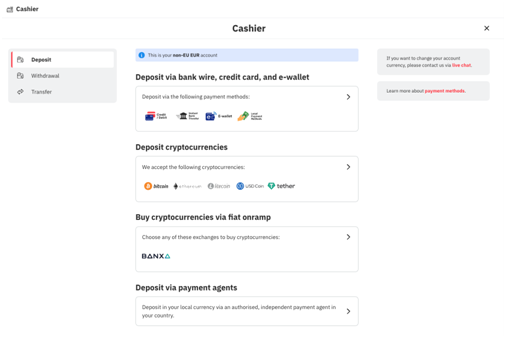

Account replenishment and withdrawal of funds at Deriv are carried out in the following ways: through online banking (bank transfer, PayTrust, Help2Pay, ZingPay, Dragon Phoenix, and NganLuong), bank cards (Visa, Visa Electron, MasterCard, Maestro, Diners Club International, and JCB), cryptocurrency (Bitcoin, Ethereum, Litecoin, USD Coin, and Tether), and e-wallets (FasaPay, Perfect Money, Skrill, Neteller, WebMoney, PaySafeCard, Jeton, SticPay, Airtm, Boleto Bancario, Paylivre, OnlineNaira, and Trustly).

-

The processing time for each application depends on the payment agent and the type of financial transaction. For example, replenishment of an account using a bank card is carried out instantly, while withdrawals are processed within 1 business day. In general, the processing time for an application varies from instant to 3 working days.

-

Note that each payment agent has restrictions on the minimum and maximum amount of replenishment and withdrawal. Also, some methods are available only for replenishing a trading account.

-

Deriv does not charge a commission for financial transactions, but this fee can be assessed by the payment agents.

-

To carry out financial transactions, the Deriv client needs to verify his personal data.

Customer Support Service

The Deriv broker provides traders with a support service that will help solve trading-related problems and questions. Customer support is available around the clock and works seven days a week.

👍 Advantages

- You can ask for assistance 24/7

- Customers can visit the company’s offline offices

👎 Disadvantages

- There is no contact by phone

- Few ways to contact support

The broker offers the following methods to contact the support staff:

-

write a message to the online chat, where the bot will help solve common problems;

-

write to the broker's email (only on cooperation and participation in the affiliate program);

-

visit one of Deriv’s real offices.

Clients can also use the "Help Center" section, where there are answers to frequently asked questions (FAQs), or contact a fellow trader for help in the Deriv community.

Contacts

| Foundation date | 2014 |

| Registration address | W Business Centre, Level 3, Triq Dun Karm, Birkirkara BKR 9033, Malta |

| Regulation |

MFSA, LFSA, VFSC, BVI FSC |

| Official site | https://deriv.com/ |

| Contacts |

Email:

marketing@deriv.com,

|

Review of the Personal Cabinet of Deriv

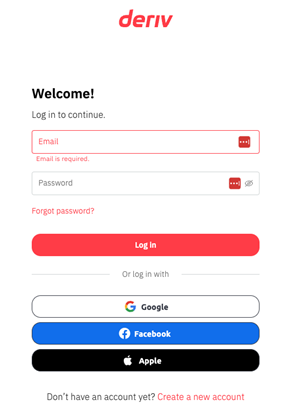

Cooperation with Deriv begins with registration on the broker's website. This is quite easy to do if you follow these step-by-step instructions.

To get started, visit the official website of the broker.

On the homepage, click on the "Log in" button.

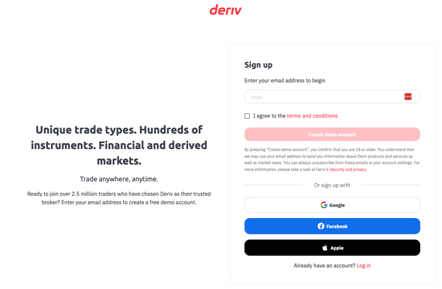

In the dialog window that opens, you can log in to an existing account or create a new one. To open a new account, click on the line "Create a new account", it is at the bottom of the page and highlighted in red. Please note that initially, traders can open only a demo account at Deriv, and only after that can they open a real account to trade in the market.

To register, enter your email address, you can also use your Google, Facebook, or Apple accounts to register.

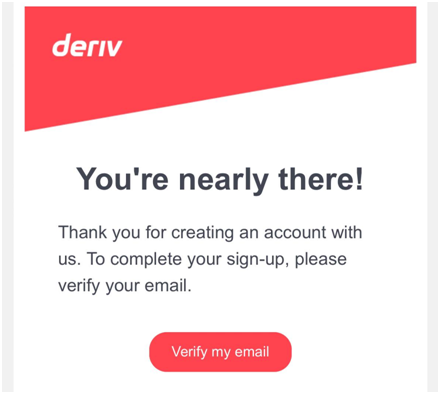

If you chose to register via a postal address, please confirm your registration application. To do this, enter your email address and open the letter from Deriv. To continue registration, click on the "Verify my email" button, which is located in the letter.

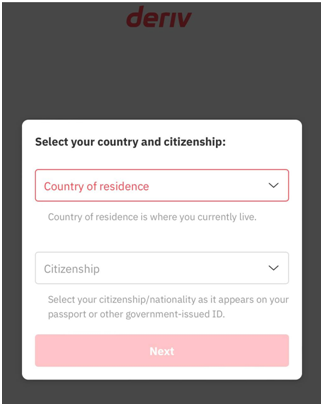

Then you need to select the country in which you live from the list.

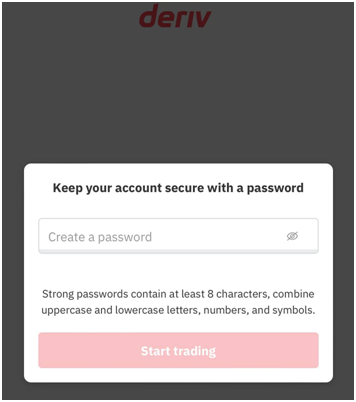

Now create a password with at least 8 characters, after confirming the password, you can click on the "Start trading" button.

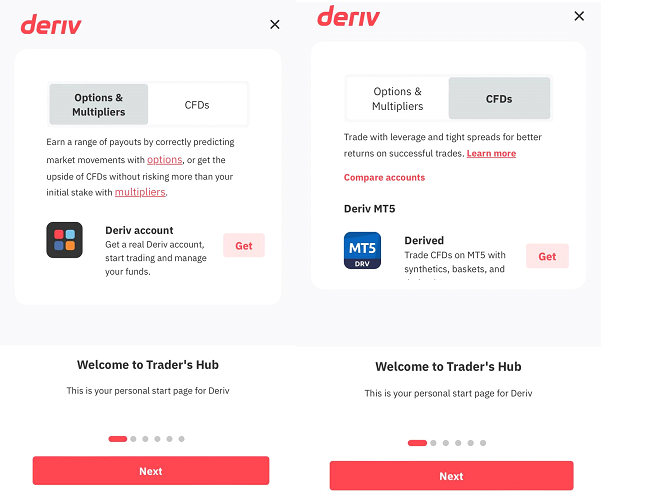

Select the type of tools you would like to work with from the list. You will then be able to learn the Deriv trading conditions and open a live trading account.

Additional functions within the personal account:

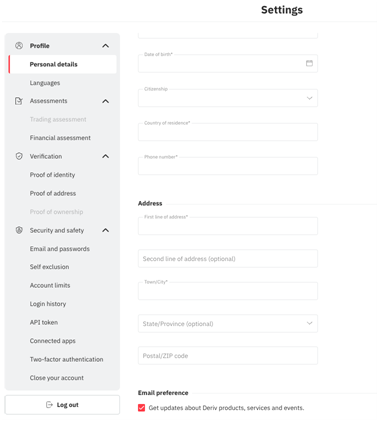

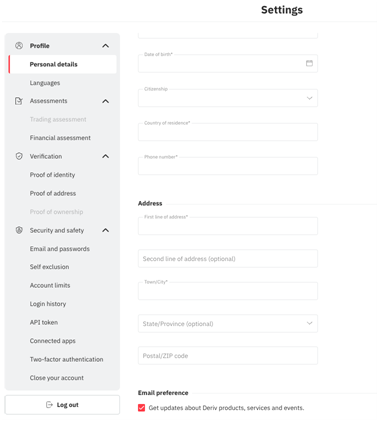

1. Manage Account Settings. Here, the trader has access to personal settings, changing personal data, viewing trading activity, etc.

2. Deposit. After opening a real trading account, Deriv clients can replenish their account in convenient ways, make a withdrawal of earnings, and view transaction histories.

1. Manage Account Settings. Here, the trader has access to personal settings, changing personal data, viewing trading activity, etc.

2. Deposit. After opening a real trading account, Deriv clients can replenish their account in convenient ways, make a withdrawal of earnings, and view transaction histories.

Also in the personal account, the trader can:

-

Review opened positions.

-

Switch between different trading platforms in one click.

-

Review alerts.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how Deriv stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the Deriv rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Deriv you need to go to the broker's profile.

How to leave a review about Deriv on the Traders Union website?

To leave a review about Deriv, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Deriv on a non-Traders Union client?

Anyone can leave feedback about Deriv on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.